2+2 =

Anybody? Bueller?

D) oh, crap....just let the gubmint do it for me

A, C, & B.

How’d I do?

Depending on who’s asking D could be the right answer - refuses to answer.

Love the see the answers from Obama’s economic advisers.

Idiocracy

Count me as one of the stupid. I’d answer the third question “it all depends on which stock and which mutual fund.”

Next, how many of the remaining actually comprehend the question? Another 25%?

There is hope, most of the rest got the answer right.

Eight million have signed up I swear it.

The assault on basic math, English and science by the left wing has left us with a nation of numbskulls.

Which is what the liberals want. Numbskull voters will buy the Gorebull warming bs and leave the financial part of their life to the left wing politicians.

If Lawanda has 2 kids and Knesha has 5 who gets more in welfare benefits

A, C, B

My mom thinks that the bank is the safest place for her money. I can’t get her to understand that with inflation she is actually losing money.

Where is that bank and who do I have to *#@$(@#( to get a 2% rate?

The average Amercan can’t tell you who the Vice President is.

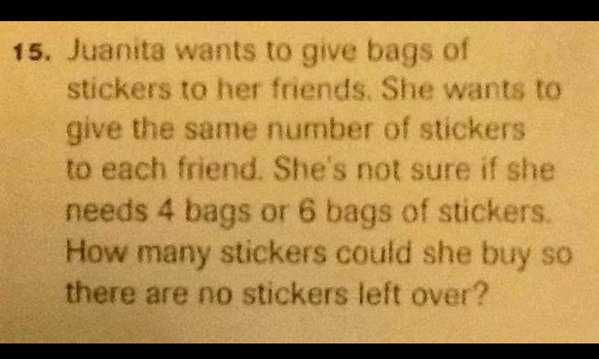

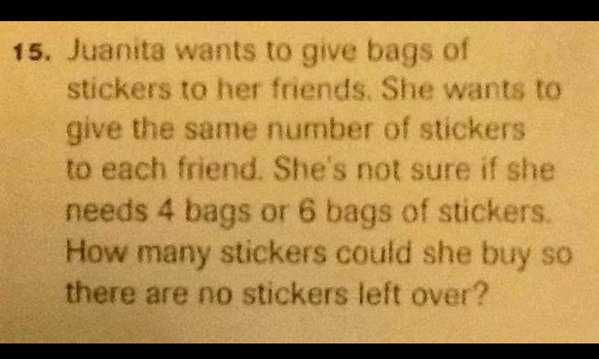

Question: You earn $35,000 per year after tax and your living expenses are $30,000 per year. You want to buy a $25,000 car. How many years do you have to save to get it?

Answer: None. I go on food stamps, default on my rent and buy the car immediately. Then when I can’t make the payments, I scream to the newspapwers that the greedy rich bastards at the car dealership are screwing the little guy and force them to forgive my debt.

For probably many, many of the LIV types and even others who consider themselves to be “financially knowledgeable”, they have never had a savings account, and would not contemplate having one, as they spend every cent they get as fast as it comes in. They would have no reason to even think about stocks or mutual funds.

PILPUL ALERT

#3 cannot be answered accurately, for two reasons.

First, many individual stocks have a lower beta than many stock mutual funds: for example, Kraft Foods (KRFT) would probably be safer than the Fidelity® Low-Priced Stock Fund (FLPSX).

Second, a “safe return” only occurs when a stock actually appreciates in value, and/or provides a dividend. If the stock market in general is losing value, contrarian stocks will appreciate in value, so buying an SP500 fund or a Russell2000 fund in a stock market recession would provide a negative return, while purchasing a dividend-producing stock of a company providing necessities—like, for example, Kraft—would provide a “safe return.”

Anyone with an IQ of average or better could be taught this, though it generally only begins to be taught in college-level microeconomics courses, or in MBA-level personal finance courses.

You want bad? A bank had a "professional" call me about helping me with planning my finances. A savings account is paying .6% interest, and that with restrictions. I asked her "roughly how long would it take my savings to double, using the rule of 72?". She didn't even know what the rule of 72 is! And that's the banks "expert".