Posted on 12/16/2022 9:02:58 PM PST by SeekAndFind

How much money do you need to be considered rich? According to Schwab’s 2022 Modern Wealth Survey (opens in new tab), Americans believe it takes an average net worth of $2.2 million to qualify a person as being wealthy. (Net worth is the sum of your assets minus your liabilities.)

To get a clearer picture of where you rank, check out this wealth report card (opens in new tab):

For more perspective, according to the most recent Federal Reserve Board Survey of Consumer Finances (opens in new tab), which is released every three years, the median net worth of all families (meaning half made more and half made less) in 2019 was $121,700, and the mean, or average, net worth was $748,800.

Here’s the average net worth by age in 2019, according to the same survey:

Younger than 35: $76,300

35-44: $436,200

45-54: $833,200

55-64: $1,175,900

65-74: $1,217,700

75 or older: $977,600

Nerd Wallet’s net worth calculator (opens in new tab) can help you determine your net worth.

The term “the American dream” is so imbedded into the American psyche that the Merriam-Webster dictionary (opens in new tab) deems it to be a “noun phrase.” The definition is: “A happy way of living that is thought of by many Americans as something that can be achieved by anyone in the U.S. especially by working hard and becoming successful.”

Haven’t you fantasized about what it would feel like to never have to look at a price tag on that cool electronic gadget, or the prices on a menu, or never having to worry about paying the medical bills…or any bills, or to just pick out that dream car and not think twice about the cost? I have. And I bet many of you have, too. I have even dreamed of winning the $2 billion lottery and how I’d share it with my friends and family (as long as they didn’t bug me about it!).

What does that fantasy really give you? For me, it gives me freedom — financial freedom. My definition of rich, like many of you, is not to have to worry about paying the next surprise bill, or actually being able to reasonably spend guilt-free. I’d also love to share that freedom with others. I’m not talking Jeff Bezos wealthy (opens in new tab) — I’m talking “not-having-to-worry wealthy.”

Many view wealthy people as being evil and exploitive, or Scrooge types. The site dnyuz.com (opens in new tab) posed a question on Instagram: “Do you think you can be rich and be a good person?” The answers were split: 44% of respondents said “yes”, while 32% said “no.” We all know that you can be a jerk regardless of your net worth. It’s just strange that people are incredulous, or perhaps jealous, of something they themselves may covet.

Here’s an interesting thing about rich people: The richest 1% of people in the world create more than double the carbon emissions of the poorest. This makes sense, because they are flying around in private jets, and the poor, in many cases, don’t even have electricity. Oxfam International found that 1% of the richest people in the world accelerated climate change far more than any others, and the poor are hit the hardest by this.

Unfortunately, the American dream is not available for everyone. Housing equity (opens in new tab) makes up about two-thirds of all wealth. The National Community Reinvestment Coalition (opens in new tab) reports that “… housing discrimination and segregation still persist, causing long-term societal effects in America. Segregation and discrimination in housing harm people’s health, their ability to accumulate wealth and the environment.”

In a 2019 survey from the Board of Governors of the Federal Reserve System (opens in new tab), it was clearly shown that people of color are not achieving the American Dream like their white counterparts are. White families’ median wealth was $188,200, while Black families’ was less than 15% of that of whites’ at $24,100. Hispanic families’ median wealth was $36,100. Growth rates for wealth among these underserved families is rising, but these figures remain disturbing.

Data used from the Survey of Consumer Finances and others, as stated by the U.S. Department of the Treasury (opens in new tab), reported that racial gaps in economic security have hindered people of color from building wealth. As recently as 2016, they reported “… that nearly 20% of Black families had zero or negative net worth compared to 9% of whites’ …” Also, when Black people were pursuing the American Dream by going to college, their student loan debt was 30% higher than that of whites.

Gen Zers (opens in new tab) are leading the way when it comes to being guided by their values and having those reflect their life decisions.

The next generation is redefining the American dream, but some of the basics we still hold. According to a survey conducted by Echelon Insights in 2020, (opens in new tab) 81% of this next generation does believe that hard work will allow them to achieve success, as they define it. They want freedom to choose what to be, financial well-being, family, a good job and housing. They also really value work-life balance.

What makes this generation very different from Boomers is that they were willing to leave a job to find the freedom and the job quality they wanted. But the tide may be changing. As the pandemic began to ease, the economy started booming and employers were begging people to work.

The result of the economy coming roaring back was inflation. Inflation means that the Fed had to put the brakes on growth by raising interest rates. The higher rates have greatly affected lots of sectors, and now we are beginning to see layoffs. For example, notable tech companies such as Amazon, Meta and Twitter are cutting thousands of jobs.

The verdict is not in as to how the newfound values surrounding freedom in the workplace vs. putting food on the table will play out. I’m thinking that food will win over freedom, but I could be wrong.

The Schwab survey also found that “more than eight in 10 Americans (82%) agree that their personal values play an important role in how they manage their finances.” Yes, price and products are important, but “almost eight in 10 Americans (79%) say they try to use their purchasing power to support brands that are aligned with their beliefs.” Seventy-three percent agree that their values also guide their investment choices.

I’m a little cynical when it comes to surveys. Who really wants to admit that their life goal is to be rich? It seems pretty vacuous. Of course people are going to say that they care about making the planet a healthier place for all living things. It sounds good. But will they really walk the walk when it comes to investing their money?

The Harvard Law School Forum on Corporate Governance (opens in new tab) estimates total ESG funds under management in 2021 to be $330 billion. It's hard to measure an ESG (environmental, social and governance), or sustainable investment, portfolio against what we would call a “regular” U.S. stock portfolio, because it depends upon the mix of investments and who is doing the selection. One report (opens in new tab) found that a U.S. stock ESG portfolio had a 7.19% compound annual return in the last 15 years, while a U.S. stock portfolio had an 8.41% return over the same time period. But the point is that people appear to be walking the walk to invest in their values.

Is more really better? I raised my kids to believe as I do, that rich means that you will never worry about being hungry or having a safe place to live, and you will also have enough to give to charity. It seems like after saying this, you should be clasping hands and singing Kumbaya. But this definition may relieve many people from looking over their shoulder to figure out what “the Joneses” are doing and always feeling like a failure. Wealth, however, is in the eye of the beholder. It is also a generational thing.

It's hard to avoid waxing philosophical when talking about being rich. My mother told me, “If you look up, you will always find people who have more, and when you look down, you will always find people with less. So, be thankful for what you have and see how you can help those who are not so lucky.”

I guess the best piece of advice came from David Rockefeller, CEO at Chase Bank when I was a budding executive there. I was fortunate to work with him on occasion. One day, we were talking about wealth. I asked him how it felt to be one of the richest men in the world. He basically told me that it’s not about the money, it’s about the legacy you leave behind. Then he quipped, “Let’s face it, you will never see a hearse with a luggage rack.”

Rich is what you make it, money is only part of the equation.

Stunning how low the median is. Just think how many are negative net worth below the median.

The writer is also a true believer in Anthropogenic Climate Change and ESG investing.

I’m quit content with what I have - and all debt free.

I’ve learned to live smaller and love it!

Frees the mind to enjoy life.

Inflation happened because the economy came roaring back. Who knew?

Money is simply needed to sustain life....so I’d have to say I have more than I really need but it’s nice to have a cushion set aside....some would consider that a need.

Well, I made the top 5% but it is an illusion. It’s all in retirement accounts which get taxed at my income level which will be high due to pensions. I should have been maxxing Roth accounts.

My mother went through $500k in 22 years. That was a lot of money in 1991

Bingo.

Dave Ramsey lifestyle rocks.

Wells Fargo apparently moved us to a “safer” position prior to the economy tanking. It cost me in fees but we suffered less that we would have. I had no idea of my net worth but they apparently did and assigned us a banker.

It’s amazing how clueless I was because I work all the time.

I am comfortable. I have what I need and I don’t want much more.

And I don’t get worked up about others having more.

God has blessed me by allowing me to survive some major ordeals.

Am I rich? In my own way, yes!

Five years after graduation, geography majors from the University of North Carolina, class of 1984, averaged five million dollars per year income. There were 12 of them. One of them was Michael Jordan.

I feel wealthy even though my net worth is well below one million dollars.

How can that be?

Low expenses.

The writer is a liar, not an idiot. The difference is important.

Blaming inflation on a tight labor market is the official part lie used to get the people looking in the wrong direction. It's about blaming the victims.

Inflation is directly caused by the government with assistance from the central bankers.

People who always want more will never have enough.

Killing over a million Americans with SAFE AND EFFECTIVE drugs is causing problems

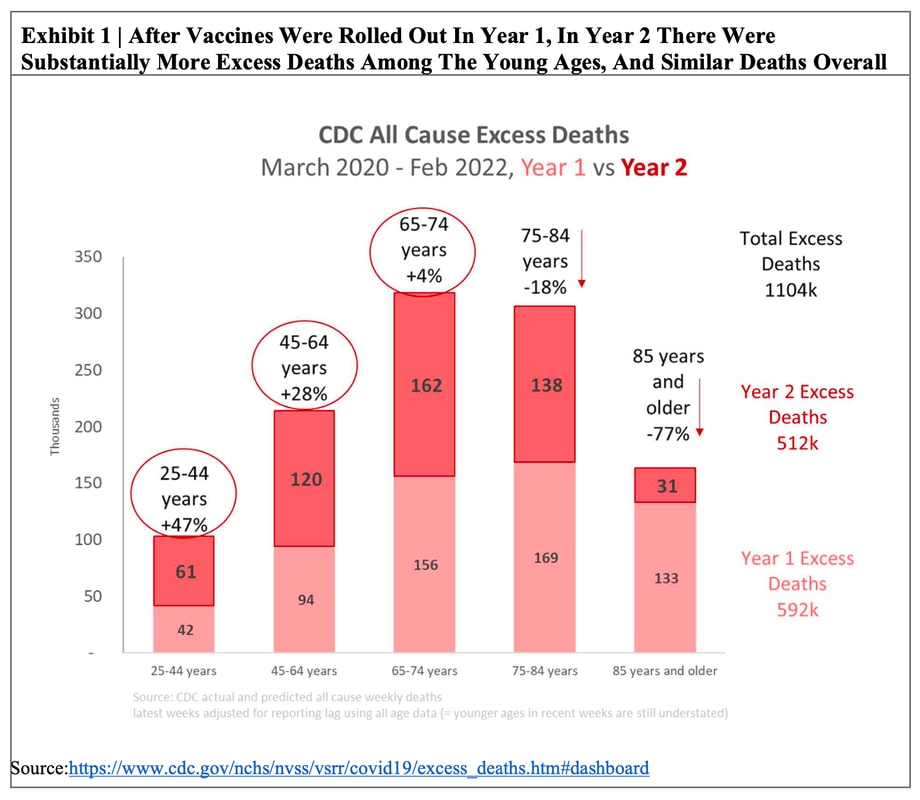

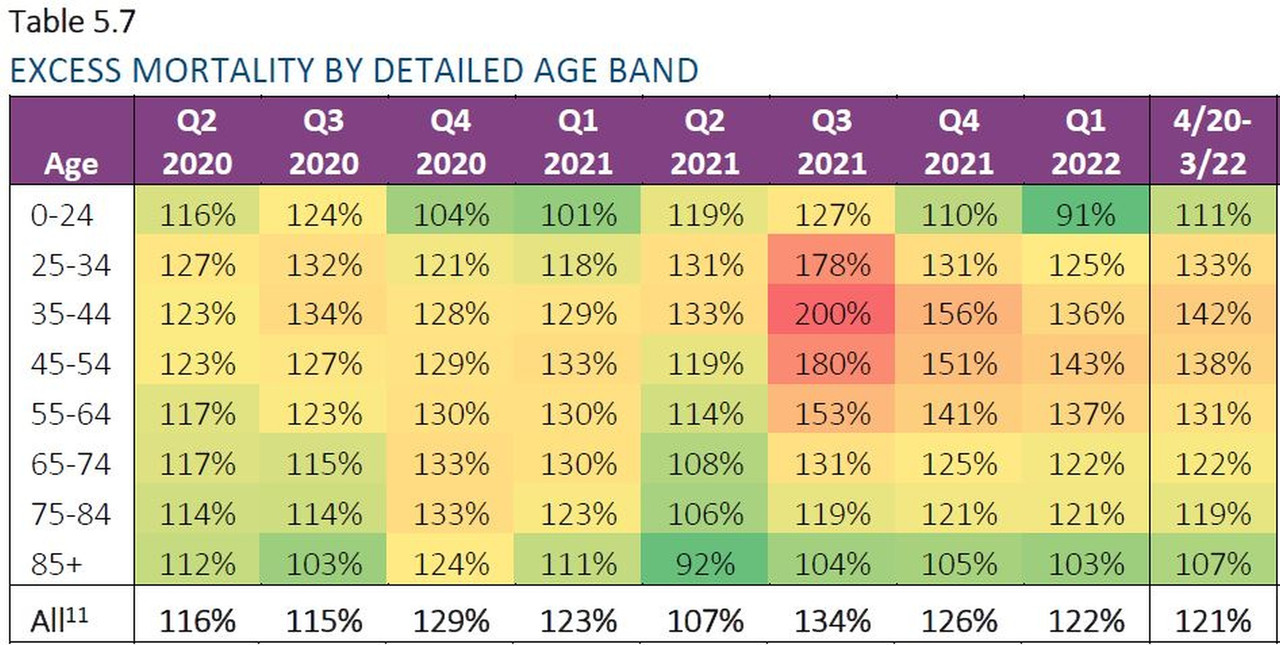

Don't believe that the vaxxxxxxines are the primary cause of the HUGE number of deaths?

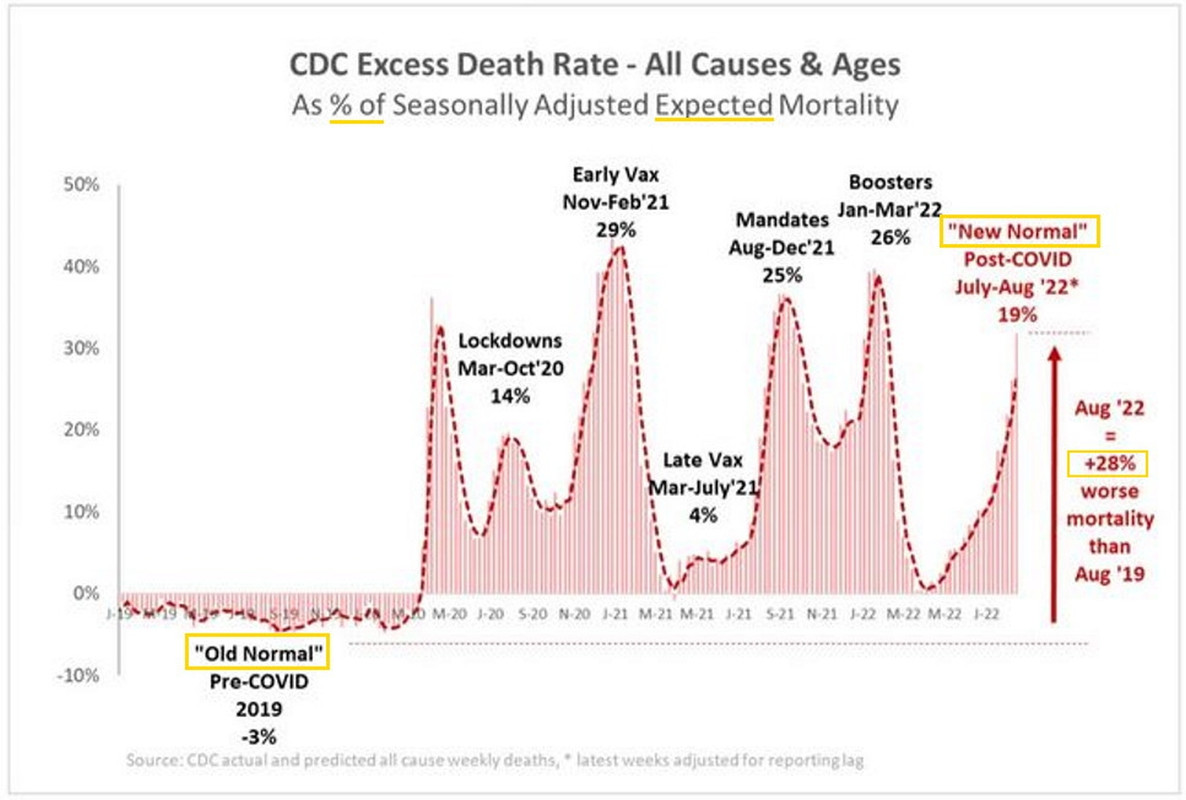

Notice the biggest peak in EXCESS DEATHS occurred when the RESIDENT ordered the mandates. Then notice that EXCESS DEATHS were relatively low and well behaved in 2019 but took off when the US government got involved with killing people.

In 2019, there were NEGATIVE EXCESS DEATHS meaning that less people were dying than expected. That would be expected when life expectancy was increasing as it had been for over one hundred years. Now that the government is killing with the vaxxxxxxines, live expectancy has decreased THREE YEARS since the vaxxxxxxxines have been pushed on an ignorant public. Life Expectancy will decrease to 52 years old by 2025 at the present rate. But don't worry too much, Biden is flooding the US will illegals that are NOT vaxxxxxxed!

Go get your boosters and flu shots ASAP if you want to avoid the rush to the graveyard. The more shots you have, the sooner you will die.

Age of head of family: Median / Average net worth

Less than 35: $13,900 / $76,300

35-44: $91,300 / $436,200

45-54: $168,600 / $833,200

55-64: $212,500 / $1,175,900

65-74: $266,400 / $1,217,700

75+: $254,800 / $977,600

Is this individual wealth or household wealth? Do you multiply these numbers by two for a husband and wife?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.