Posted on 08/15/2022 8:58:36 PM PDT by SeekAndFind

Ahead of this quarter’s 13F filing from Warren Buffett’s Berkshire Hathaway, we already knew it was going to be far less exciting than the last one we got. As the company recently reported, Berskhire racked up $3.8 billion in net stock purchases in the second quarter, far short of the $41 billion it bought up in the first quarter of this year (it also spent far less on stock buybacks during Q2).

Additionally, some of the positions that aren't being disclosed today include the company’s stake in Occidental Petroleum, even though we already are aware of these thanks to recent filings. Still, as Bloomberg notes, investors are always keen to see what the Oracle of Omaha is thinking, and this will provide a little more insight into the situation.

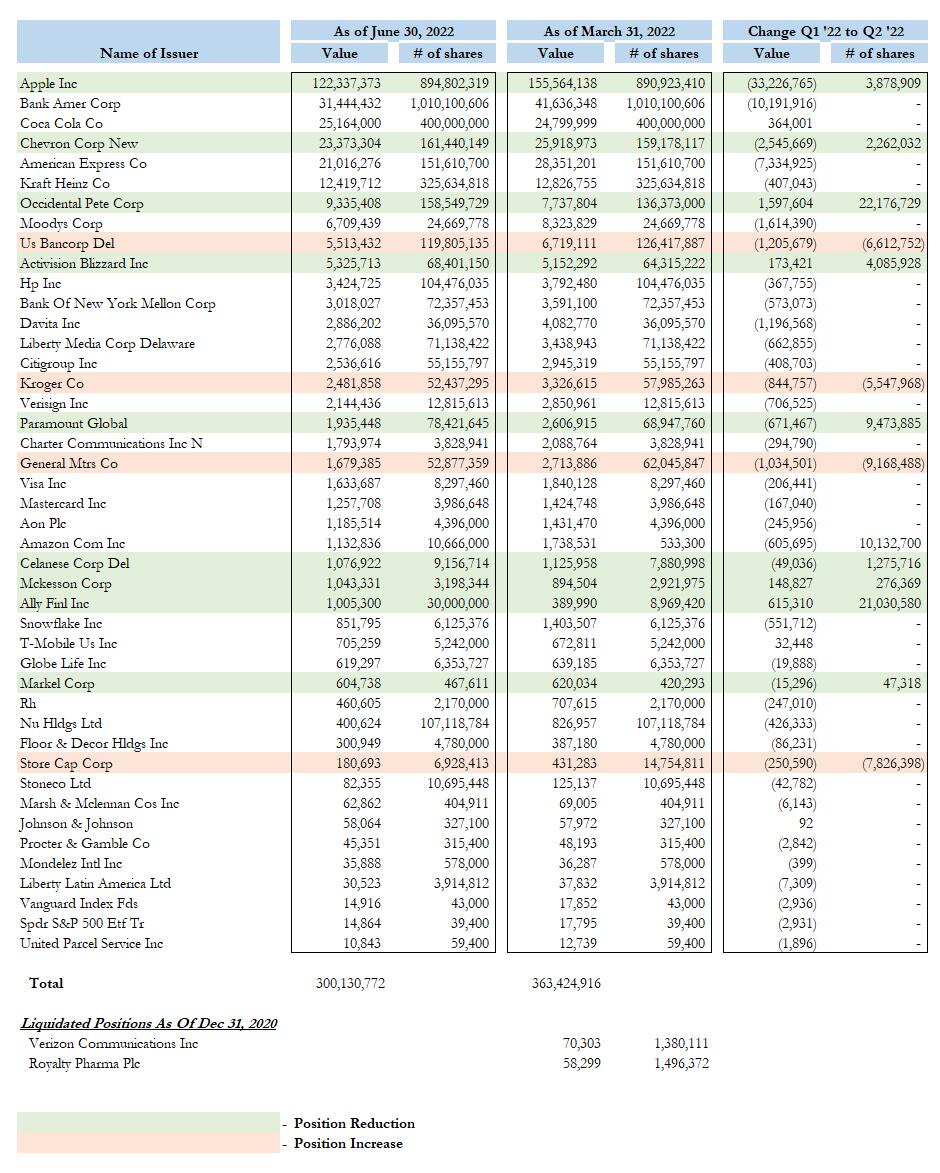

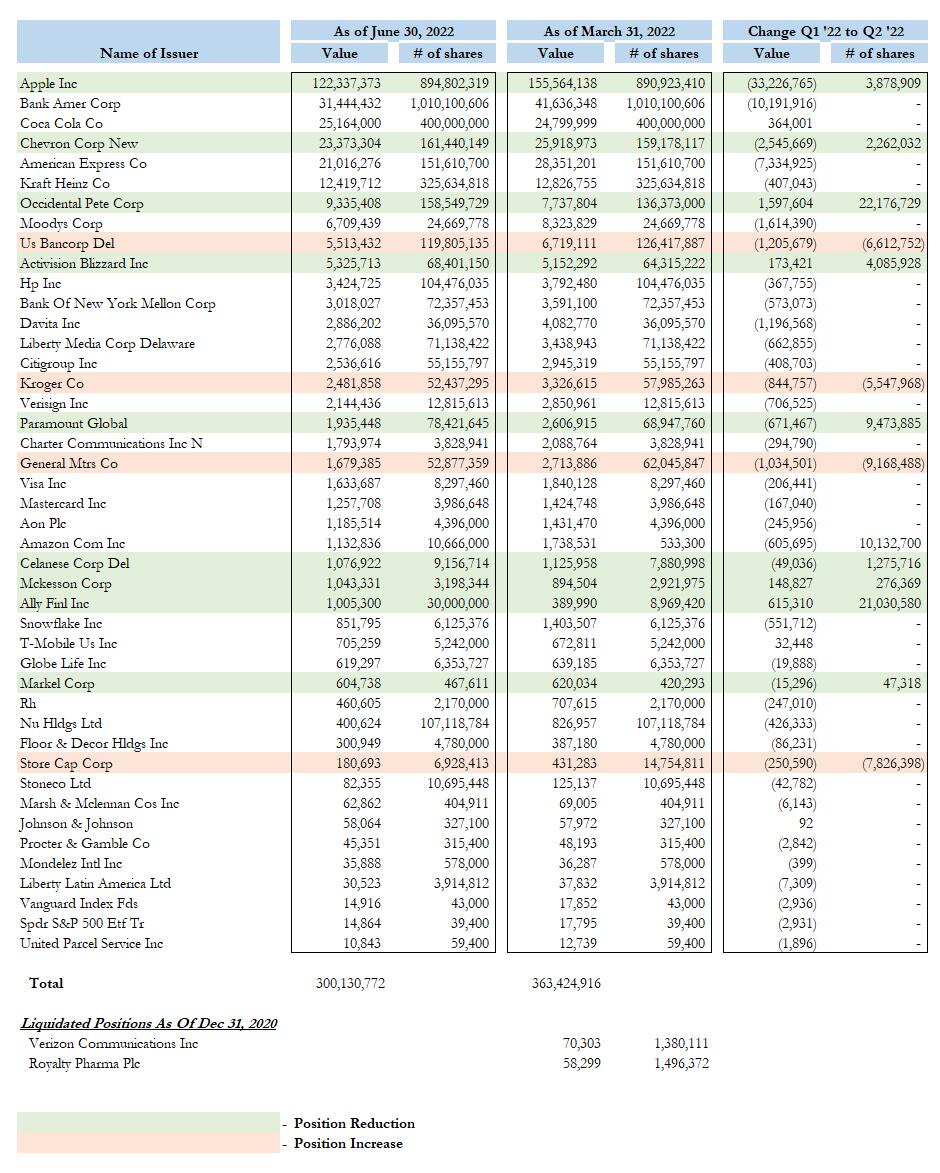

With that in mind, here is what Berkshire did in Q2 (we warned you, it would be a dud):

Apple remains Berkshire's largest holding, representing 41% of total disclosed assets. And speaking of total assets, the fund disclosed just over $300BN in long, US positions as of June 30, a notable decline from the $363BN as of March 31.

Overall, a very boring quarter for the world's biggest non-central bank portfolio.

Full details of all Berkshire Q2 moves can be found in the table below.

shoulda bought pork bellys

Had to read the headline three times. First two times, I read it as “The Oracle of Obama.”

He was reported to have lost $43.8 billion this year!

https://news.yahoo.com/berkshire-hathaway-posts-huge-quarterly-123149331.html

So much for the Oracle of Omaha!

He was reported to have lost $43.8 billion this year!

____________________________

That’s just in the cushions of his recliner!

Bookmark

Later

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.