Posted on 10/15/2025 7:18:00 AM PDT by delta7

China’s $128/oz Premium Sets Global Benchmark, Triggering a Worldwide Silver Supply Shock and Redefining Pricing Everywhere.

Raw silver is commanding $128 per ounce in China, the world’s largest physical silver marketplace—a price more than double prevailing global spot rates. In an interconnected world, silver always flows to the market that pays the most and treats it best. When benchmark prices surge so dramatically in one dominant region, those levels ripple outward, redefining what buyers everywhere must pay for the real metal.

As word spreads of China’s sky-high premiums, sellers and traders naturally align their offers to match, making $128 not just a local anomaly, but a practical new baseline. The days of regional price gaps are vanishing, replaced by a global standard set by those willing to pay.

Ultimately, silver goes where it is valued highest—and when one market leads, the rest follow. As news of China’s $128 per ounce silver price circulates, it quickly becomes the effective price for physical silver worldwide.

The silver shortage gripping global markets in late 2025 is not an abstract concept; it’s a rapidly unfolding crisis affecting wholesale, retail, and industrial supply chains in every major region. Silver is suddenly unavailable from trusted mints and dealers, cascading real-world consequences for manufacturers, investors, and everyday buyers. This systemic scarcity, driven by a confluence of supply chain breakdowns and surging demand—especially in Asia—has triggered new pricing benchmarks, stunned old-economy players, and left the world scrambling for solutions.

Perth Mint and India: Supply Vanishes

In Australia, the globally respected Perth Mint has halted all silver product sales, effectively erasing one of the planet’s most reliable sources of new supply. Not a single coin or bar now leaves their facility; the only response to inquiries is silence or “unavailable.” This sudden stop eradicates a crucial export pipeline, radiating downstream effects throughout Asia Pacific and beyond.

The situation in India is equally dramatic—retailers and dealers report not even “a sliver of silver available”. Amazon-based sellers are now defaulting on deliveries, advertising silver bars, accepting payment, and then failing to produce the metal. This breach of trust highlights the severity of the crunch: some dealers have run out of physical stock and cannot honor sales, leaving frustrated consumers without recourse. These abrupt defaults mark a transition from mere inconvenience to financial risk with reputational damage.

Physical Shortage Splits the Market

In London, physical silver shortage signals have become acute, sending lease rates spiraling to 39%—a panic level not seen in recent history. Banks unable to locate sufficient metal are forced to buy back futures contracts or deliver actual silver, moves that can spark explosive price surges overnight. The crisis has bifurcated the market: futures and paper contracts trade at one price, while the real metal commands far greater premiums, sometimes double the spot rate due to scarcity.

China Sets the New Global Price

Nowhere are these pressures more visible than China, the world’s largest physical silver marketplace. Silver sheets on top trading platforms like Rongtong Gold have disappeared, cutting off both bulk buyers and industrial demand. JD.com, the nation’s top e-commerce retailer, shows almost all merchants have delisted raw silver bars; only one remains, offering $108.25 per ounce for raw silver and $128.50 for small bars. These prices are more than 100% above official global spot, signaling not just local demand but a reset in global pricing logic.

Why does China’s price matter so much? Sellers always migrate to markets offering the highest returns and best conditions. With China consuming a vastly disproportionate share of global silver supplies, its domestic premiums exert gravitational pull—aligning international prices with Chinese benchmarks. If sellers can receive $108-$128 per ounce in China, the rest of the world quickly follows, making China’s retail prices the new “de facto” global standard for physical silver.

North America: Mints and Banks Run Dry

The supply pinch is intensifying in North America. The Royal Canadian Mint, revered for stability, reports zero inventory on its iconic 10-ounce and 100-ounce silver bars; buyers are met with “out of stock” notices or indefinite waitlists.

TD Bank, a giant in Canadian retail bullion, shows every single silver product marked “unavailable.” Even collectors seeking small, themed bars are left wanting. The tightness extends deep into the institutional segment—banks, mints, and retailers cannot replenish stock or assure customers of future deliveries.........

Right now, you can’t sell silver unless it is .999 or .0000 to the refiners. And dealers are paying less than spot for .999 and even less for 90% silver, if they are even buying.

not sure about this story. I went to a silver web site and was told many, many silver products are available. https://www.apmex.com/category/80253/silver-available-products

The current spot price of silver is about USD 47.96 per troy ounce

There is a thread about 3D printed aluminum.

It might make a good conductor for solar panels.

I am seeing silver at around $53 per ounce.

“In Australia, the globally respected Perth Mint has halted all silver product sales,”

False.

I posted the story into ChartGPT and asked it to evaluate. This is a summary of the response:

Overall evaluation: mostly false / exaggerated, with kernels of truth

The central numeric claim ($128/oz raw silver in China) appears to be false or massively exaggerated relative to real-world data.

The general idea that physical premiums can deviate from paper spot pricing, and that tightness and regional stress can ripple outward, is plausible and consistent with known market dynamics (though usually on a much smaller scale).

Many of the sweeping statements about global shortage, systemic collapse of supply in every region, and wholesale defaults are unsupported by credible data and verge on sensationalism.

If I had to rate the claim’s truthfulness: I’d assign it a ~10–20 % credibility—it mixes real tension in physical markets with dramatic exaggeration and speculative leaps.

Remember when the Hunt bros. tried to corner the silver market back in the day. Remember how that turned out.

Why would China do this, aside from the economic chaos it created?

Is there some new technology heavily dependent on silver?

That would make sense from a military point of view.

Buy up all or most of the silver and deny your enemy the advantage....................

“Raw silver is commanding $128 per ounce in China, “

Silver bars $53

https://silverprice.org/silver-price-china.html

I was just looking at JM Bullion. They were buying silver at $0.13 under spot. That’s the best price they’ve had in a long time.

They are paying about $10/oz over spot for gold.

“Right now, you can’t sell silver unless it is .999 or .0000 to the refiners.”

Refiners don’t buy refined silver. They SELL refined silver.

silver spot price is reported at $53.29 per troy ounce, representing a $1.56 increase from yesterday

They are not buying anything less than .999, You can find it yourself all over the internet.

.

Back in 1980, the Hunt Brothers borrowed heavily from the COMEX exchange to buy silver futures on margin. As soon as the COMEX (with prodding from US Treasury) changed their margin requirements, the Hunt Brothers were finished. By the way, Lamar Hunt's son, Clark Hunt, is the present owner of the Kansas City Chiefs football team - so the family is still doing OK.

This time, instead of two rich Texans, its the country of China, which is simply buying up real, physical silver, and don't expect it to ever leave China again, except possibly in the form of computers, solar panels, weapons, etc...

So its a very different situation.

“China....the worlds Wealth is moving from the West to the East, as forecasted.”

Drowning in Debt: is China’s economy the Walking Dead?

https://youtu.be/qdeZcOAj2fo?si=p67VBf51YMQOtYVi

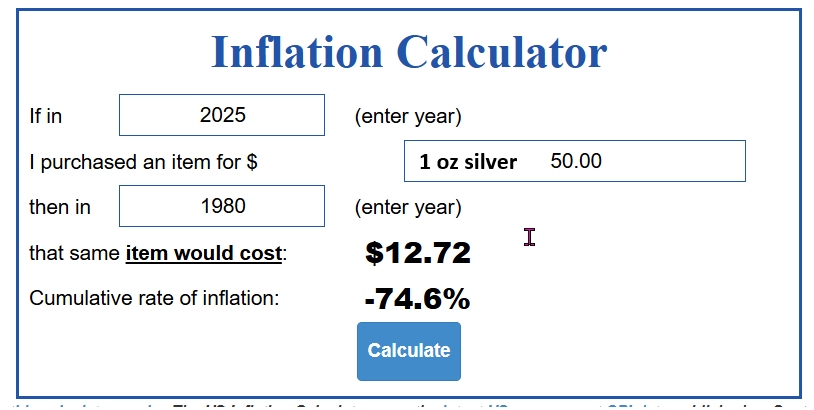

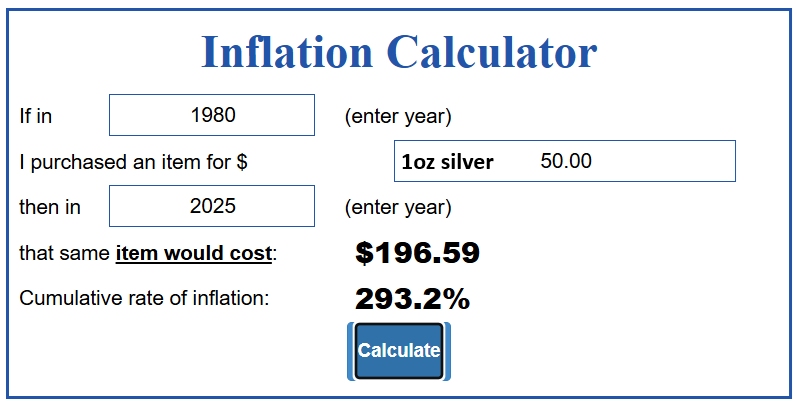

I assume your calculation is based on government-issued CPI figures.

what would the price be if you doubled the government-stated inflation rate?

Just playing it safe so as to not to rile up the US dollar fan base.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.