Posted on 10/14/2010 2:43:59 PM PDT by blam

Sovereign Debt Default Risk

by: Bespoke Investment Group

October 14, 2010

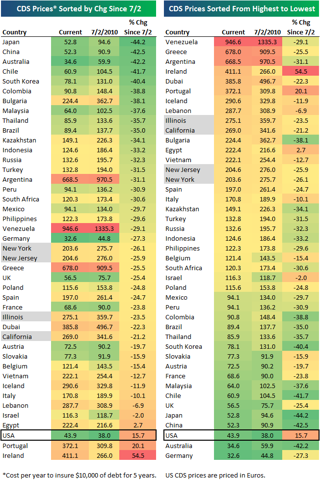

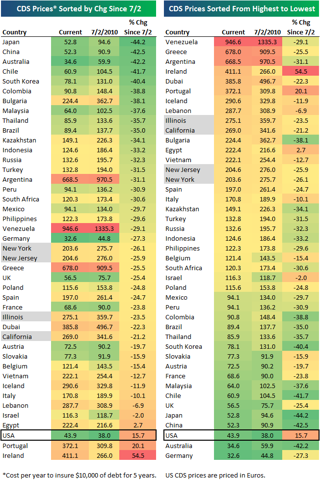

Below we highlight the 5-year credit default swap prices for the debt of 39 countries and four high-risk US states. We also highlight how default risk has changed since equity markets bottomed at the start of July.

As shown in the left column below, default risk has fallen the most for Japan, China, Australia, Chile, and South Korea since July 2nd. It has risen for just four countries -- Egypt, Portugal, Ireland, and the US. Yep, the US has seen default risk rise 15.7% since the start of July, even as the equity market has performed well. Germany has the lowest default risk of all the countries shown.

Of the four high-risk states highlighted, Illinois currently has the highest default risk at 275 bps, followed closely by California at 269 bps. New York and New Jersey are both just above 200 bps.

BTTT

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.