The rollout of disappointing first-quarter earnings has continued in recent days, with sectors such as airlines and tech getting hit and eclipsing memories of early beats by the big banks. But the biggie has to be the disappointing top- and bottom-line miss by Apple (AAPL) after the close on Tuesday, marking the company's first quarterly revenue decline in 13 years.

Apple was down more than 8 percent in after-hours trading on those earnings that came in at $1.90 per share (vs. $1.97 expected), an 18.5 percent decline from last year. Revenues came in at $50.6 billion (vs. $52.2 billion expected), a 12.8 percent decline from last year. Profitability declined as well, with gross margins at 39.4 percent vs. 40.8 percent last year.

Related: The End of an Era for Apple and the iPhone

As the U.S. market's single biggest stock by market cap, the Apple result is bad news for a few reasons.

First, it calls into question the health of the smartphone market and the ecosystem around it — which has been, besides oil fracking, arguably the big driver of this economic expansion. Watch for shares of Apple suppliers such as Skyworks (SWKS), Micron Technology

Second, the details of the report reinforced concerns about China.

Third, the market's dismissal of further debt-funded accounting gimmickry in the form of a $35 billion share buyback authorization increase and a 10 percent dividend increase suggest investors are tiring of one of the main catalysts of this bull market.

Fourth, by virtue of its market capitalization, Apple has an outsized influence on the major stock averages (mainly, the S&P 500 and the Nasdaq Composite) and thus will drag down overall S&P 500 earnings growth for the quarter. It is also widely held, by regular investors investing in the major indices as well as by hedge funds, of which 163 are long shares, according to data compiled by Goldman Sachs.

Let's dig further into the details.

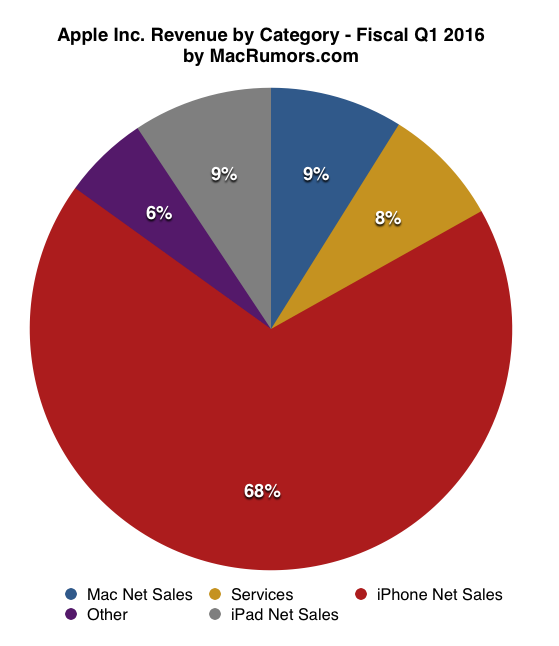

There was a big drop in iPhone shipments to 51.2 million from 61.2 million last year, as well as weak iPad (10.3 million vs. 12.6 million) and Mac (4.0 million vs. 4.6 million) shipments. Revenue in China, a recent point of concern, was weak as well at $12.5 billion vs. $16.8 billion last year and $18.4 billion last quarter.

Hype was building for the upcoming release of the iPhone 7 later this year, but with reports of only a modest update that will retain the same form factor (removing the headphone jack, adding a second speaker, better camera and bigger battery) ahead of a possible all-glass iPhone 8 next year, much of that has been deflated.

Waiting more than a year for an all-new iPhone not only gives competitors an opening to capture market share, but it keeps investors waiting for that big positive catalyst. Based on the drop in the extended session, folks simply don't have the patience with CEO Tim Cook and his team in Cupertino.

The earnings call did nothing to turn spirits around, with Cook admitting that the smartphone market was "not growing" while analysts wondered aloud if the low-price iPhone 5/SE could result in lower average selling prices for iPhones in general and thus weigh on overall revenue growth — similar to what happened to the iPad after the cheaper iPad mini debuted in late 2012.

Note that iPhone trailing 12-month unit sales have rolled over, as shown above, for the first time ever. The debut of the iPad mini marked the top of the iPad growth trajectory as well.

For the S&P 500 overall, the earnings per share growth rate now stands at -8.8 percent for the first quarter, down from the -8.6 percent forecast at the end of the quarter and well below the +0.7 percent expected back in January. Revenue growth is -1.3 percent. When Apple's terrible results are factored in, these numbers will decline even further.