Help End The Obama Era In 2012

Your Monthly and Quarterly Donations

Help Keep FR In the Battle!

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

Posted on 08/07/2012 3:02:11 PM PDT by blam

Top Wall Street Strategist: 'We're On The Verge Of The Next Great Bull Market'

Mamta Badkar

Aug. 7, 2012, 5:19 PM

In an interview with Bloomberg TV however, BMO's Brian Belski says that despite the lack of investor confidence, stocks are set to do well.

He also said investors in the past decade have focused too much on macro as opposed to stock fundamentals:

"What we have here to quote Cool Hand Luke is "a failure to communicate". Investors clearly have confidence issues this year and that's why you've seen these sharp moves to the upside and the downside. We continue to think we're on the verge of the next great bull market.

...I'm not trying to price myself out of a job but in the last 10 - 12 years we in the investment world have become so macro dominated we've forgotten that really fundamentals define stocks. We live by one very simple premise that stocks lead earnings, which lead the economy. "

In a note to clients, Belski along with BMO strategists Nicholas Roccanova and Mira Borisova point out that "S&P500 earnings are not U.S. GDP". They write that earnings growth is more sensitive to emerging market growth anyway so it could weather a slowdown in the U.S.. They also say historical precedence shows that stock market performance has been strong even when earnings growth has deteriorated.

In fact, continuing on his vein of stock leading earnings, which lead the economy, Belski says:

"We think the stock market revival we've seen in the last several weeks is foreshadowing what's going to happen in the economy again …meaning a recovery in the second half."

Bottom line: While higher earnings growth have led to higher stock prices, it doesn't mean that weakening earnings growth

(snip)

(Excerpt) Read more at businessinsider.com ...

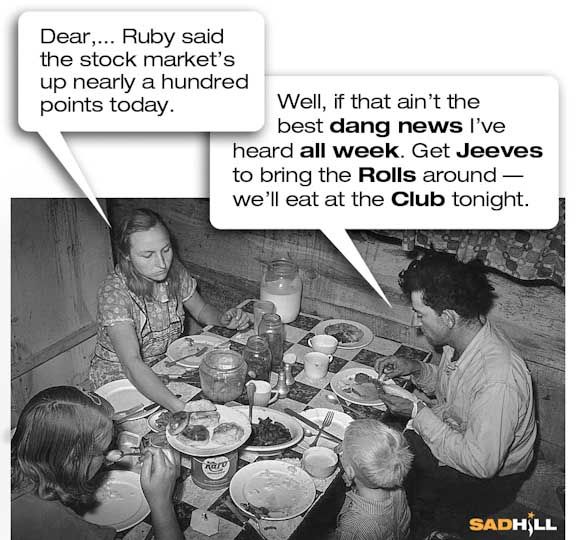

Sounds like a lot of bull to me.

I’ve seen emails from Nigeria that sounded more convincing than this guy.

Eat, drink and be merry, for tomorrow we die!!! (or almost wish we did)

Gosh I WONDER if AFTER the election we’ll see these rosy stories, right...?

NOT. HOLDING. BREATH.

/johnny

Obama operative: I’m telling you folks, the very day after the election things are set to boom.

Now that I can believe...

The market taking off? Not so much.

Frankly I’m amazed it’s where it is. It defies logic to me, but what do I know. My money sure isn’t in it.

Hey folks, go back four years. Weren’t they saying business was really going to rally under Obama?

How did that work out? Why should we believe them now?

“Oh pleeeeese, just one more chance, just one, I’ll be good...”

Guy is nine years old I’m tellin ya.

I don’t know what to do, anymore. Stocks were poised to crash. I was thinking about shifting lots to precious metals, and shifted some. But I mostly held back. Then gold and silver declined, a lot. Good thing I didn’t cash out of stocks, and good thing I didn’t buy more metal on it’s way down. Now my stock holdings are up, crazy market. What to do?

Need I say more?

Kool Aid drinker.

He sounds like one of those experts that is “surprised” by the “unexpected” news on an almost weekly basis.

Bad news is so are Barry's capital gains taxes.

Thanks for nothin'

Maybe when Obama loses 90 days from now.

If Obama is elected it will a Burro market... currently its a Donkey market..

If Romney is elected it will be a RINO disguised as an Elephant market..

Obama has butchered the BULL... for steaks and hamburger for his friends..

The writer may be correct. But to me it sounds like the precursor to another “Pump and Dump”.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.