Posted on 10/13/2011 3:53:13 PM PDT by TLittlefella

Cain’s website is scant (at best) describing his 999 proposal. Pelosi said “pass the plan

and read it later” and the damn fools did exactly that. With the scant details provided by

Cain’s 999 there is little difference between those damn fools and those of us touting the

mysterious 999 plan.

Individual Flat Tax – 9%

Gross income less charitable deductions

Empowerment Zones will offer additional deductions for those living and/or working in

the zone.

Retirement income – Is that subject to the 9% tax?

Social Security Income – Is that subject to the 9% tax?

Disability Income received by returning disabled war heroes – Is that subject to the 9%

tax?

Child Support Received - Is that subject to the 9% tax?

Cain’s website does not say these incomes are exempt so are we to assume they are not?

Gross income less charitable deductions – does this mean all charities? I can see a lot of

new charities emerging. Perhaps even charities openly hostile to the American way of

life. It seems odd to me that Cain favors charitable deductions over mortgage interest

deductions. The hell with the American dream of owning a home, let’s be a nation of

renters.

Empowerment Zone deductions – there is little doubt what class of people this will favor

National Sales Tax – 9%

Cain’s website does not list a single exemption from this tax.

Will buying a new home be taxed? Oh, I forgot, we are not buying homes anymore – we

have become a nation of renters.

Buying a new car will add 9% to the state sales tax for many of us. Hell if we are renting

we may as well all use cabs for transportation to escape the 9% sales tax. Using a cab will

even save us the added 9% to the $4 a gallon of gas we need for a car. And we won’t

need to buy tires, oil changes, etc. – all subject to the 9% sales tax.

I just had a yard sale and sold my lawn mower for $100. Who is responsible to collect the

$9 sales tax from the buyer? What form will I use to file the $9 sales tax I owe? Maybe I

could collect the $9 sales tax from the buyer and use that same $9 to pay the income tax I

owe.

Summary

For sure Cain is aware of the many questions associated with his plan. Yet his website

remains very lacking in details. This is troubling. We don’t need verbal details from Cain

on various talk shows, we need written answers on his website.

Cain will often tell us he will surround himself with knowledgeable people to fill the gaps

in his lacking knowledge about any given subject. This is a great concept and I agree with

it 100%. The problem comes when you don’t scrutinize those gap filling ideas and that is

what happened with Cain and the Lowrie produced 999 plan. Cain failed to fully

understand the impact on the middle class, he probably saw the impact on the lower class

and threw in the Empowerment Zones exemption as a fix.

The 999 plan is unlikely to ever pass in Congress. It is Cain’s apparent lack of

understanding the impact of such a plan would have on the average American that troubles

me.

Cain - a great man

with a terrible plan

Thomas Littlefella

.

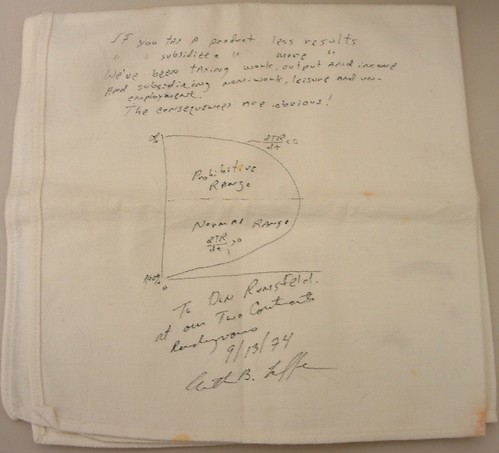

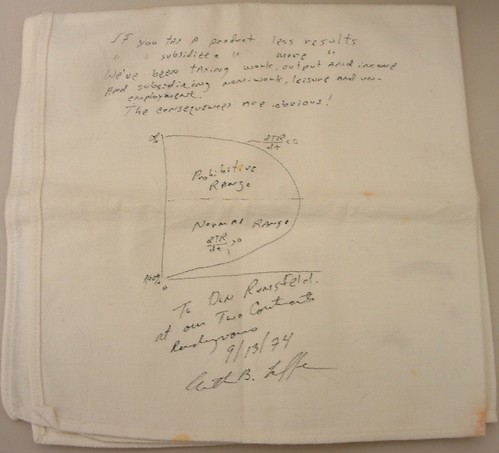

Art Laffer endorsed 999. Just saying

Art doesn’t hold an economic candle to tlittlefella.

/sarc

Well, what would one expect from a neophyte...

Yep, forget about Paul Ryan and Art Laffer.

As they say, so goes tlittlefella...

40% of the cost of everything you buy, from a home to a car to a toothbrush is tax upon tax upon tax. When the GNP is 10 trillion dollars and the government spends 4 trillion dollars ...where do you think the 4 trillion comes from?

Buy a car? 40% of the cost is layers of taxes assessed on the earnings of everyone involved from the guys that dug the ore out of the ground to the guy attaching the windshield.

People like you need to get a clue.

The same person who currently collects sales tax for your illicit crack cocaine transactions.

If you don’t know the details of the plan as you have just admittted to everyone then how can you call it a terrible plan?

Back to the drawing board for you. Sheeze...

I don’t think that Cain’s 9-9-9 plan is the center of the attraction for Cain supporters. I think that it’s more the fact that Cain came into this race with a plan and stands by it without waivering, through all the criticism.

If the 9-9-9 plan is unworkable, it won’t pass Congress, but it will force Congress to take a serious look at reforming the tax code.

The draw for Cain is that people think that he is trustworthy. Something they haven’t seen in a politician for a very long time.

We are 13 months away from the election.

The Hermanator is introducing general principles and sparking a debate on whether that is the right direction to go in.

That is exactly what we should be doing now. The parallel you are trying to draw to Obamacare is stupid.

I believe I read the 999 plan doesn’t count used items as taxable. Or maybe I just dreamt it.

Yeah! Cain is a ‘neophyte’!

The real answer is a stuttering, corrupt, imbecilic, ‘expert’ from Texas who can’t string 3 words together into a coherent sentence.

Unfortunately, the only thing Rick Perry seems to be well trained in is taking a great debut and frittering it away into a race with Jon Huntsman for 1%.

Exactly right. I have issues with 9-9-9 myself. I still like Cain though.

I like Cain. But is his 9% sales tax on top of my 7% local sales tax? That’s 17% on everything I purchase...

BS !

Cain's proposal is at least a serious attempt to do away with the abomination which is our Federal Tax Code. I think I, nearing retirement, would come out behind. If that's the case, so be it. The country, going forward, would be better off. If we all stick to a "What's in it for me" attitude, we'll never escape the Welfare State the establishment has foisted upon us.

ML/NJ

Don’t tell me. Tell TLittlefella.

The “9-9-9” plan is a proposal, not a full-scale legislative bill ready for submission to the US Congress.

It would take years, and a considerable change in attitudes, before this or any similar plan may be accepted by the legislative branch. So far, we have “think tank” appraisal of the merits and flaws of this proposal, and nothing is set in stone.

Before ANY taxation scheme is ever agreed to, a Balanced Budget Act resulting in an amendment to the US Constitution has to be in place. As of now, there is nothing that prevents Congress from making an end run around this or any other tax proposal, and raising or modifying it on a simple majority vote. Requiring a two-thirds concurrence of BOTH Houses of Congress, and Presidential approval, tends to make any changes to the level of spending or assessment of new taxes compliant to a much higher threshhold.

Time we were talking about spreading the burden of supporting the government widely enough so EVERYBODY has “skin in the game”. Paying for government is not only the province of the wealthy, you know, because there is no reliable way of taxing wealth. With the right incentives, great wealth may be harnessed for the benefit of all.

But the “all” have to provide their capability to carry the load too. And a consumption tax falls on the wealthy and less wealthy alike.

My feelings exactly.

999, in the real world, translates to:

1) Pass the national sales tax, while keeping the income tax too.

2) Trust Congress not to raise tax rates anymore.

Hey, what could go wrong?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.