Posted on 12/27/2016 4:08:04 PM PST by ARGLOCKGUY

For millions of public sector workers in the U.S., state-run pension funds are the only chance left for a comfortable retirement. In the hopes of providing a stable future for their families, an entire generation was duped into putting decades of their earnings into these supposedly ‘risk-free’ investments. Unfortunately, those who have entrusted the government to manage their life savings may end up destitute as a result.

Budgetary shortfalls that have plagued Detroit for years are now spreading to other municipalities. Since 2008, six local governments have been forced to renegotiate their debts in bankruptcy court, with many others on the same trajectory. The scale of the problem has been repeatedly understated by the media, but across the nation, a somber reality is beginning to set in.

States with large populations, like California, often find themselves in the spotlight when it comes to deficits, but there are several others that are in even worse shape. Illinois, New Jersey, and Connecticut are among those facing the biggest hurdles to meet their obligations to retirees. Instead of maintaining a surplus, politicians have continuously prioritized spending today on things like sports stadiums, for example, to ensure re-election. Policymakers on both sides of the aisle have echoed solutions that involve either massive cuts to benefits or shifting the financial burden onto the taxpayer. The price to prop up these insolvent funds will come in the form of higher property taxes, income taxes, and other stealth forms of subsidization.

The ongoing exodus of people from the Northeast to states that offer better opportunities and a lower cost of living is putting even more stress on the already fragile system. Pension payouts depend on the contributions of current workers, and as the labor force dwindles, so does the money available.

They’re going to try to dump this on DJT. Paint him as the bad guy. “Trump to California: Drop Dead.”

This will somehow become Trump’s fault.

“Public Service” indeed.

If they try to dump it on the federal government, then they are dumping it on those of us that live in fiscally responsible states. Just say no to state welfare.

“Pension payouts depend on the contributions of current workers, and as the labor force dwindles, so does the money available.”

For most states the governments failed to set aside money for pension funds. It isn’t that the money wasn’t there. The money was spent on other things. In most states the governments were aware that the problem was only getting worse, but they continued to spend money they should have set aside, secure in the knowledge that the system would not fail on their shift. Well, the end is here.

Florida’s system is secure because the law requires the system to be fully balanced at the end of each year. The legislature has done exactly that. It can, therefore be done. But let’s face it, for the most part politicians exist to funnel money to their cronies and through circuitous routes to their own back pockets. That’s were the various unions and former state workers should start looking for it.

Make no mistake:

Gov workers are the most selfish self-righteous bastards there is when it comes to their salary /benefits.

They will stop at nothing and demand everyone else pay their six-figure retirement.

Trump should take all federal funded gov pensions and roll them into the “social security trust fund”.

And put them all on Obamacare “bronze” level.

Nonsense, Obama used the 1 trillion stimulus funds to sure up the union pension funds. The invested in the stocks which went up with Qe low interest fed rates.

New Hampshire does not have an income tax.

They will stop at nothing and demand everyone else pay their six-figure retirement.

Oh, absolutely. Every one of them thinks he or she "sacrificed for the public good" while they were raking in above-market compensation, layoff-proof, unfireable, for twenty or thirty years.

In Romania, the head Government Worker was willing to fire machine guns into a crowd of tens of thousands of his citizens rather than give up power.

Any one of them will do exactly the same.

We have the same nonsense in Illinois. Government employee pensions are protected by the state constitution. So bypass changing the state constitution by declaring the pension funds insolvent, then let the government retirees live off SS.

Oh man: If they’re red states what do the feds owe them?

Please let California “go”.

The game was rigged.

The politicians allowed public employee unions.

The union collect money from their members.

The union passes some of this money back to the politicians.

The politicians increase wages and benefits.

Rinse and repeat.

The taxpayers do not have a seat at the table but they are expect to pay.

Please California go.... let them eat tofu and have dry canals.

‘Bleak future’? Pfft. More bleak than mine. I’ll have worked 47 years when done and when I get the last paycheck, that will be it. $0.00 coming my way after that last direct deposit on the last payday. And no, I’m not counting on a penny of Antisocial Security. I just consider it a 7.65 percentage point surtax on the Internal Revenue Code, and you should too.

I don’t want their stinking paupers alms anyway.

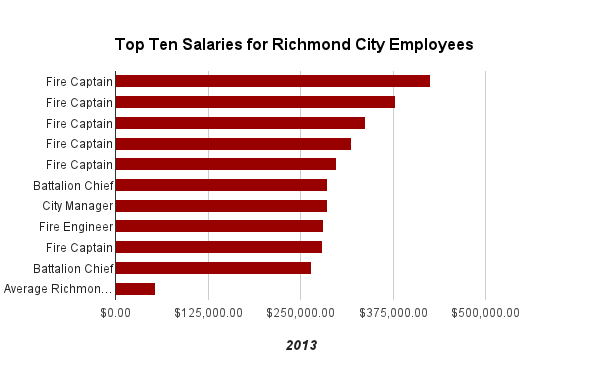

Wow. $400,000 plus. High house prices/rent but wow.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.