Posted on 01/22/2009 7:53:45 AM PST by Lorianne

Toll Brothers (TOL) just lowered the bar for the home building industry.

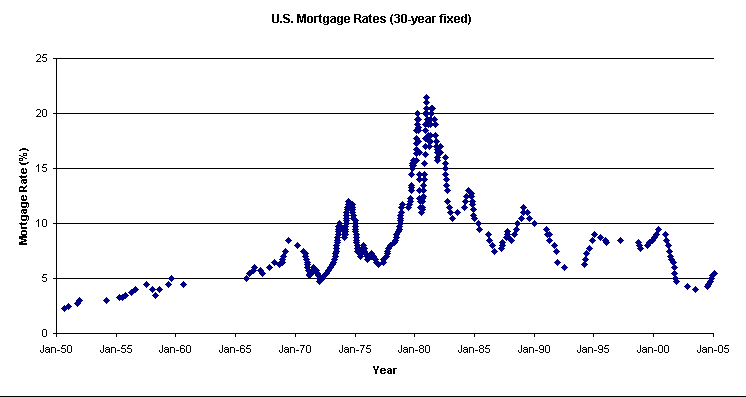

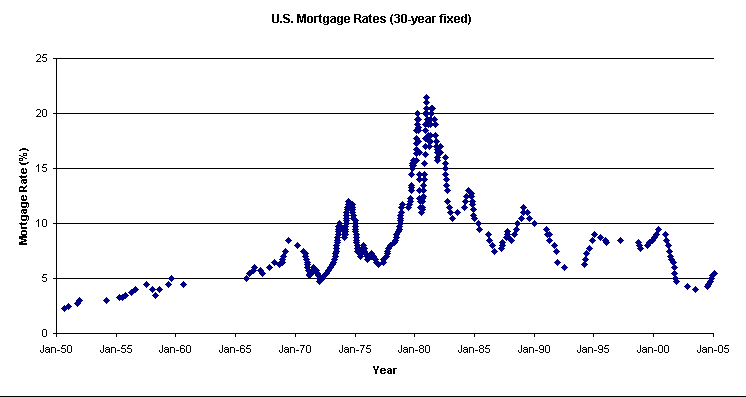

Horsham, Penn.-based Toll this week started offering a 3.99% fixed mortgage rate for loans $417,000 or below for 30 years with no points, one of - if not the - industry's lowest rates, one well below the national average of just below 5%.

It's too early to say if other builders will copy the attention-grabbing rate, but as the market worsens, competition is fierce and this move could launch a scramble to match [rates]

(Excerpt) Read more at online.wsj.com ...

What a disaster it will be for Obama if this glitch on the economic screen just passes away in a few months, but the GOP needs to be on record predicting that, or they pass the credit to the socialists.

The national average is 5% with no points? Boy, it sure isn't where I live.

My co-worker re-fied at 4.5% last week.I’m waiting on .5%.

*Ping*

ping

Yes, it is actually just under 5% for a conforming 30 year fixed loan, no points.

Bernanke has been buying agency paper to get the rate down.

Is anyone taking on a 417K loan these days? MAybe a few.

With the population aging and the number of DINKs, you would think builders would focus on the “Sun City” model of home

2 Br, 2 Ba and a larger living room or kitchen, overall - a small house on a no-maintenance lot.

But, I guess they know their market.

I assume you must have picture-perfect credit to take such a loan.

That’s interesting. I’ve checked 4 different companies rates in my area and the best today is 5.75% with no points or origination fees, very high credit scores and 30% down.

Ahhh... there was one thing I forgot to ask: what area of the country is the subject property?

I have a five year adjustable rate mortgage that is currently at 5.54%. It adjusts at the end of July to 3% over the weekly average yield on the US Treasury Securities adjusted to a constant maturity of 5 years. If it were to adjust right now it would go down to 4.50% (it is rounded to the nearest 0.125%).

The housing market can’t fix itself until it does something about requiring 80% LTV ratios before someone can refinance.

Suddenly concerned about best practices for underwriting, mortgage companies could still use standards that made sure only the most qualified borrowers could refi into these loan rates (and thus free up cash that might help the economy and would certainly help confidence rates).

Right now you can good income, a sterling credit rating, a nice home, but the tremendous drop in home values keeps you paying at way-above market rates. This penalizes the good customer. Which is extremely dumb.

From what I’ve heard, Toll doesn’t build houses that can be paid for with a $417,000 mortgage.

Toll Brothers is a “luxury home” builder.

A 20% downpayment and a $417,000 mortgage will get you a $520,000 house, ignoring closing costs and fees.

I’m not sure Toll builds many houses that cost less than $520,000.

Is this in any way meaningful?

Then again, I'm looking for any good news I can, especially with the housing market.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.