Posted on 01/27/2021 6:41:58 PM PST by SeekAndFind

On the back of disappointing earnings from Facebook and Netflix, AAPL stock dipped into its earnings release, but as the company's stellar results just showed this may have been a bit premature, because Tim Cook's company just reported blockbuster earnings including its first ever $100BN quarter, around in its iPhone 12 release quarter.

Here are the details:

Some more details from the quarter:

Tim Cook gave some additional numbers, noting that AAPL now has an active installed base of 1.65bln devices, of which more than 1 billion iPhones; perhaps more importantly, AAPL has 620 million paid subscribers now as part of its ecosystem.

Of note: Mac sales were strong yet not strong enough to beat estimates despite soaring laptop sales which have surged during work and study from home. As Bloomberg notes, "there might be a bit of disappointment with that one". Still solid growth and a high number, and sales will likely skyrocket this year with redesigns coming to nearly the entire line.

One potential counter: as Bloomberg notes, "one of the major factors weighing on hardware sales has been global shortages of components. That might be what’s hurt Mac sales. Investors will be listening in closely on that front. Perhaps Apple’s switch to supplying itself with processors will alleviate that risk going forward?"

On the positive side, the Wearables, Home and Accessories boost is due to major updates in that line, including two new Apple Watch models, the AirPods Max headphones, and the HomePod mini. Apple went all out on accessories this past quarter

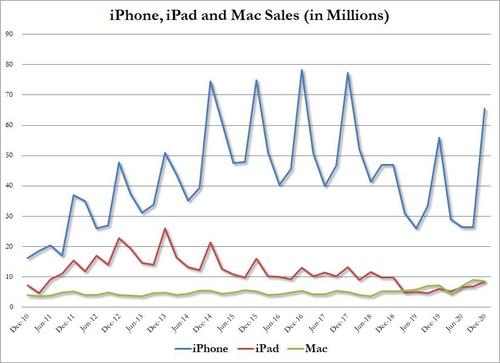

One potential negative: even in the company's record quarter - the one where the iPhone 12 was introduced - the company still can't meet its iPhone sales hit back in 2016-2017, confirming that Apple's iphone is no longer the must have accessory it once was.

This may explain why as Walter Piecyk notes, "that's the first time $AAPL R&D/revenue has dropped y/y since the June quarter in 2015, the year of the iPhone 6."

That's the first time $AAPL R&D/revenue has dropped y/y since the June quarter in 2015, the year of the iPhone 6. — Walter Piecyk (@WaltLightShed) January 27, 2021

The closely watched Services soared to $15.76BN, beating expectations of $14.89B...

... and up 23.9% from the $12.7BN a year ago.

Service revenue is likely to remain strong, likely due to the App Store, Apple Music, and iCloud subscriptions. Furthermore, the newest offerings - Fitness+, TV+, Arcade, News+, and Apple Card - all still appear to not have any material impact on the company.

Also remarkable was the surge in Chinese revenues, which soared by a whopping 57% Y/Y...

... to a record $21.31BN from $13.6Bn a year ago.

Discussing the quarter, Tim Cook said that “this quarter for Apple wouldn’t have been possible without the tireless and innovative work of every Apple team member worldwide. We’re gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we’re a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States.”

Luca Maestri, Apple’s CFO, also chimed in saying that the "December quarter business performance was fueled by double-digit growth in each product category, which drove all-time revenue records in each of our geographic segments and an all-time high for our installed base of active devices. These results helped us generate record operating cash flow of $38.8 billion. We also returned over $30 billion to shareholders during the quarter as we maintain our target of reaching a net cash neutral position over time.”

And in keeping with this, Apple’s Board of Directors has declared a cash dividend of $0.205 per share of the Company’s common stock. The dividend is payable on February 11, 2021 to shareholders of record as of the close of business on February 8, 2021.

In his take on the quarter, Bloomberg analyst Anand Srinivsana said “No major surprises here - iphone was great -- services great -- drove margins higher. China did well. PC units have been strong but disproportionately driven by the low end. Macs are about 2x the average selling price of the average PC."

And some more color from Shannon Cross of Cross Research:

“It was an extremely strong quarter, what’s likely weighing on the stock at the moment is that they didn’t give guidance. Clearly iPhone was the strength, China was up significantly, reflecting that consumers in China were waiting for 5G iPhones.”

“As always, there are questions about the sustainability of the App Store and services. Clearly the strength this quarter shows continued solid growth.”

“Apple is continuing to benefit from work from home. Keep in mind last time there was a stimulus, iPhone shipments increased.”

One final potential disappointment: Apple once again didn’t provide investors with a forecast for the current period. That’ll make every statement on the earnings call all the more important as analysts will beg for a clue as to what to project going forward.

Perhaps indicative of just how priced to perfection Apple was, however, the stock has barely budged and after some initial kneejerk moves both lower and higher, it was virtually unchanged from the close.

Indeed, as Bloomberg explains the lack of reaction, "expectations had been sky high for the company on suggestions of a new iPhone “super cycle,” spurring a stock surge in recent months. Apple also recently introduced other new devices, including an updated Apple Watch, and demand increased for iPads, Mac computers and services from consumers working and studying from home during the pandemic."

So yes - amazing quarter, but not that amazing to push the stock to a new permanent plateau.

Just as I thought. You didn’t read it. You just barreled ahead with spouting off your ignorance. Typical. So what do you have to bring to the table in an Apple thread except your bile and ignorance and insults? Nothing worthwhile.

Then just skip over the Apple threads. . . Just as I skip over the gardening threads.

The majority of the Apple threads I don’t post the articles, other Freepers do that, often negative Anti-Apple haters like you. I merely ping the members of the list to the thread for their attention because they’ve asked me to do so. I also comment on ignorant comments like yours, correcting misinformation and outright lies like yours, posting links to the correct information from mainstream tech sources, not “advertisements.” That’s your claims. You post your ignorant warped opinion with no experience with using Apple products, sprinkled with insults and slurs about Apple users.

I made a great living working on WINDOWs machines, supporting small businesses, non-profit, and public entities with their PROBLEMS using Windows computers and other Microsoft products. I owned a cross platform support business for over 35 years and I am an expert in them... You have your limited experience in Windows. I know where the problems lay... where the money was made because which system was the problem. It was NOT Apple where there were problems.

Did I have problems with Macs? Of course, such as a major magazine publisher who allowed do-it-yourself ad makers (everyone is a home-brewed graphic artist, you know) to bring in custom fonts they made or found on the internet, that overwrote the purchased Adobe fonts (read “very expensive”) in the publisher’s library and resulted in a magazine file that had one character on a page, then another character 32 pages later and could not figure out what was wrong and called me in to figure out why they could not go to press with a hard deadline. THREE TIMES. Definitely loose nuts on the keyboard issues... despite firing three different loose nuts who allowed the bad ad fonts to be brought in. You’d think the worker bees would have heard through the grapevine, and seen the big alerts signs I printed and posted about every workstation about NOT ALLOWING EXTERNAL CUSTOM FONTS, and accepting only self-contained PDF ads. Nope! Workers must have been blind as bats to those signs, or ignored the strict rules about PDF ads only. (Had a similar problem with a Windows machine, but they were not often used in high-end six-color direct-to-press publishing at the time.) And, over twenty-five years ago, finding Pre-OSX MacOS 9.2 or lower extension conflicts could be fun and time consuming. Not hard, but time-consuming, since there could 40 or 50 OS extensions.

I am now retired and am glad I will not have to ever look at another Intel/Windows machine ever again. Incidentally, at the peak of my business, I was running NINE distinct operating systems on my Intel Xeon based Mac Pro simultaneously, including four different versions of Windows... all so that I could step through talking my clients through solving a problem telephonically while doing it on my computer at the same time, going through menus with them in real time. The Mac Pro handled it without a hiccough.

In retirement, I am now down to just three clients and field perhaps just two to three calls in a quarter... and they are clients who are running Macs. Each call takes maybe five minutes to answer and always involves software, not once has it involved hardware... and I haven’t even had to startup my Mac. It was a JOY to delete the Virtual Drives that held the Windows files from my Mac Pro on the day I retired and shut down all Windows support and sold off my Windows client list. Ah, heaven.

Sorry, but YOU are the one who is here invading this thread, wasting your time. I am not wasting my time. You do not have to be here, SO, Adorno, GO AWAY! Stop wasting your time with this... but it is YOU who is doing this. Not me. You have a need to do this. Why???

You seem to be the one wasting your life invading Apple threads to talk about something you don’t like.

No. Where did I say I was. That’s the exact opposite of what I said. You are delusional. You ask a question you could learn by the simplest research of scrolling to the top of this thread. Are you an idiot? Must be. Seekandfind posted this thread, but it’s about Apple’s record breaking 1st Quarter 2021. It’s an open thread in which any Freeper can participate. It’s not yours to come into and start throwing your ignorant myths in.

You are the one who claims to be uninterested in things relating to Apple, but you seem to be mightily interested in spreading your ignorant opinion about those things based on your lack of accurate contemporary information.

I merely corrected YOUR Contrary-to-fact LIES that Apple will not be moving iPhone and other production out of China with a CONTEMPORARY NEWS article written the day after the Biden inauguration when you said Apple had only been doing that to kowtow to the Trump Administration. You have no inside sourcing, no factual basis for your fracture. You just made a false assertion.

I hoisted you on your own petard and YOU did not like being shown to be wrong. Again you did not bother to read what I wrote, not even the by-line DATE. I can’t help you with your ignorance if you just post your opinion based on it. So you keep doubling down on your ignorance.

Good one SM!

If I were interested in that kind of junk, I’d look it up myself.

—

Education is hard

You area mean person indeed

You make a lot of insulting assumptions, don’t you? You not only revel in your ignorance, you celebrate it. You are PROUD of your ignorance. You are unwilling to correct your ignorance. That makes you stupid.

This article is WAY outdated. Apple stock (AAPL) is now at $131.79, a full 10 points lower than the chart above, down 5.5% on Friday alone.

A lot of the Hedge Fund people are selling AAPL to make up for the losses in GameStop... dumping a lot of AAPL will depress the price no matter how good the last quarter was.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.