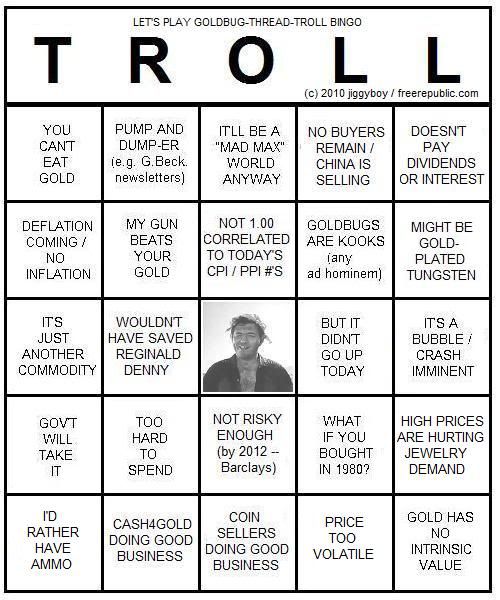

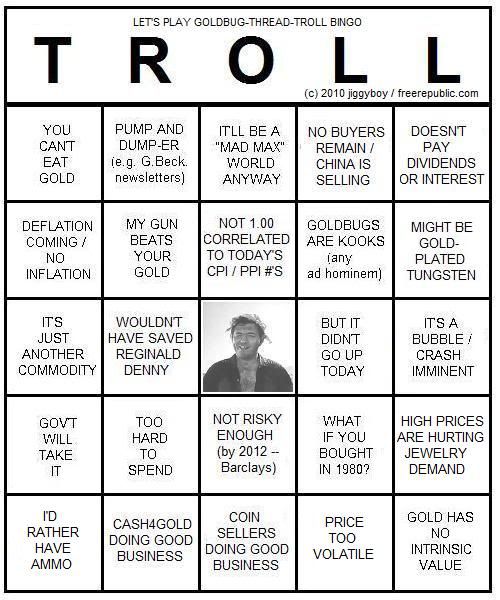

Get your markers out, I think we're gonna need 'em on this thread:

Mail me to get on or off the Free Republic Goldbug Ping List.

Posted on 07/22/2010 10:18:25 AM PDT by SeekAndFind

Imagine being contacted by a real estate agent about a 5,000-square-foot house, only to show up and find a home half the size. Off the bat, the prospective purchaser would have very little trust.

Of course the above scenario is purely hypothetical given that a foot is a foot. Since its definition is unchanging, 5,000 square feet means the same today as it did 20 years ago. Whatever the level of trust home buyers have in their real estate agents, square footage will never be a factor; that is, unless the length of the foot is allowed to "float," and its length declines. Suddenly, 5,000 square feet could very well mean 2,500 square feet in "real terms," and trust in real estate agents will plummet.

Sadly, this is the case with the world's currencies. Debased currencies without definition are what the world has suffered since August of 1971, when President Richard Nixon severed the dollar's link to gold. No longer defined in terms of the most stable commodity on earth, the dollar has been left to fluctuate without a golden anchor, its value changing minute by minute, hour by hour, and day by day.

Most problematically for savers and investors, the dollar's value since 1971 has collapsed. While a dollar bought 1/35th of an ounce of gold back then, today it purchases roughly 1/1200th.

Is it any wonder then that today, particularly since the dollar's value has fallen from 1/250th of an ounce of gold since 2001, that trust among Americans in our government has declined? At its core the dollar is a concept of value issued by our federal government, but Washington has let it collapse, and in the process the savings and wages of most Americans have been eviscerated.

(Excerpt) Read more at forbes.com ...

There are bold steps that could turn this all around in pretty short order. Perhaps if the next two election cycles are dramatic enough this country may hit the big Reset button. But both the Dems and the Republican establishment will stand athwart such an effort.

The “boldest step” would be to shut down the Federal Reserve. We have seen the result of politically-influenced technocrats making policy because they believe they are smarter than us all.

No Fed = no bailouts, Govt would not be able to spend us into oblivion with printed money, and therefore no more Progressive, social-engineering schemes, realistic interest rates for savers, value of money protected for salary earners.

For my second week in office ...

Returning to a Constitutional Standard would also work...

Unfortunately there isn’t enough gold in the world to support a gold standard, even in just the USA.

Get your markers out, I think we're gonna need 'em on this thread:

Mail me to get on or off the Free Republic Goldbug Ping List.

“Unfortunately there isn’t enough gold in the world to support a gold standard, even in just the USA.”

Yes, there is. However, an ounce of gold would represent an even higher value of purchasing power than it has now.

I’m not going to argue with someone sporting a handle that cool! I’ll just say at $3,600 a gram, gold would be a difficult medium of exchange. It’s industrial use would be even more difficult.

Cheers.

Gold standard = silver coins

I have some pre-1965 U.S coins (90% silver) that are worth about $12.92 times their face value if I melted them down. In 1964, $10 in silver U.S. coins bought $10 worth of goods and services. Today those same silver coins buy $129.20 in goods and services (equivalent to a compound annual interest of ~5.9%).

If you put that same $10 in a savings account in 1965, you would have only $38 in your account today (assuming compound annual interest of 3%). So where is anyone’s motivation to save money in a bank account? Interest on a savings account does not beat inflation! If you think this is bad, fiat currency value decreases exponentially, which means it will only get worse here on out.

Returning to those silver coins means more people will be willing to save money (they don’t have to worry about inflation). More money in the bank means more credit and lower interest rates... all without government intervention.

There never was enough gold to ‘support’ the gold standard even when the world was on the gold standard.

The Bank of England never had anywhere near enough gold to redeem every banknote in circulation, but it wasn’t neccessary as long as there was enough confidence in the system by being disciplined in the use of public spending. This forced the governments of the day to be fiscally responsible so that there would not be a run on the bank. No such restraining influence is on any government today, especially in the US where the currency is the world’s reserve currency...

.....There never was enough gold to ‘support’ the gold standard even when the world was on the gold standard.....

Balderdash. There is always enough gold to back the currencies. You speak of the Bank of England not having enough gold. You don’t see the reality of the situation. The value of gold is constant. The Pound Sterling at the time was over valued.

Gold is the constant. Everything else is variable.

Once more to be sure it isn’t missed....

Gold is the constant, everything else is variable.

When you realize that currency is merely a physical representation of a ledger entry, an electronic blip, you can develop a sense of the reality that gold is real. all else is merely thought.

I don’t really see how the pound was overvalued if gold wasn’t, it was literally defined as being worth 0.2354 of an ounce of pure gold, which was the AGW of a £1 sovereign gold coin. Its value was strictly tied to the value of gold between 1821 and 1916. Between 1925 and 1932, I will admit that the £sterling was overvalued in gold terms because by putting Britain onto the exact same official standard it had been on before the war when it had already been inflated to pay for the war, the British Government (and a certain Chancellor of the Exchequer Winston S Churchill) were denying reality.

However, I would take issue with Gold being the ‘constant’. This is often espoused by gold fanboys but I don’t believe it. I work in the bullion industry, so I have ample opportunity to monitor the changing gold price in relation to the purchasing power of my weekly wage. When I started working were I am, Gold was £560 an ounce, now it is £771 an ounce (and has been as high as £860 recently) in spite of this, the purchasing power of my weekly wage, in terms of being able to purchase basic commodities such as food and paying rent etc has not really altered that much in the past 12 months, but I get a lot less gold for my money today than I could a year ago. Gold is simply a commodity like anything else, and its value fluctuates in real terms compared to more practically useful goods and services.

However, if you want a stable commodity to use as a monetary standard to judge inflation and purchasing power, the Mars Bar is far more reliable than gold for this purpose:

http://specials.ft.com/nicocolchester/FT3WNIFSEIC.html

It also makes more sense to base a constant value on a commodity that is actually useful, rather than a yellow metal which has limited industrial use and whose only other real purpose is ornamental. Most of its value is based on human delusion. Gold has always been artificially inflated far above its actual rarity and usefulness. If the value of precious metals had any rational basis, Palladium would be at least 10 times as valuable as gold because it is more than 10 times rarer than gold. It also has more useful industrial applications and even unique ones where certain technologies that use hydrogen are concerned, and yet Palladium is scarcely worth £300 an ounce at the moment, considerably less than half that of Gold...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.