Posted on 12/11/2022 4:44:12 AM PST by EBH

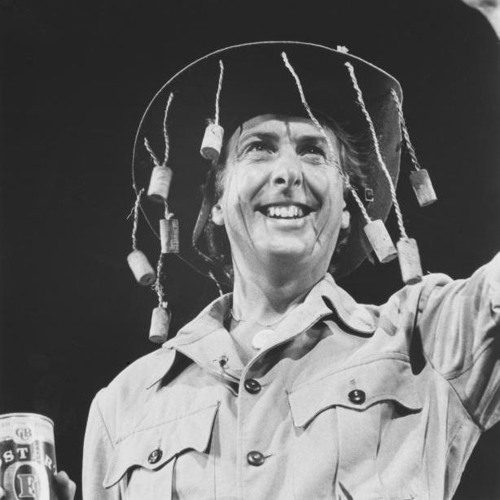

G’day Bruce!

Aaaannnd....it’s gone.

In the U.S., if the bank gives away your money without your authorization, the bank is liable for the full amount.

Maybe the bank thought the Nigerian Princess was legitimate.

What incompetent nitwit at a bank processes that kind of transaction without thorough documentation?!

Out of curiosity, I just looked it up. Ubank is evidently a virtual bank. There are no actual brick-and-mortar locations. All transactions are done over the internet or by phone.

I guess I’m old-fashioned, but I’d never consider banking that way. I want to be able to talk face-to-face with a bank officer if I need to.

But on the plus side Ubank‘s deposits are guaranteed by the Australian government. So there’s that.

Wonder what amount the Aussie government insures individual accounts. US FDIC insurance is $250,000 per depositor, per insured bank.

If I lost $600,000 to a “glitch” I sure wouldn’t be calling customer service. I’d be standing in the President’s office demanding an answer.

Most decent on-line banks:

—Have maximum withdrawals per transaction, per day, per week etc—all well below 500K.

—Use a second method of authentication before processing any transactions (call you, message you, email you)

EBH :" Not scammed. Bank really lost their money!"

Imagine how this scam occurred ...

Now imagine how a national digital currency exists without any safety precautions

Thievery can exist through 'hackers' or rogues in government agencies.

I must be old-fashioned, too. I read that virtual banks offer higher interest rates for savings accounts, but I wouldn’t risk opening an account with them. I want to speak with a banker in person. We all know how phone lines for other businesses work these days: If the business doesn’t force you to “chat” online, its toll-free number forces you to talk with a machine or sit on hold for an hour, only to speak with someone who gives you misinformation or disconnects you.

IIRC similar happened recently to a crypto account also in Australia because an account number was entered MANUALLY incorrectly.

In this day and age you’d think manual data entry would be a thing of the past.....especially when it comes to money accounts.

They should have contacted him BEFORE emptying and closing the account to verify this transaction.

That’s a horrible experience. Then being ignored by the bank, would be enough to turn some people to extreme violence seeking revenge.

What kind of bank, when referring to that much money would send an email:

“Just wanted you to know...”? That sounds very unprofessional and shady.

I won’t ever have his level of savings, but the “crumbs” I do have, I wouldn’t trust any virtual bank to hold them.

Never with my life’s savings.

That would be nice but most banks have gone virtual. Our bank started closing up brick and mortar branches and put up ATM about a half hour away from us. They wanted to transfer all our accounts to a different bank that opened a brick and mortar in the other direction 40 min. away but we resisted because we had been at our bank for over 24 years. If we transferred we would have lost all our account “advantages” we had earned over the years and had to revamp ALL of our financial accounts like utilities, insurances, etc. It is a great thing we didn’t go for the transfer because that “other” bank closed down their office near us 2 years later with no ATMs anywhere to be seen. But the one disadvantage is we have to still do all our banking virtually. Hopefully, what happened to this poor dude in Australia won’t happen to us.

Nope. Last time I had to do a wire, it was entirely up to me to verify that the destination numbers provided (by the receiving bank) were correct. The official at my bank hand entered those numbers, twice, but it was again up to me to verify that that was the destination account.

If the target bank had erred (and I didn’t catch it) or my bank person had typoed (and I didn’t catch it) $X would be gone in the wind with no way to get it back.

This is of course monumentally stupid and protects nobody except the banks — so it remains. A system developed with any integrity would establish and confirm the link before doing any action, and would thereby allow for reversals in the case of error.

This is like dialing some phone number scribbled on a notepad and, before even asking who’s on the other side, rattling off your name, DOB, and SSN. What could go wrong?

Unless the “bank” can prove he authorized the withdrawal I expect he’ll get his money back. BTW Bruce, never put all your eggs in one basket.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.