Posted on 07/24/2024 9:19:43 PM PDT by SeekAndFind

In 2024, the median salary for the typical American home buyer has risen to $104,339 - up from $88,000 just two years prior.

Despite record-high home prices, housing demand continues to outpace supply, even with mortgage rates at their highest in over a decade. As one bright spot, housing inventory is steadily increasing, with the number of homes for sale up almost 19% in May compared to the previous year. This growth in inventory could help ease the cost of home ownership looking ahead.

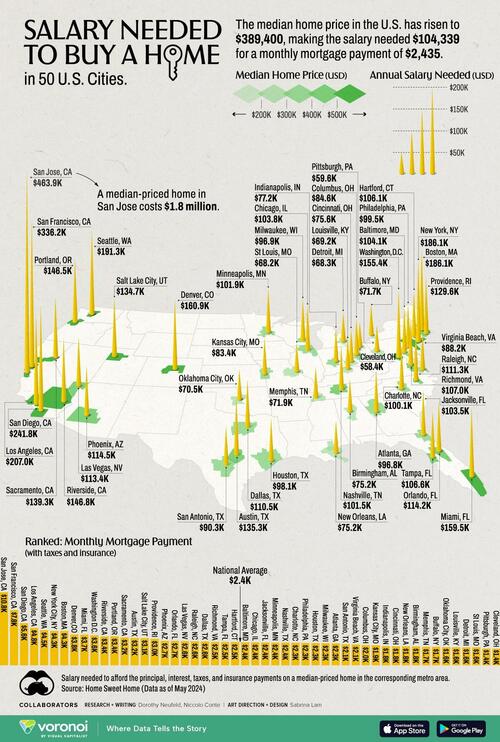

This graphic, via Visual Capitalist's Dorothy Nuefeld, shows the salary needed to buy a home across the 50 largest U.S. metropolitans in 2024, based on data from Home Sweet Home.

Below, we rank U.S. metro areas based on the salary needed to buy a median-priced home.

| 2024 Ranking | Metro Area | State | Median Home Price | Salary Needed |

|---|---|---|---|---|

| 1 | San Jose | California | $1,840,000 | $463,886.5 |

| 2 | San Francisco | California | $1,300,000 | $336,170.4 |

| 3 | San Diego | California | $981,000 | $241,783.5 |

| 4 | Los Angeles | California | $823,000 | $207,030.2 |

| 5 | Seattle | Washington | $755,300 | $191,332.4 |

| 6 | New York City | New York | $659,200 | $186,122.8 |

| 7 | Boston | Massachusetts | $704,700 | $186,058.7 |

| 8 | Denver | Colorado | $651,000 | $160,874.3 |

| 9 | Miami | Florida | $625,000 | $159,528.2 |

| 10 | Washington, D.C. | N/A | $600,200 | $155,370.4 |

| 11 | Riverside/ San Bernardino | California | $579,900 | $146,791.9 |

| 12 | Portland | Oregon | $574,000 | $146,483.4 |

| 13 | Sacramento | California | $533,900 | $139,283.1 |

| 14 | Austin | Texas | $466,700 | $135,333.1 |

| 15 | Salt Lake City | Utah | $551,200 | $134,691.8 |

| 16 | Providence | Rhode Island | $470,700 | $129,565.5 |

| 17 | Phoenix | Arizona | $470,500 | $114,499.6 |

| 18 | Orlando | Florida | $435,000 | $114,215.9 |

| 19 | Las Vegas | Nevada | $465,400 | $113,354.8 |

| 20 | Raleigh | North Carolina | $439,800 | $111,347.6 |

| 21 | Dallas | Texas | $377,700 | $110,463.0 |

| 22 | Richmond | Virginia | $425,000 | $106,952.9 |

| 23 | Tampa | Florida | $405,200 | $106,614.1 |

| 24 | Hartford | Connecticut | $350,400 | $106,127.9 |

| 25 | Baltimore | Maryland | $385,000 | $104,132.8 |

| 26 | Chicago | Illinois | $349,300 | $103,794.0 |

| 27 | Jacksonville | Florida | $390,000 | $103,487.6 |

| 28 | Minneapolis | Minnesota | $373,500 | $101,868.4 |

| 29 | Nashville | Tennessee | $404,300 | $101,535.4 |

| 30 | Charlotte | North Carolina | $398,300 | $100,140.4 |

| 31 | Philadelphia | Pennsylvania | $342,500 | $99,535.4 |

| 32 | Houston | Texas | $334,100 | $98,135.3 |

| 33 | Milwaukee | Wisconsin | $354,000 | $96,942.7 |

| 34 | Atlanta | Georgia | $369,200 | $96,825.1 |

| 35 | San Antonio | Texas | $305,800 | $90,259.9 |

| 36 | Virginia Beach | Virginia | $336,500 | $88,208.3 |

| 37 | Columbus | Ohio | $306,600 | $84,598.5 |

| 38 | Kansas City | Missouri | $308,600 | $83,386.1 |

| 39 | Indianapolis | Indiana | $300,100 | $77,181.6 |

| 40 | Cincinnati | Ohio | $280,600 | $75,634.6 |

| 41 | New Orleans | Louisiana | $277,700 | $75,218.3 |

| 42 | Birmingham | Alabama | $295,000 | $75,193.9 |

| 43 | Memphis | Tennessee | $272,400 | $71,943.2 |

| 44 | Buffalo | New York | $229,700 | $71,669.2 |

| 45 | Oklahoma City | Oklahoma | $251,000 | $70,455.8 |

| 46 | Louisville | Kentucky | $262,000 | $69,169.8 |

| 47 | Detroit | Michigan | $240,000 | $68,334.7 |

| 48 | St Louis | Missouri | $241,100 | $68,240.0 |

| 49 | Pittsburgh | Pennsylvania | $207,100 | $59,604.2 |

| 50 | Cleveland | Ohio | $191,900 | $58,402.6 |

| National | $389,400 | $104,339.0 |

Note: These calculations determine the salary needed to afford the principal, interest, taxes, and insurance payments on a median-priced home in the corresponding metro area as of May 2024. Figures reflect homes with a 30-year fixed-rate mortgage and a 20% down payment.

As the most expensive city overall, residents in San Jose require a salary of $463,887 for a median-priced home in 2024—more than quadruple the national average.

Since 2023, this required salary has skyrocketed almost $100,000, soaring to a monthly payment of $10,824 to own a home. One reason why San Jose prices are sky-high: it sits at the heart of Silicon Valley. On average, homes on the market sell in roughly nine days.

Like San Jose, the San Francisco metro area is highly unaffordable. In May, median home prices stood at $1.3 million. The metro area houses more billionaires than anywhere in the world, in addition to having among the most individuals with $100 million in investable wealth globally.

New York City residents need an annual salary of $186,123, making it the sixth-highest in the country. While the annual growth in home prices fell into negative territory, the required salary to own a home jumped over $25,000 since last year. Overall, just 30% of New Yorkers own homes, compared to the 66% national average.

On the other hand, Cleveland, Pittsburgh, and St. Louis are the most affordable metro areas in the dataset, where a salary under $70,000 can buy a median-priced home.

Sure, let millions of illegals/asylum seekers in. What could go wrong? Remember back 5 short yrs ago…and vote accordingly.

bookmark.

Tell that to the millions of illegals now registered to vote somehow.

Seems that the 10s of millions of illegals will also add to the increasing home prices. Imagine that.

That’s Xidenflation for you.

And I don't care, I want and expect President Trump to deport all illegal aliens. That's likely 30-60 million.

Newark - New Jersey - $34.50 - $213.47

No mention of Boise on the list, but it would be pretty high. There’s a house down the street from me on the market for $590k. It hasn’t sold yet because it’s overpriced. It will probably sell for closer to $500k eventually, but that’s still a lot of money, especially with interest rates where they are.

In the days before we massively increased government and taxes, a household could enjoy a stay at home mom, one working husband AND afford a home.

My younger daughter and her husband are currently looking for a house in the Chicago suburbs. They make enough, between the two of them, to buy in the price range for that area, but with Biden’s “wonderful” economy, it’s a little scary. Still, better than plowing the money into rent every month. At least they’ll start building some equity.

Government buys houses and gives them to ‘migrants rent free via section 8 housing initiatives. This reduces the supply for “normal” buyers ( non leaches )

The latter is why housing prices are never going to come back down significantly. Wages are not keeping up with Bidenflation, so everything tangible is becoming less affordable and will continue to do so.

Not just illegals jacking up the price but TX is and has had a huge invasion of Kalifornians along with their woke ideas. Add the companies moving into Austin bringing more and more and more people in causing a housing shortage. The urban sprawl and new construction increased greatly during the lockdowns. Now Musk is going to bring in more leftists, grrr.

The article’s numbers are too low, imo. Crappy little 1950-60s 1600 sq ft homes are selling for $1.5 million no thanks to the CA invasion. Ooooh, but TX doesn’t have a state income tax, snicker. 8.25% sales tax missed the top 10 by a whisper. Property tax increases 10% each year. Our property tax used to be 2 weeks of income but is now 5+ months. Then there’s the couple hour morning commute to work which only going to increase.

Since there is a housing shortage, clearing out the illegals will even things out.

You’d have a rabid bidding war for that in Austin, TX. The chart numbers are far too low.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.