Skip to comments.

US severely exposed if rates rise: Erskine Bowles

CNBC ^

| 02/03/2014

| Matthew Belvedere

Posted on 02/03/2014 7:57:47 AM PST by Rusty0604

Edited on 02/03/2014 9:19:23 AM PST by Admin Moderator.

[history]

The United States spends about $230 billion a year in finance payments to creditors

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy

KEYWORDS: debt

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61 next last

To: ex-snook

Very well— I think their PPP per capita income is now #3 (US is #6)

41

posted on

02/03/2014 9:41:19 AM PST

by

pierrem15

(Claudius: "Let all the poisons that lurk in the mud hatch out.")

To: Night Hides Not

Our new Secretary of the Treasury?

42

posted on

02/03/2014 9:42:07 AM PST

by

pierrem15

(Claudius: "Let all the poisons that lurk in the mud hatch out.")

To: tired&retired

Gotta love the oily smoothness of that curve: like Mann’s climate data, those figures are better massaged than Tony Soprano coming out of Madame Chi’s Rub-Down in Hoboken.

43

posted on

02/03/2014 9:44:36 AM PST

by

pierrem15

(Claudius: "Let all the poisons that lurk in the mud hatch out.")

To: Rusty0604

We don’t have a spending problem. We have a paying for it problem...At least that is what a democrat told me.

To: kabar

The problem with SS is the exported jobs. American workers and their employers pay in. Let’s say there were 10 American workers for each retiree. Now 7 or so of these workers are on exported jobs and neither they nor their employers pay in. Put a SS tariff on all imports to equalize the SS cost to American companies, level the playing field. This can be fixed.

45

posted on

02/03/2014 10:45:21 AM PST

by

ex-snook

(God is Love)

To: Rusty0604

Why is this such a mystery. (rhetorical) Y'all should know that I've heard a pattern around here from those 'with a dog in the fight' (i.e., those in financial services, including a friend of mine), talking up the pluses of economic reports and almost 'talking-point' point-by-point rejection/explanation of negative stats.

I wish Conan would do one of these on 'Economics'...

To: logi_cal869

See a lot of that on CNBC. Not from Rick Santelli.

To: pierrem15

It’s based upon assumptions....

The best part of it is how they turned the current trend around before they extrapolated it into the future!!!

To: babble-on

“Simpson-Bowles is a very reasonable plan. I wish Republicans would support it.”

Please don’t tell me you really belive that. Its a terrible plan. Its right up there with the Gang of 8.

49

posted on

02/03/2014 11:48:25 AM PST

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped.)

To: ex-snook

The problem with SS is the exported jobs. If so many jobs were exported, why are we bringing in 1.2 million legal permanent immigrants a year and 700,000 guest workers annually on temporary work permits? We have 45 million foreign born in this country.

American workers and their employers pay in. Let’s say there were 10 American workers for each retiree. Now 7 or so of these workers are on exported jobs and neither they nor their employers pay in.

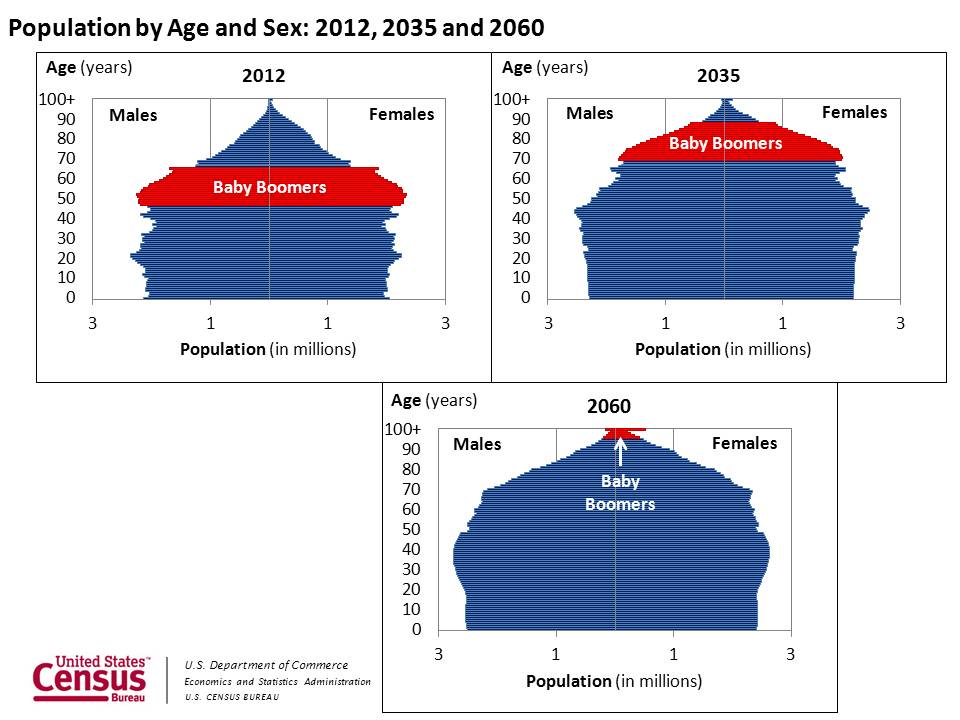

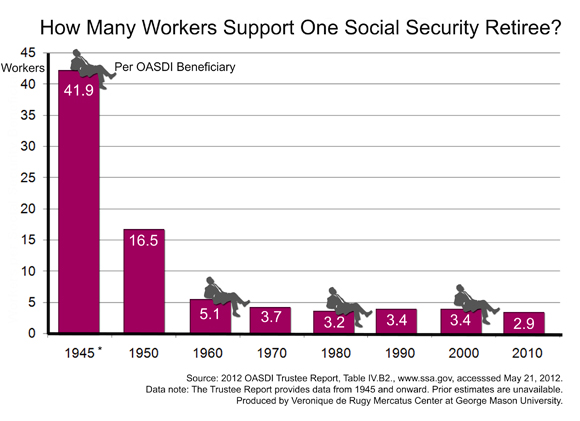

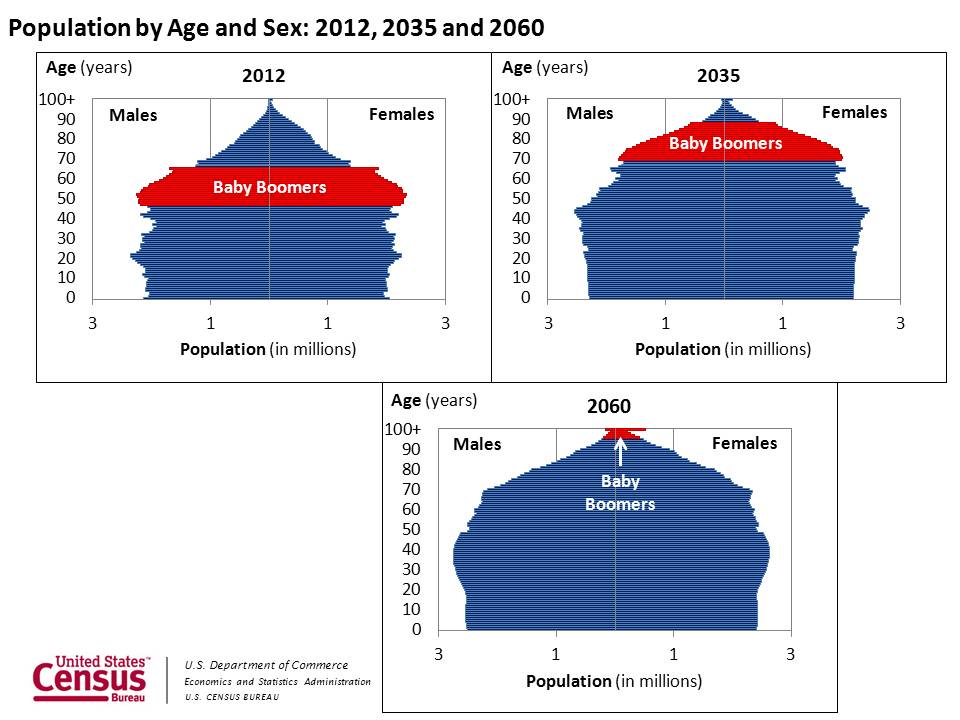

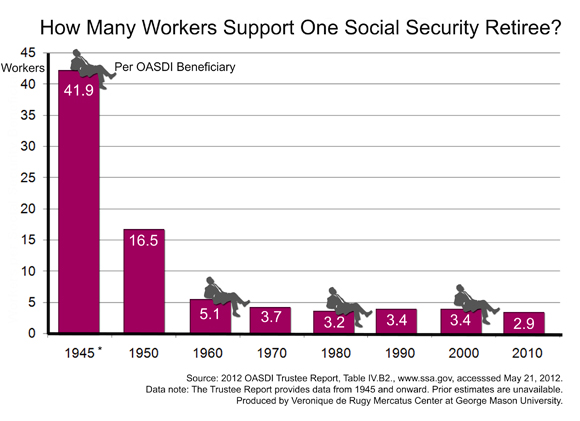

In 1950 there were 16 workers for every retiree; today there are 3; and by 2030 there will be two workers for every retiree. We have an aging society. 10,000 baby boomers retire daily and will continue to do so for the next 20 years. SS is going broke because it is a Ponzi scheme. Unless we raise taxes or decrease benefits, we won't be able to pay full benefits.

Each year the Trustees of the Social Security and Medicare trust funds report on the current and projected financial status of the two programs. This message summarizes the 2013 Annual Reports.

Neither Medicare nor Social Security can sustain projected long-run programs in full under currently scheduled financing, and legislative changes are necessary to avoid disruptive consequences for beneficiaries and taxpayers. If lawmakers take action sooner rather than later, more options and more time will be available to phase in changes so that the public has adequate time to prepare. Earlier action will also help elected officials minimize adverse impacts on vulnerable populations, including lower-income workers and people already dependent on program benefits.

Social Security and Medicare together accounted for 38 percent of federal expenditures in fiscal year 2012. Both programs will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment and, in the case of Medicare, to growth in expenditures per beneficiary exceeding growth in per capita GDP. In later years, projected costs expressed as a share of GDP trend up slowly for Medicare and are relatively flat for Social Security, reflecting very gradual population aging caused by increasing longevity and slower growth in per-beneficiary health care."

In 1970 the population of the US was 203 million; today it is 317 million, and by 2060 it will be 420 million. According to the projections, the population age 65 and older is expected to more than double between 2012 and 2060, from 43.1 million to 92.0 million.

The older population would represent just over one in five U.S. residents by the end of the period, up from one in seven today. The increase in the number of the “oldest old” would be even more dramatic — those 85 and older are projected to more than triple from 5.9 million to 18.2 million, reaching 4.3 percent of the total population

50

posted on

02/03/2014 1:11:11 PM PST

by

kabar

To: kabar

Interesting graphics.

I’ve always felt one big motivation for Obamacare was how the Death Panels can make a huge improvement in the Medicare and Soc Sec financials.

51

posted on

02/03/2014 1:14:30 PM PST

by

nascarnation

(I'm hiring Jack Palladino to investigate Baraq's golf scores.)

To: kabar

You skipped over the SS contributions lost by exported jobs, didn’t you? About everything bought here is made somewhere else. Inflation and exported jobs is what is killing SS.

52

posted on

02/03/2014 1:43:48 PM PST

by

ex-snook

(God is Love)

To: ex-snook

You skipped over the SS contributions lost by exported jobs, didn’t you?No, I didn't. Exporting jobs is not what is causing SS to go broke. Our aging population coupled with rising life expectancy are the problems. When SS was implemented in the 1930s, it had 37 workers for every retiree. By 1950 there were just 16 workers for every retiree, long before we were exporting jobs.

SSA:Due to demographic changes, the U.S. Social Security system will face financial challenges in the near future. Declining fertility rates and increasing life expectancies are causing the U.S. population to age. Today 12 percent of the total population is aged 65 or older, but by 2080, it will be 23 percent. At the same time, the working-age population is shrinking from 60 percent today to a projected 54 percent in 2080. Consequently, the Social Security system is experiencing a declining worker-to-beneficiary ratio, which will fall from 3.3 in 2005 to 2.1 in 2040 (the year in which the Social Security trust fund is projected to be exhausted). This presents a significant challenge to policymakers.

The Social Security program matured in the 1960s, when Americans were consistently having fewer children, living longer, and earning wages at a slower rate than the rate of growth in the number of retirees. As these trends have continued, today there are just 2.9 workers per retiree—and this amount is expected to drop to two workers per retiree by 2030.

The program was stable when there were more than 3 workers per beneficiary. However, future projections indicate that the ratio will continue to fall from two workers to one, at which point the program in its current structure becomes financially unsustainable.

53

posted on

02/03/2014 4:03:36 PM PST

by

kabar

To: kabar

That’s why the Death Panels are so vital.

Every year sliced off the lifespan is huge for the SocSec and Medicare funding.

54

posted on

02/03/2014 4:05:22 PM PST

by

nascarnation

(I'm hiring Jack Palladino to investigate Baraq's golf scores.)

To: LucianOfSamasota

It’s actually $240,000,000,000,000.00 net of taxes.

Search on Lawrence Kotlikoff.

55

posted on

02/06/2014 4:59:27 AM PST

by

1010RD

(First, Do No Harm)

To: Starboard

It’s actually $240 trillion. It will never be paid. Either default or inflation will pay it off. I pick inflation, though not by choice.

This is a problem we could have solved back when Reagan was in office.

56

posted on

02/06/2014 5:01:03 AM PST

by

1010RD

(First, Do No Harm)

To: kabar

Medicare and medical costs will collapse with the collapse of Obamacare. If the GOP follows up quickly with a Commerce Clause based attack against unconstitutional local/county/state restraint of trade via zoning/permitting laws, it will drop even faster.

57

posted on

02/06/2014 5:03:47 AM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

Whatever the actual number really is, the debt is so large that even a slight rise in interest rates (e.g., 5 Year T goes from 1.5% to just 2%; a 33% increase) will have an exponential effect on debt service costs. This is one of the reasons why the Fed keeps printing money. If rates were anywhere near normal historical levels, we’d be in serious trouble.

To: Starboard

The velocity of money is falling, though. So we won’t have inflation. It’s low interest rates that are driving investors into the market for higher returns via higher risk.

What will likely happen is means testing for Medicare and Social Security. Which is fine in exchange for breaking those two programs by making them optional and appropriately priced.

59

posted on

02/06/2014 6:24:01 AM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

So we won’t have inflation.

************

Not officially; they won’t acknowledge it. But anyone who needs to eat, keep warm, have a roof over their heads, educate themselves, or pay for medical care knows otherwise.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson