Posted on 04/21/2025 6:32:33 AM PDT by Miami Rebel

The yield on the 10-year U.S. Treasury note rose Monday as investors weighed concerns over tariffs and comments by President Donald Trump criticizing Federal Reserve Chair Jerome Powell.

The benchmark 10-year Treasury yield was 8 basis points higher at 4.401%. The 2-year Treasury yield was 1 basis point lower to 3.788%.

One basis point is equal to 0.01%. Yields and prices move in opposite directions.

The moves come after Trump on Friday levied another salvo at Powell for not lowering interest rates. The president vocalized his discontent with the Fed chair’s economic policy leadership during a question-and-answer session with reporters.

“If we had a Fed Chairman that understood what he was doing, interest rates would be coming down, too,” Trump said, pointing to examples of falling prices. “He should bring them [interest rates] down.”

White House economic advisor Kevin Hassett added on Friday that the president and his team were studying whether firing Powell was an option.

A day prior, Powell sounded the alarm on growth and inflation risks as a result of the Trump administration’s tariffs. He described a scenario in which the U.S. could find it difficult to balance the need to temper inflation and support growth.

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” Powell said in remarks made to the Economic Club of Chicago. “If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

Concerns over the impact of Trump’s tariff regime on global growth pushed investors toward safe-haven assets like gold on Monday. Spot gold prices — which also got a boost from a weaker dollar — hit a record high above $3,400 an ounce.

(Excerpt) Read more at cnbc.com ...

On top of which, bond traders loathe political uncertainty.

The Fed can only control short term interest rates, long term rates are determined by the market. In other words, the Bond market is melting down.

Loss of confidence signals crisis.

From the article: Concerns over the impact of Trump’s tariff regime on global growth pushed investors toward safe-haven assets like gold on Monday. Spot gold prices — which also got a boost from a weaker dollar — hit a record high above $3,400 an ounce.

—————

The Bond markets are signaling crisis ahead, but more importantly, with Gold now taking 3,400 dollars to purchase an ounce, is signaling an historic meltdown ahead.

The much talked about “ Great Reset” has begun.

Heads up.

—————

….and 99 percent of John Q. Public have absolutely no idea or understanding of today’s events. The only safeguard? Going back, way back to the basics, and that isn’t anything denominated in paper or electrons on a screen.

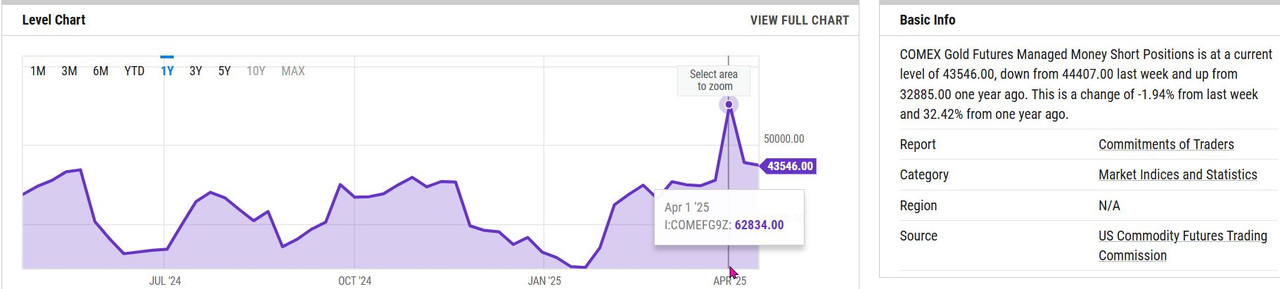

And yet they are managing to still keep silver prices suppressed. At least that’s my opinion in any rate

Who is “they”?

The gold/silver ratio is stretched, which is why I’m buying SLV and HL. That said, it’s not necessary to find conspiracies under every rock.

Silver can often lag in times of economic uncertainty because it has far higher instances of industrial usage.

Before jumping, take a look at the 10-year “break-even inflation rate” (this is the difference between the 10-year Treasury and the 10-year inflation-adjusted Treasury).

https://fred.stlouisfed.org/series/T10YIE

This implicit forecast of inflation grew to 3 percent under Biden and has since settled down to 2 to 2.5 percent.

The Federal Reserve’s long-run target for inflation is 2 percent, and getting the inflation rate all the way down to 2 percent is proving to be tough.

The Federal Reserve’s long-run target for inflation is 2 percent

————-

The admission the target for 2 percent inflation confirms US paper is dying, going the way of all paper currencies. …the next “ target” will be 3, then 5, then 8 percent inflation.

Why not have a stated “ target” of Zero inflation?

Because they can’t, since we got off the Gold standard in 1971, inflation and loss of purchasing power has been rising…..signs of a dying currency.

spot gold up 2.54%

gld up 3.21%

what do these imply

IIRC, the Fed likes to keep rates high in some proportion to economic activity in order to maintain a target inflation rate.

Again, IIRC, if economy is hot, which increases inflation, the feds raise rates.

But inflation also increases the more government dilutes the currency with its outrageous spending.

So to me, the natural question is - Are rates high because of the economy or the dilution?

If the economy, Trump is doing a good jump getting things going here. If the dilution, congress, as usual, is doing a crappy job keeping spending under control.

I not looking for “conspiracies”. I’m referring to market manipulation. When a lot more paper silver is sold than bullion available the market is altered.

The gold/silver ratio is a more than stretched.

If one does not hold the metal, good luck exchanging paper for silver when/if the real crunch comes.

Millions of Baby-Boomers have their assets tied up in Bonds. This bodes ill for whomever is in charge, politically speaking.

If you shop around, you can often manage to buy silver knives and forks at less than current melt value.

There is a 102 dollar premium on the Shanghai Gold Exchange top of that Gold Price, too.

There’s way more paper gold than real gold.

The problem that creates a tension between Powell and Trump is that they are trying to bail out the ocean with a teaspoon. In other words, $46 trillion or $47 trillion debt accumulating at the rate of $1 trillion every 100 days means that the slightest tremor can knock these two gentlemen off the tight rope where the profligacy of the country has placed them.

If Powell reduces interest enough to stimulate the economy and maintain employment for political reasons, as the Fed did on several recent occasions described as QE, he risks the bond vigilantes staying away from the window. If, on the other hand, Powell raises interest rates high enough to assuage the doubts of bond purchasers who fear inflation, he could tank the economy.

Enter Donald Trump with his tariff war, whether for good or ill, whether wisely or unwisely, whether necessary for the ultimate survival of the nation, his tariffs certainly induced tremors. It appears that some of those tremors were caused by the Chinese selling US bonds hand over fist. At any rate, the tremors evidently caused Trump to pause his tariff war, while admitting that the pause was due at least partially to market queasiness.

Politicians like Trump, who are forced to navigate the tight rope, would naturally prefer the Fed to err on the side of supporting employment. Hence Trump's jawboning Powell.

Powell's rejoinder is almost a plea for understanding of his predicament and the difficulty of balancing on the tight rope. Like Goldilocks, he can neither be too hot nor too cold.

Our state of extreme indebtedness is precarious; we will be damn lucky if we can get off the tight rope as rich as we are today.

Well, forget today then. President Trump has been yapping about Powell. He seems unable to control himself at times.

“The Fed can only control short term interest rates,”

The feds cannot control short term interest rates. The can only “influence”.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.