Posted on 04/15/2025 5:49:31 AM PDT by delta7

Top 10 Countries with the Most Natural Resources in the World

Natural resources form the backbone of global economies, providing raw materials for industries, energy production, and exports. The value of these resources is a reflection of a country’s wealth and potential for economic development. According to Basic Planet, the following are the top 10 countries with the highest natural resource values, measured in trillions of U.S. dollars.

1. Russia – $75.7 Trillion

Russia tops the list with an estimated $75.7 trillion worth of natural resources. The country is rich in oil, natural gas, coal, and timber, making it a global energy powerhouse. Russia also holds vast reserves of precious metals such as gold, platinum, and nickel, contributing significantly to its resource wealth.

2. United States – $45.0 Trillion

The United States ranks second with $45 trillion in natural resources. It is the world’s leading producer of natural gas and has extensive reserves of coal, oil, and timber. Additionally, the U.S. is a significant producer of minerals like gold, copper, and uranium, which are essential for its advanced industries.

3. Saudi Arabia – $34.4 Trillion

Saudi Arabia is renowned for its oil reserves, which form the cornerstone of its $34.4 trillion resource wealth. The country is the largest exporter of crude oil, and its reserves make up a significant portion of the world’s supply, cementing its role as a leader in the global energy market.

4. Canada – $33.2 Trillion

Canada boasts $33.2 trillion in natural resources, driven by its vast reserves of oil sands, natural gas, and minerals. The country is also rich in timber and fresh water, further enhancing its economic potential.

5. Iran – $27.3 Trillion

Iran’s $27.3 trillion in natural resources is primarily attributed to its massive oil and natural gas reserves. The country holds one of the largest gas reserves in the world and is a key player in the global energy sector.

6. China – $23.0 Trillion

China’s $23 trillion resource wealth is driven by coal, rare earth metals, and industrial minerals like iron and copper. The country is the world’s largest producer of rare earth elements, which are critical for electronics, renewable energy technologies, and advanced manufacturing.

7. Brazil – $21.8 Trillion

Brazil is rich in iron ore, gold, and timber, contributing to its $21.8 trillion in natural resources. The Amazon rainforest, one of the world’s largest ecosystems, also provides a vast reserve of biodiversity and renewable resources.

8. Australia – $19.9 Trillion

Australia’s $19.9 trillion in resources stems from its vast reserves of coal, iron ore, gold, and uranium. The country is a leading exporter of these minerals, supporting global industries and energy needs.

9. Iraq – $15.9 Trillion

Iraq’s natural resource wealth of $15.9 trillion is almost entirely derived from its oil reserves. The country has some of the largest proven oil reserves globally, making it a critical player in the energy market.

10. Venezuela – $14.3 Trillion

Venezuela holds $14.3 trillion worth of natural resources, primarily due to its oil reserves, which are among the largest in the world. However, political instability and economic challenges have limited the country’s ability to fully capitalize on its resource wealth.

Re-establishing trade with Russia and the entire global economy benefits. The EU is being strangled, but then that may be the plan?

Now it should be very obvious why NATO is being used to penetrate or defeat Russia. It is too bad politicians like Graham and McConnell are not held to bear for the true disastrous ramifications of their greed.

The evaluation is a little bit silly.

Placing numbers on minerals that represent a total of printed pieces of paper that were created from nothingness has no meaning.

Never ever forget that money comes from nothingness. Central banks create it via QE and they do so with the wave of a hand and a few key presses on a terminal. It’s value is determined strictly by the imagination of counterparties.

Oil value is determined by the quantity of joules. Those are not created from nothingness by the whimsical waving of a hand over a keyboard.

According to your previous statements it is not resources, but manpower productivity that determines a nation’s wealth.

You cited Japan and Germany as examples of countries without natural resources that became great after WWII.

Agree.

We have to develop our rare earth minerals. Or we need a science fix.

Now, do it per capita. That would be very telling.

(This is also a good argument for Canada to be another state, or two. ;-)

It is too bad politicians like Graham and McConnell are not held to bear for the true disastrous ramifications of their greed.

————-

When senile Joe weaponized the USD and confiscated a sovereign nation’s assets ( Russia) it started the world’s de- dollarization. Suicide.

https://goldnewsletter.com/go041425/

Selling America...

Whether the rest of the world can do without the U.S.A. is an open question.

However, one thing is certain: They’re trying their best.

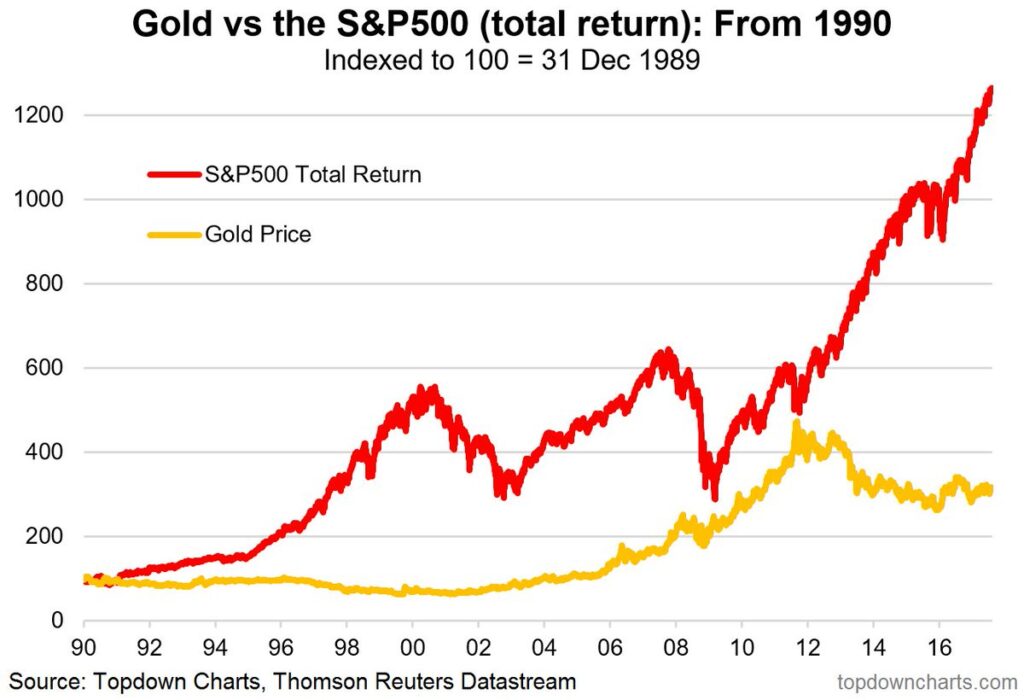

The world is worried. And typically in such an environment, investors across the globe rush to three safe havens: the U.S. dollar, U.S. Treasurys and gold.

*This time is different — because they’re dumping the greenback and Treasurys...and buying gold hand over fist.*

This dynamic isn’t just unusual, it’s unprecedented...and illustrated in the chart below.

In this chart, the Dollar Index is in green, the 10-year Treasury yield is in red and gold, of course, is the gold area in the background. The bottom panel is the 20-day rolling correlation between the dollar and Treasury yields.

In normal times, the dollar and yields are positively correlated, with the correlation line above zero. That brief dip in the correlation in late March merely reflects some back-and-forth, trendless action earlier in the month.

Now note the sharp divergence over the last week when, counter to the Trump administration’s hopes and plans, their harsh tariff policies sent the world running from the U.S....and toward the one remaining safe haven of gold.

The dollar sank, Treasury yields jumped and the gold price soared.

Put simply, the rest of the world is selling America.

Importantly, as the chart also shows clearly, that flight from U.S. safe havens into gold ended the metal’s brief correction and sent the price skyward, wiping out much of its overbought status in the process.

Today, gold was slammed on the U.S. open, as investors flocked back to U.S. equities after President Trump delayed his reciprocal tariffs and exempted electronics exported from China from his most onerous levies.

The steady-state demand from central banks along with investors and institutions around the world is still in place, though, and sparking a rebound from the early-session price lows.

Mining Stocks Take Off

A soaring gold price is nothing new — we’ve seen this kind of action over and over since February of last year.

What’s different this time is that Western investors are now coming to the party...finding the move in gold far advanced...and deciding to play the trend via gold mining stocks.

The result is that, even with gold rocketing higher, the gold stocks have been doing even better. This chart of the GDX gold mining index/gold price ratio shows the dramatic outperformance of the miners.…”

Proving yet again that physical possession of stuff does not make for wealth.

PRODUCTIVITY creates wealth.

NOT STUFF.

We’ve got the extraction technology plus the military subsidies to protect our investment. Not a good strategy unless the host country pays for their protection. Guyana comes to mind as the threat is there but minor if we’re there. With all this stuff around the world why did England fight over the Falklands?

No mention of what’s in Greenland.

Our military can’t do much in countries that are unstable.

That plus the rest of your post is 100% correct. I'd add to that it matters a lot that you don't have leaders who are part of the warmageddon cult suppressing your natural resources so that other countries can control you.

Brazil has rare earth minerals and is number 2 in this category to China. US needs a new supply chain here. Must keep China out of Americas.

This list seems to prove Rush Limbaugh’s point that the wealth of a nation is determined by its adoption of free market principles, not by its natural resources.

Add Canada as a nonvoting territory and the US would be #1—not even adding Greenland!

Proving yet again that physical possession of stuff does not make for wealth.

——————

I guess by your opinion, with the ENTIRE world’s Central Banks buying historic amounts of physical Gold means nothing and the US should sell off all its Gold reserves? Foolish, as 5,000 years has shown.

Note: The Basel III Agreements go into full effect 1 July 2025. Back to “ equal weights and measures “…..

From Google search AI...

The United States has several significant rare earth deposits, with the largest estimated deposit located in Halleck Creek, Wyoming, potentially holding 2.3 billion metric tons of rare earth minerals. Another major find is the Sheep Creek deposit in Montana, which US Critical Materials claims to be the highest-grade rare earth deposit in the U.S. These discoveries, along with other deposits in states like Arizona, Nevada, Colorado, and Idaho, indicate a potential for a larger domestic rare earth supply.

Key Points:

Halleck Creek, Wyoming: Estimated to contain 2.3 billion metric tons of rare earth minerals.

Sheep Creek, Montana: US Critical Materials claims it to be the highest-grade rare earth deposit in the U.S.

Other Potential Locations: Arizona, Nevada, Colorado, and Idaho are also believed to have significant rare earth deposits.

Our military can’t do much in countries that are unstable.

————-

As our Founding Fathers stated, Do not get involved in foreign entanglements ( wars), rings truer every day.

PRODUCTIVITY creates wealth.

————-

Without natural resources, there is no production.

Those which we send money to all these years should begin to either support thems3lves, or pay us back. Pres Trump had it right demanding Ukraine pay back with mineral rights, or a % at least

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.