Posted on 03/30/2014 5:37:23 PM PDT by expat_panama

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow we'll go on with our--.

Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

======================

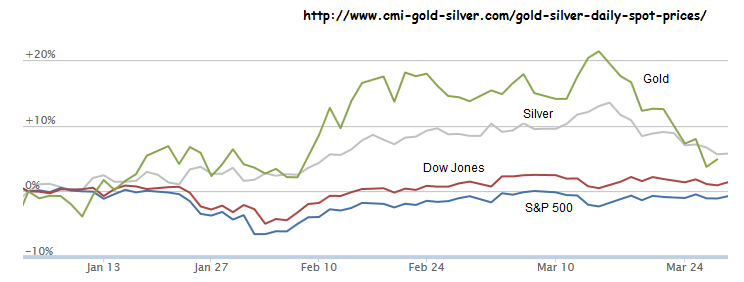

Year to date trends with stocks'n'metals--

--along with 'end-week' articles:

Amid signs that many technology and biotech stocks may have peaked -- the Nasdaq fell 3 percent last week -- markets will look to this coming Friday’s U.S. March employment report for support. The rout in tech and biotech stocks last week has some investors worried that a bubble has indeed [...] Forbes

This Fool sees a limb to go out on. And another. And another. Motley Fool

Stocks discussed on the in-depth session of Jim Cramer's Mad Money TV Program, Friday March 28 . 11 Things to Watch In The Week Ahead: CarMax ( KMX ), Monsanto ( MON ), Buffalo Wild Wings ( BWLD ), Micron ...Seeking Alpha

1. HFT doesn’t prey on small mom-and-pop investors. In his first two TV appearances, Lewis stuck to a simple pitch: Speed traders have rigged the stock market, and the biggest losers are average, middle-class retail investors—exactly the kind of people who watch 60 Minutes and the Today show. It’s “the guy sitting at his ETrade (ETFC) account,” Lewis told Matt Lauer. The way Lewis sees it, speed traders prey on retail investors by “trading against people who don’t know the market.”

The idea that retail investors are losing out to sophisticated speed traders is an old claim in the debate over HFT, and it’s pretty much been discredited. Speed traders aren’t competing against the ETrade guy, they’re competing with each other to fill the ETrade guy’s order. While Lewis does an admirable job in the book of burrowing into the ridiculously complicated system of how orders get routed, he misses badly by making this assumption.

Dammit, I was going to purchase some next week, but now PNG is all sold out. : (

Aside: Todd Carmichael (born 1963) was the first American explorer to cross Antarctica to the South Pole alone, on foot and with no assistance. He arrived at the pole on December 21, 2008, after a total travel time of 39 days, 7 hours and 49 minutes.

From Business Insider:

This 5-year-old bull market still has legs.

First, the scoreboard:

Dow: 16,573.0 (+40.3, +0.2%)

S&P 500: 1,890.8 (+5.3, +0.2%)

Nasdaq: 4,276.4, (+8.4, +0.2%)

And now the top stories:

The S&P 500 closed at a new all-time high today. And it has been coinciding with improving economic data following the recent unusually cold winter. “So once again, a relief rally is driving stock prices higher,” said veteran strategist Ed Yardeni. “We saw that yesterday in response to the solid M-PMI and auto sales for March.”

Goldman Sachs’ proprietary Global Leading Indicator confirms that global growth has at least stopped decelerating. “This ends six months of slowing and locates the global industrial cycle on the cusp of the ‘Expansion’ phase,” said a team of Goldman analysts led by George Cole. “Korean exports improved and U.S. Initial Jobless Claims also trended lower. The Belgian and Netherlands Manufacturing Survey and the Baltic Dry Index showed some strength as well. On the negative side, the S&P GSCI Industrial Metals Index® continued to drop sharply, while the AUD & CAD TWI aggregate was only marginally lower.”

ADP’s National Employment Report got a decent amount of attention today. According to ADP, U.S. companies added 191,000 private-sector jobs in March, which was a bit below Wall Street’s estimate for 195,000. “The job market is coming out from its deep winter slumber,” said Mark Zandi of Moody’s Analytics. “Job gains are consistent with the pace prior to the brutal winter. The gains are broad based across industries and business size classes. Even better numbers are likely in coming months as the weather warms.”

Some continue to believe ADP offers a good preview of the Bureau of Labor Statistics’ official jobs report. However, an increasing number of people are ignoring it. “It’s a shame that April Fool’s Day fell yesterday and not today, because we have come to regard the ADP employment report as a bit of a joke,” said Ian Shepherdson of Pantheon Macroeconomics. According to Shepherdson’s research, the ADP numbers are problematic because they appear to put a lot of weight into lagging data from the BLS. “This glaring flaw in the construction of the ADP report means we can no longer take the number seriously as an advance guide to the official data.”

If that's the findings of the original research then the point was lost before the media ran with it. This story is being portrayed as a betrayal of "the little guy":

Financial Post: (Flash Boys: Former RBC trader hero of Michael Lewis’s new book on how U.S. stock markets are rigged) "SEC Commissioner Daniel Gallagher said on March 28 that individuals are concerned that high-frequency traders detract from fairness in the marketplace. “The problem with high-frequency trading right now is that there’s a perception that for the little guy, the markets aren’t fair,” Gallagher told CNBC during an interview. “That perception to me is a reality. It’s something we need to address.”

Yes the market is rigged. So what?- MSN Money 'You're going to get crushed': Is Wall Street rigged? MSN Money 1 day ago - The little guy will always be at a disadvantage, but there's never been a ... But if the big reveal of "Flash Boys" is that the stock market is rigged ..'You're going to get crushed': Is Wall Street rigged? Sydney Morning Herald - 21 hours ago Whether the practice is market rigging, as Lewis claims, is open to ... "The little guy is going to say, 'Why isn't the regulator doing their job and ...

Not a Good Day to Be a Stock Exchange - Stocks To Watch ... blogs.barrons.com/.../not-a-good-day-to-be-a-stock-exchange/ Barron's 1 day ago - Raymond James analysts Patrick O'Shaughnessy and Cory Dlugozima called the argument that the market is rigged against the little guy ...

The U.S. stock market is rigged to hurt the average investor and...finance.yahoo.com/.../ These HFTs give the big guys an edge that the little guys cannot compete with, says Michael Lewis, ...

etc. etc.

OK, we agree that the hype is wrong about HFT's being harmful to traders in general. Maybe we can also meet on the idea that no proof has been presented to the affect that HFT's are criminal. Bottom line here (imho) is that anyone who doesn't like HFT's needs to show proof of a crime, or show how even more state control of the marketplace could possibly do more good than harm.

He specifically stated on Jon Stewart’s show last night that HFT doesn’t compete against the guy with the etrade account.

I watched that interview. Didn’t hear him mention e-trade and can’t find it in the transcript. Please provide. Thanks.

“Lewis said the stock exchange sells special access to high-speed traders as a way to exploit ordinary investors - these traders actually get advanced word of the price movements of the stock (by milliseconds) so they can act before everyone else.”

http://www.cbsnews.com/news/is-the-us-stock-market-rigged/

Steve Kroft: What's the headline here?

Michael Lewis: Stock market's rigged. The United States stock market, the most iconic market in global capitalism is rigged.

I never ever mentioned e-trade. In my prior posts I talk about “the Market is Rigged” comment. I do not understand why you brought up e-trade? E-trade is not the issue. Lewis who is selling his book makes an obnoxious statement and he should be called out on it.

Steve Kroft: By whom?

Michael Lewis: By a combination of these stock exchanges, the big Wall Street banks and high-frequency traders.

Steve Kroft: Who are the victims?

Michael Lewis: Everybody who has an investment in the stock market.

I agree. I think a more accurate representation is "system favors the house". Which is what probably irks the day traders the most. Rigged insinuates illegality, which obviously is not the case.

I saw that and agree that it’s hyperbole. There was a comment about trade in another post. It was not mentioned on 60 minutes.

That's true in the gaming industry as casino patrons knowingly pay for entertainment services provided by the owners. The charges come out of patrons' wagers as agreed.

Let's decide that the market is for working adults and no place for fun'n'games. I enter the market with my eyes open and make my choices of my own free will, I'm a satisfied customer for what I buy and I'm grateful for my customers' business when I sell. If the market is 'rigged' at all then it's us guys buying and sell who're doing all the rigging. I mean, we're the guys who set the prices and all.

Nothing new today, everything's just like it was yesterday. News:

Stocks Finish Higher After Data U.S. Market Stocks rose Wednesday following mixed economic data. Automatic Data Processing's (ADP) March private-sector employment report showed 191,000 jobs were created, falling just short of the expected ... MorningstarWorld shares rise on China stimulus, US hiring World stock markets were mostly higher Thursday as investors took heart from new stimulus in China and evidence of stronger U.S. hiring. Gains were modest, however, in early European trading, as markets ..

Treasurys extend fall after ADP payrolls report NEW YORK (MarketWatch) -- Treasury prices extended a fall Wednesday, pushing yields higher after a report showed the private sector added 191,000 new jobs in March. The prior month's gains were also revised ... MarketWatch

The Wealth Gap in America Is Growing, Too It’s not just the income inequality between America’s very rich and everyone else that’s at issue. There is also a significant wealth gap as well.

The New York Times Hulbert: A Great Second Quarter Is Still Possible The first quarter was a real dog for the market, but that doesn’t mean the second quarter will be as well. Mark Hulbert joins MoneyBeat to break down the charts. WSJ Live

My "house" comments come from the process that large institutions have the ability to make those millsecond trigger calls where they can invest, and profit on the smaller player's slower moves. Huge moves skimming pennies a trade can add up pretty big. Fair?., probably not, but it is probably more of a competitive advantage (scale and technology) versus the claim of rigging.

Again since I don't I don't day trade, this doesn't bother me that much. 8 transactions a month is a pretty busy one for me.

KCG Morning Update:

U.S. stock-index futures were little changed, after the Standard & Poor’s 500 Index set a record, as

investors awaited reports on initial jobless claims and service-industry activity.

Gilead Sciences Inc. rose 1.7 percent in early New York trading after the drugmaker said a phase-three clinical trial for one of its products met its primary endpoint. IRobot Corp., which makes robot vacuum cleaners, advanced 2.9 percent in German trading after announcing a share-buyback program.

Futures on the S&P 500 expiring in June gained 0.1 percent to 1,884.6 at 7:33 a.m. in New York. The equity benchmark rose to a record 1,890.9 yesterday. The index climbed 1.3 percent in the first three months of 2014, its fifth consecutive quarterly advance. Dow Jones Industrial Average contracts added 22 points, or 0.1 percent, to 16,509 today.

“Any negative reports are largely ignored at the moment, or only taken into account in the very short term,” said Kai Fachinger, who oversees about $700 million as a money manager at RobecoSAM AG in Zurich. “This shows the clear optimism of investors, and the market could rise even more, especially if

tomorrow’s employment report comes in with good numbers. The risk of slight setbacks has increased, but for today investors will probably just take it easy.”

A Labor Department report at 8:30 a.m. in Washington may show that more Americans applied for unemployment benefits last week. Jobless claims rose to 319,000 in the seven days through March 29, according to economists surveyed by Bloomberg News. That compares with 311,000 for the previous week. The monthly jobs report due tomorrow will show that hiring increased in March, according to forecasts compiled by Bloomberg.

The Institute for Supply Management’s services index advanced to 53.5 last month from 51.6 in February, economists predicted. The ISM releases the data at 10 a.m. Readings above 50 mean that activity expanded.

European stocks were little changed, after climbing for seven days, as the European Central Bank kept

its benchmark interest rate at a record low. U.S. stock-index futures and Asian shares were also little changed.

Nokian Renkaat Oyj slid 2.6 percent after cutting its 2014 profit and sales estimates because of weaker Russian demand. Deutsche Bank AG dropped 1.6 percent as JPMorgan Chase & Co. downgraded Germany’s largest lender on capital concerns. Pernod Ricard SA fell 1.9 percent as Credit Suisse Group AG recommended selling the stock. BTG Plc added 2.3 percent after saying annual sales will be near the top of its forecast range.

The Stoxx Europe 600 Index slipped 0.2 percent to 336.26 at 12:46 p.m. in London, following its longest winning streak since October. The equity benchmark has climbed 3.7 percent since March 24 as improving U.S. data signaled the world’s largest economy is recovering from the harsh winter. Contracts on the Standard & Poor’s 500 Index gained 0.1 percent today, and the MSCI Asia Pacific Index added 0.1 percent.

• Support:1885, 1879, 1870

• Resistance:1894, 1898, 1908

Parallels between the current bull market in U.S. stocks and a 1980s surge point toward a decline later this year, according to Jim Paulsen, chief investment strategist at Wells Capital Management.

As the CHART OF THE DAY illustrates, the rally since March 2009 has now outlasted one from August 1982 to August 1987. The Standard & Poor’s 500 Index rose 179 percent through yesterday, approaching the 229 percent gain for the earlier advance.

“Investors should wonder a bit about how much 2014 may ‘rhyme’ yet later this year with the 1987 stock market,” Paulsen wrote yesterday in an e-mail about the comparison.

The S&P 500 peaked on Aug. 25, 1987, and plunged 20 percent in a day less than eight weeks later, on Oct. 19. Paulsen said yesterday in an interview that he isn’t expecting a recurrence of the Black Monday crash.

“We’ll have a correction to bring us back to where we started the year” after the S&P 500 advances to 2,000, the Minneapolis-based strategist said. The index began 2014 at 1,848.36, or 7.6 percent below his projected peak.

Renewed concern among investors about faster inflation may lead to the decline, he said. Consumer prices increased at no more than a 2 percent annual rate from November 2012 through February, according to data compiled by the Labor Department.

Something like my speed; for me its easier to pick a good company for holding a few weeks when so much new data comes out weekly. iirc they call us 'swing traders'. There are folks that can make money holding for a few hours at a time but I'm not one of them.

It was a great ride --four days of rising stock prices-- but it got cut short yesterday in light trade that looked like consolidation/profit taking; more details in the wrapup free at IBD TV. This morning seems more like a return to normal with metals'n'stock futures soaring (heat map here). News:

Related threads:

--and a beautiful Friday morning to all!

It’s NFP day!!!

How is monthly jobs report compiled? CNBC explains

http://www.cnbc.com/id/44451664

When someone loses a job, a family is affected. When many people lose their jobs, eventually the whole nation is affected. Workers lose income, while the country loses production and consumer spending.

With such a strong impact, the unemployment rate is a key way to measure the state of the economy.

So how is unemployment actually measured? Is everyone who is out of work counted? What are the so called “shadow unemployed”? CNBC explains.

What is the definition of unemployment?

As defined by the U.S. Bureau of Labor Statistics(BLS), unemployment is when someone does not have a job, has actively looked for work in the past four weeks, and is currently available for work. Also counted as unemployed are people who are temporarily laid off and waiting to be called back to that job.

How is unemployment measured?

Every month, the BLS releases a report on the gains or declines of unemployment from the previous month. The bureau does not use the number of persons filing claims for unemployment insurance (UI) benefits under state or federal programs. Why? Because some people are still jobless when their benefits run out, and many more are not eligible at all or never apply for benefits.

So, the BLS measures unemployment through monthly household surveys, called the Current Population Survey (CPS).

Not every household in the country can be counted, so the survey is meant to be representative of the U.S. population. The bureau says about 60,000 households in specific geographic areas are used for this survey, which translates into approximately 110,000 individuals.

Some 2,200 trained Census Bureau employees interview people in the sample households for information on whether they have jobs or are seeking one. Every month, one-fourth of the households in the sample are changed, so that no household is interviewed more than four-consecutive months.

The surveys have been conducted every month since 1940. They were started as part of the government’s response to the Great Depression, when millions in the U.S. and around the globe became unemployed.

The BLS unemployment statistics are based on people who are 16 years old and over. Excluded, however, are people of any age in an institution like a prison, nursing home or mental health center. People on active duty in the Armed Forces are also excluded.

To come up with an unemployment rate, the BLS takes the number of unemployed workers it has found and divides that by the total civilian labor force. The rate is released in the first week of every month and widely reported by news organizations.

The unemployment rate has obvious limitations. It can’t differentiate between full-time and part-time jobs. It doesn’t account for people who are underemployed, or working in jobs for which they are overqualified because they can’t find a good job. It won’t tell you how many people have become so discouraged in their job search that they have given up hope of finding a job. (See shadow unemployment below).

Why is the unemployment rate so important?

It’s one of the clearest indicators of which way the economy is moving. Rising unemployment is seen as a sign of a weak economy, with slow growth and little spending. That might cause action by the Federal Reserve, which has a mandate to help reduce unemployment, like increasing the nation’s money supply, also known as Quantitative Easing, in order to boost the economy.

On the other hand, if employment is rising and the economy is growing, that could cause fears of inflation and the Fed—with a mandate to control inflation—could raise interest rates to slow down an overheating economy.

Do states and cities conduct their own jobless rate surveys?

Yes. In addition to calculating the national rate, the BLS partners with states and cities to collect information for unemployment rates that are released each month. There are some 7,300 areas where this information is collected, including cities with populations of at least 25,000, all the states, and some selected counties.

Who is considered employed?

Anyone is considered employed if the person did any work at all for pay or profit during the time the BLS collects data. This includes all part-time and temporary work, as well as regular full-time, year-round employment. People are also counted as employed if they have a job at which they did not work, whether they were paid or not, because they were:

On vacation

Ill

Experiencing child-care problems

Taking care of some other family or personal obligation

On maternity or paternity leave

Involved in an industrial dispute

Prevented from working by bad weather

What is shadow unemployment?

This term describes people who have no job, have stopped looking for one and are considered out of the labor force by the BLS. As such, they are not added to official unemployment statistics.

Many who are not in the labor force are going to school or are retired, but would rather have full-time jobs. Family responsibilities keep others out of work as well. As a result, many people stop looking for work because they can’t find a job. They are what’s known as the “shadow unemployed,” and if counted, would increase the number of those out of work.

How do the seasons affect the jobless rate?

Total employment and unemployment are higher in some parts of the year than in others. For example, unemployment is higher in January and February, when it is cold in many parts of the country and as a result work in agriculture, construction and other seasonal industries is curtailed.

In June, both employment and unemployment rise, when students enter the labor force in search of summer jobs.

Who can and cannot collect unemployment insurance?

To get benefits, a person must have worked at least 680 hours in the past year and must have lost a job through no fault of his or her own. To remain eligible each week, the person must be physically able to work, available for work and actively seeking work.

People who own businesses or are members of limited partnerships or limited liability companies are not eligible for unemployment benefits.

Unemployment benefits are calculated on someone’s earnings. Each state has its own rules regarding the maximum and minimum weekly payout, but the range of weekly benefit payments is usually $130 to $590. To calculate the benefit amount:

Add the total wages for the two highest quarters in the past year.

Divide the total by two.

Multiply by 0.0385.

Generally, the unemployed are eligible to receive up to 26 weeks of benefits. If those are used up, a federal program kicks in extending the benefits up to 33 more weeks, and up to 99 weeks in some states, for those who qualify.

Unemployment benefits come from taxes collected from workers and businesses. Jobless benefits were first started in the U.S. in Wisconsin in 1932, but became national as part of the Social Security Act of 1935.

Prediction: at 8:30 everyone will talk about the report as if it were important, and then proceed to do what they were about to do anyway, but say it was the report that made them do it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.