Posted on 09/04/2024 6:37:28 AM PDT by daniel1212

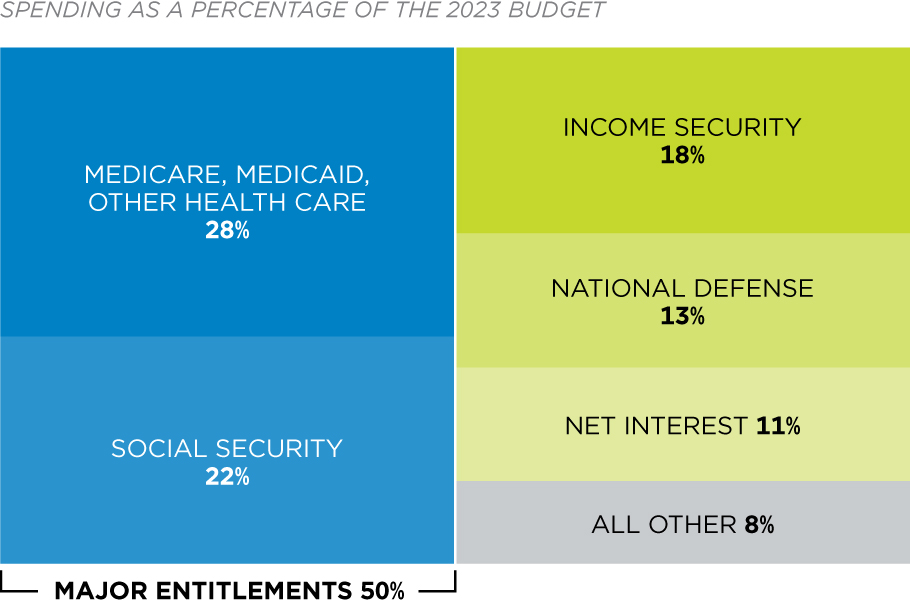

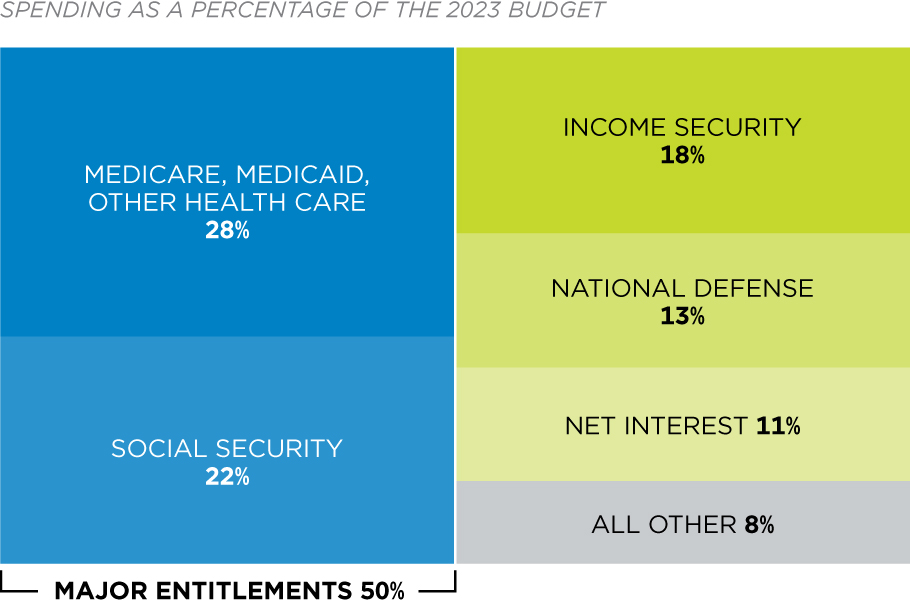

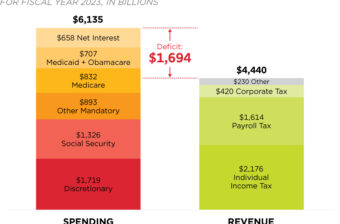

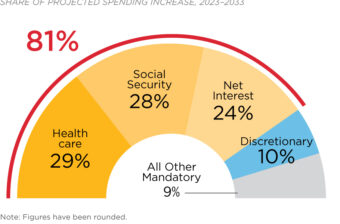

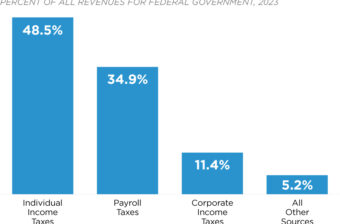

In 2023, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 50 percent of all federal spending.Soon, this spending will be larger

“Art 1 sec 8 has 17 Federal job duties they are allowed to do... Everything else is prohibited.”

That is incorrect.

“ARTICLE IV....Section 3....The Congress shall have power to dispose of and make all needful rules and regulations respecting the territory or other property belonging to the United States...”

If the US government takes $10,000 from you via income taxation, that $10,000 becomes US property. The Congress can toss the $10,000 into a Waste Management truck or give it to a relative of the binman who works the back of the truck.

Entitlement my ass.

Um, all that "entitlement" means in government-speak is a payment that someone is entitled to receive as a matter of law. That's it. So maybe you should untwist your panties and calm down?

Heh-heh. I'm a Boomer myself, albeit on the younger side. I'm just honest enough to recognize that the Boomer generation has ransacked and looted this country and left it to die, metaphorically-speaking.

So, you know, piss off, you angry old man. :-)

That’s what they want you to think. The truth is the money you paid in went to fund the SS benefits of those already retired. You get essentially an IOU that next working generation will pay your benefits. It’s not your money there have been several federal court decisions that say you have no asset rights to the paid in. It’s a tax like any other with a promise to pay you something later. We now have 2.3-2.8 workers paying in for each worker receiving benefits. In 1940 it was 168 to 1.

Mr. & Mrs. Alter might have paid $100,000 in school taxes after their kids have finished school.

In return, the kids in the schools funded by those school taxes might pay $100,000 in FICA/SE taxation that gets passed on to Mr. & Mrs. Alter via Social Security.

I remember distinctly an arguments against a single-payer system as being the long wait times and not being able to get what one needed. And it occurs to me that it is happening now with insurance companies.....Health Insurance companies = privatized single payers.

The large area hospital systems in the USA are in scope very much like the traditional ‘trusts’ of the British NHS.

I see. Yes something has to be done. I think “insurance companies” should be out of the loop. They are an expense (via profit requirement) that could be wrung out of the system. Besides insurance is supposed to be for unforseen catastrophe, not to cover everyday issues. We ALL are going to need healthcare at some point.

Healthcare should be decoupled from employment. It probably would do away with a lot of the age discrimination going on.

Also when you don’t have to worry about paying for the healthcare of someone working remotely from Mumbai, it’s no wonder American workers are at a disadvantage.

It IS correct. Art 1 is the list of things Art 4 would then be making the rules on. Anything not on Art 1 Sec 8 is hands off.

Period.

How much would be freed up if Obamacare was eliminated? Considering that it should have never been started.

“not being able to get what one needed”

This is due to premiums being numerically fixed by contract.

It is possible that an insurer might fund profits and administrative costs on a per claim basis and for care by billing insured amounts that vary by month.

The entry month premiums for a person of a certain age might be $800/month. The profit amount for each claim might be 5% of the Medicare allowable amount and the administrative amount for each claim might be $10 plus $1/Medicare eligible line item plus 8% of the Medicare allowable amount. The care and product amounts paid to providers would be as per contract.

In January and February, the premiums would be $800/month. In March, the premium might be $820. In April, the premium might be $787. In May, the premium might be $813. In June, the premium might be $826.

The ‘insurance’ company would simply act as a claim payer.

The financial risk would be borne by the covered persons.

The Medicare allowable amount might be $22,000. The ‘insurance’ company might have contracted to pay $27,000.

I agree completely. If I were dictator for life:

Sales tax-—everyone chips in.

HMO networks are established. Not-for profit, privately run.

Govt just the sales tax collector. Govt sends the collected funds to HMO based on a per member enrolled. (I think medicare advantage is like this????) HMO takes care of members. Members vote on trustees of HMO.

Other private healthcare providers are free to operate outside of this setup, preserving freedom of choice.

Flame away!

There is more than one way to skin a cat!

Problem is too many people with their hand in the cookie jar for anything to be done

Don’t lump me or other pensioners in with the millions of entitled free loaders who’ve paid nothing in taxes or otherwise. I’ll calm down when you STFU. It’s just a big joke to you it seems.

Touch my Social Security and I’ll shank you!

Well, come on over baby

Whole lot of shankin’ goin’ on

When it comes to SS, I’m Paulie from Goodfellas. “F You! Pay Me!”

“Healthcare should be decoupled from employment. It probably would do away with a lot of the age discrimination going on.”

There’s age discrimination in Britain too.

I can’t say how the rates of age discrimination compare, but I’m pretty sure health insurance is cause for much of the age discrimination in the USA.

How this might be dealt with is by age-based employer contributions for say new parent leave and house down payments.

If the PPACA silver plan amount for a 62-year-old would be $900/month and the PPACA silver plan amount for a 22-year-old would be $300/month, the employer might be required to put $600/160 per hour of work (or $600 per month for a salaried employee) into an employee savings account, which could be used for a house down payment, new child leave, etc. The employer contribution might be phased in over time, starting with say one/fourth, and in the following years, the difference going to one/half, then three/fourths and then the full ($600) difference.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.