Posted on 02/03/2013 7:54:32 AM PST by blam

Harry Dent: Stock Market Roller Coasters And Bear Megaphones

Stock-Markets / Stocks Bear Market

February 02, 2013 - 06:57 PM GMT

By: The Gold Report

Booms and busts in the economy are based on predictable demographic cycles such as those studied by Harry Dent, founder of HS Dent, chairman of SaveDaily.com and author of "The Great Crash Ahead: Strategies for a World Turned Upside Down." In this Gold Report interview, Dent predicts a global crash between mid-2013 and early 2015, in an ongoing decade of economic coma. For now, gold and gold equities are great investments, but when the crash comes, read on to find out what he suggests will be a good sector until the echo generation enters the workforce and starts buying potato chips and houses.

The Gold Report: Harry, you base your economic predictions largely on demographics and demographic cycles. As the baby boomers enter old age and spend less, will that quash any hope of an upward trend in the overall economy?

Harry Dent: Ultimately, yes. Spending by baby boomers hit its peak in countries like the U.S. in 2007. On average, baby boomers will spend less and less in the years ahead as they move toward retirement. Governments and central banks around the world keep stimulating to keep their economies up and to keep their banks from failing, but they are fighting against the largest generation in history. Stimulus works less well with an older population that does not have kids to raise and put through college. Demographics will make stimulus plans more and more difficult, and at some point they will fail.

TGR: A lot of your thinking is rooted in history. One of your recent articles mapped the trajectory of the 1929, 1968 and 2007 booms and busts, noting that politicians and investors blew those opportunities by focusing on the symptoms rather than the causes. Is there any tactic that can overcome the demographics?

HD: We have two major trends. The first is the baby boom peaking in most wealthy countries. The second is the greatest debt bubble in history, especially in real estate.

Private sector debt has grown 2.7 times the economy since 1983; government debt has grown almost as fast. In a debt bubble, assets rise, people overspend, businesses overexpand and it takes a period—usually a decade or so—to work off those excesses. Today, governments around the world are refusing to countenance a downturn. They are trying to replace every dollar of economic downturn or of bank losses with stimulus money created out of nowhere. Similar to an addict taking more and more of a drug to not come down off of a high, the governments are keeping the bubble going.

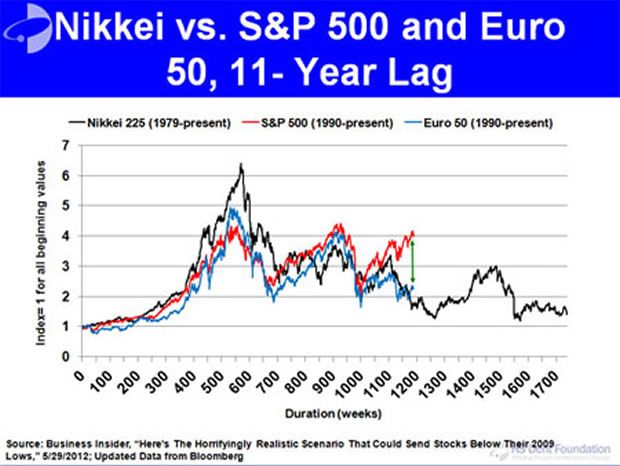

Stimulus can avert a crisis in the short term, but not long term. You have to deal with your debt or you will not emerge from the crisis, as Japan has shown clearly after 23 years of a coma economy.

TGR: One of the trends you wrote about recently was what you called the "currency war" among Japan, the U.S. and the Eurozone, in which all are printing money. What does that mean for investors and how should investors react?

HD: After the last great debt bubble, in the 1930s, governments did not step in to prevent the collapse of banks. Governments did increase trade tariffs, which led to trade wars.

Recently, Japan's strategy has been to print enough yen to push down its currency to increase exports, even though its domestic economy is dying due to an aging population, bad demographic trends and super-high debt ratios. By doing this, Japan is starting the next trade war. Other countries will respond by lowering their currencies and doing more stimulus. If you keep doing this, the whole thing will break down at some point.

The question is when. We think the next breakdown will start in late 2013 or early 2014.

Europe tried a $1.3 trillion quantitative easing (QE) stimulus program in late 2011/early 2012, but fell into a recession anyway. The U.S. has had QE3 and now, QE3 Plus. Japan, too. These are signs of desperation, not progress. Countries cannot reinvigorate economies that are comatose, they can only keep them barely alive on life support.

These latest stimulus plans will create very little incremental growth and even decline. Stimulus only works so long because it is artificial. It is not real.

TGR: Do you expect the result to be inflation or deflation?

HD: We had deflation for several months in late 2008 and early 2009, when the financial system actually melted down from the debt bubble bursting. Then the government stepped in and started stimulating like crazy to create inflation. If we had seen this level of money printing and stimulus anytime in the past, inflation would have gone through the roof. But it has not; inflation is at a modest level.

With governments fighting deflation with inflation, we will get more inflation in the near term from all the stimulus. But if the system melts down again, which we expect between late 2013 to early 2015, deflation will set back in. There is also likely to be another crisis and deflationary period between 2018 and 2019. These are the two danger periods we see ahead for investors.

The pattern is inflation, deflation, then another government stimulus plan, followed by minor inflation and then deflation again. Until governments eliminate their restructured debt, they cannot come out of their debt crises. No government is doing this, which is not a good sign for the future.

TGR: How can investors protect themselves in such an unsettled economy?

HD: Investors must realize that there is a new normal. Stocks will not be growing at 12%/year. Bonds will not yield 5–6%. The new normal is not even the expectation of 4% on stocks and 2% on bonds that people like Bill Gross from PIMCO suggest. The new normal is a roller coaster of one bubble bursting after another.

Investors have to get away from the traditional concepts of diversification and asset allocation for the next decade or so. When bubbles burst, everything goes down. In 2008, real estate, oil, commodities, gold and silver crashed. The U.S., European and emerging markets crashed.

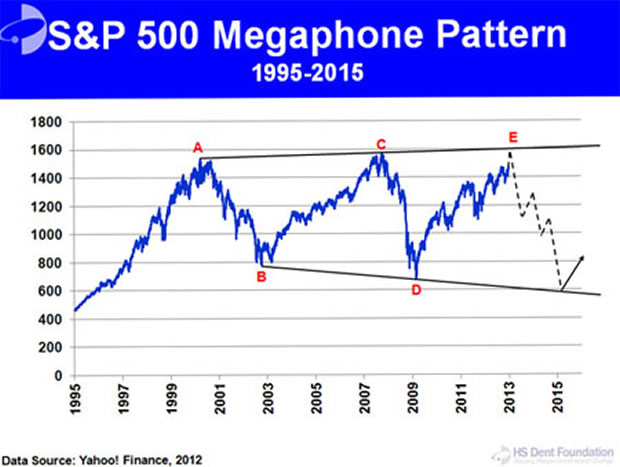

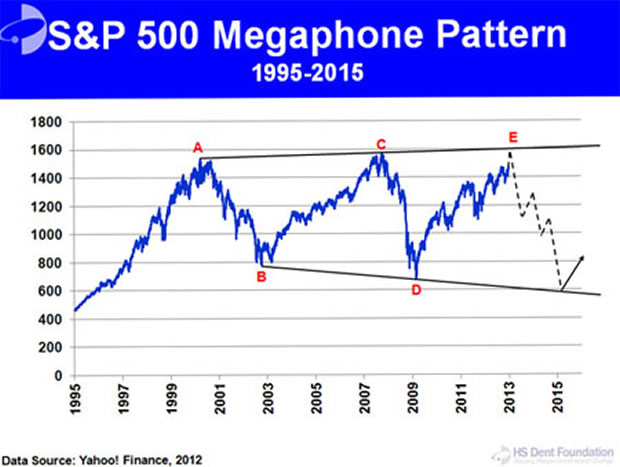

With each bubble, the market has gone to a slightly new high and to a slightly new low when the bubble bursts. We call it a megaphone pattern.

We are likely to see new highs in a lot of stock indexes in the first half of 2013. Our target for the Dow is 6,000 in the next two or three years, when we see the next burst coming.

You need to think like a long-term trader. Get more defensive. When stocks crash, get back into them. This will not be a decade where investments will only go down. It will be a roller coaster of boom, bust, boom, bust.

TGR: Roller coasters can be scary things. Unless you are looking in the rearview mirror, how do you know when is the high and when is the low?

HD: It is not easy. We predict that the Dow could go as high as 15,000 this year before dropping to 6,000 in early 2015. Nobody can predict the exact top or the exact date.

You can only guess by seeing when investors are overly bullish or bearish and when patterns are stretching on. And if governments are able to contain the next crash and crisis to, say, 1,100 on the S&P 500, then we will see a bigger crisis between 2018 and 2019.

The megaphone pattern is the best single pattern we have right now. The next top in this megaphone pattern in the S&P 500 is around 1,600; only 6% from now. Stocks do not have a lot of upside despite all the good news about fiscal cliffs being averted, QE3 Plus and stimulus from Japan and China.

I do not see a lot of good news coming. Baby boomers will keep aging and spending less. Stock earnings are decelerating, although still growing for now.

Gold is the one thing we see going up more than anything else in the near term. The more money governments print, the better it is for gold. But when that government strategy fails and economies melt down, gold will go down.

Gold and silver may be the best investments in the next several months. The gold and bond bubbles will be the last to peak as even the bond bubble seems to be starting to unravel. Everybody has been rushing into gold, silver and bonds as safe havens, but the truth is investors keep rushing into every bubble until it bursts and, at some point, all the bubbles burst.

TGR: How high do you think gold could go before it bursts?

HD: For two years, gold has been trading between $1,520/ounce (oz) and $1,800/oz. If gold breaks above $1,800/oz, the next target is $1,934/oz (the past high), and then a new all-time high is likely between $2,030–2,080/oz. If it gets that high, we would advise people to take their gains in gold.

However, I think gold is likely to fall to $750/oz in the next two to three years, maybe even lower.

TGR: What about gold equities, particularly the juniors, are they on a downtrend or have they hit bottom and are ready to come back up?

HD: I think gold stocks are near a bottom and, like gold, are likely to rally in the first half of 2013. The equities are much oversold. Traders are very bearish on them, which is a good sign.

In general, we see stocks in the U.S. and Europe as having 4–6% on the upside. However, silver and gold stocks could go up anywhere from 10–25%. Gold and silver equities are very good plays right now.

TGR: You have called this an opportunity for once-in-a-lifetime investment success and have suggested investing in Asian, multinational, technology and healthcare stocks. What are some specific names that could succeed in this roller-coaster environment?

HD: I focus more on sectors than stock analysis. In general, whenever there is a crash, you want to buy because another bubble or expansion will follow, even in a long-term bear market. You want to buy the sectors most favored by technology and demographic trends.

If I am right, and stocks crash again in late 2014 or early 2015, I want to buy in the healthcare sector in the U.S. and Europe, especially the most leveraged areas: biotech, medical devices and pharmaceuticals. The baby boomers will continue spending on healthcare and healthcare products, even as budgets get crimped by entitlement reductions. [Editor's Note: For more ideas on investing in the life sciences, visit The Life Sciences Report].

Next, I want to invest in areas of the world with strong demographics and emerging countries that are not as dependent on commodity cycles. We think commodity cycles, which have peaked every 30 years, most recently between 2008 and 2011, will go down into the early 2020s before turning up again. Instead of emerging areas like Brazil, the Middle East or Africa, which are large commodity exporters, I want to invest in countries like Vietnam, Cambodia, Thailand, Indonesia and especially India. India is not a major commodity exporter and it has the best demographics.

But whatever you buy, you have to wait for the crash, maybe two to three years from now. You have to wait for the crash because all stocks go down to some degree in a crash, so you do not want to buy now.

TGR: Do you also trade based on the daily headlines? For example, I have read about Apple Inc. (AAPL:NASDAQ) taking a short-term dip that is part of a larger wave. Do you take advantage of daily dips?

HD: We are more expert in the long-term trends, demographics and cycles, but, yes, we do look at the short-term technical indicators. Stock being oversold or overbought or people being overly bullish or bearish are the most important factors.

Apple is a classic example. It was around $700/share and in a matter of months went down to $440/share. Wall Street loved Apple and now is shedding the stock. That is classic short-term thinking.

Apple will probably go a little lower, but it is undervalued now. I would rather buy Apple than Google Inc. (GOOG:NASDAQ). In fact, I would rather buy gold, which is undervalued and overly bearish.

Long-term trends are highly predictable. Short-term trends depend on political decisions like the fiscal cliff and on traders over- or undervaluing stocks.

TGR: We have talked about the baby boomers. Let's turn to the other end of the age spectrum. According to your research, when will enough young people be in the workforce earning money, buying potato chips and houses to pump up the economy again?

HD: We are looking for that to happen in the early 2020s. That is when the echo boom, the next generation, will enter the workforce in large enough numbers and start to raise their families and buy housing. The next boom will not be as strong, but it will turn the trends back up.

The echo boom generation in almost every wealthy country—whether it is in Japan, which peaked earlier than us, or Korea, which will peak later—is not as large as the baby boom generation. The baby boomers built all this housing and infrastructure, and it bubbled and now it is bursting.

Look at Japan. Real estate there has been down for two decades. The next generation should be buying houses by now, except the young generation has much more part-time work and lower wages than its parents' generation. The older generation has been protecting all of its benefits and entitlements and retiring at their expense. A recent survey showed that 40% of young Japanese males have no interest in sex, dating or marriage. Why? Because they cannot afford it. They just want to be carefree and survive on a small budget.

Everything that has happened in Japan will happen in Europe and the U.S. The U.S. and Northern Europe, where the echo generation will move forward in the early 2020s, have better demographic trends than Southern Europe, Germany and Switzerland. The trends in East Asia, Japan, Singapore and Korea and eventually China, are horrible.

TGR: What should we be doing while the market is in a coma to be ready to prosper when the country comes back in 10 years?

HD: Fortunes were made in the early 1930s, from Joseph Kennedy to major companies, like General Motors and General Electric. In a downturn, you take advantage of the fact that everything falls. Buy when things are down.

Everyone likes a sale. Who would not want to buy a $500 Brioni shirt for $150 or pay $30,000 for a Mercedes that normally goes for $60,000? That is what will happen in financial securities over the next decade.

We will continue to see crashes, and after a crash you can buy businesses, commodities, real estate, stocks, even gold, at unbelievably lower costs. You create wealth by buying things at the bottom.

The smart people in the new normal environment of ongoing crashes think like long-term traders. They sell stocks, commodities, real estate and gold when they are high and re-buy them at unbelievable discounts when they crash. The world is your oyster if you are patient.

Your key goal should be to protect the gains you made in the greatest global bubble boom in history. Get out, keep cash and wait for the next big crash. Then buy at $0.20 or $0.40 on the dollar. What could be better than that?

TGR: Sounds like an opportunity to me. Thanks, Harry, for your time and your insights.

I’m in equities. I buy protection on the weekends in case it crashes with the system down or if I’m away from my desk during market hours. It feels toppy. But it can go up another 5% also.

The Fedgov is just like that family in 2007 riding a wave of false prosperity based on maxxed out credit cards and helocs on a house with negative equity. Two leased luxury SUVs and a McMansion.

The Baraqqis were able to keep the charade going and buy the 2012 election, but I don’t think the gravy train will make it to 2016.

It will be painful for most all of us.

Milton Friedman predicted all this rise in the stock market fifty years ago. He wrote that when an Obama type administration borrowed, printed and spent wildly, there would be an increase in equity prices as a hidden form of inflation, but no corresponding increase in real wealth. Eventually those stocks will crash because there is no real economic foundation. Its not just in the US. China sits on the world’s biggest real estate bubble and has squandered enormous amounts of capital. Gold is probably a very good investment.

I feel like all I can see is doom and gloom, but I can’t rationalize it away.

It looks to me if Dent is basing most of his reasoning on demographics. There is so much more stuff, very scary stuff, at work here. Too much to even begin listing here.

Hell, the truth is, we are just screwed. Next year or the year after, as The Hildabeast says, what difference does it make?

I’m invested in 3D printing stocks.

He’s a pretty reasonable analyst but no way will gold retreat to $750. The 2008/9 deflation brought it down from 1000 to 750. The next deflation will bring it from 2000 down to 1500 (or higher). Granted, gold won’t be a good investment for a year or two but that only matters to speculators not to me.

I’m waiting on a pullback before pulling the trigger on ADSK. DDD and SSYS have ran too far too fast for me. I do have ONVO I bought at $2/shr. If it falls to $3/shr I’ll buy more.

My biggest issue with Harry Dent is that he believes in long-term economic cycles based purely on demographics. However, I think that maybe when a nation maxes out it’s “credit card” that there is something more fundamental that “just another cycle” taking place.

Later in the article...

“Apple will probably go a little lower, but it is undervalued now. I would rather buy Apple than Google Inc. (GOOG:NASDAQ). In fact, I would rather buy gold, which is undervalued and overly bearish.”

Gold likely to crash in two years, but it is undervalued, so buy buy buy?

This turkey is hawking gold so he can dump his before the crash.

It has felt tippy at every climb to me. I mostly predict wrong and am in good company for that.

I felt like it was too high in mid-Nov at 13,000 with the reelection of satan and the whole fiscal mess but look what has gone on now.

For us who would like to retire on our nest egg it looks pretty bleak. If you get the peak wrong or just ride though it can be a disaster without some way to support cash flow.

I see nothing ahead but blood, toil, sweat and tears.

So much to read and so little time. This is a great link I had never heard of. Thank you.

I am reminded by this that the best producer at one of the Merrill offices is not a successful stock picker but a salesman. His eminent knowledge in all things financial springs from his in depth background as a house painter and a jewelry salesman at the Houston Gold Exchange.

I am also reminded of something I posted here as an example of reality, “In oil companies, production departments sell oil, board rooms sell stock. Oil is the means to the end.”

Our task of course is to somehow make sense of the nonsensical world we are in and somehow make money we have earned work for us. It seems to me that the best investments I have ever made are in me. That is, a business that I can some how manage and exert some control over. That however is becoming harder all the time because we are so much less free all the time.

I think the best plan is to continue working and then just die.

The two things you mention are connected. Dent knows that and has written about that too.

I was goofing off in life until about 1979 (aged 30). Then I started saving, and by 1981 I was investing on a small scale in real estate. I read Dent in the early 90’s and invested more based on his books.

I mostly retired in 2009 (aged 60), having sold my investment real estate and/or converted it to mineral rights by then. I slipped out before the real estate downturn hit hard, thank to Dent.

I never paid attention to his stock market predictions, I’m a real estate guy. It was a nice run, and now I’m cherry picking at rental investment when they are too good to pass up.

Thanks, Mr. Dent.

Thank you. I hear this crap that China is such a growing giant blah, blah, blah. China is just as vulnerable as other countries.

Can a 3d printer make parts to make a 3d printer?

———the best plan is to continue working and then just die.——

: )......... yep

At 70 my little business has somehow got out of hand. There is more to do than I want to do. I wonder sometimes if I should just quit rather than take on the bother of growth or working more than I want to. I’m not getting wealthy at it, but I enjoy it.

I guess you are right. Just keep on keeping on and then just die.

Regarding investments, he uses the phrase inflation at a modest level. My view is that modest means as high as will be tolerated. Further, that level is 6-7%. That rate compounded for 10 years will reduce the original debt by half. It is this compounded inflation that will increase the price of hard assets...... companies, gold, real estate.

Here's an article on a 3d printer that replicates itself.

http://www.reprap.org/wiki/Main_Page

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.