Posted on 07/23/2010 9:15:08 AM PDT by NormsRevenge

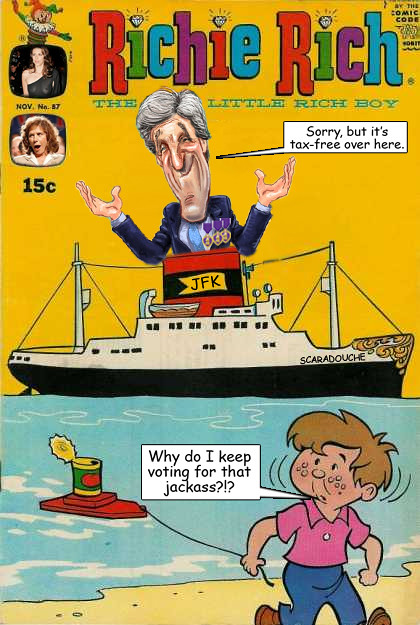

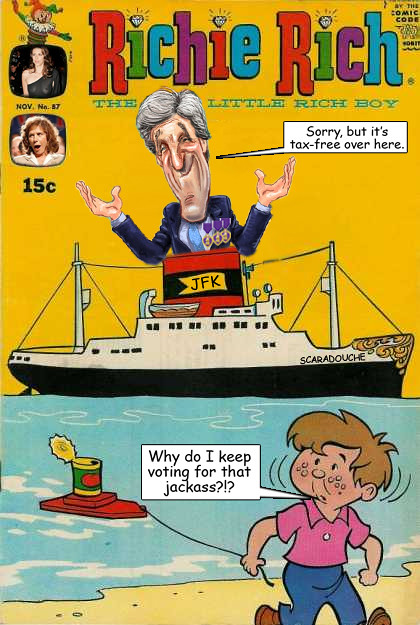

BOSTON – Massachusetts Sen. John Kerry is docking his family's new $7 million yacht in neighboring Rhode Island, allowing him to avoid paying roughly $500,000 in taxes to the cash-strapped Bay State.

If the "Isabel" were kept at the 2008 Democratic presidential nominee's summer vacation home on Nantucket, or in Boston Harbor near his city residence, he would be liable for $437,500 in one-time sales tax. He would also have to pay $70,000 in annual excise taxes.

Rhode Island repealed those taxes in 1993. That has made the state something of a nautical tax haven.

(Excerpt) Read more at news.yahoo.com ...

It was build in New Zealand too.

Gee, mighta been a few American jobs there if he had it built here, huh?

Frankly, I find it hard to blame Kerry.

$437K is a LOT in taxes.

I suggest that everyone in Taxachussetts follow Senator Kerry’s example and move their taxable assets out of state.

Any connection ?

~~~~~~~~~~~~~~~~~~~~~~

About Great Point Partners LLC

**

The principals of Great Point Partners have a long history of helping executives build successful health care companies.

Our investment team is augmented by our CEO Advisory Board and Medical Advisory Board, members of whom are available to provide advice and assistance to our entrepreneurs and their portfolio companies.

In 2003, we started the firm with a vision of helping growing health care companies achieve their full potential. Like our portfolio companies, Great Point Partners itself has been a fast-growing company. Currently we have over 15 professionals. Our team is hardworking, creative, and dedicated to building the best health care investment firm in the country.

We recognize that there is tremendous synergy between investing in both private and public companies. We understand the strategies of public companies and the opportunities for the next generation of private company innovators. Since our founding in 2003, Great Point Partners has invested over $1 billion in capital in more than 100 businesses.

The knowledge base within our firm is extensive. Our Managing Directors have more than 40 collective years of private equity experience, averaging 14 years per Managing Director. We understand the financial and operational issues that confront managers of growth companies because we have dealt with them ourselves.

We have built an extensive record of helping CEOs maximize shareholder value. Our senior investment professionals serve on the boards of directors and support the management teams of our portfolio companies, providing them with direct access to all of our resources. In addition, our experience and professional network has helped entrepreneurs realize value through initial public stock offerings, follow-on financings, and mergers and acquisitions.

http://www.gppfunds.com/about_great_point_partners/index.html

~ ~ ~ ~

Great Point Partners LLC

If you think Great Point’s private equity capital and our health care expertise might be appropriate for your growing health care business, we would like to speak with you about a possible investment. We prefer to get familiar with companies before they make the firm decision that they need capital. We can speak informally about your business, your market, and your strategy for success as you start to formulate views on your particular financial requirements. We offer extensive health care knowledge, deep financial expertise and strong investing experience to address immediate capital needs and long-term goals and objectives. Please call Great Point or email your business plan or offering memorandum to us by clicking the “Submit a Business Plan” link below.

Great Point Partners, LLC

165 Mason Street, 3rd Floor

Greenwich, CT 06830

Voice: 203-971-3300

Fax: 203-971-3320

http://www.gppfunds.com/contacts/index.html

~ ~ ~ ~

Current Investors

**

We currently manage approximately $500 million of equity. Capital for these funds has been committed by more than 50 world-renowned organizations.

Advisors, Family Office, and Fund of Funds

* Morgan Creek Capital Management, LLC

Financial Institutions

* Caxton Select, LLC

* Goldman Sachs Private Equity Group

* The Olayan Group

Foundations and Universities

* Major University Endowments, Charitable Foundations,

and Other Tax-Exempt Investors

Other Major Investors

* Health Care CEOs and Entrepreneurs

* The Great Point Team

http://www.gppfunds.com/about_great_point_partners/current_investors.html

~ ~ ~

Team - Morgan Creek Capital Management

http://www.morgancreekcap.com/MCCM_team.html

~ ~ ~

Olayan Group

The Olayan Group is a private, multinational enterprise made up of more than 50 companies and affiliated businesses.

Founded in 1947 by Suliman S. Olayan, the Group has spent more than 60 years building its reputation on a bedrock of dedication, integrity, teamwork, continual improvement, and growth.

In Saudi Arabia, where the Group originated, Olayan engages in product distribution, manufacturing, services and investment, often alongside leading multinational and regional partners. Internationally, the Group invests in public and private equities, including real estate, and in other asset classes.

http://www.olayan.com/index.aspx

~ ~ ~

Saudi Operations

The Olayan Group has a strong track record of diversified operations in Saudi Arabia, having started its first business in the Kingdom in 1947. Today, over 40 affiliated companies of the Group are engaged in product distribution, manufacturing and services in Saudi Arabia, other Gulf countries, and the wider Middle East. These include wholly owned operating companies, joint ventures with major multinationals, and firms in which the Group has substantial non-majority ownership interests.

Riyadh-based Olayan Financing Company manages the Group’s commercial and industrial operations in Saudi Arabia and the Middle East. It is also a leading investor in major private enterprises in the region and has been a long-time participant in the Saudi stock market.

Saudi Arabia’s economy continues to grow and diversify. The 2010 “Doing Business” report, published by the International Finance Corporation-World Bank, ranked the Kingdom as the 13th most economically competitive country in the world. Moreover, Saudi Arabia is consistently ranked as the best place to do business in the Middle East and Arab world.

With more than 60 years of pioneering business experience in Saudi Arabia, The Olayan Group is well-positioned to capitalize on new opportunities in this dynamic economy while continuing to play a leadership role in the country’s private sector development.

http://www.olayan.com/operations.aspx?catid=1

~ ~ ~

Health Care Supplies & Services

Medical products from Baxter, Cardinal Health, Edwards Lifesciences, and others, plus local manufacture with Kimberly-Clark of disposable surgical coverings.

http://www.olayan.com/operations.aspx?catid=1

___________________________________________________

A look at the homes owned by John Kerry and Teresa Heinz Kerry (no pics)

http://www.freerepublic.com/focus/f-news/1103094/posts

________________________________________________________

The many homes of John Kerry (with pics)

http://urbanlegends.about.com/library/bl_kerry_homes.htm

Comments: Apart from one egregious falsehood - namely that John Kerry sold an Italian mansion to actor George Clooney just before announcing his run for the presidency - the above facts and figures were lifted directly from an Associated Press story dated March 22, 2004, and are presumably accurate. According to that article, the combined value of the properties owned by the candidate and his wife, Teresa Heinz Kerry, is nearly $33 million.

Please note, however, that all but one of the properties are deeded to Teresa Heinz Kerry alone, or to the Heinz family. The only residence in which candidate John Kerry owns a personal stake is the Beacon Hill brownstone in Boston.

The Marshal Islands is the place many, many super-rich register their pleasure vessels.

This craft was an instant classic the day it was launched.

$7 mil is a lot of money, but I'm sure Madam wouldn't let little Johnny waste her money.

Sen. Kerry: “Taxes for thee,but not for me....nani..nani..booboo”

I can’t imagine there aren’t some places in Mass. that can service and maintain the boat just as well as the folks in RI. Maybe he should check with the Kennedy’s. I think kerry needs to spend his money in his home state.

And, I’m SURE he would be very happy to pay the sales tax and docking tax.

for 7 million? wow, custom deluxe for sure, I hope it sleeps at least 4 comfortably, ya could build a nice houseboat barge for that

No, wait, this is just their sail it around on Sunday and show it off yacht.

No room for servants and security on an overnighter and you know Tahrayzaa and her gin soaked raisins, she says the hugh sacks stowed below are just ballast. John will say its all the rice he plucked out of his butt in Vietnam. anyway, no room for servants either.

Quelle Qerryesque!

Can you say...hypocrite?!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.