Skip to comments.

The week that risk became reality

FT ^

| 08/15/08

Posted on 08/16/2008 10:33:51 PM PDT by TigerLikesRooster

The week that risk became reality

Published: August 15 2008 19:31 | Last updated: August 15 2008 19:31

Trouble has been in prospect ever since the credit squeeze began last summer, but this was the week when both shoes dropped at once, everywhere from the UK to Japan and most points between. For decades, a concerted world slowdown would have only one cause: a US recession. That is no longer entirely true. To paraphrase Tolstoy, each unhappy economy is unhappy in its own way.

Japan has begun to contract, and plummeting exports are not the sole culprit: domestic demand is weak and consumer confidence has never been lower.

Spain’s economic woes have persuaded the prime minister, José Luis Rodríguez Zapatero, to interrupt his summer holiday; the key problem there was a housing boom, an unsustainable overhang of new property, and the subsequent collapse of a construction sector that provided every eighth job. The UK’s housing boom has ended for a different reason: the banks no longer care to play the game.

Meanwhile, Germany’s resurgent export sector seems to have been smothered by a strong euro, and perhaps the hangover from an unexpectedly good first three months: the economy shrank by 0.5 per cent in the second quarter

(Excerpt) Read more at ft.com ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: currency; exchangerate; globalism; inflation; loosecredit; trade

To: TigerLikesRooster; Uncle Ike; RSmithOpt; jiggyboy; 2banana; Travis McGee; OwenKellogg; 31R1O; ...

2

posted on

08/16/2008 10:34:17 PM PDT

by

TigerLikesRooster

(kim jong-il, chia head, ppogri, In Grim Reaper we trust)

To: TigerLikesRooster; Fred Nerks

More gloom and doom!

Its all just Bull.

The US economy is cranking along with no sign of slowing down into a recession.

The fact is that we are emerging from a speculative economy where risk taking and borrowing fueled expansion. That has ended, except for one more dip driven by financials and then by November the economy in the USA will begin booming.

Now the US economy will grow based on consumers who pay cash for goods and services, with less borrowing power.

The gloomers and doomers cannot see past an economy which is highly leveraged in its operative character. They are similarly myopic about Japan and other nations.

The adjustment away from a highly leveraged economic machine is a very healthy one. It does not bode sickness and collapse. It bodes great stability based on value exchanged for value, not value exchanged for someone elses value as borrowed.

Conservatives therefore feel bullish.

Liberals feel bearish and want the world to believe that the sky is falling because they can't borrow money to gain their accustomed affluence. Such folks will have to learn again to live on the wrong side of the tracks in Hooterville, at least for a decade or so.They did that to themselves!

The economy has turned conservative.

And that FRiends is hardly the end of the world. It is actually a cause for celebration!

My stock analyst put "hold" recommendations on the three banks in which I am invested. That is as good as it gets in times when the financial sector is supposed to have its bottom falling out.

This thread article is Liberal Socialist Myth.

Now is the time to buy stock, and to buy it smart.

Notice that the US dollar now rules.

The liberal socialist economists have looked so hard for a recession and do not realize that THEIR DOG WON"T HUNT. Their light simply shines right through their economic dog, which happily keeps right on trucking. That has them puzzled to no end.They just have the wrong point of view to understand what is actually happening with the economy.

Liberal socialist economists are therefore just like this:

So don't believe a word they say. Check with the professionals who know, and you will see how wrong this article is. You see no mass exodus from the stock market. People are holding, and holding smart.Even Lehman Brothers is making gains.

So don't believe a word they say. Check with the professionals who know, and you will see how wrong this article is. You see no mass exodus from the stock market. People are holding, and holding smart.Even Lehman Brothers is making gains.

3

posted on

08/16/2008 11:13:02 PM PDT

by

Candor7

(Fascism? All it takes is for good men to say nothing, (Ridicule Obama))

To: Candor7; Fred Nerks

I'm tempted to agree -- but I'm not sure.

What proportion of our economy which had been based on production and service of tangible goods has been outsourced overseas? (Because the thinking went, there was a higher profit margin based on servicing and facilitating the movement of money, rather than in creating a good or service for the 'end user' and exchanging money for *that*. E.g.

Making the business model about the financing of automobiles, and foisting any schlock product in order to have an item to finance.

And then structuring transactions so that people pay money and then return the product after three years (leasing) so there is no actual purchase involved by the initial customer;

And then finally selling the now-degraded product to a different, final consumer, at a much-reduced (but still confiscatory price).

Yeah, profit margins go up as long as you can keep the game going; but it is not sustainable economic development, since people can only go upside-down on their payment books and leases for so many years.

IF we had kept much of the primary manufacturing and such in our country, I'd agree that we would just settle back to a lower standard of living. But much of what we do is merely "value added" for higher-end products -- and if the market for the high-end products shrinks significantly, there is no need at all for the "value added" part. And the lower-end products (and jobs that come with them) are now overseas.

Your thoughts?

Cheers!

4

posted on

08/17/2008 5:19:12 AM PDT

by

grey_whiskers

(The opinions are solely those of the author and are subject to change without notice.)

To: grey_whiskers

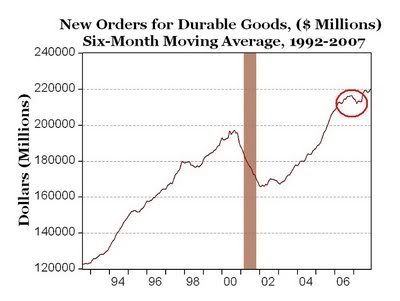

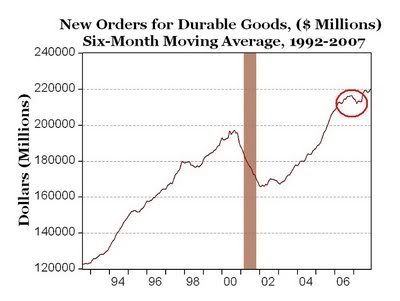

My thoughts are that the production figures do not lie. We still have a solid manufacturing business in the USA of durable goods.Just take a look at Catapillar for eample. They can barely keep up.

The weaked dollar was a shot in the arm. Orders are still up and show no signs of slowing down, despite the problems of GM, which has marketing problems, not demand problems.All the have to do is lower their profit margins on vehicles for a few years. They too have fleeced the market with high prices, leasing, and high finance charges. Now their marketing debauchery has caught up with them as people flock to alternate manufacturers, with more energy efficient automobiles and trucks. GM has enoug COH for one year. If they are smart they will do what the are capable of. Make another Model T for America.Slim down their model varieties, and get competative with their products. Its easy to see what sells in the market.

Our economy is still growing, and we have one more financial sector dip to get through, which should work its way through the economy by the end of September, a second lesser waive of failed residential mortgages, pulling down a few more financial institutions. Then we have a soft landing and up from there.

Then we are off on a revised economy that doesn't have a pyramid selling model as its primary driving force.This is great news.People do not realize it yet.

Our economy has just shed itself of a lot of junkie speculators, many of whom have made quick fortunes , and nearly ruined our economy.(Many of them have justifiably lost their shirts.) The fed will not allow that to happen again, much to the chagrin of the liberals and leftist economists who keep touting gloom and doom and blaming oil companies for the "fix we are in." Nothing could be further from the truth.

We are in a so called fix because of loose money policy and and lapsed lending security guidelines.Much of that was driven by Utopian dreams foisted on the nation by democrats and lefties, convincing many of our financial institutions to stray from good banking practises.Same with Freddie MAC.

Between now and the end of September is the time to buy smart on the stock market.Bargains abound.People will buy smart and hold. Then the real estate market will be really good to buy in for another couple of years.And you have to know where the paces are to do that. The real estate bubble has been spotty. A good part of the country is just fine and values remain up. But the paces to buy are where the highest speculation spirals drove up prices under liberal lebding policies, largely in states run by liberals.Thats where the bargains are.

I believe oil will be down to about 70 to 80 dollars per bbl. by next spring. Right now its at $111.00 down from a high in July of $147.00

Oil prices no longer drive any economy in the western world, they simply contibute to stock market volatility because people do not know where to put their money.Many are just holding cash waiting to get back in at the bottom of the market. The world economy has adjusted to higher oil prices by passing them on, as has the consumer market by using less. Yes consumers will buy less for a couple of years, but the major items neededby the public will still have a good cash market.

Its not gloom and doom, unless a person has been involved with speculation on borrowed money, and those folks have taken risks and will pay the price for it.

We are back to a conservative style economy. That does not mean a Bear economy. It will be a conservative market which will evolve to be increasingly bullish and should do very well indeed in another year.

And if any one tells you that war willbe bad for oour economy, they need to get a life. Since when has war ever been bad for our economy? People just invest in Raytheon, Honeywell and bulk supply agricultural companies.

And the Dems? They increasingly appear to be losing this election. Their domestic record in Congress brings a US public approval rating of 9%. Internationally, conditions do not favor militarily weak candidates like Obama or Hillary. They will not be able to get elected and impose higher taxes. We should have a relatively conservative government to accompany the evolution of a conservative, bullish economy

Investors should avoid the heavy sell to make a quick buck, buy into companies that have a good debt equity ratio, and a high certified book value and cash flow. There are hundreds of them.The question is simply when is the best time to buy. That time is likely from now until about the 10th of October or so.

Things are actually quite rosy.

5

posted on

08/17/2008 7:07:42 AM PDT

by

Candor7

(Fascism? All it takes is for good men to say nothing, (Ridicule Obama))

To: Candor7

Oh hogwash... the photo is cute, but the chart is just one leg... The cost of fuel is thru the roof ...food is spiraling upward.... put real cash in your wallet and go shopping. Then, come back to the formum with your new-found news.

6

posted on

08/17/2008 4:47:04 PM PDT

by

pointsal

To: TigerLikesRooster

7

posted on

08/17/2008 7:37:06 PM PDT

by

GOPJ

(If Hillary steals the nomination, blacks will sit home - GOP will take it all. Go for it Hillary.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

So don't believe a word they say. Check with the professionals who know, and you will see how wrong this article is. You see no mass exodus from the stock market. People are holding, and holding smart.Even Lehman Brothers is making gains.

So don't believe a word they say. Check with the professionals who know, and you will see how wrong this article is. You see no mass exodus from the stock market. People are holding, and holding smart.Even Lehman Brothers is making gains.