Skip to comments.

11 Signs That Gold Is In A Bubble That Is Going To Burst

Business Insider ^

| 10/25/2010

| James Altucher

Posted on 10/25/2010 7:43:44 AM PDT by SeekAndFind

I first wrote about gold in early July at WSJ.com. I took a lot of heat then but the jury is still out.

In fact, since July 9, stocks and gold have performed almost exactly the same.

But with stocks trading at record low multiples over earnings (versus bond yields) and with gold at an all time high I can think of 11 straightforward reasons why the Gold Bubble is going to burst and stocks are the primary place one should put their money.

* It has very few industrial uses.

* Gold has no dividend yield.

* Gold has no earnings yield.

* The US should start selling its gold to pay down its debt.

* Interest rates are at zero and the Fed is printing money.

* John Paulson and George Soros can't carry the market forever.

* Gold production is rising.

* Gold sentiment is at an all-time bullish high

* Assets in the GLD ETF, the ETF which tracks gold, are also reaching a level usually associated with a top

* The Oracle is a huge gold bear (That's Warren Buffet)

(Excerpt) Read more at businessinsider.com ...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: altucher; bubble; gold

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-43 next last

To: SeekAndFind

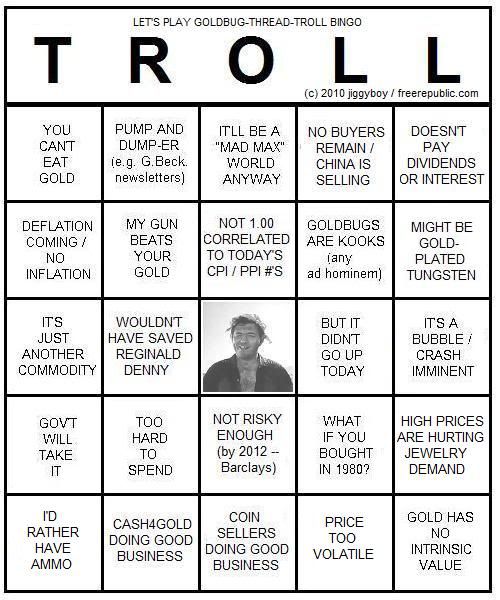

And here, again, are my signs that gold is NOT in a bubble:

- Nothing can be in a bubble unless it is well past the previous inflation-adjusted all-time high

- Gold regularly drops up to ten percent in three days or less and once dropped more than twenty percent nearly without a break in 2008. Bubble price action goes one way.

- In every case, gold “corrections” have taken weeks and months to recover. Bubble price action is exponential — not a grinding, grudging “recovery”.

- It is almost a commodity, yet supply is not readily available. That’s a supply shortage, not a bubble.

- Boiler-room companies (i.e. cash4gold) are begging the masses to sell to them, not to buy from them (see below)

- CNBC is still bashing goldbugs instead of worshipping them

- We haven’t seen a TIME or Business Week magazine cover with a cartoony John Q. Public engaging in borderline-sexual acts with Lady Liberty from the Saint Gaudens Double Eagle

- Nobody you know, knows what Lady Liberty from the Saint Gaudens Double Eagle looks like

- Hollywood hasn’t yet made gold-related TV shows, movies, etc.

(Here are three jewelers within sight of one another all offering to buy ANY kind of gold at the Lakewood Center Mall in southern California in mid-September 2010.)

21

posted on

10/25/2010 8:24:27 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: SeekAndFind

* The US should start selling its gold to pay down its debt.

Does the US have any gold?

The US (I'm assuming he's talking about the government) should stop spending so friggin' much!

22

posted on

10/25/2010 8:27:08 AM PDT

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

To: ASOC

The difference with silver is that the 1970’s highs came from an attempt to corner the market by Hunt. So those highs have no relationship to a market reality at the time . . . market was rigged. Gold market, as far as I know, had no attempt to corner.

To: rahbert

Either way his assertion that gold has few industrial uses is false.

24

posted on

10/25/2010 8:29:55 AM PDT

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

To: SeekAndFind

Oh wait, this is from James Altucher?

Here one of our threads on his July article where he's roundly and rightly hooted down http://www.freerepublic.com/focus/f-news/2554310/posts, which itself includes (at my post #30 there) a link to another grown-up who puts Altucher in his place.

25

posted on

10/25/2010 8:30:51 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: SeekAndFind

The dollar is being systematically crushed by Bernanke and with a trillion dollars about to be dumped in the coffers of the banks....gold will only hold and appreciate. I seem to remember Buffet losing his ass when he exited the silver market about 2 years ago. Silver has since doubled in value.

Gold will see $1650 before February and beyond $2000 before the end of 2011.

To: SeekAndFind

To: philman_36

I’d respond that at 1600+/oz. it has precious fewer industrial uses than it had when I last bought it at

476/oz.

28

posted on

10/25/2010 8:34:54 AM PDT

by

rahbert

To: Zakeet

BBC News ^ | Monday, October 25, 2010 | BBC

The US dollar has hit a 15-year low against the yen after the G20 nations agreed to avoid a currency war.

Hmmm - What happens if the US dollar experiences double digit inflation?

Do you really think the Feds will raise interest rates with 10% unemployment? Back in the days of Jimmy Carter we had Stagflation. If I recall correctly - Gold did pretty good.

To: rahbert

I’d respond that at 1600+/oz. it has precious fewer industrial uses than it had when I last bought it at 476/oz.

True enough. If I could find an equally effective alternate for a cheaper price I would switch simply to save production costs.

30

posted on

10/25/2010 8:45:19 AM PDT

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

In fact, since July 9, stocks and gold have performed almost exactly the same. He has a pretty liberal definition of "almost exactly the same". The shape of the two graphs are going more or less in the same direction, yes, but you have to ignore late August when the the S&P dropped 5% while gold rose 5%, and also the period ending in mid-October where gold had risen 15% while the S&P had risen half that.

31

posted on

10/25/2010 8:52:13 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: SeekAndFind

I believe gold prices will collapse too, but the big question is WHEN? I thought it would collapse last year and was wrong.

32

posted on

10/25/2010 8:56:01 AM PDT

by

Cronos

(This Church is Holy,theOne Church,theTrue Church,theCatholic Church - St. Augustine)

To: philman_36

This is how you know he’s a disinformation artist. The statement “it has very few industrial uses” is possibly technically true if you pretend that electronics is “only” one “industrial use”. Kinda like asserting that gasoline can’t be that important to the U.S. economy because we really use it in only one way, burning it.

33

posted on

10/25/2010 9:01:06 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: jiggyboy

RE: The statement “it has very few industrial uses” is possibly technically true if you pretend that electronics is “only” one “industrial use”.

BTW, which of the two metals have more industrial uses — Silver or Gold?

I’d say Silver and by the looks of it, the ratio of the price of Gold vs Silver tells me that Silver is more undervalued ( although both of their prices have been rising in tandem this year).

To: Zakeet

You are absolutely right that fiat money, or any medium of exchange, can go all the way down to zero.

Doesn’t mean that gold will be the best store of value if it does.

35

posted on

10/25/2010 9:21:48 AM PDT

by

Sherman Logan

(You shall know the truth, and it shall piss you off mightily)

To: jiggyboy

BTW, which of the two metals looks to be more undervalued — Gold or Silver?

I’d say Silver and by the looks of it, the ratio of the price of Gold vs Silver tells me that Silver is more undervalued ( although both of their prices have been rising in tandem this year).

To: jiggyboy

Actually, that proves we ARE in a bubble, just like the real estate business a few years ago, but YOU keep buying it. When it drops, I am sure you’ll be glad to come back and say you were wrong.

37

posted on

10/25/2010 10:10:42 AM PDT

by

packrat35

(I got your tag line..)

To: SeekAndFind

I believe everyone should have some precious metals put back to hold for emergency economic situations. Beyond that, it depends on what you believe the economic future is going to be like.

Back in fall of 2007, I had a few extra bucks, and was looking for some relatively cheap stocks to buy. I couldn't find a single stock that met my criteria. They were all overpriced. I liquidated 1/2 of all my stocks and mutual funds in favor of Treasuries.

I did not try to eek out that last rise of the market. I just knew that a correction was due, and took some chips off the table. Never regretted it. After the fall crash in September 2008, I picked up a few stocks at bargain basement prices, such as Ford.

If you believe that runaway inflation is just around the corner, gold and silver make sense to protect your buying power, so do stocks, if you can pick the winners in the economic environment that is coming.

I remember watching the melt-down of some South American country many years ago. Rampant inflation - people were storming the stores grabbing everything in sight to buy as an effort to protect their buying power.

Sugar, Salt, Flour, coffee etc etc (all sorts of necessities with long storage life), can be used to barter if need be. Plus, everyone will need food, and your dollars available may not be worth enough to pay for your needs. Don't forget the ammo either.

We are already experiencing substantial inflation at the grocery store. For example, toilet paper at our store has experienced a 39% increase this year.

Last week, dish-washing liquid went up more than 60%. A bottle costing 97 cents for 16 oz, is no longer available. Same brand is available for 20 oz size at $1.98.

Also, some companies are just decreasing the size of their packages by a few ounces, and leaving the prices the same..

Housing prices have been deflated due to an oversupply, but compute the replacement cost, or get a quote to build a new house.

If your region is like mine, the cost to build a new house is more than the current sale price of homes that were built in the last few years. Sooner or later, the sale price will come back into equilibrium with the cost to build.

38

posted on

10/25/2010 10:59:44 AM PDT

by

greeneyes

(Moderation in defense of your country is NO virtue. Let Freedom Ring.)

To: packrat35

I’m a trader myself. I’ve been in and out at least five times since the beginning of the year, and I think I posted all my trades on line with my Goldbug Pings. In fact, I’m short now — I posted the other day that I think the highs are in for 2010, and that late December would be a buying opportunity rather than a selling opportunity.

39

posted on

10/25/2010 11:29:33 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: SeekAndFind

Silver has made a tremendous move the last two months or so compared to gold but I am in agreement with a lot of articles that silver will continue to see bigger net gains than gold in the future.

I think the gold/silver ratio now is about 57 or so, down from the very high 60’s just this summer. I don’t think a ratio in the 40’s is out of the question before it’s all done. But that that means for an absolute price, I don’t know.

40

posted on

10/25/2010 11:33:02 AM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-43 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson