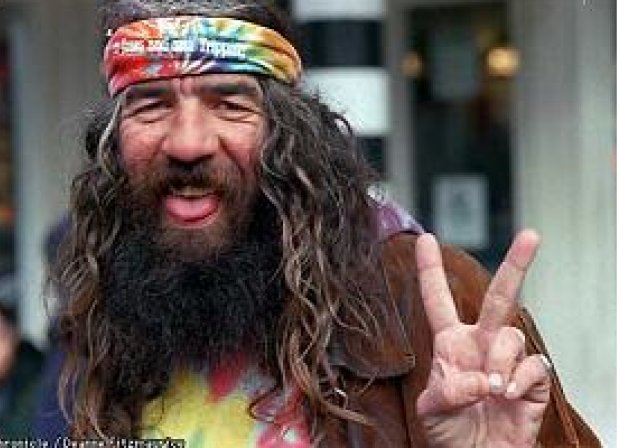

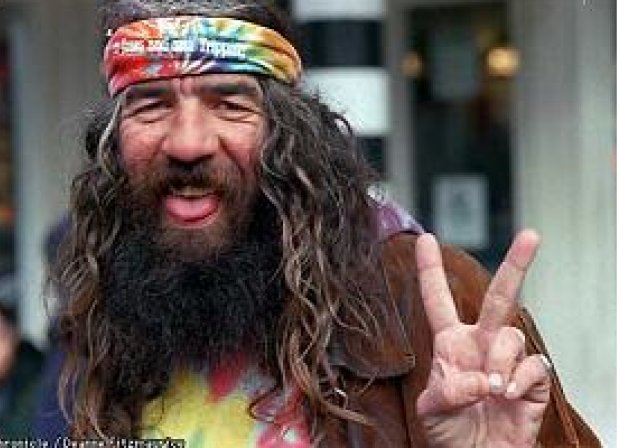

It's, like, deep stuff, man. Words and stuff that, like, blow yer mind, man! Don't be a conformist!

Posted on 05/21/2012 6:12:31 AM PDT by SeekAndFind

In the late 1990s, the craze for initial public offerings was hailed as the dawn of a new age. The Internet was replacing manufacturing. Who needed a factory floor when you could point and click?

Facebook’s Friday IPO, which opened with a staggering $104 billion valuation for the company, hasn’t transported us back to the bubble years of the 1990s. But, like that time, today’s Facebook frenzy is about what our society values. When Mark Zuckerberg rang the opening bell on Friday, his company’s $38 share price wasn’t rooted solely in the economics of the social networking giant. What the financial analysts are selling isn’t just the initial public offering of a company that Zuckerberg started in his dorm room at Harvard eight years ago. They are selling an image of the United States.

When public offerings break records, as Facebook did with most shares traded on the day of its IPO, they do so because the company mirrors how we see ourselves — and the image of the future we want to project.

Before the tech bubble and the “new economy,” IPOs were about manufacturing strength and proven American power. That’s what the public offerings from General Electric at the turn of the 20th century and Chrysler and General Motors in the 1920s showed.

When Ford finally went public in 1956, it broke records as the largest IPO. By the time Americans could line up to buy a piece of the company, it had been around for 50 years. The stock market was driven by companies with established products seeking to expand, a growth idea that has been uniquely American.

The notion that a product didn’t have to be well-established to attract starry-eyed investors began in the 1960s.

(Excerpt) Read more at washingtonpost.com ...

If anyone can discern a coherant point in that gibberish please clue me in.

Sheeple are valuable?

Facebook stock is gonna crash.

All the hype...seems like a house of mirrors to me.

The guys with the gold and silver are already sitting in their chairs. (ahem)

If anyone can discern a coherant point in that gibberish please clue me in.

As Sam Walton once said, “It’s only paper.”.................

Nothing.

Stupid article.

I still don’t see anything close to that much economic value in FaceBook. I have never followed a FaceBook ad, bought any of their merchandise (do they have any?), or spent any money based on information that showed up on FaceBook. I use it as a discussion board for my extended family, and even searching for a source of economic value over the weekend, I couldn’t find the justification for that share price and P/E ratio. I genuinely don’t get it, unless people are buying FB stock as this year’s Furby, Tickle-me-Elmo, Cabbage Patch Doll, Rubic’s Cube, and Pet Rock.

Facebook is an advertising and marketing company based on people talking about themselves and gossiping about others.

I do see it as a reflection of people’s value(s): ENTERTAINMENT IS ALL

I remember the ridiculous prices being paid for cell phone bandwidth and I thought, man, they must know something I don’t. And now I have a basic plan with one of the cheapest providers and my cell bill for my wife and me is $116 a month. It is our third highest bill. And the company we use is still teetering on possible collapse, IMO (T-Mobile, also the company I worked for for five years before going Galt last year)

Regarding facebook, I turn down all requests for info and will not accept terms for any service from their video or photo sharing software to sharing my calendar. And I have NEVER clicked through to an ad. So maybe they are depending on a younger and less skeptical generation.

The true test of social-networking companies may be proven in a future crisis. Will the federal government be likely to prop up Facebook as it did GM and Chrysler or even AIG and the big banks? That’s not a question about market hype or expectations. Only the hard facts about a company’s worth to the economy.

It's, like, deep stuff, man. Words and stuff that, like, blow yer mind, man! Don't be a conformist!

35.72

GM just pulled out its ads in Facebook. The claim that they spent $10 million in return for close to nothing.

BTW, for Facebook users out there, how many of you have ever really clicked on an advertisement when you see it?

RE: Facebook is an advertising and marketing company based on people talking about themselves and gossiping about others.

_____________________

GM just pulled out its ads in Facebook. GM execs claim that they spent $10 million in return for close to nothing.

BTW, to you Facebook users out there, how many of you have ever really clicked on an advertisement when you see it?

$34.06 @ 0943 EDT.

Is there a myspace page for this IPO? Maybe a Geocities neighborhood? How about a LiveJournal review of it? How about at least an AOL board on it? A Prodigy Community?

Is it worth 1/3rd of Apple? Or half of Google? Well, it is part of everyday life for a whole lot of people. Then again, the same can be said for Twitter - not a sterling recommendation there.

If you bought it at the offering and sold it at 40, I think you did ok. If you’re still holding it today expecting it to increase in value, you’re putting your eggs in the basket of people who have no concept of investor relations (see Timeline.) Not to mention this magic system where people can go to share their lives, buy and sell, advertise, etc, can’t even be utilized to sell stock in the company.

It’s really quite simple. Find places where people waste time, and show them advertisements for stuff.

TV, facebook, newspapers, websites, freeway roadsides.

And...

I keep reading that they don't have any money and probably won't.

(I also noticed that he waited until he had the money in the bank to marry his long time girlfriend)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.