Wrong.

U.S. Electric Power Industry Net Generation, 2006

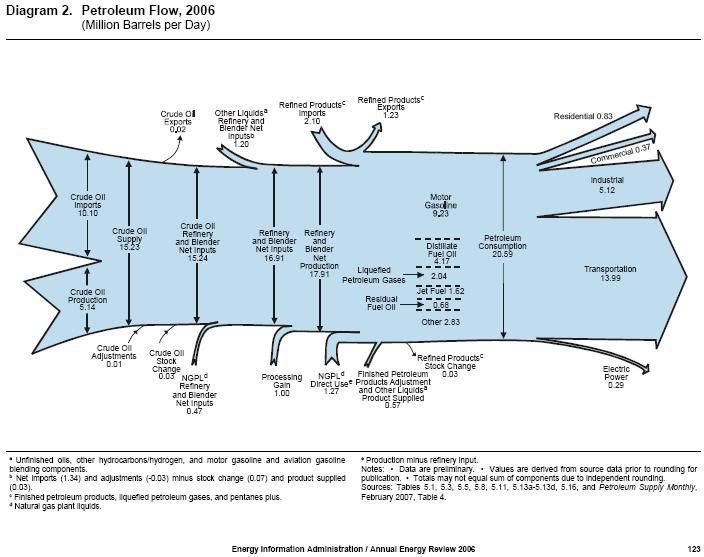

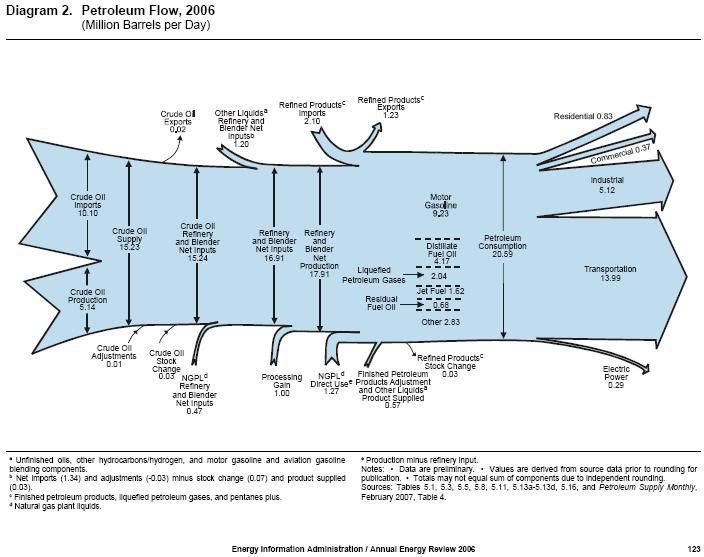

And much of the petroleum that is used is residual oil and petroleum coke. Lower value refinery "leftovers" after the lighter products like gasoline and diesel have been removed.

Posted on 04/16/2008 4:38:39 AM PDT by TigerLikesRooster

Oil hits new high above $114, dollar supports

1 hour, 37 minutes ago

Oil struck a new record high above $114 a barrel on Wednesday, buoyed by the weak U.S. dollar, inflows of speculative money and long-term constraints on supply.

U.S. crude was 53 cents higher at $114.32 a barrel by 5:43 a.m. EDT, just below a fresh peak of $114.41. Today's price is more than three times the average price of 2002, when oil's rally began.

London Brent crude for the new front-month of June was up 54 cents at $112.12.

"The funds and technicians are in the driving seat," said Christopher Bellew, of Bache Commodities Ltd.

"There has been growth in the level of speculative money going into commodities markets."

The weak dollar -- together with strong demand -- has driven oil and other commodities such as corn, gold and rice to record highs in recent months, as investors and speculators have sought a hedge against inflation.

"The dominant factor continues to be the U.S. dollar and I expect this to continue for a while," said Gerard Rigby, an analyst at Sydney-based Fuel First Consulting.

"Whenever you get any kind of good economic news out of the (United States) at the moment, the dollar will rise and oil falls, and the other way round, you get a new oil record," he added.

The dollar headed towards a record low versus the euro on Wednesday, hurt by caution ahead of quarterly earnings announcements by major U.S. banks and worries about the turmoil in credit markets.

CHINA DEMAND

Lifting some concerns over a supply squeeze, Mexico, a major supplier to the U.S., reopened its three main Gulf of Mexico oil ports as bad weather cleared, the government said. Only a smaller Pacific port remained shut.

But in a sign that consuming countries were still concerned about a supply shortfall, Britain's prime minister Gordon Brown on Tuesday called on the Organization of the Petroleum Exporting Countries to boost production to counter rapidly rising prices.

OPEC, which pumps more than a third of the world's oil, insists it is supplying enough oil.

Demand in the world's top consumer may be losing steam. U.S. crude oil imports fell in February to the lowest level in a year.

They declined by 486,000 barrels per day (bpd), or 4.9 percent, from the month before to 9.514 million bpd, the federal Energy Information Administration said.

But China's diesel imports rebounded in March to 490,000 tonnes, up some 49 percent from a month earlier, and remained robust in April and May, as the government extended a tax break on imported fuels.

China's economy grew 10.6 percent in first quarter, the National Bureau of Statistics said, slower than the 11.2 percent in the fourth quarter, but stronger than forecast of 10.0 percent, underscoring the resilience of the world's fourth largest economy despite fierce winter weather and a global credit crunch.

U.S. crude oil inventories likely rebounded last week, with an increase in imports lifting supply, following a surprise drawdown the week before, a Reuters poll of 14 analysts showed. But gasoline stocks probably fell for the fifth week running.

(Additional reporting by Annika Breidthardt in Singapore; editing by James Jukwey)

Yeah could be. Or maybe the Fed is printing too many dollars.

Has Soros bought up the corn futures? Gold? Lead? Nickel? Aluminum?

Shocking economic principle!

Oil production constrained by socialist government policies:

http://www.breakingviews.com/2008/04/15/Peak%20oil.aspx?sg=breakingstories

This is what happened when a ‘free market’ is really an oligopoly.

We need to recall when not all that long ago when leading Asian economies were suffering from the currency traded triggered 'Asian Flu', sinking crude oil prices to under $11 dollars a barrel, dropping pump prices to under $1 a gallon. That was only eight/nine years ago.

Traded commodities which soar quickly have a history of plummeting twice as fast, (2001 palladium prices being a prime example) however, in terms of the energy sector, once OPEC's Iranian jihadist thugs are finally delivered long over due justice, the resulting panic in the oil pits could conceivably skyrocket oil prices beyond $200 a barrel in the chaotic midst of energy trader pandemonium, as global stock market are bearishly sinking fast. Anything can happen before the November elections.

That would make a great newspaper add come next november.

If you really believe that, lots of money to be made in the futures market.

April & May 2009 currently trading at $106~107.

Wrong.

U.S. Electric Power Industry Net Generation, 2006

And much of the petroleum that is used is residual oil and petroleum coke. Lower value refinery "leftovers" after the lighter products like gasoline and diesel have been removed.

Weak dollar is to blame. Nevermind the dollar is about where it has been for several months.

Hmm. I’ll have to revise that then. The numbers I had were admittedly not recent. Somewhere around 60%, I think.

Thanks.

60%? Were you using numbers from the 1930s?

I don’t even remember, but it was before ‘04, and I don’t remember the site.

Most likely completely bogus.

Figure 14. Petroleum Consumption by Sector

Energy in the United States: 1635-2000, Petroleum

http://www.eia.doe.gov/emeu/aer/eh/petro.html

It looks like the dollar is going to retest the March all time low here pretty quick.

.

Oil prices are up when priced in Euros, just not as much dollars.

Look at the last 5 years or so change in dollar value and change in oil price. Most of it is not from the dollar.

I just changed it.

Russian oil production is off some but whether it calls for global limited nuclear war is a question for those who might profit in some way from global limited nuclear war.

Average oil company profits are also ~8.3%, not 10%.

The Truth About Oil and Gasoline: An API Primer

http://www.energytomorrow.org/energy_issues/truth_about_oil_gasoline_primer.pdf

2007 Earnings by Industry, Page 14.

Of course I’ve got to recommend you stop vandalizing private property. I think that type of action is best left to the enemies.

It’s not vandalizing any more than the people putting ads on your door or windshield offering jobs or carpet cleaning services. The glue is quite weak.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.