Posted on 04/21/2013 8:03:09 AM PDT by blam

Gold Price Forecast Drop Target $787.40

Commodities / Gold and Silver 2013

April 21, 2013 - 04:00 PM GMT

By: Brian Bloom

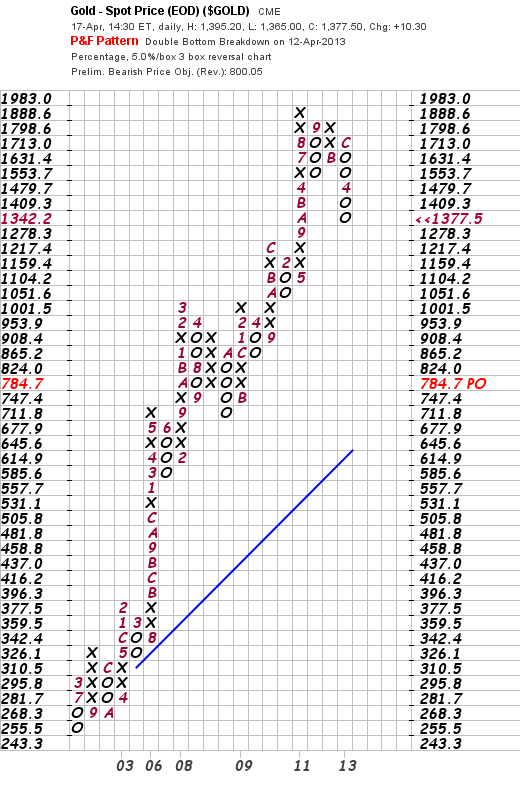

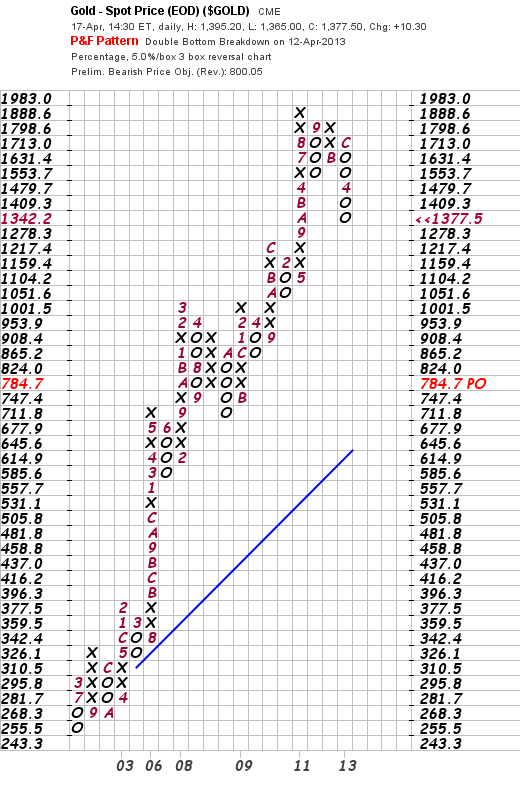

The unemotional 5% X 3 box reversal P&F chart below (courtesy stockcharts.com) shows a measured move target for gold at $787.40.

No time horizon is capable of being forecast.

Too few understand that:

· the Fed’s purchases of existing government debt does not add to the money supply and, therefore, it is not inflationary. (I read a scathing “expose” of Dr Bernanke’s stupidity and it was clear that the person attacking him did not understand the bookkeeping entries. )

· the slowing velocity of money across the planet serves to place a drag on both the money multiplier and the increasing money supply. Therefore, the Fed’s printing of money is losing its potency to drive the US economy, which is potentially deflationary.

· the underlying reason for the Cyprus deal structure was that the Greek public debt would have had to have been marked to market if the deal was not done in that way. If one of the two banks had been liquidated, the value of Greek sovereign debt would have become transparent. In turn, this would have triggered a cascading domino collapse of supposedly solvent banks who would have been forced to mark to market

· this situation of keeping sovereign debt on the books at full value is not sustainable. At some point, European sovereign debt will have to be marked to market. Should this happen, it will certainly be deflationary

· the people who will benefit most from deflation are the mega wealthy; the people who will have access to both income and cash in an environment of falling asset prices.

With these facts in mind, the above chart becomes believable, but I stress that the time it might take is unknowable. I have been blogging for eleven years trying to explain the real drivers of the economy. After due consideration, for me to continue blogging now will be pointless. My two fact-based novels make constructive suggestions. If people are interested in my thoughts in that regard then they should read those novels.

What rubbish. Just try buying an ounce of physical gold or silver at the “official” (paper) prices. Good luck! The premiums for physical are keeping the actual price of physical PMs up. We are seeing a divergence between paper gold and physical gold, IMHO. This split will continue, as investors who believe they have an option for physical delivery try to get their hands on “their” gold. Good luck to them, too!

Cool, Imma buy at 750...

Cool, who gonna sell at $750?

Not me!

The trick to getting rich on gold here will be buying at the bottom price. If employment goes up inflation will jump as more people chase more goods with more dollars causing shortages.

I’ll be shocked if it drops to $1,000.

We’re destroying wealth faster than central banks can create it. Of greater importance is how one defines “wealth.”

I know how I do and it can’t be corrupted.

He with physical gold always wins,at any price.

"#1 According to Zero Hedge, the U.S. Mint set a new all-time record for the number of gold ounces sold on Wednesday..."

"#2 Precious metals dealers all over the United States are having a really hard time keeping up with demand right now. According to Chris Martenson, many are warning customers to expect waiting times of five to six weeks at this point... "

(snip)

Brian, the LBMA market has been running on something like a 40-1 paper to metal ratio. It’s a fractional reserve bullion system. It works just fine until people want to take possession of their gold.

That time has come. Ever since ABN AMRO announced a gold default on the 1st April the wheels have been coming off.

This caused a run on the Gold held by LBMA member banks. That’s why there was that orchestrated selloff. The Fed (who have a huge stake in the reserve status of the dollar) sold 500 tons of paper gold in a single day in an attempt to shake metal out of weak hands.

Which didn’t work out so well. There are queues of buyers round the block at Scotia Mocattia (Toronto), UBS (Zurich) and in Hong Kong. The *enormous* Dubai Gold souk has been cleaned out. And that’s with Gold at 1400.

If you want to apply technical analysis apply it to a decoupling market. I don’t doubt that paper promises of Gold will pass through 700 bucks/oz - on their way to zero.

Actually, the price of paper gold will probably fall to zero sometime within the near future.

Gold bullion, however, is selling near all time highs in almost all currencies despite the best price suppression efforts of central bankers. Just about everybody with an I.Q. greater than a carrot expects this trend to continue unabated as long as rampant money printing continues.

In related news, for some mysterious reason, Ben Bernanke To Miss Jackson Hole Symposium Due To "Scheduling Conflict". This is sort of like a football coach missing a big game because of "other commitments." The Helicopter does not want to talk to other economists or face the media, even in a structured, sheltered, controlled and friendly environment. For the life of me, I can't figure out why this would be so.

Rubbish. If that we're true, then the Fed should buy up 100% of the debt, we can cancel all taxation, and just keep the Fed purchasing debt.

If I had to bet my life, I’d bet Gold reaches $2000 before it reaches $1000.

You can buy 1 ounce gold coins from Kitco for 4.5% above spot. Same with silver. They have plenty on hand. Or, if you mortgage the house you can buy a 400 ounce bar right now for $565,000. That is only a $6.00 per ounce spread.

Buy on the dips.

That’s such a half truth that I’m going to call it a lie. They have Krugerrands and Eagles; they are not offering Maples or Philharmonics any more — although they do offer to buy them.

Also, please note the multiple instances of “Only shipping outside USA”, “due to high demand”.

https://online.kitco.com/bullion/completelist_USD.html

Let’s hope his “personal scheduling conflict” features a tear-stained handwritten note and a 10th-story window ledge.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.