Posted on 01/06/2016 10:07:26 AM PST by amorphous

As Wall Street axioms (Santa rally, January effect, as goes January etc.) are rapidly falling by the wayside at the start of 2016, following a chaotic but return-less 2015, the UBS analysts who correctly forecast last year's volatility are out with their forecast for 2016. It's simple - Sell Stocks, Buy Gold.

UBS Technical Analysts Michael Riesner and Marc Muller warn the seven-year cycle in equities is rolling over.

(Excerpt) Read more at zerohedge.com ...

Buy gold because we want out.

How true. You nailed it.

I think the market is so controlled and manipulated that it no longer behaves as one would expect based on history. For example, when a lot of selling starts to happen, computers shut down trading. This is an unnatural process that on the surface appears to be a good thing but surely there are many unintended consequences.

The other thing is the feds manipulation if the currency and the free money that the banks can take and invest in the markets. Everything is artificial now, and I think at the right time, some group of people has the power to flush it. Maybe right before the election for example like what happened in 2007...

Derivatives and especially those like "A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer (the creditor of the reference loan) in the event of a loan default (by the debtor) or other credit event. " are completely krap when not linked 0n on one to the underlining security instrument.

Let some peeps do that, but disconnect those ba$t@rds from the rest of the financial system.

The markets to me, seem to have been infiltrated at all levels by ‘elites’. There is always fraud and thieves in politics and markets but I think it is far worse than we know. For example, Trump has opened my eyes to the level of fraud in the political system. I always new that the parties had a big degree of control over who is elected. But now I realize that it is far worse. Only a candidate like Trump can push through the shennanigans and even for him it will be hard.

30% Ouch!

I started doing that... boy can you run out of dry powder fast!

Goldbug ping.

Some were predicting $600 gold. I didn't think so, and still don't. Silver is an astounding value currently, but decreased industrial demand, due to the economy, is really hammering it.

Gold is not bad, but in a deflationary depression, cash is king. Sit back and buy income producing assets later.

What about in an “inflationary” depression?

Unlikely. But in that hypothetical I'd recommend foreign currency, foreign stocks, natural resource plays, TIPs.

Plus some gold and silver is always appropriate

Agree

But in that hypothetical I'd recommend foreign currency, foreign stocks, natural resource plays, TIPs.

Disagree.

First, I think the rise in the price of gold, while other commodities have/are falling, is a signal the long anticipated inflationary depression may finally be upon us.

Second, Cash isn't king in an inflation - though I agree the dollar may be the last fiat standing. Likewise, stocks and some commodities aren't going to be great for storing wealth either (i.e. the deflationary half of the equation).

An inflationary depression means we need to think differently, if that's what we're headed into, and I believe we are. So I'm thinking gold, alternative money (digital gold, BTC, etc.), commodities/stocks that are absolute necessities (farming, medical, water, etc.) and certainly a little self-sustained hideaway someplace.

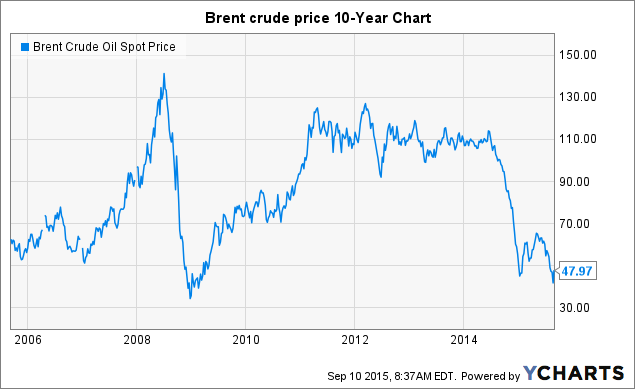

Not a good time to buy gold. Europe and China are collapsing down and the markets are fleeing to the dollar, which has held the Wall Street stocks high. Oil prices are way down @ 70% and have been falling for the last year and gold prices should have followed the wrest of commodities going down in price. The stronger dollar masks a gold price that should be down below $700/ounce instead of @ $1,100. Waiting for gold to drop below $800 and than once down to that level will wait to see if the test low goes to $600.

I think that's wrong headed-thinking, but by all means go for it, if that's what you believe - it's your money.

Than you do not understand commodities pricing. Gold is just another commodity like oil. The oil prices shout up above $100/barrel when actual supply and demand should be at $30 oil. Well we are back to the oil prices of ten years ago, so gold should also continue its plunge below $1000 on its way to balance which is closer to $600 or less as it was when oil was at that price. In reality compared to oil pricing gold should be back down to $400. The petro dollar is struggling and could collapse anytime. Speculation and fear are no way to invest. You want to make a good return by investing in what people need and want in the market. People that purchased gold at $1,400 and higher because Obama got into office are going to lose their shorts. Guns and ammo have a higher margin of return on investment. Martin Armstrong is the most accurate forecaster out there and has pegged it right, this is not the time to buy gold. Do not buy gold now and do not sell now if you are locked in at a higher price because it is going to continue to fall. People buy gold as a hedge against government failure, but should never buy it as a hedge against inflation. Cash is king right now.

I’ll bet UBS sells gold.

If you held onto your $300 gold before Obama got into office and sold your gold after he was elected again at its peak near $1,800, you will make 600% profit when it hits $300 again. Even if it only goes to $600, when you buy back the gold you sold you will have made 300% profit and tripled your gold holdings. The bankers are selling their gold and making people panic to buy it. Than they will purchase it again when the market bottoms. Pure speculation on an economy unhinged and out of balance.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.