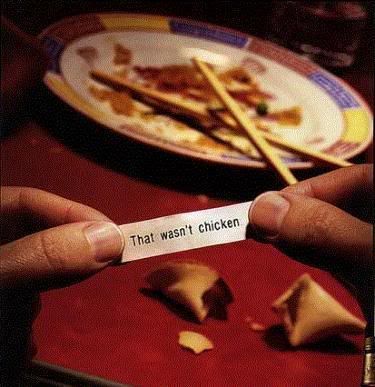

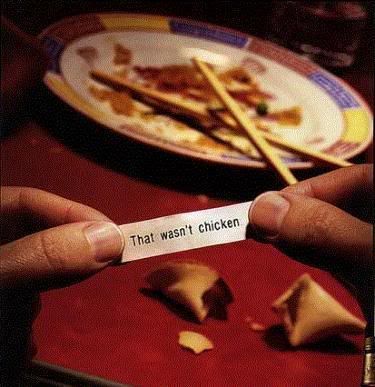

"Hint: After eating their food you will be hungry an hour later."

Posted on 09/18/2008 12:38:31 PM PDT by politicket

NEW YORK (AP) -- Wall Street surged higher Thursday, with the Dow Jones industrials up more than 400 points after a report that the federal government is considering creation of a repository for banks' bad debt. CNBC said Treasury Secretary Henry Paulson is considering creation of an entity like the Resolution Trust Corp. that was formed after the failure of savings and loan banks in the 1980s.

(Excerpt) Read more at biz.yahoo.com ...

Bush, Clinton, Pelosi, Obama, Bush Sr. and more, are all globalist. They all have gotten America into a mess. If I were in charge, I would try them all in a court of law for vowing to take care of American interests and failing uphold America. These law makers, including Obama, are acting smug, not wanting to even tell about globalization and how it is destroying us as a country. They are bringing us to our knees without firing a shot. They are transferring the wealth of America to the third world countries. I think they are guilty of treason. Obama even has Senate bill #2433 up for a hearing, about giving billions of hard earned American dollars to the poverty people of third world countries, who have no interest in supporting themselves.

Yep, seems to me I recall something like that....

;)

DickG

~~~~~

+1

“The Feds needed to do something to keep the derivatives market from exploding. “

. . . and your solution is??

"Hint: After eating their food you will be hungry an hour later."

Another RTC...oh boy! Those on the “inside” are gonna acquire a ton of properties for peanuts....and guess who’s gonna hafta pay the piper.

However, you need to realize that an RTC-style setup (which takes approximately 2 years to establish and get running) will not solve this current problem. It's a big gulch between the S & L problems and the current issues in the derivatives market.

The ONLY thing that ths will do is get money moving again between financial institutions - because they have just been given a free ride on the gravy express.

Agreed.

Okay....and what’s your solution?

unbelievable . . . so in essence, if this RTC-vehcile comes to fruition . . . the bankers let the .gov buy all their toxic paper and it gets dumped on us taxpayers.

The responsible parties (bankers) make out like bandits and we (taxpayers) get stuck with the bad paper.

Oh, and just where is the Fed going to come up with the $$ to buy all this toxic waste from the banks . . . print it . . . inflation

why can’t we just let this thing take its natural course . . . sure, it will hurt bad in the short term . . . but the alternative I see shaping up is USSR-esq

Let it happen. It will hurt. People will be hurt. Industries will be hurt. But at least there will be something left at the end.

Please understand that this current "solution" is simply growing and prolonging a very serious problem that will explode. It is only a matter of when.

Pure socialism. Banks will then be requried to be run according to government rules, regulations, and perhaps even employees.

You’re not alone. We don’t even own a house, we pay an indecent amount of income tax and it sounds like we’ll be paying more to pick up the tab for thieves and slackers.

In SOME areas (California Valley, Phoenix, Vegas and some others).

First of all, we are not taking over “foreclosed” properties. Those belong to the foreclosers and they know, for the most part, how to value those assets.

What the new system would take over are the mortgage backed securities where the future foreclosure rate is unknown. And that uncertainty is what is killing the market. By reducing the uncertainty, the future foreclosure rate will be less than it otherwise would have been.

Add to that that the lenders aren’t going to get away scot free, that they are going to receive an (as yet undisclosed) discount on the face value of the debt they pawn off to the new entity, plus, undoubtedly, new fees for loan originations to cover the costs.

The question is the over all health of the economy. We saw that today as the Dow recovered almost all its losses from yesterday. This is good news for people with pensions, 401k, money market funds or other investments.

If taking these uncertain risks out of the market increases confidence, investment and consumer spending, then everybody wins. After all, your tax rate doesn’t really matter if you don’t have a job...

CodeToad....are you saying they aren't now?

This isn’t legal.....

Here is another one of your supporters.

http://www.youtube.com/watch?v=Wfplk7TA0Uw

Maybe you can all have dinner to celebrate your "commonality".

Why? Because the masses are ignorant. This action exactly mirrors the panic buying of houses during the last leg of the housing bubble. People think they HAVE TO buy or be priced out, so they buy. Then they get crushed in the downturn.

So now we have equity buyers who have been programmed to buy every dip, and the DOW falls 1000 points in 2 days and they think the market MUST HAVE bottomed and they are getting bargains.

You would think they learned by now. Nope. Still the same people making the same mistakes. No doubt some companies are way oversold, the baby being thrown out with the bath water. Still and all, that presumes those companies won’t be even further oversold as the bath tub is drained as the liquidity crisis spirals downward.

Oh well... SEP.

Why? Are these people "owed" a "decent" return on their money?

At what point are people and companies responsible for their own economic and business decisions.

Your argument sure sounds like carefully structured Socialism.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.