Posted on 08/19/2019 10:40:11 AM PDT by SeekAndFind

On Tuesday, the markets bid higher following a statement from the U.S. Trade Representative’s office that tariffs will commence on September 1st, but that some products will be delayed until December 15th. To wit:

“…some tariffs will take effect on Sept. 1 as planned, ‘certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10 percent. Further, as part of USTR’s public comment and hearing process, it was determined that the tariff should be delayed to December 15 for certain articles.”

The only part the algos heard was “tariffs delayed,” which sent them into stock panic buying mode.

However, stocks crashed again on Wednesday as the yield curve inverted, sending “recession fears”through the markets.

Of course, since President Trump has pegged the success of his Presidency on the rise and fall of the markets, on Wednesday, as “tweets” about a “trade talks continuing” failed to lift the markets, he resorted to more direct measures to manipulate the markets: Via CNBC:

“Trump held the call with J.P. Morgan Chase CEO Jamie Dimon, Bank of America’s Brian Moynihan and Citigroup’s Michael Corbat, according to people with knowledge of the situation.”

This, of course, was reminiscent of the call made by Steve Mnuchin, U.S. Treasury Secretary, during the market rout last December. But most importantly, this is about the upcoming election:

“Trump has been reaching out to corporate leaders this week amid his concerns that a slowing U.S. economy could impact his reelection chances, according to a Thursday piece from the Washington Post.”

Hopefully, he will listen to them.

But even if the trade dispute was ended today, the damage is likely already done.

Economic growth has weakened globally

Corporate profit growth has turned negative.

Tax cuts are fully absorbed into the economy

Interest rates are signaling there is something “broken”

Yield curves are negative as “deflationary” pressures are rising

All of which is leading to rising recession risk.

In other words, while investors have hung their portfolios hopes of a “trade deal,” it may well be too little, too late.

This is all assuming Trump can actually succeed in a trade war with China.

Let’s step back to the G-20 meeting between President Trump and President Xi Jinping. As I wrote then:

“There is a tremendous amount of ‘hope’ currently built into the market for a ‘trade war truce’ this weekend. However, as we suggested previously, the most likely outcome was a truce…but no deal. That is exactly what happened.

While the markets will likely react positively next week to the news that ‘talks will continue,’ the impact of existing tariffs from both the U.S. and China continue to weigh on domestic firms and consumers.

More importantly, while the continued ‘jawboning’ may keep ‘hope alive’ for investors temporarily, these two countries have been ‘talking’ for over a year with little real progress to show for it outside of superficial agreements.

Importantly, we have noted that Trump would eventually ‘cave’ into the pressure from the impact of the ‘trade war’ he started.

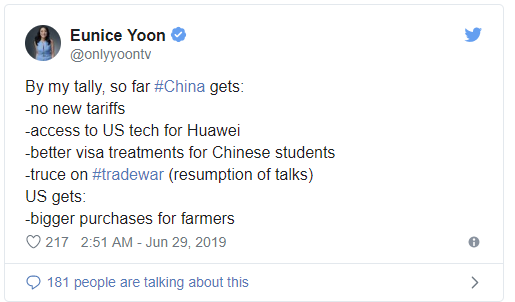

Of course, Trump caving to China was evident in the agreement made during the G-20 summit.

By agreeing to continue talks without imposing more tariffs on China, China gained ample running room to continue to adjust for current tariffs to lessen their impact. More importantly, Trump gave up a major bargaining chip – Huawei.

“One of the things I will allow, however, is — a lot of people are surprised we send and we sell to Huawei a tremendous amount of product that goes into a lot of the various things that they make— and I said that that’s OK, that we will keep selling that product.” – President Trump

Oh…so all the spying, technology stealing, etc. doesn’t matter now?

As I stated then, it was only Trump who was surprised. Not by the amount of product sold to Huawei, but rather by the pressure applied by U.S. technology firms to lift the ban. While Trump appeased his corporate campaign donors, he Trump gave up an important “pain point” on China’s economy.

Yes, China agreed to buy more agricultural products from U.S. farmers, which was crucially important as the “rust belt” were big supporters of Trump during the 2016 campaign, but China had no intention of following through. As I wrote on May 24, 2018:

“China has a long history of repeatedly reneging on promises it has made to past administrations.

By agreeing to a reduction of the ‘deficit’ in exchange for ‘no tariffs,’ China removed the most important threat to their economy as it will take 18-24 months before the current administration realizes the problem.”

What the current administration fails to realize is that China is not operating from short-term political-cycle driven game plan. Their goal is very different. To wit:

China is playing a very long game. Short-term economic pain can be met with ever-increasing levels of government stimulus. The U.S. has no such mechanism currently, but explains why both Trump and Vice-President Pence have been suggesting the Fed restarts QE and cuts rates by 1%.

The pressure is on the Trump Administration to conclude a “deal,” not on China. Trump needs a deal done before the 2020 election cycle AND he needs the markets and economy to be strong. If the markets and economy weaken because of tariffs, which are a tax on domestic consumers and corporate profits, as they did in 2018, the risk off electoral losses rise. China knows this and are willing to “wait it out” to get a better deal.

China is not going to jeopardize its 50 to 100-year economic growth plan on a current President who will be out of office within the next 5-years at most. It is unlikely as the next President will take the same hard-line approach on China that President Trump has, so agreeing to something that won’t be supported in the future is doubtful.”

While President Trump thought “trade wars would be easy to win,” they aren’t, and the domestic economic pain will likely be more than he bargained for. Such is already evident as corporate profits continue to come under pressure.

“Despite a near 300% increase in the financial markets over the last decade, corporate profits haven’t grown since 2011.”

But, if you think China is going to acquiesce any time soon to Trump’s demands, you haven’t been paying attention. China previously launched a national call in their press to unify support behind China’s refusal to give into Trump’s demands. To wit:

“Lying behind the trade feud is America’s intention to stifle China’s development. The U.S. wants to be a permanent leader in the world, and there is no way for China to avoid the ‘storm’ through compromise.

History proves that compromise only leads to further dilemmas. During previous trade tensions between the U.S. and Japan, Japan made concessions. As a result, its political stability and economic development were adversely affected, with structural reform being suspended and hi-tech companies being severely damaged.

The only way for a country to win a war is through development, not compromise. To achieve development, China will open its door wider to the world and fight to the end.”

These were Xi Jinping’s mandates.

While China agreed to purchase more agricultural products from the U.S., there was nothing committing China to do anything. Since buying agricultural products would have boosted support for Trump, it should be of no surprise that China failed to follow through.

As usual, China said they were going to be buying “big” from our great American Farmers. So far they have not done what they said. Maybe this will be different! — Donald J. Trump (@realDonaldTrump) August 13, 2019

“The U.S.- China confrontation will be a war of attrition: while China has shown a willingness to make a deal on shrinking its trade surplus with the U.S., it has made clear it won’t bow to demands to abandon its industrial policy aimed at dominating the technology of the future.”

China has no intention of giving in.

They are not going to compromise as they know time is growing extremely short for President Trump as the election cycle heats up.

The problem for Trump will be the mounting economic, and corporate, pressure the Administration will face. That pressure is what led to the latest mistake.

Trump’s latest move to delay tariffs is another critical error with respect to dealing with China. As I wrote last time, Trump may well be following his “Art Of The Deal” tactics, but Xi is clearly operating on the foundation of Sun Tzu’s “The Art Of War.”

“If your enemy is secure at all points, be prepared for him. If he is in superior strength, evade him. If your opponent is temperamental, seek to irritate him. Pretend to be weak, that he may grow arrogant. If he is taking his ease, give him no rest. If his forces are united, separate them. If sovereign and subject are in accord, put division between them. Attack him where he is unprepared, appear where you are not expected.“

As noted above, China has been attacking the “rust-belt” states, which are crucial to Trump’s 2020 reelection. As noted by MarketWatch:

“China has lashed back with tariffs on $110 billion in American goods, focusing on agricultural products in a direct and painful shot at Trump supporters in the U.S. farm belt.”

Trump caved to corporate pressures over Huawei at the G-20 summit, and has now caved to pressures from retailers heading into the critical shopping season. (The tariffs on electronics, apparel, shoes, and other items are specific goods which will impact consumers the most during the critical holiday shopping season.

“We’re doing this for the Christmas season. Just in case some of the tariffs would have an impact on U.S. customers.” – President Trump

Not “just in case.”

As noted above, this was directly is response to his calls with corporate leaders early last week. Those tariffs would have further crushed sentiment and the profits of companies who are dependent on the holiday shopping season for a bulk of their annual revenue.

From China’s perspective, this is another “nail in the coffin” of Trump’s negotiating strength.

While the U.S. will now expect China to reciprocate by buying U.S. agricultural products in the coming weeks, China has no incentive to do so.

Why does China have to agree to anything, given that Trump is now negotiating with himself to keep his corporate donors happy?

For China, this is a big “win.”

“Chinese experts said the sudden postponing of impending tariffs showed that the maximum pressure tactics of the US are losing their bite when it comes to China. These measures are set to greatly reduce the weight of US tariffs, as electronics goods alone account for about $130 billion.

‘The US has realized that its maximum pressure strategy to force China back to the negotiating table has not worked as expected. Washington knows that only through talks can the two sides reach a deal,’ Wang Jun, chief economist at Zhongyuan Bank, told the Global Times on Tuesday.”

With Trump’s own economy working against him, China doesn’t have to do much, but wait.

Yes, China will gladly have meetings to talk about “trade” as they now know that following each meeting they will walk away with more time.

Time is all they need.

When Trump is out of office, the next administration will abandon the “trade war” as the first order of business.

However, with the “yield curve” plummeting, there is a rising possibility, China may not have to wait that long.

As I wrote last time:

“While Trump is operating from a view that was a ghost-written, former best-seller, in the U.S. popular press, XI is operating from a centuries-old blueprint for victory in battle.”

Trump has already lost the “trade war,” he just doesn’t realize it, yet.

It appears we may be entering a “post globalism” era.

I don’t consider that to be a bad thing. Markets are basically just a form of gambling compared to what they once were.

Any pompous pinhead who attempts to give DJT advice or criticism regarding business or the economy is not worth further consideration.

It’s nice to start with 20$ million, but it’s something else altogether to turn that into 9$ billion.

I don’t pretend to understand it all, but neither do I think Lance Roberts, whoever he is - or thinks he is - has all the answers...

BS article. Recession will be here and it has nothing hardly anything to do with tariffs. It has everything to do with economic cycles caused by human nature. We overspend during era of prosperity and are forced to retrench when we have bought everything and just plain run out of money to buy more.

If there is tariff on a pair of headphones from China, and the price goes up by 10% to 25% for example, we will buy them from Vietnam or S Korea. Basic manufacturing materials such as steel if become 25% more expensive for Chinese import, it makes local manufacturing competitive again, which creates more jobs here and the money circulation grows accordingly.

Maybe read later.

Don’t usually pay much attention to anyone who begins an explanation or argument with “to wit”.

Lance Roberts? Same guy with the radio show? What is he selling?

I’ll put my trust in DJT on this issue. He actually is the most experienced and qualified person to conduct trade negotiations. I think the Chinese are being stubborn and delaying the inevitable. Trump is no fool, he deals from a position of strength and the Chinese have never been challenged before. They’re use to getting their own way and not being called out for breaking trade agreements. They’re use to running rough shot over everyone. Trump is doing well and is slowly getting what we want.

This is about as pro China article as you can get.

China is *not* in a commanding position.

If they were, there would not be any protests in Hong Kong. They would already have been put down.

This phrase is repeated through out this entire screed.

I, I, I know..., Trump is a stupid loser, he has lost the trade war, but only I know it, Trump is too stupid to realize that China is winning.

What an ego maniacal prick.

So China won?

All our base are belong to China?

We should welcome our new imperial overlords?

Don’t. Think. So.

“With Trump’s own economy working against him, China doesn’t have to do much, but wait.”

There is the fundamental error of his analysis.

Time is not on China’s side, for the significant tariffs already in place, or the flight of business and capital out of China. Some actions are still in the works (WTO and International Postal Union) that are likely to hit them in the next few months as well.

The communists would be lucky to squeak through the election without an economic crisis of some sort (Currency, Stock Markets, Housing, Recession, Debt Crisis, etc.). If President Trump is re-elected, he could pull the lever on their economy at will.

In fact, President Trump could likely pull the lever to send communist China into crisis shortly before or after the election, even if not re-elected.

The communists are at much greater risk, and are paying much greater costs.

President Trump can afford to wait, and fine tune things to suit our economy and his re-election, because he controls the levers, and calls the tune.

Glad I skipped ahead to the end.

PDJT is definitely on the right path to try to get a fairer trading relationship with Communist China (if we are to continue trading with them, that is... watch what they do against Hong Kong first...)

Will our globalists and US corporate paymasters snatch defeat from the jaws of victory? It the Chinese continue to steal our intellectual property, force technology transfers, manipulate their currency, and dump Chinese government subsidized products, the US will decline as a world power and our workers will see lower wages and fewer job opportunities. The US welfare state will continue to grow and the dollar will cease being the world's currency. This is a war for our survival.

Lots of arm chair quarterbacking in that article.

And Trump hasn’t tied his success to the markets.

Trump has pointed to the markets as an indicator of his success, but it’s far from the only one. He’s also pointed to unemployment, manufacturing, the reduction of regulations, and many others.

Some of the new tariffs (about $1.33 Billion per month), have been delayed until December - but the rest (about $1 billion per month) go into effect in two weeks.

More businesses will be/are fleeing China.

In the mean time, China continues to bleed from the previous tariffs, which continue in place - their total bill is ramping up toward $10 billion per month.

If that is us losing, it pays pretty good.

Trump is supporting Main Street over Wall Street. It is economic nationalism versus globalism. Trump is placing the interests of American workers over the cheap labor express and the moving of our manufacturing out of the country. The US became the world’s most powerful economy during times of high tariffs to protect our manufacturing base. We don’t have fair and reciprocal trade now.

And now the Left is saying, “That’s OUR Wall Street, now”.

The author omits the pain China has endured (their economy has slowed to a crawl) and the potential the trade war can lead to a change in power there. All the risks and potential disadvantages are not on the U.S. side. The tone of this article is Trump-bashing and not financial analysis.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.