Skip to comments.

The Dollar Looks Ready to Rally

Barron's ^

| 29 April 2008

| By KOPIN TAN

Posted on 04/27/2008 3:01:19 PM PDT by shrinkermd

When the Federal Reserve cuts interest rates for a seventh consecutive time this Wednesday, it will begin to wind down a pernicious campaign that has flooded the market with cheap dollars since last summer. At the same time, the whoosh of air from Europe's deflating credit bubble puts new pressure on the European Central Bank to begin cutting borrowing costs in order to goose growth.

The strategy shifts by central banks will drive a greenback comeback against the overpriced euro, turning back the 15% slide that since August has lifted the euro -- to a record $1.60 last week -- even as the dollar continues to struggle against the undervalued currencies of Asia.

Monetary policy isn't the only catalyst for a healthier dollar. "A lot of what has happened since last summer also is emotional, and that can change on a dime," says James Paulsen, Wells Capital Management's chief investment strategist. Among other drivers: mounting evidence that the credit crisis loosening its grip stateside is still tightening across the Atlantic, and a growing belief that the U.S. economy could bottom and rebound before Europe's.

The rehabilitation, ironically, is driven by a weak dollar, which makes bargains of our exports, fills Manhattan's 65,000 hotel rooms with European tourists, and entices foreign giants from Ikea to Toyota to open factories here to exploit our increasingly cheap labor.

Already, the dollar has begun to strengthen against commodity-driven currencies from the Canadian loonie to the South African rand, and odds are it is close to a bottom against the euro, sterling and most developed-world currencies. On top of that, "negatives about the dollar are more fully discounted compared to the potential positives," says Marc Chandler, Brown Brothers Harriman's currency strategist, who expects the euro to pull back to test the $1.40 threshold this year

(Excerpt) Read more at online.barrons.com ...

TOPICS: Business/Economy; Editorial; Politics/Elections

KEYWORDS: currency; dollar; dollarrally; economy; euro; fed

Navigation: use the links below to view more comments.

first previous 1-20 ... 201-220, 221-240, 241-260 ... 281-293 next last

To: JasonC

Banks do not need to have anything to open a loanI don't know what opening a loan means (other than the paperwork that says the borrower will pay back the loan about to be made). When the bank actually makes the loan, it writes out a check for real money against real cash on deposit that will get withdrawn by the the federal reserve's clearing house when that check hits another banks inbox. If your bank does not have the money on deposit for that check, a lot of very nasty things start happening (lawsuits and forensic audits by Justice, your bank gets closed down, folks go to jail for fraud). Even Toddster and I are apparently in agreement on that particular fact.

To: JasonC; Travis McGee

You are wrong that the way to do that is to outlaw finance, or have a big depression with a contracting money supply, or outlaw the Fed, or any of the usual Paulean nonsense.You both use ad hominem's and put unuttered words in the mouths of others. Ron Paul is more or less an Austrian, and what is wrong about the Austrian school of economics in the minds of everyone who opposes them right now is that they predicted that the mess we are in as a result of runaway monetary expansion (which only about 3 idiots around here think that the FED does not control) ALWAYS ends in a bust, and that the way you get out of this mess is not to get into it. Once in, you either have a collapse of the currency through runaway inflation (and devaluation) or you have massive default. You can pick your medicine, but you cannot pick no medicine). Your choices are amputation or death through Gangrene. The wonder drug for two decades of debt accumulation that are invested in unsound enterprises does not exist. Nothing can turn empty high rise condos or sprawling unfinished housing projects into pharmacies or factories (the major expense in which is labor and specialized equipment and not the empty shell of a useless building). Even the economic value of the land is paltry compared to the previously ascribed investment value.

Like it or not we are stuck with a central bank, and no one has called for outlawing central banks or more absurdly attempting to outlaw finance. A lot of us think it is time we got off the charlattan patent medicine free gifts of credit expansion merry-go-round- that has characterized the ignorance and naivte of the American culture since before the revolution. You do that through policies of sound money. What we are appalled by is that folks think you can abandon the laws of accounting or physics, the notion that through finance you can get something for nothing. Expanding an economy requires that excess capital GOODS (intellectual capital, labor, commodities) be accumulated that can be put into expanding means of production. No amount of credit expansion substitutes for the hard work of creating new enterprise to generate goods and services that make life better for humans in the US. Finance is a component, yes, but it is only the component that measures how much capital you have accumulated for investment, if any. Finance itself creates NOTHING. (Go read Adam Smith if you remain confused on this point. He got it more than 200 years ago).

To: AndyJackson; Moonman62

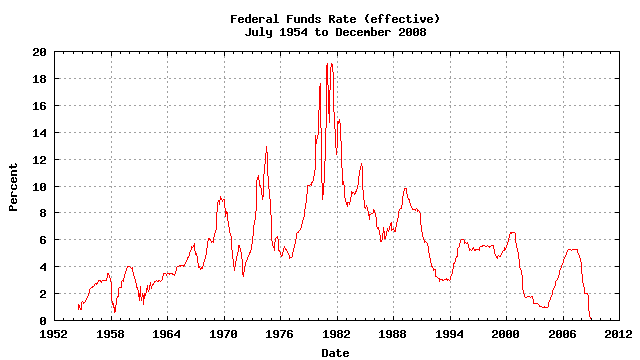

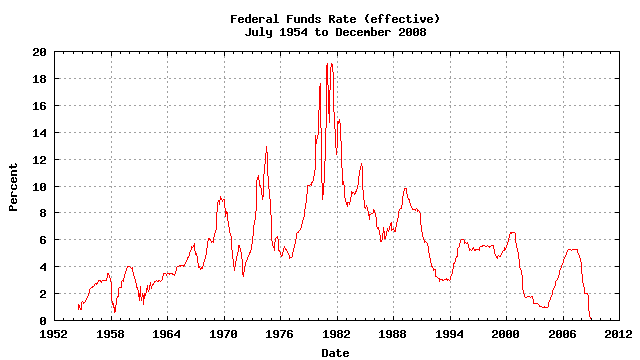

1. We have not had a tight money policy in this country since Volker was chair.You don't think an inverted yield curve is a sign of tight money?

You never admitted that new loans increase M2. Figure it out yet?

223

posted on

05/02/2008 6:49:11 AM PDT

by

Toddsterpatriot

(Why are doom and gloomers, union members and liberals so bad at math?)

To: AndyJackson

1. We have not had a tight money policy in this country since Volker was chair. Oh, I get it. The Fed has to raise o/n rates to 18% or they aren't tight. Sheesh.

2. Orange County was not caused by tight money. It was caused by an idiot

Oh you're right about that. The tight money just drew back the curtain on the idiot. Same thing for LTCM, the dot com bubble, the 1987 crash, and now the RE bubble/Bear Stearns.

Notice how every time the Fed, what would you call it: gently tightens? a major entity seems to disintegrate. I guess you'd prefer that be major entiTIES. Hell, bring down the entire financial system and take us back to a primary, agricultural economy.

224

posted on

05/02/2008 7:14:16 AM PDT

by

groanup

(War is not the answer. Victory is.)

To: shrinkermd

A phony desperate rally. If OPEC abandons the US Dollar, then expect China to dump their Treasury bonds. Wall Street see’s one ok report in a Sea of bad news, and they go nuts. We are going to fall like Rome unless we change.

To: groanup

I get it. The Fed has to raise o/n rates to 18% or they aren't tight. Sheesh.Just exactly when was the FED tight with money expansion in this graph. Arguably briefly in the 1994 time frame. Otherwise, it has been up up and away in Greenspan's beautiful balloon, pretty much straight line logarithmic growth.

Notice how every time the Fed, what would you call it: gently tightens? a major entity seems to disintegrate. I guess you'd prefer that be major entiTIES.

Tell me which of these entities were major engines of expansion of US economic productivity. They were merely speculative participants in our transformation to an information/service economy.

Hell, bring down the entire financial system and take us back to a primary, agricultural economy.

I advocate an economy where we actually provide our own goods and services, you know, like start building lots of nuclear power, transform our transportation system to something sustainable that does not run off of middle east oil. But we used to be the world's leading industrial power without traders creating and trading 10 x our GDP in derivatives, and we could probably survive just fine without those guys.

To: AndyJackson

Notice that sometimes the line is moving up.

Tell me which of these entities were major engines of expansion of US economic productivity

The dot com revolution transformed the world and still is - especially in the area of productivity.

The real estate market isn't exactly a potted plant.

227

posted on

05/02/2008 6:16:32 PM PDT

by

groanup

(War is not the answer. Victory is.)

To: AndyJackson

pretty much straight line logarithmic growth I would say your graph illustrates goldilocks growth. How would you have the line drawn differently? Flat line? That's hardly an economy that's growing.

228

posted on

05/02/2008 6:18:40 PM PDT

by

groanup

(War is not the answer. Victory is.)

To: groanup

Poor Andy still doesn't understand that MZM can grow without the Fed doing a thing.

229

posted on

05/02/2008 7:10:01 PM PDT

by

Toddsterpatriot

(Why are doom and gloomers, union members and liberals so bad at math?)

To: Toddsterpatriot

Poor Todd doesn’t understand central banking.

To: AndyJackson

I just borrowed $1 billion and increased MZM by $1 billion. And the Fed wasn't even involved. LOL!

231

posted on

05/02/2008 9:34:53 PM PDT

by

Toddsterpatriot

(Why are doom and gloomers, union members and liberals so bad at math?)

To: groanup

I would say your graph illustrates goldilocks growthYes. You are right. It illustrates fairy-tale growth. Of course someone as smart as you keep telling us you are very well knows the difference between monetary growth with economic growth, and what the chart illustrates is only monetary growth.

Here is an interesting table comparing YOY monetary growth in various countries. Funny that Switzerland has very little monetary growth, but maintains a very very productive economy, wheras we put ourselves in the ranks of the socialists and communists. Source

| GLOBAL MONEY SUPPLY |

| as of 10/04/07 Country |

YOY %

|

| Russian Fed. M2 |

43.71

|

| India M3 |

20.15

|

| China M2 |

17.06

|

| Australia M3 |

16.64

|

| Denmark M3 |

14.53

|

| UK M4 |

13.06

|

| Mexico M4 |

12.69

|

| Brazil M2 |

12.37

|

| Korea M3 |

9.97

|

| OECD Total M3 |

8.22

|

| Canada M3 |

8.15

|

| United States, M3 reconstructed |

15.07

|

| Germany M3 |

6.16

|

| Japan M4 |

4.22

|

| France M3 |

2.72

|

| Spain M2 |

1.98

|

| Switzerland M3 |

0.95

|

To: Toddsterpatriot

I just borrowed $1 billion and increased MZM by $1 billion. And the Fed wasn't even involved. LOL!But you didn't. LOL!

To: AndyJackson

Not only did you not just borrow $1B, but if you had it would not have increased the money supply. The total volume of loans outstanding would be some multiple (say 10) of the reserves on hand. By writing out a check for $1B your bank expanded another banks cash on hand by $1B but contracted it's own cash on hand by $1B. There is no new money in the system, and overall loans cannot increase. New lending is only possible with new net reserves in the system and the FED creates those.

The total volume of bank loans could only increase by the FED intentioanlly injecting more cash into the system. It can do this in a few ways. One, it can by a treasury, effectively giving the treasury money to spend, which when spent ends up in the banking system. Second, it could purchase a security, say a CDO containing your loan as part of the bundle. In other words, the FED has by this action monetized what is normally a debt instrument.

Of course none of this counts truly private debt - you sell me your house and take my private bond in exchange. In an ideal world we could create all the paper money we wanted in this fashion. In reality we cannot because the IRS is going to come looking for taxes both on the sale of the house and on the interest on the mortgage that is generated, and that requires that the debt instrument become monetized in some fashion. It becomes MZM if and when the FED agrees to purchase it, or a CDO containing it, for newly created cash money. It is no secret that the FED has started to do that.

To: AndyJackson

Your table is meaningless. Of course ex communist countries that are suddenly capitalists are going to experience explosive growth. China and India are blasting off... finally.

Switzerland is a borderline socialist state. You like that? And, BTW, what statistics do you have that shows Switzerlad as a very productive economy. As far as I can tell, it hasn't come close to the type of GDP growth that we have in recent years.

I think I'm debating with one who would rather see economic growth stifled.

235

posted on

05/03/2008 6:12:28 AM PDT

by

groanup

(War is not the answer. Victory is.)

To: AndyJackson; groanup; JasonC; Fan of Fiat

Not only did you not just borrow $1B, but if you had it would not have increased the money supply.Yes, Andy, my borrowing of $1B most definitely increased the money supply.

The total volume of loans outstanding would be some multiple (say 10) of the reserves on hand.

You got one right!

By writing out a check for $1B your bank expanded another banks cash on hand by $1B but contracted it's own cash on hand by $1B.

Cash on hand? What are you talking about? You don't think that MZM is cash on hand, do you?

There is no new money in the system,

The $1B loan was deposited in my account. The money supply grew by $1 billion.

The total volume of bank loans could only increase by the FED intentioanlly injecting more cash into the system.

You're wrong.

It can do this in a few ways. One, it can by a treasury, effectively giving the treasury money to spend, which when spent ends up in the banking system.

The Fed doesn't buy Treasuries from the Treasury.

236

posted on

05/03/2008 8:01:07 AM PDT

by

Toddsterpatriot

(Why are doom and gloomers, union members and liberals so bad at math?)

To: groanup

Your table is meaningless. Thank you for proving a.) that you don't get around the world much, and b.) that you yourself are an idiot. Switzerland has always been and remains today one of the world's most advanced industrial countries. They have a far more educated population on average than our (hate to wound your ignorant patriotic price) and are very technically sophisctated. ETH (you have heard of it - Einstein was there for a number of years, for instance) is one of the world's premier research universities).

There are a couple of other not so minor idiocies in your claims as well. First, the US economy has been growing at best at 4% per year (relying on USG inflation corrected statistics), with some years a lot less, and currently it is running close to zero. Monetary growth above GDP growth is inflation, so that would suggest that even with the BLS corrected inflation numbers in GDP monetary growth has been outstripping GDP by 11% per year. Now that kind of monetary growth for many years suggests that the BLS adjusted inflation numbers are much lower than reality, which accords with the experience of most of us who actually buy things in the economy.

The problems in BLS inflation correction we could go into, but that is probably too deep for a feeble mind that does not even know that per capita the US is not the wealthiest country in the world anymore, even excepting the bizarre case of Luxembourg.

Since you seem to think that thing are so much better in the US than anywhere else in the world, here is another meaningless useless table for you to ponder Source

| |

2005 |

2006 |

| Luxembourg |

68810 |

76040 |

| Norway |

60890 |

66530 |

| Switzerland |

55320 |

57230 |

| Denmark |

48330 |

51700 |

| Iceland |

48570 |

50580 |

| Ireland |

41140 |

45580 |

| United States |

43560 |

44970 |

| Sweden |

40910 |

43580 |

| Netherlands |

39340 |

42670 |

| Finland |

37530 |

40650 |

| United Kingdom |

37750 |

40180 |

| Austria |

37190 |

39590 |

| Belgium |

36140 |

38600 |

| Japan |

38950 |

38410 |

| High income: OECD |

36506 |

38120 |

| Germany |

34870 |

36620 |

| France |

34600 |

36550 |

| High income |

34962 |

36487 |

| Canada |

32590 |

36170 |

| Australia |

33120 |

35990 |

| European Monetary Union |

32101 |

34149 |

| Italy |

30250 |

32020 |

| Singapore |

26620 |

29320 |

| Hong Kong, China |

27690 |

28460 |

| Spain |

25250 |

27570 |

| New Zealand |

25920 |

27250 |

| Greece |

19840 |

21690 |

| Slovenia |

17430 |

18890 |

| Portugal |

17190 |

18100 |

| Korea, Rep. |

15880 |

17690 |

| Trinidad and Tobago |

10870 |

13340 |

| Czech Republic |

11150 |

12680 |

| Estonia |

9530 |

11410 |

| Antigua and Barbuda |

10700 |

11210 |

| Hungary |

10210 |

10950 |

| Slovak Republic |

8100 |

9870 |

| Croatia |

8350 |

9330 |

| St. Kitts and Nevis |

8250 |

8840 |

| Seychelles |

8390 |

8650 |

| Equatorial Guinea |

5410 |

8250 |

| Poland |

7150 |

8190 |

| Latvia |

6760 |

8100 |

| Palau |

7670 |

7990 |

| Mexico |

7300 |

7870 |

| Lithuania |

6910 |

7870 |

| World |

7016 |

7439 |

| Libya |

5930 |

7380 |

| Chile |

6040 |

6980 |

| Venezuela, RB |

4940 |

6070 |

| Upper middle income |

5053 |

5913 |

| Botswana |

5530 |

5900 |

| Russian Federation |

4470 |

5780 |

| Lebanon |

5510 |

5490 |

| Malaysia |

4970 |

5490 |

| Mauritius |

5250 |

5450 |

| Turkey |

4750 |

5400 |

| South Africa |

4820 |

5390 |

| Uruguay |

4560 |

5310 |

| Argentina |

4460 |

5150 |

| St. Lucia |

4920 |

5110 |

| Gabon |

4390 |

5000 |

| Costa Rica |

4660 |

4980 |

| Panama |

4640 |

4890 |

| Romania |

3830 |

4850 |

| Europe & Central Asia |

3968 |

4796 |

| Latin America & Caribbean |

4157 |

4767 |

| Brazil |

3890 |

4730 |

| Grenada |

4120 |

4420 |

| Bulgaria |

3510 |

3990 |

| Dominica |

3840 |

3960 |

| St. Vincent & the Grenadines |

3530 |

3930 |

| Serbia |

3490 |

3910 |

| Montenegro |

3310 |

3860 |

| Kazakhstan |

2940 |

3790 |

| Belize |

3570 |

3650 |

| Jamaica |

3420 |

3480 |

| Belarus |

2760 |

3380 |

| Fiji |

3170 |

3300 |

| Namibia |

2960 |

3230 |

| Suriname |

2540 |

3200 |

| Macedonia, FYR |

2830 |

3060 |

| Middle income |

2636 |

3051 |

| Algeria |

2720 |

3030 |

| Marshall Islands |

2930 |

3000 |

| Iran, Islamic Rep. |

2600 |

3000 |

| Thailand |

2720 |

2990 |

| Bosnia and Herzegovina |

2680 |

2980 |

| Tunisia |

2880 |

2970 |

| Albania |

2580 |

2960 |

| Peru |

2640 |

2920 |

| Dominican Republic |

2300 |

2850 |

| .. |

| Zimbabwe |

340 |

.. |

| Source: World Bank Development Indicators 2007 |

To: groanup

I think I'm debating with one who would rather see economic growth stifled. It is you who thinks that loose monetary policy is a necessary component for economic growth. I stand with the Austrians in claiming that the exact oposite is the case, and that excessive monetary growth lead to malinvestment. Our real estate debacle is proof enough of that.

Further, there is plenty of evidence around the world that economic growth is possible while maintaining stable monetary values. In fact, we became the world's leading economic power while being on the gold standard.

And as the FED monitizes that Real estate debt that went into inflating real estate values it is returning to the case economy where we are seeing soaring escalations in commodities prices, which leads inevitably to soaring downstream production prices.

To: AndyJackson

Since you seem to think that thing are so much better in the US than anywhere else in the world, here is another meaningless useless table for you to ponder Source Well that sure is meaningless since you failed to identify it as PPI.

Wow, six tiny European countries have a higher PPI than the vast United States. So what?

Switzerland has always been and remains today one of the world's most advanced industrial countries.

Then why does it have an unemployment rate higher than Cuba?

Hint: see how easy it is to use charts?

Source

239

posted on

05/03/2008 8:32:03 AM PDT

by

groanup

(War is not the answer. Victory is.)

To: AndyJackson

I stand with the Austrians in claiming that the exact oposite is the case Yes, you would choke off all economic development just in case there might be inflation.

Woe unto us if such policies were adopted. Go to Austria and live. Delta is ready when you are.

I like the job the Fed has been doing. Most people do, because if your stocks aren't growing more rapidly than inflation you're in a heap of trouble:

240

posted on

05/03/2008 8:42:39 AM PDT

by

groanup

(War is not the answer. Victory is.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 201-220, 221-240, 241-260 ... 281-293 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson