Posted on 05/19/2019 11:14:07 AM PDT by DUMBGRUNT

Billionaire Robert F. Smith, who received an honorary doctorate at Morehouse College’s Sunday morning graduation exercises, had already announced a $1.5 million gift to the school.

But during his remarks in front of the nearly 400 graduating seniors, the billionaire technology investor and philanthropist surprised some by announcing that his family was providing a grant to eliminate the student debt of the entire Class of 2019.

... He doesn’t know who the keynote speaker will be at Colin’s graduation ceremony but is hoping for a return performance by Smith.

“Maybe he’ll come back next year.”

(Excerpt) Read more at wsbtv.com ...

For every 30¢ the federal government spends to make college “affordable,” the cost of college goes up $1.00. Get the feds out of education and watch it become affordable again and the need for loans goes away.

How about paying professors 6 figure salaries to teach one course. Hello, Elizabeth Warren.

Wow. Talk about putting your money where your mouth is.

> his family was providing a grant to eliminate the student debt of the entire Class of 2019 <

Well, that’s nice. But what about the kids who took a job after school each day, to avoid taking on debt? What about them? I guess they’re all suckers.

A better choice would have been to give each graduate a start-up gift of $15,000, or whatever.

Billionaires don’t think that way.

6 figure salaries to teach one course. Hello, Elizabeth Warren.

Not so much at Morehouse.

https://www.paysa.com/salaries/morehouse-college—professor

NB: The average salary at my kid’s high school is over $100,000.

For a part-time job.

Kids and families who worked hard and paid their own way MUST FEEL STUPID NOW!

Its his money and if he wants to spend it that way, I applaud him.

Can I ask a stupid question??

If someone is paying your debt for you, in this manner, isn’t that considered as a type of debt forgiveness, and thus, taxable income?

Put another way, if a student in this class has $30,000 in student loan debt paid off, is he/she going to get a 1099 indicating that he/she had $30,000 of income? And then have to pay tax on that money which he/she never saw?

Will this billionaire have to pay gift tax on giving these huge gifts to the class?

Just saying, the way our tax laws are structured, and I admit to being no expert, but know that debt forgiveness is generally considered to be taxable income.

But what about the kids who took a job after school each day, to avoid taking on debt? What about them?

Jeez. Why find fault? Some people would

complain about getting hung with a new rope.

But, hey, now that Grumpy cat is dead, maybe

you can fill in? Nah, Debbie Downer’s got that. LOL

I don’t think donors pay a gift tax.

Au contraire it might be a good write off.

I think what Leaning Right was getting at, is that if he pays off the loans for the class, those without loans don’t get any benefit from his generosity. That’s how I interpreted his/her comments anyway.

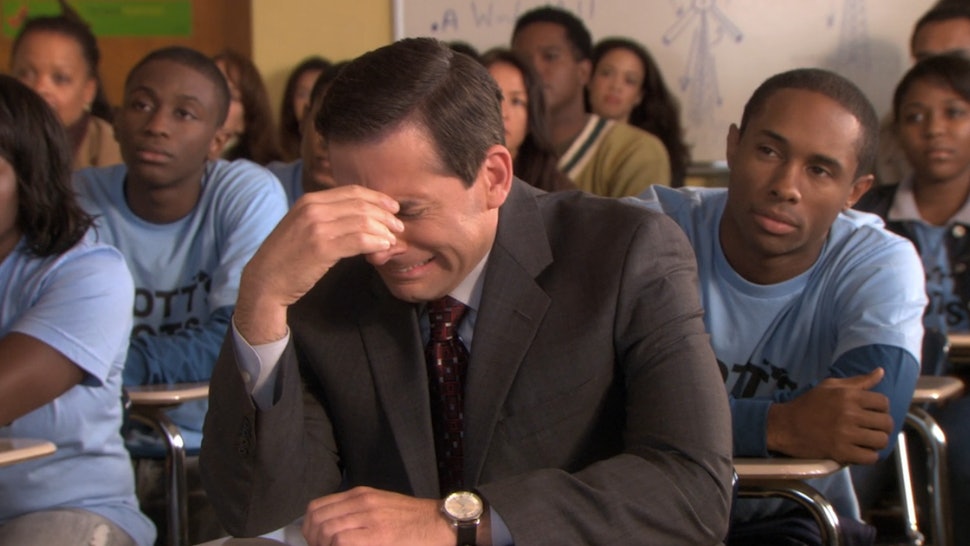

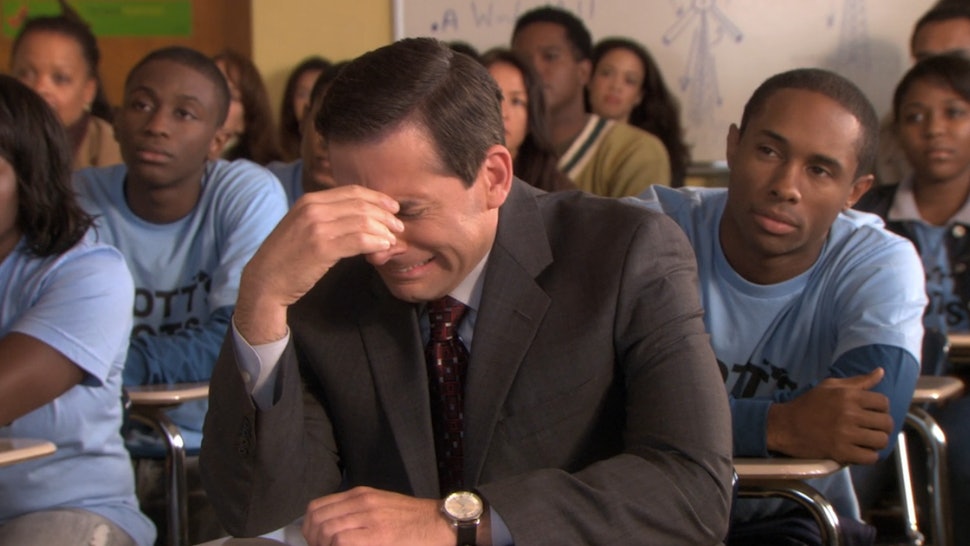

Google says, related to a TV show?

I’m not much of a TV watcher.

Can you give some context?

> They could turn down the gift, I guess. <

??? If I’m reading the article correctly, the philanthropist is paying off student debt.

Student A borrows every last cent he can. He graduates with $70,000 in debt. He gets a $70,000 gift.

Student B borrows only when he must. He graduates with $10,000 in debt. He gets a $10,000 gift.

Student C hates to carry debt. So he works part-time at McDonald’s every evening. He graduates with no debt. He gets no gift.

That seems a bit off to me. Better to give every graduate a nice chunk of change to start life with. But as others have noted, it’s Smith’s money. He can do with it what he likes.

> if he pays off the loans for the class, those without loans don’t get any benefit from his generosity <

Yes, that’s what I meant...you just said it better! See post #17 for my attempt to clarify my remarks.

I do like that he didn’t say ‘Black, Hispanic or Minority Students ONLY!”

‘Mike’ Obama would say black girls from single mom families only.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.