Skip to comments.

Monetary Base jumps 500%

St. Louis Fed | Economic Research ^

| 2008-09-24

| St. Louis Fed

Posted on 10/03/2008 8:20:31 AM PDT by Santiago de la Vega

Monetary base jumps to 939.472 from 874.750 for two week period.

From September 10 till the 24th the Fed added nearly $65 billion dollars in High Powered money.

At an annual rate, this is a jump of more than 500%.

TOPICS: Business/Economy; Government

KEYWORDS: fed; inflation; monetarybase; moneysupply

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

The Fed is trying to alleviate the problems faced by the banking system.

To: Santiago de la Vega

2

posted on

10/03/2008 8:22:29 AM PDT

by

sickoflibs

(What's Next ?? the feds buy up GM stock to save the economy??)

To: Santiago de la Vega

jumps to 939.472 from 874.750 for two week period Must be new math. That's not a 500% increase.

Oh! I see! If this rate of increase continued, it would be an annual rate of 500%! Oh! That's different!

Saaaaaaaaaay ... what would the rate be if this continued for the next 10 years?

3

posted on

10/03/2008 8:23:52 AM PDT

by

ClearCase_guy

(I ain't gonna quit until I'm laid in my tomb and even then they better shut it tight.)

To: Santiago de la Vega

4

posted on

10/03/2008 8:23:54 AM PDT

by

Paladin2

(Palin for President! (PUMA))

To: sickoflibs

No, the Feds should just buy up all the “surplus cars” that GM and Ford can manage to produce.

5

posted on

10/03/2008 8:24:29 AM PDT

by

Boiling Pots

(Hey B. Hussein, are you going to prosecute me now?)

To: Santiago de la Vega

6

posted on

10/03/2008 8:27:16 AM PDT

by

SeeSharp

To: Santiago de la Vega

I don’t think people realize just how much the Fed needs to pump liquidity in the short run. There are hundreds of businesses and corporations that depend on short term debt and commercial paper for their working capital. Whole solid businesses are close to bankruptcy solely because of the lack of liquidity.

To: Santiago de la Vega

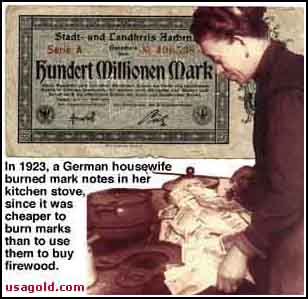

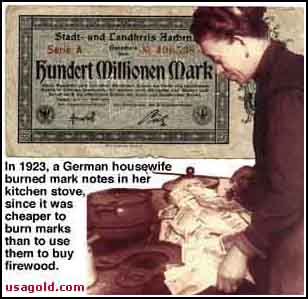

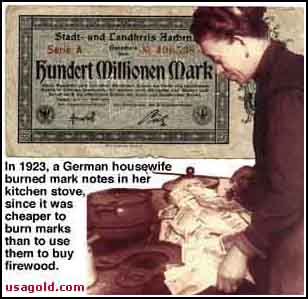

Those who know not history, are doomed to repeat it.

8

posted on

10/03/2008 8:27:45 AM PDT

by

OB1kNOb

(The Late Great Nation USA.)

To: Santiago de la Vega

"The Fed is trying to alleviate the problems created by the banking system. By creating hyper inflation, look forward to $8 a gallon gas and exhorbarant prices at the supermarket. I fixed your errors for you.

9

posted on

10/03/2008 8:31:24 AM PDT

by

Tempest

(http://www.youtube.com/watch?v=gNlXgzzdJQA)

To: Santiago de la Vega

Maybe we should invest in Zimbabwe dollars.

10

posted on

10/03/2008 8:32:09 AM PDT

by

Ruy Dias de Bivar

(We're not supporting clean coal --- Joe Biden)

To: Boiling Pots

Hey! Mayeb thats the way to look at this mess! The Fed is going to buy up houses the way the government buys up corn and wheat farmers DO NOT produce

11

posted on

10/03/2008 8:32:21 AM PDT

by

Mr. K

(Some days even my lucky rocketship underpants don't help)

To: Boiling Pots

"No, the Feds should just buy up all the “surplus cars” that GM and Ford can manage to produce." Why not. They are doing it with cheese. There are factories that make cheese that sell everything they make to the government. The government puts it in storage and pays hundreds of million annually in storage costs. When the cheese is close to being bad, they give it away.

12

posted on

10/03/2008 8:33:18 AM PDT

by

blam

To: Santiago de la Vega

Talk about a misleading title.

To: winner3000

The is no reason for the bailout.

This bailout among other actions will put us in to hyper-inflation combined with soon to be double diget interest rates and double diget unemployment rates.

Worse part is the laws that brought this problem about are not only still on the books but have been reinforced in the bailout bill.

No consernative would support this bill.

The passage of this bill is a mortal wound to the free markets here in the US.

14

posted on

10/03/2008 8:37:50 AM PDT

by

stockpirate

(October 1, 2008-the day McCain lost my vote, I'm now voting Sarah Barracuda)

To: winner3000

This is simply a game of chicken between the banks and Gub’ment. Backdoor Barney told them to make the loans and the socialists in our Gub’ment would force the lunkheaded masses to pay for it. BROKE AND FREE... BROKE AND FREE!!

15

posted on

10/03/2008 8:38:30 AM PDT

by

Camel Joe

(liberal=socialist=royalist/imperialist pawn=enemy of Freedom)

To: Santiago de la Vega

16

posted on

10/03/2008 8:40:28 AM PDT

by

ari-freedom

(Betcha they're good. Why shouldn't they be? Their one mistake was giving up me!)

To: OB1kNOb

The current crisis is wildly DEflationary. The economy is facing violent contractions and can absorb all this money and more.

17

posted on

10/03/2008 8:40:48 AM PDT

by

Petronski

(Please pray for the success of McCain and Palin. Every day, whenever you pray.)

To: Toddsterpatriot; Mase; expat_panama

You notice anything funny about the headline versus the body?

18

posted on

10/03/2008 8:41:03 AM PDT

by

1rudeboy

To: Petronski

not when gold is $847 an ounce

19

posted on

10/03/2008 8:44:55 AM PDT

by

ari-freedom

(Betcha they're good. Why shouldn't they be? Their one mistake was giving up me!)

To: 1rudeboy

You notice anything funny about the headline versus the body? You mean that it's an actual increase of 7.4% but that the author annualized it and still missed the math?

20

posted on

10/03/2008 8:55:04 AM PDT

by

groanup

(Does all of Wall Street get on the gov't pension plan now?)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson