Skip to comments.

Investment & Finance Thread (Apr. 13 edition)

Daily investment & finance thread ^

| April 13, 2014

| Freeper Investors

Posted on 04/13/2014 3:35:12 PM PDT by expat_panama

Investment & Finance Thread (Apr. 13 edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

======================

|

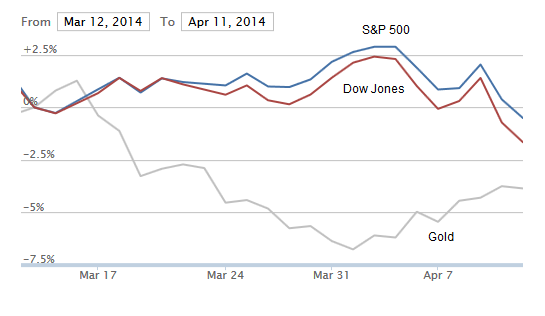

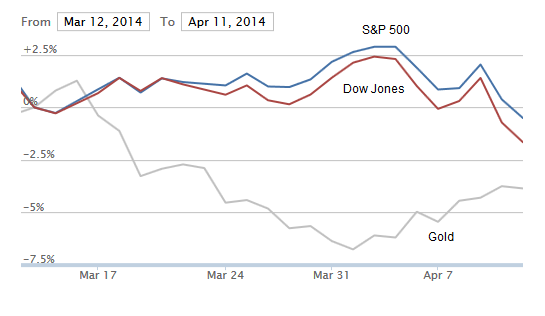

OK, so if April began with "a heck of a week", then it's moving along with another one that's even more so; we're seeing gold'n'silver maintain a rebound and stocks hammering down new lows (from here). OK, so if April began with "a heck of a week", then it's moving along with another one that's even more so; we're seeing gold'n'silver maintain a rebound and stocks hammering down new lows (from here). (click to enlarge) There're many opinions from say, CNNMoney, Investing.com, FTLondon, as to what it all means, but imho Investing Daily (not to be confused w/ IBD) says their take is that this latest shift is money not fleeing the markets but rather 'rotating' from one set of sectors (including 3D printing & exotic meds) to stodgy big caps. |

|

Maybe kind of like what we had at the end of the 'dot.com' bust where the big caps just kept chugging along while the NASDAQ got creamed. (click to enlarge) I mean, last Fri. we just saw the NASDAQ crush thru it's longer term support while the big cap Dow/S&P's haven't even got to their support levels yet. My thinking is that this was kind of foretold a week ago when we were watching the techs limping even while the big kids were pegging new highs. |

So let's fast-forward to this week's office stock strategy pool. I'm voting for watching for this correction's 'follow-thru-day' and moving back in and enjoying the next run-up.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

To: expat_panama

KCG Closing Summary:

Today’s S&P 500 Intra-day Chart:

NYSE Volume: 675 million

Sector Performance:

End of Day Summary:

Closing Market Summary: Stocks Post Third Day of Consecutive Gains

The stock market finished the Wednesday session on an upbeat note with the Nasdaq (+1.3%) ending in the lead. The S&P 500 settled higher by 1.1% with all ten sectors posting gains.

The benchmark index spent the entire trading day in the green, rallying to new highs during the last hour of action. The tech-heavy Nasdaq, meanwhile, briefly dipped into the red during morning action, but was able to recover swiftly.

Stocks began the trading day with modest gains after the overnight session featured the release of China’s Q1 GDP. Although the report could be classified as better-than-feared, it did not necessarily produce a clear-cut signal as the year-over-year reading of 7.4% beat estimates (7.3%), while the quarter-over-quarter growth of 1.4% was just below expectations (1.5%).

When the opening bell rang at the New York Stock Exchange, the Dow and S&P 500 maintained relatively narrow ranges through the first two hours of action, while the Nasdaq slipped below its flat line due to weakness among chipmakers. The largest industry player, Intel (INTC 26.93, +0.16), reported a slim earnings beat, but other semiconductor names struggled. The broader PHLX Semiconductor Index shed 0.2%.

Even though chipmakers knocked the Nasdaq into the red, the index was able to overcome that weakness due to the relative strength of biotechnology and recently-battered momentum names. The iShares Nasdaq Biotechnology ETF (IBB 222.79, +5.18) jumped 2.4%, ending just above its 200-day moving average (219.97) after struggling with that level for the past week.

Interestingly, the broader health care (+0.6%) sector did not follow biotech’s lead as several large components weighed. UnitedHealth (UNH 78.19, -1.32) contributed to the underperformance, falling 1.7% after receiving a downgrade from Citigroup ahead of its earnings report, which will be released ahead of tomorrow’s opening bell.

Elsewhere among influential sectors, consumer discretionary (+1.4%), energy (+1.2%), and industrials (+1.5%) provided support to the broader market, while financials (+0.9%) lagged. The economically-sensitive sector was pressured by Bank of America (BAC 16.13, -0.26), which lost 1.6% after missing bottom-line estimates. The financial sector will be in focus once again tomorrow with the market digesting quarterly results from American Express (AXP 87.40, +1.36), Goldman Sachs (GS 157.22, +2.30), and Morgan Stanley (MS 29.89, +0.34).

On the countercyclical side, health care (+0.6%) ended at the bottom of the leaderboard, while consumer staples (+0.9%), telecom services (+0.9%), and utilities (+0.8%) had some difficulty keeping up with the broader market.

Treasuries settled modestly lower following a range bound session. The benchmark 10-yr yield ticked up one basis point to 2.64%.

Participation was below average as 661 million shares changed hands at the NYSE.

Reviewing today’s data:

Housing starts increased 2.4% in March to 946,000 from an upwardly revised 920,000 in February. The Briefing.com consensus expected 955,000 new starts. Overall, the residential construction report was encouraging, but did not provide any evidence that the weakness in January and February was weather related. Starts remained well below 1.00 million, which was the average in the fourth quarter. Had weather factored into the weakness, then there should have been a much stronger bounce from delayed starts. Single-family construction, which languished below 600,000 in January and February, rebounded 6.0% to 635,000. That was more in-line with the trends over the last 12 months. Multifamily starts fell 3.1% to 311,000 in March from 321,000 in February. That was a typical decline from a normally volatile sector.

Industrial production increased 0.7% in March after increasing an upwardly revised 1.2% (from 0.6%) in February. The Briefing.com consensus expected industrial production to increase 0.5%. Manufacturing production increased 0.5% in March, down from an upwardly revised 1.4% (from 0.9%) in February. The March gain was in-line with the ISM production index. Despite a 0.8% decline in motor vehicles and parts production, durable goods manufacturing production increased 0.5%. Nondurable goods manufacturing production increased 0.7%, which was mostly the result of a 3.3% increase in petroleum and coal products production.

Tomorrow, weekly initial claims (Briefing.com consensus 312K) will be reported at 8:30 ET and the Philadelphia Fed Survey for April (consensus 8.6) will be released at 10:00 ET.

S&P 500 +0.8% YTD

Dow Jones Industrial Average -0.9% YTD

Nasdaq Composite -2.2% YTD

Russell 2000 -2.6% YTD

Bond Summary:

Curve Flattest Since October 2009: 10-yr: -03/32..2.637%..USD/JPY: 102.24..EUR/USD: 1.3815

Treasuries finished mixed amid a choppy trade.

The complex held small losses into the U.S. cash open before some light buying emerged in response to the disappointing housing starts (946K actual v. 955K expected) and building permits (990K actual v. 1003K expected) data.

Maturities would slip onto their worst levels of the session following the strong industrial production (0.7% actual v. 0.5% expected) and capacity utilization (79.2% actual v. 78.8% expected) numbers, but failed to see follow through selling.

A choppy trade persisted before Fed Chair Janet Yellen suggested the central bank remains committed to an accommodative policy and that there is greater chance inflation runs below the Fed’s target.

The latest Fed Beige Book indicated “economic activity increased in most regions of the country since the previous report.”

Outperformance at the long end saw the 30y shed -0.6bps to 3.454%. The yield on the long bond closed on session lows, and at a level last seen in June.

The 10y edged up +0.9bps to 2.637%. Traders will continue to monitor the 2.600% level over the coming sessions as that level has held up since early February.

The 5y lagged, finishing +3.7bps @ 1.655%. Selling produced a fourth straight rise in yield, and has action moving towards a test of resistance in the 1.660%/1.700% area.

Today’s mixed trade flattened the yield curve with 5-30-yr spread tightening to 180bps, which was last seen in October 2009.

Precious metals were firm with gold +$2 @ $1302 and silver +0.13 @ $19.62.

Data: Initial and continuing claims (8:30), and Philly Fed (10).

Commodities Summary:

Closing Commodities: Gold Rise 0.3%, Closes Above $1300/Oz, Crude Gains 5 Cents

June gold traded in positive territory for most of today’s pit session. Prices advanced as high as $1307.10 per ounce and dipped to a session low of $1297.90 per ounce in mid-morning action. The yellow metal eventually settled with a 0.3% gain at $1303.40 per ounce.

May silver rose to a session high of $19.81 per ounce shortly after floor trade opened. It then chopped around near the $19.60 per ounce level and settled with a 0.8% gain at $19.64 per ounce.

May crude oil rose to a session high of $104.82 per barrel in early morning floor trade but slipped into negative territory following inventory data that showed a build of 10.0 mln barrels when a smaller build of 1.8-2.3 mln barrels was anticipated.

The energy component managed to inch higher in afternoon action and settled at $103.73 per barrel, or 5 cents above the unchanged line.

May natural gas chopped around in the red today. It touched a session high of $4.57 per MMBtu in early morning action and settled with a 0.9% loss at $4.53 per MMBtu, just above its session low of $4.52 per MMBtu.

NYMEX Energy Closing Prices

May crude oil rose $0.05 to $103.73/barrel

Crude oil rose to a session high of $104.82 in early morning floor trade but slipped into negative territory following inventory data that showed a build of 10.0 mln barrels when a smaller build of 1.8-2.3 mln barrels was anticipated. The energy component managed to inch higher in afternoon action and settled 5 cents above the unchanged line.

May natural gas fell 4 cents to $4.53/MMBtu

Natural gas chopped around in the red today. It touched a session high of $4.57 in early morning action and settled just above its session low of $4.52, booking a loss of 0.9%.

May heating oil rose 2 cents to $3.01/gallon

May RBOB settled unchanged at $3.04/gallon

CBOT Agriculture and Ethanol/ICE Sugar Closing Prices

May corn fell 6 cents to $4.98/bushel

May wheat fell 13 cents to $6.88/bushel

May soybeans rose 17 cents to $15.19/bushel

May ethanol fell 9 cents to $2.17/gallon

July sugar (#16 (U.S.)) rose 0.06 of a penny to 24.40 cents/lbs

The information contained in this communication is not intended as an offer or solicitation for the purchase or sale of any securities, futures, options, or any other investment product. This communication is not research, and does not contain enough information on which to make an investment decision. The information herein has been obtained from various sources including Bloomberg, Wall St. Journal, Briefing.com, Dow Jones, Reuters

Sources: Commentary adapted from Bloomberg, Wall St. Journal, Briefing.com, FT.com, Reuters, and/or Dow Jones NewsPlus.

John Longobardi

Corporate Relations Director

One Liberty Plaza

165 Broadway

New York, NY 10006

+1 646 428 1704 tel

+1 203 887 2202 mobile

jlongobardi@kcg.com

www.kcg.com

This e-mail and its attachments are intended only for the individual or entity to whom it is addressed and may contain information that is confidential, privileged, inside information, or subject to other restrictions on use or disclosure. Any unauthorized use, dissemination or copying of this transmission or the information in it is prohibited and may be unlawful. If you have received this transmission in error, please notify the sender immediately by return e-mail, and permanently delete or destroy this e-mail, any attachments, and all copies (digital or paper). Unless expressly stated in this e-mail, nothing in this message should be construed as a digital or electronic signature. For additional important disclaimers and disclosures regarding KCG’s products and services, please click on the following link:

http://www.kcg.com/legal/global-disclosures

To: expat_panama

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Looks like we're starting out the morning with futures down on metals and more down on stocks, this after finding out yesterday's stock surge was in unusually light trade. True, the last rally began in weaker trade but not this weak --the adventure continues... Meanwhile:

Google, IBM cast shadow on global markets European stocks dipped on Thursday as disappointing earnings from U.S. tech heavyweights Google and IBM dampened the previous session's upbeat tone on Wall Street, and the dollar weakened on dovish remarks from the Federal Reserve.

Yellen Sees Muted Inflation as Unemployment Curbs Wages Businessweek - 3:55am Janet Yellen is eyeballing wages for signs of inflationary pressure. She doesn't see any so far. “Wage gains continue to proceed at a historically slow pace in this recovery, with few signs of a broad-based acceleration,” the Federal Reserve chair said ...

Asian Stocks Broadly Higher Ahead Of Easter Break RTT News - an hour ago Asian stocks ended mostly higher on Thursday following reassuring comments from the Federal Reserve chief. Gains, however, were modest on growing concerns about military activity in Ukraine and amid caution ahead of a long weekend.

To: expat_panama

-—Wage gains continue to proceed at a historically slow -—

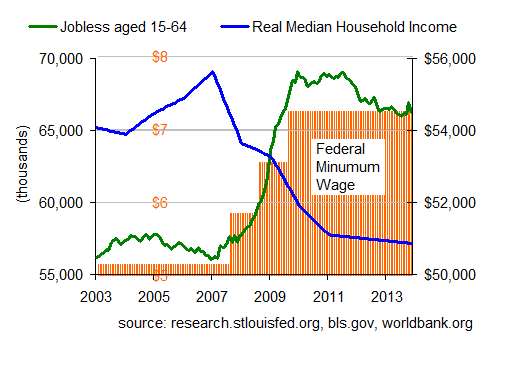

She’s not paying attention.....The minimum wage has been increased in cities and states 25% or more. That is pretty serious inflation

44

posted on

04/17/2014 4:30:12 AM PDT

by

bert

((K.E. N.P. N.C. +12 ..... History is a process, not an event)

To: bert

To: Wyatt's Torch

To: Wyatt's Torch; bert

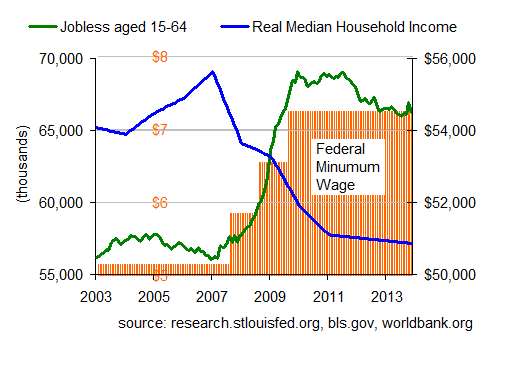

Measuring incomes has become increasingly controversial as opposing hacks pick out what they want --and there's much to choose from.

Employee wages are just part of the income picture. By including more kinds of incomes we got the average U.S. after tax income at an all time high. The problem is that people aren't seeing these big incomes and real median household incomes have been falling for 15 years. On top of all this is the fact that politics is corrupting the data --those median numbers come from our impuned Census Br. while disposible income stats are from technocrat geeks at the BEA.

To: Wyatt's Torch; expat_panama

I understand the concept of inflation being a monetary process

I omitted the intermediate step. Wage increases become desirable as the $$ value decreases.

To stay even or to get ahead a little, wages and salaries must increase to compensate for the devaluation. There is I believe a political desire on both sides to have some inflation to effectively devalue the debt. An important component is wage inflation. The problem is that with the rate of unemployment high, increases in wages just don’t happen across the board. The hue and cry and in some cases actual increase in the minimum will nudge general wage increases.

And then there is another, definitely non monetary vector. That is Obamacare. The pain of Obamacare cost increases can be masked by everybody getting a raise.

Between the monetary vector and the Obamacare vector, the moonbats have powerful incentive to howl for a vector resolution, for minimum wage and thus across the board wage and salary increases.

48

posted on

04/17/2014 5:17:45 AM PDT

by

bert

((K.E. N.P. N.C. +12 ..... History is a process, not an event)

To: Wyatt's Torch

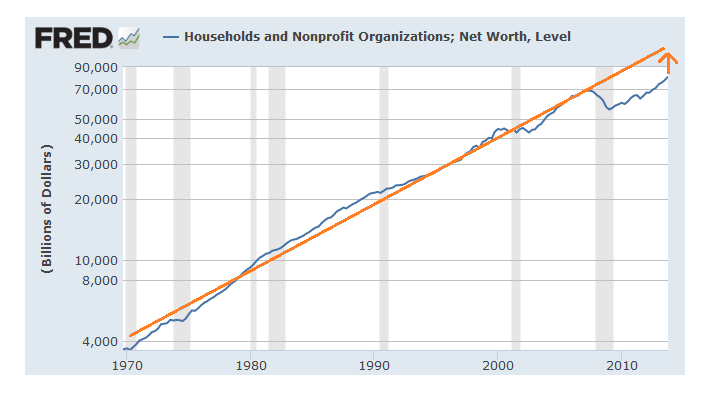

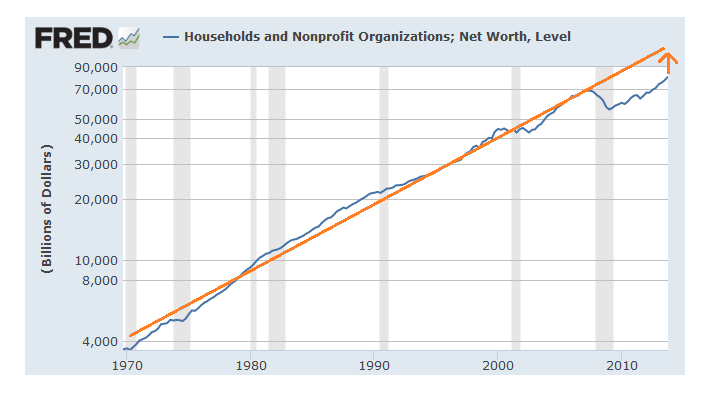

"Real GDP Growth Trend. We are not catching up!"That's an important reality to keep in mind when understanding today's economy, and the same can be said for private net worth too--

The problem (imho) is that people seem to have gotten it in their little minds that the Fed controls the economy. Left wingers push it so they can avoid being blamed for all the harm they're doing. Right wingers push it so they can sell their gold for $2k/oz. Economists push it so they'll get named to cushy gov't positions. Fact is that raising GDP by cutting interest rates never really worked that well and is now totally spent:

To: expat_panama; bert

I go back to Dallas Fed Chairman Fisher’s comment on the destructive impact of fiscal policy. As bert mentioned Obamacare, minimum wage, EPA, and all the other choking regulation is what is killing growth. Business Insider had an article yesterday that this is the worst earnings growth performance in 50+ years. The politicians, ALL OF THEM, are killing the economy.

To: expat_panama

Initial Claims = 304,000 beating estimates

To: bert

the minimum will nudge general wage increasesThat's the conventional wisdom but it's a myth disproved by looking at how it works. Reality is that a min. wage hike does not require an employer to pay more for an employee than he's worth. If a worker brings in $10/hr into a company, he'll have a job when the min. wage is <$10 and lose it when the mw is >$10. Business is business.

What's happened over the past decade is that min. wage hikes have lowered general wages by putting people out of work. Soaring unemployment has cut demand which has lowered prices and that drops wages:

To: expat_panama

To: expat_panama

THE LOOK…April 17th, 2014

U.S. stock-index futures fell, after the biggest three-day rally in two months for equities, as Google Inc. posted worse-than-estimated sales and investors awaited data that may show jobless claims rose.

Google slid 3.2 percent in early New York trading as increasing costs and a shift of advertising to mobile phones curbed first-quarter results. Facebook Inc., which also derives most of its revenue from advertising, lost 2.5 percent. International Business Machines Corp. dropped 3.7 percent after

reporting quarterly sales that trailed projections. General Electric, on the other hand, is currently trading up 2 percent after releasing earnings this morning.

Futures on the S&P 500 expiring in June declined 0.2percent to 1,848.4 at 11:28 a.m. in London. The equity gaugeadvanced yesterday, capping a three-day gain of 2.6 percent, asYahoo! Inc. earnings topped estimates and industrial productionclimbed more than forecast. Dow Jones Industrial Average

contracts retreated 46 points, or 0.3 percent, to 16,285 today.

“It has been a bit direction-less in the markets,” OttoWaser, chief investment officer at R&A Research & AssetManagement AG in Zurich, said by telephone. “There’s been a bit of a rotation out of technology — these sectors that had gotten a bit stretched in their valuations — but there hasn’t been any

major correction in the U.S.”

Twenty-five companies in the S&P 500 report earnings today. Profit per share for the index’s constituents probably dropped 0.9 percent in the first quarter, according to analyst estimates compiled by Bloomberg. Revenue climbed 2.6 percent from a year earlier, the projections show.

A report at 8:30 a.m. in Washington may show 315,000 people filed first-time applications for unemployment benefits in the week ended April 12, up from the previous week’s reading of 300,000 that was the lowest since May 2007, according to the median economist projection compiled by Bloomberg.

European stocks declined, paring their advance this week, as SAP AG slid after posting worse-

than-forecast earnings and sales, outweighing gains by carmakers. U.S. index futures slipped, while Asian shares rose.

SAP lost 3.3 percent as Germany’s biggest technology company also said that revenue from new software licenses dropped in the quarter. Akzo Nobel NV slid the most in nine months as its sales missed projections. Remy Cointreau SA and Diageo Plc led beverage stocks lower after reporting lower

sales. Renault SA and PSA Peugeot Citroen each gained more than 1 percent as a report showed European car sales rose in March.

The Stoxx Europe 600 Index retreated 0.3 percent to 329.86 at 10:53 a.m. in London as diplomats from Ukraine, Russia, the U.S. and the European Union meet for talks in Geneva today. The benchmark has still added 0.3 percent this week. It has fallen 2.8 percent from this year’s high on April 4 amid a confrontation between Ukraine’s government and pro-Russian separatists in the country’s eastern region.

“Investors are very cautious because of Ukraine and

· Support:1851, 1840, 1824

· Resistance:1867, 1873, 1889

The Federal Reserve is increasing its dominance in the daily market for the borrowing and lending of Treasuries while putting a floor under money-market rates.

The top panel of the CHART OF THE DAY shows the allotment at the central bank’s daily fixed-rate reverse repurchase agreements, which are tri-party transactions conducted daily by the Federal Reserve Bank of New York. The daily use levels, which appear as a negative on the chart as they represent a temporary drain of reserve from the banking system, have risen as increases in allowable per counterparty bids have been matched with demand. The bottom panel shows the activity has helped Treasury repo rates move up from almost zero.

“The Fed with its reverse-repo program is playing a greater role in Treasury repo, accounting for 17 percent of the tri-party market,” said Joe Abate, a money-market strategist in New York at primary dealer Barclays Plc. “In addition to establishing a harder floor under short-term interest rates by increasing allotment sizes, the program seems to be changing the behavior of money market investors, who have been increasing their holdings of Treasury repo.”

Money market mutual funds’ holdings of Treasury repo averaged $220 billion from September 2013 to March 2014, which compares to an average of $180 billion between January 2013 and the start of the Fed’s program in September of that year, according to Abate.

The Fed is using the fixed-rate reverse repo facility to improve control of short-term borrowing costs and help facilitate the eventual unwinding of monetary policy. The facility will eventually allow the Fed’s ligible tri-party reverse repo counterparties, which range from banks to broker-dealer to money market funds, to lend the Fed unlimited amounts of cash overnight in exchange for Treasuries. The per-counterparty daily allotment cap is $10 billion at a fixed rate of 0.05 percent.

The counterparty limit was $500 million when the program began. Under the Fed’s current guides for the operations, the fixed rate can range from 0.01 to 0.05 percent.

Disclaimer:

The information contained in this communication is not intended as an offer or solicitation for the purchase or sale of any securities, futures, options, or any other investment product. This communication is not research, and does not contain enough information on which to make an investment decision. The information herein has been obtained from various sources including Bloomberg, Wall St. Journal, Briefing.com, Dow Jones, Reuters

Sources: Commentary adapted from Bloomberg, Wall St. Journal, Briefing.com, Streetaccount, theflyonthewall, FT.com, Reuters, and/or Dow Jones NewsPlus.

This e-mail and its attachments are intended only for the individual or entity to whom it is addressed and may contain information that is confidential, privileged, inside information, or subject to other restrictions on use or disclosure. Any unauthorized use, dissemination or copying of this transmission or the information in it is prohibited and may be unlawful. If you have received this transmission in error, please notify the sender immediately by return e-mail, and permanently delete or destroy this e-mail, any attachments, and all copies (digital or paper). Unless expressly stated in this e-mail, nothing in this message should be construed as a digital or electronic signature. For additional important disclaimers and disclosures regarding KCG’s products and services, please click on the following link:

http://www.kcg.com/legal/global-disclosures

To: Wyatt's Torch

The politicians, ALL OF THEM, are killing the economy.As a group they are, but that's meaningless given that the ultimate source of power in the American body politic is the American people. Some people and politicians are helping and others aren't, and the difference is in policy. The poison (imho) is class warfare, and that's a spiritual pathology borne of the age-old crimes of covetousness and envy. We prospered in the '80's in no small part because our leaders were saying that we don't help ourselves by harming others.

To: Wyatt's Torch

direction-less in the marketsFor sure. Now we got index futures on top. I may have to open positions today after all --although (as we're seeing) that can change at any minute...

To: expat_panama

Do you think yesterdays lower volume was due to Easter?

To: Lurkina.n.Learnin

yesterdays lower volume was due to Easter?Really seems that shouldn't have done it. I mean, volume tanks the day after Thanksgiving, not 2 days before. Like Wyatt & I were saying, there's no direction; futures were down, they were up, and now indexes are down. That's in the first 5 min...

To: expat_panama; bert

To: Wyatt's Torch

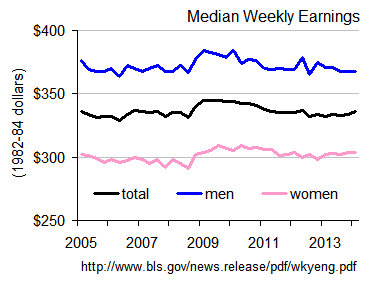

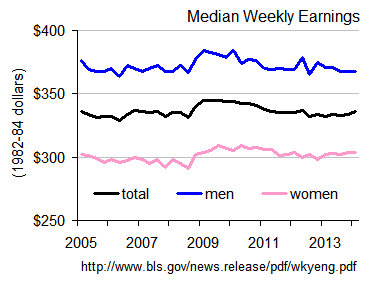

"Median weekly wages grew at the fastest pace in the first quarter in more than four years..."Using the same BLS source but getting the numbers adjusted for inflation tells us that--

--wages are flat, and that the male/female wage gap is shrinking. This is great news for everyone that wants (1) stable prices, and (2) men and women being physically closer to each other.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson