Posted on 04/22/2013 8:29:02 AM PDT by xzins

FXstreet.com (Barcelona) - Instead of improving to 5.01M in March, US existing home sales fell from 4.95M to 4.92M,

(Excerpt) Read more at nasdaq.com ...

UNEXPECTED! Bottoms up!

The “Unexpected” administration...!

EVERYTHING happens to them unexpectedly. That is because they are just plain clueless to begin with.

As expected, “unexpectedly.”

“Unexpectedly” to whom? Not to me. Wish I had a penny for every time that word was used in the last 5 years.

Their policies are SUPPOSED TO WORK (in their minds).

So, something “unexpected” is happening to thwart these policies’ efficacy.

I don’t know why it would be unexpected if banks are expecting customers to come up with down payments and other methods of slowing down the ability to finance a mortgage. In the banks’ defense, why should they loan to those who aren’t good credit risks???

If the bulk of houses are on the low price end, and if those loans are harder to get, it doesn’t take a rocket scientist to predict a drop in sales.

These people blow my mind.

Existing Home Sales in March: 4.92 million SAAR, 4.7 months of supply

The NAR reports: March Existing-Home Sales Slip Due to Limited Inventory, Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 0.6 percent to a seasonally adjusted annual rate of 4.92 million in March from a downwardly revised 4.95 million in February, but remain 10.3 percent higher than the 4.46 million-unit pace in March 2012.

Total housing inventory at the end of March increased 1.6 percent to 1.93 million existing homes available for sale, which represents a 4.7-month supply at the current sales pace, up from 4.6 months in February. Listed inventory remains 16.8 percent below a year ago when there was a 6.2-month supply.

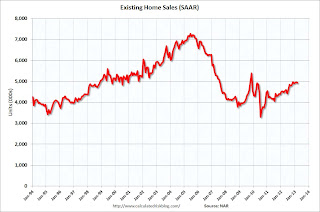

Existing Home SalesClick on graph for larger image.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2013 (4.92 million SAAR) were 0.6% lower than last month, and were 10.3% above the March 2012 rate.

The second graph shows nationwide inventory for existing homes.

Existing Home InventoryAccording to the NAR, inventory increased to 1.93 million in March up from 1.90 million in February. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer (so some of this increase was seasonal).

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Year-over-year Inventory Inventory decreased 16.8% year-over-year in March compared to March 2012. This is the 25th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Months of supply increased to 4.7 months in March.

This was below expectations of sales of 5.03 million, but close to Tom Lawler's forecast. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. This was a solid report. I'll have more later ...

They lie and then quietly issue the truth. This government in DC is broken... not our Constitution. DC=District of Corruption.

LLS

"It was all so, uh, uh, uh.... UNEXPECTED"

If it falls by “minus .6%”, then it rises “.6%”. 6th grade algebra.

Yes, but that’s not what they meant.

I assume they meant that it went in a negative direction. :>)

I am closing on a purchase and sale of a house. I am borrowing 25% of its appraised value. It is amazing how much info the bank wants for this mortgage. They would MAKE $200,000 if I defaulted on my debt.

If that’s your 25%, then salute!

"To combat the Great Recession, the Fed has bought trillions of dollars of mortgage bonds and U.S. Treasuries to juice the housing market and the economy in general."

It is amazing how much info the bank wants for this mortgage.”

Things have changed a lot. I bought my house 6 years ago. Filled out two pieces of paper which included my ss# and a listing of all my debts, added copies of my three prior bank statements and three weeks later I closed.

* Softer than expected report, adding to recent indications of a pause in the housing market recovery early this year. Existing home sales dipped 0.6% in March to a 4.92 million unit annual rate, little changed from 4.90 million at the end of last year and down slightly from the recent high of 4.96 million in November. Tight mortgage lending conditions continue to be a restraint on a stronger recovery, but, on the more positive side, the National Association of Realtors also blamed low inventories as the flow of distressed sales continues to ease, supporting a solid rebound in prices in the past year.

* Along with the flattening out in existing home sales in recent months, the homebuilders survey has turned lower in recent months, falling to 42 in April from a seven-year high of 47 in January, single-family housing starts fell 5% in March and are close to flat year-todate, and new home sales fell 5% in February after hitting a four-year high in January. Residential investment is still on pace to post a robust 14% gain in Q1 after rising 15% in 2012, but some slowing may be seen in Q2 if the recovery doesn't get back on track soon.

* The number of homes listed for sale, which is not seasonally adjusted in this report, rose 1.6% in March to 1.93 million, which was 4.7 months of supply at the current sales pace, up from 4.6 in February but still well below the 6 months considered balanced normally.

* There is still a significant overhang of shadow inventories, but this has come down substantially from the early 2010 peak, and a slowing flow of distressed properties has supported a solid rebound in average home selling prices. Distressed sales made up 21% of existing home sales in March, down from 24% in February and 29% in March 2012. This has supported a 19% rebound in the median sales price from the $154,600 January 2012 low to $184,300 in March.

* Housing affordability is at historically unprecedented levels. Principal and interest payments on a $184,300 median-priced existing home after a 20% down payment with the recent average 3.41% 30-year mortgage rate would be only $656 a month, unusually low relative to rising average rents. Difficulty obtaining a mortgage for borrowers with less than pristine credit remains an important headwind to a stronger recovery in home sales, however.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.