He'll tough it out at in his new $20m digs on Martha's Vineyard. The lease only runs $35K per week after all. Chump change to Zero!

Posted on 07/27/2009 11:36:55 PM PDT by FARS

US State Dept has advised embassies worldwide to stock up on a year's worth of the local currency in anticipation of collapse of the US dollar. Look for a temporary banking shutdown timed for around September 2009. As under Roosevelt, some banks won't reopen. 96% of bank reserves are currently held with the Federal Reserve who tells the banks not to loan the money, but rather to save it for further banking acquisition and consolidation. Chapman foresees a bank holiday lasting 4-5 days. Chapman thinks this first bank holiday presages a much more significant bank holiday months to years later which will involve simultaneous devaluations of multiple currencies as well as other significant changes in the banking system.

(Excerpt) Read more at antimullah.com ...

Specially if the Dollar crashes so do other currencies very quickly after that. Buy Pesos while the dollar has some value and go live in Mexico?

Hard not to feel desperate with Obama-Hussein in the Obama House

Do you know what it’s like for Americans in Mexico without a worldwide panic existing?

May God have mercy on these United States of America if such an event occurs.

Terrifying to be potentially going through this with th Chicao Gangstere team running th ecountry kinto the ground.

Want to bet Obama will disappear to Kenya and live comfortably or at least in an easy survival mode while we all crash and burn?

Just like Saddam Hussein, Oba-Hussein has his bolt hole ready.

I agree

“Specially if the Dollar crashes so do other currencies very quickly after that. Buy Pesos while the dollar has some value and go live in Mexico?”

Well, I am living on pesos, Philippine Pesos.

Since January, they have held pretty steady at 48 pesos/dollar.

My worry is that I now live on Social Security which

comes to my Philippine bank by direct deposit. I then have to convert dollars to pesos.

I have to live in fear of a dollar collapse, as well as a failure of social security.

"bank holiday"

Ironically, the word "holiday" is a contraction of the two words "holy day".

Not Kenya. He’ll end up in Saudi Arabia.

Historical precedent.

does anyone remember that?...I would love to go reread it.....thx...

in the meantime, what about credit unions?....are they safe?...

This stuff may be true, but the injection of “helicopter” into the description of Bernanke and the use of “criminal” in the description of the U.S. Fed makes it sound like a crank. It doesn’t have the feel of a well-reasoned analyst.

This exact same story was floating around about 3 months ago.

Sounds like someone just put a new date on top.

Just my .02.

If teh dollar is a worthless piece of green cloth/”paper” it does not matter who holds it, teh banks, teh credit unions, foreign banks - it is worthless.

Bit like Hilter years when it required a wheelbarrow full of banknotes to buy a loaf of bread.

He'll tough it out at in his new $20m digs on Martha's Vineyard. The lease only runs $35K per week after all. Chump change to Zero!

I remember it well. I posted an article about an economic terrorist attack that atlas shrugs had at the time. Is this the one you mean?

http://www.freerepublic.com/focus/bloggers/2184661/posts

Along the same lines. The original story at the Anti-Mullah link is fully underlined. Again, it may be valid, but it comes off looking like grade-school journalism copy. This is not the academic quality stuff you were posting a few months back.

The FDIC has been quietly training thousands of accountants, property managers, asset appraisers, etc -- http://www.fdic.gov/about/jobs/oncamp.html. In your neighborhood, you may know of empty houses with NO “For Sale” sign out front that have NOT been statutorily-foreclosed on. WHY?

The Financial Accounting Standards Board eased the rules on mark-to-market bookkeeping in April. But the banks can't keep the foreclosed properties off the books FOREVER.

When banks are "compelled" by the FDIC to begin executing on the mass of "non-foreclosures" that have been piling up the last few months, the new rules will bring all those non-executed foreclosures onto the books. When that happens, they'll be forced to ‘mark to market’ and will have to put the new low value of the properties onto their books. The huge loses mean they'll be even further uncapitalized, and the government will force those banks to raise more capital, or close down.

As a result, it's really worse than the banks are reporting ... in more ways than one!

Within months, the Second wave of foreclosures will start kicking in, while the FDIC Deposit Insurance will have dried up because the public does NOT want more Bailouts, as inflation starts to spike due to piles of HARD cash sitting in the Federal Reserves...

$300 Billion in Foreclosures since October; $1.4 Trillion between now and Fall 2012 ...

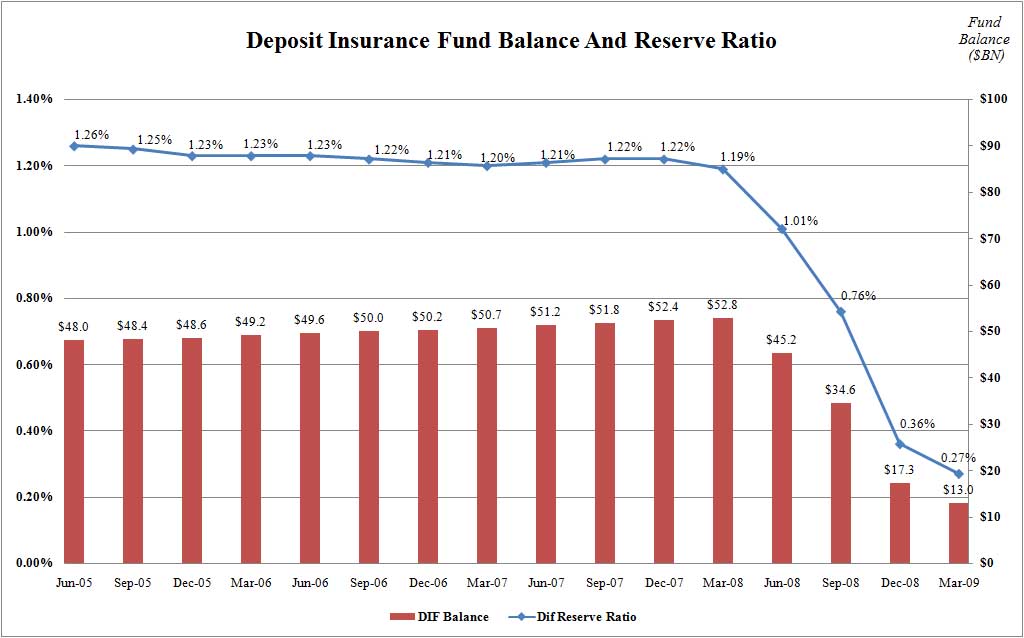

Most likely, the FDIC Deposit Insurance funds have dried up since Mar 09 -- it just hasn't been disclosed to the public yet...

The US Treasury is printing money like mad, and the public wants NO MORE BAILOUTs.

Well, one thing’s for sure...the dollar is tanking tonight!

Are you kidding me? Michelle in a burqa? ROFLMAO. Meeshell owns Barry's balls!

You didn't see her covered in any Saudi photos, didya? France will let them in...

The only real link on the article I saw was a link to the World Socialist Web Site.

http://wsws.org/articles/2009/jul2009/bisr-j21.shtml

Not a credible source.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.