Posted on 06/28/2022 9:24:04 PM PDT by SeekAndFind

On Saturday, June 18 the price of bitcoin fell to around $17,700… its lowest price since 2020, and a 74% drop from its all-time high last November.

Now, it doesn’t take much for bitcoin and crypto critics to declare the end of crypto… so when bitcoin fell below $18,000 for the first time in years, you can imagine what happened.

It was once again the death of bitcoin as we know it… and the fifteenth declaration of bitcoin’s demise in 2022, according to Bitcoin Obituaries.

But regular Daily readers know that these headlines aren’t anything new… we see them all year long, regardless of where crypto prices move.

And the articles rarely touch on anything more than price action, clueless quotes from people like Elon Musk or Warren Buffett, or the author’s personal feelings about crypto.

So today, I want to make a case for crypto’s longevity… and give you evidence-based reasons why we’re bullish about crypto’s future.

Bullish Indicator No. 1: Growing Usage

Regarding this metric, it’s important to take a step back and look at crypto over the long term…

When you do, you get an idea of how much the market has grown over the last three to four years.

For example, there are over 300 million crypto users today… That’s a 10x increase from the roughly 30 million users at the end of 2018.

This user base is also spread out across the globe… Half of those users are in Asia, and there are users in every country.

But it’s not just more users… there’s more usage as well.

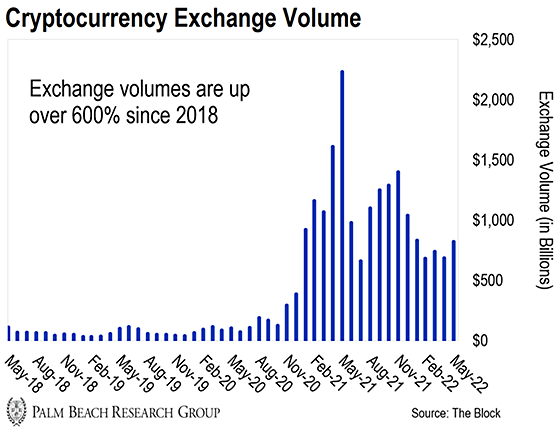

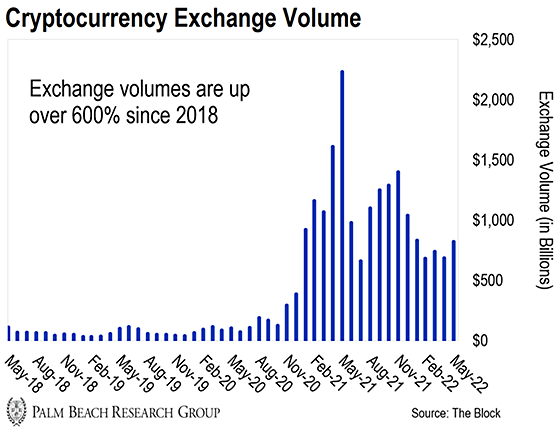

As you can see from the chart below, crypto usage – as measured by long-term crypto trading volumes – continues to grow.

Sure, volumes are not at all-time highs right now… But that’s missing the bigger picture.

Overall, exchange volumes are up 647% compared to this time in 2018. That’s healthy growth and usage.

Another useful way to look at usage is to focus on bitcoin’s “on-chain” volume… or how much BTC moves to exchanges from things like crypto wallets.

This gives us a true read of activity on the bitcoin network.

And as you can see in the chart below, bitcoin’s on-chain volume has increased nearly 800% since 2018…

That’s impressive growth in usage… and you’d be hard-pressed to find comparable numbers from nearly any other asset on the market.

Bottom line: Adoption and usage are the most important metrics for determining whether crypto is dying or thriving… These numbers prove that its future is bright.

Bullish Indicator No. 2: Venture Capital

The second reason to remain bullish is venture capital (VC) funding.

Institutions provide VC funding to crypto entrepreneurs and startups to help them expand a product or business.

These early-stage projects can’t go public and seek funding from retail investors… And VCs are adept at profiting from investments in high-risk sectors.

VC funding also shows investor confidence and adds legitimacy to a project.

In 2021, venture capitalists invested over $33 billion into crypto and blockchain startups… an industry record, and 4x the funding in 2018.

Keep in mind, the Q2 number is the amount known to date, not the total for the quarter yet… but VC funding remains strong in 2022, despite extreme volatility.

And those numbers don’t include recent news… like the creation of a $4.5 billion crypto fund from VC firm Andreessen Horowitz.

Andreessen Horowitz likens the long-term opportunity in crypto to “the next major computing cycle,” after PCs, the internet, and mobile computing…

We believe crypto represents the next era of computing, and the top VCs realize that now is the time to take advantage of this shift.

Bullish Indicator No. 3: Web 3.0

The third reason to remain bullish is Web 3.0.

Web 2.0 is the version of the internet we know today… and while Web 2.0 enables lightning-fast interaction and engagement on a global scale, it isn’t without problems.

First, there are internet gatekeepers like Amazon, Facebook, and Google… These companies not only have control over what we see online, they’re constantly tracking and storing our personal info.

The current internet model also largely relies on centralized servers and protocols. That creates centralized points of failure that malicious actors can target.

But Web 3.0 is designed to solve these problems…

It enables decentralization and user control of personal data via a multi-chain network… so multiple blockchains work together with no primary gatekeeper or point of control.

And although some in the media are quick to write it off as a fad, interest continues to surge, according to Google…

Google measures search interest on a scale of 1–100 relative to its peak popularity. A value of 100 is when the term was most popular. A value of 50 means that the term is half as popular as it was at its peak.

Over the last seven months, search interest in “Web 3.0” has been consistently high. Take a look…

There’s also an increase in Web 3.0 funding and usage when you measure the growth of Decentralized Finance, or “DeFi.”

DeFi is a broad category of financial applications developed on open, decentralized networks… and it has the potential to be even bigger than the traditional finance sector.

Back in November 2018, DeFi was just a small idea. There was only about $45 million invested across DeFi applications… Today, it’s about $135 billion. That’s a massive 3,000% increase.

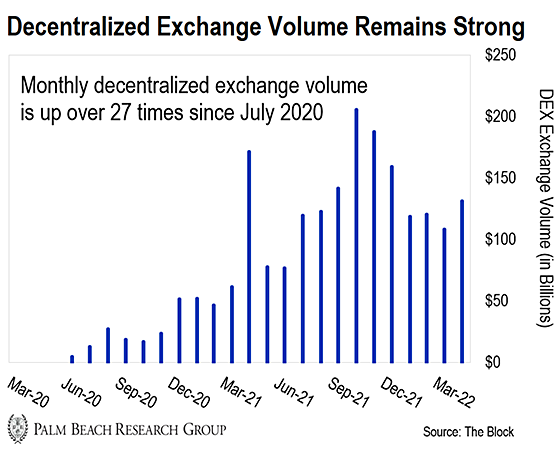

And usage of decentralized exchanges remains strong too…

As you can see in the chart above, monthly decentralized exchange volume is up 2,651% since July 2020.

This shows that Web 3.0 is more than just a marketing line… It’s a massively growing industry.

Bullish Indicator No. 4: The Merge

The fourth reason to remain bullish on the cryptocurrency market is “The Merge”… that’s the name for the next evolution of Ethereum.

I don’t want to get into the weeds, but here’s a brief explanation…

We’re about to see a major reduction in ETH’s incoming supply, thanks to the Merge.

This is when Ethereum transitions from a Proof-of-Work (PoW) protocol to a Proof-of-Stake (PoS) protocol.

In the PoW model, crypto miners solve complex math problems to validate transactions and earn a reward… think bitcoin mining.

With PoS, miners validate transactions by staking tokens on the network, and the network determines who receives the award.

Since PoS networks don’t rely on warehouses full of mining equipment, they’re less expensive to run… and networks can issue far fewer tokens as rewards.

This creates scarcity by reducing the incoming supply of tokens… and scarcity increases the token’s value.

Ethereum is in the process of switching to PoS right now… And when it’s complete, we’ll see as much as a 90% reduction in the amount of new ETH coming to market.

So after the Merge, there will be fewer tokens in circulation – making each more valuable.

Plus, our research suggests vast amounts of money on the sidelines waiting for Ethereum to complete its Merge…

Institutional money managers are getting a lot of heat from folks demonizing proof-of-work because of its energy-intensive nature.

A move to proof-of-stake kills that argument and clears the way for further investment.

The other consideration is that institutional money managers don’t like risk. It’s far safer for them to wait until Ethereum’s move to PoS is complete…

And the good news is that they won’t have to wait much longer.

Ethereum completed its first successful test merger in early June, and there will be two more test mergers very soon.

Ethereum developers say the Merge could happen as soon as August if these additional tests are successful.

The Long Term Is Still Bright for Crypto

The crypto markets are just brutal right now… And we could be in tough times for the foreseeable future as markets cope with hawkish monetary policy and myriad other issues.

But we’re long-term investors, investing in an innovative technology growing closer to mass adoption.

Early investors of tech stalwarts such as Apple and Amazon went through drawdowns of 80% to 90%.

Those losses threw doubt into those companies as investments… But both continued to innovate and build and are now worth trillions.

Crypto is no different.

It’s been here before, and it’s come back stronger every time to reward those who stuck around.

So as Daily editor Teeka Tiwari said Friday, “Stay the course.”

When crypto goes mainstream, the gains will be massive.

Someday Silver will be worth money.

personally, i’m really bullish on the long term prospects for CryptoTulips, though i am willing to sell off just a few of the extra ones i own right now ...

Long term, sure. But first BTC is going down to $12,000, and perhaps lower, in the next few months (or sooner)

Bitcoin’s prospects haven’t changed with the current decline.

Either it will become worthless or it will go way, way up — say a 50% chance of each.

I’m really bullish on gold and silver.

Increased usage? Is there a way to separate crypto to cash vs. crypto from one wallet to another? If the latter then it's just whales offloading to schmucks.

PoS? So now the whales who have the most crypto get to exchange ahead of the schmucks. Pump and dump anyone? NFTs anyone?

VC? Venture or vulture? Start an exchange, market, stock up, collect money, close up shop and disappear into the ether...eum.

Web 3.0? Snoop Dog and his buds have already bought up the best "real" estate. So schmucks go from being losers IRL into Losers 3.0.

Crypto is still vaporware and sooner or later it’ll be “Joshua fit the battle of bitcoin” all over again.

People who fall for this article also like the falling knife syndrome - and are on the wrong side of the ‘greater fool theory’.

Exactly - $12,000 is the next train stop after this current level works its process.

Bullshart!

Crypto is a fad similar to the Pet Rock.

This article is a superficial take on biggest change in human society we will ever see, unless bug-eyed aliens take over soon.

Bitcoin was invented in 2009, in a Satoshi white paper. “Crypto” however, is the me-too crap that came afterwards in an attempt to cash in on the concept. Most “crypto” turned out to be a rug-pull scam or will before long.

ONLY Bitcoin is truly decentralized. There is no rug nor anyone to pull it. ONLY Bitcoin can BE truly decentralized because it absorbed most of the private computational resources which are available for a decentralized money. There was one worm available for the eating and Bitcoin was the early bird.

The exchange-rate boost for Bitcoin will happen after “crypto” and “DeFi” finally die completely and stop acting as dead weight on Bitcoin. The money-scammers were able to bury Bitcoin in crypto BS by association for a while, but gravity cannot be denied forever.

If you think the diminishing dollars (due to inflation) in your wallet are screwing you, just wait until they’re replaced by Fed CBDC. CBDC will come with TOU (Terms Of Use). They intend for it to be your only money, which they control completely. They will not allow payments/donations to Christian churches, gun/ammo dealers, or disfavored political advocacy groups. This will be Fed policy rather than government directly, so there will be no recourse in the law.

The government role will be to ban gold and probably silver for trade and possession, other than some amount of jewelry probably. Being banned won’t make it disappear from your safe, but it will greatly depress the trading value. If you want to buy something not on the CBDC white list, especially online, Bitcoin will be the sole means for practical purposes, other than barter.

All your fiat is debt-based and amounts to rented money with an evaporation rate. Bitcoin is all asset and no debt, and if you keep it correctly (as a list of words in your head), it cannot be confiscated from you unless the Spanish Inquisition shows up to torture you. Which no one ever expects.

Que the “its a ponzi scheme”, “Its going to zero”, “I don’t understand how something that is code could be worth money” blah blah blah from those who don’t know anything about it.

We’ve heard it all before many times.

PUMP and DUMP. Bitcoin is the tulip mania of the 21st. century.

Yours is an interesting take. One of my concerns about Bitcoin is that it’s located only in the Cloud. Let’s say a government, or a group of governments, wanted to destroy Bitcoin.

Couldn’t they interfere with the Cloud to the extent that Bitcoin transactions became impossible to do?

P.S. I suspect that your last line was from Monty Python. If so, bravo!

This type of cycle has happened a bunch of times in Bitcoin.

Remember from 2017 to 2019 it went from $20k to under $4k. A similar drop from the recent high would put this cycle’s bottom in the $13-$12k range.

Stay away from the crap crypto, don’t invest the rent money, and forget about it for a couple years…it usually comes back.

And Thank the Lord you didn’t invest in Netflix.

The only reason to stay bullish is so you figure you won’t lose everything and maybe even break even:-)

Meanwhile, the fiat dollar has lost 85% of its value since 1971. The future of the dollar will be measured in wheelbarrows.

Bitcoin IS its network, which is definitely not “in the cloud”. The network is many thousands of privately owned mining ASICs running for profit and thousands of Bitcoin nodes hosted by businesses which use Bitcoin or simply enthusiasts like me.

The network is global and deeply integrated with the Internet. The only way for a government to turn it off is to turn off the Internet, which in fact may not be possible at all. The Internet is probably the most indestructible creation of man.

That Bitcoin is its network is why I say there can’t be another Bitcoin. There aren’t thousands more private miners and nodes out there waiting for something better than Bitcoin. There was one opportunity space for a truly decentralized money unconnected to any government or bank, and Bitcoin filled it for the foreseeable.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.