Skip to comments.

Silver: The Best Commodity Investment in a Stimulus-Driven Slow Recovery

Seeking Alpha ^

| 11/28/2010

| Irfan Chaudry

Posted on 11/29/2010 8:11:19 AM PST by SeekAndFind

Precious metals outperformed most asset classes over a 3, 5 and 10 year period. Silver was a little late to the party. Silver is a business cycle sensitive investment against gold, which is a fear / value / wealth trade. Silver fell to its lowest level relative to gold in early 2009 as the silver price went as low as $8.92, which was 84th of an ounce of gold. However, as the business cycle turned, it became one of the best performing assets in 2010. This outperformance looks set to continue in 2011 due to the very bullish fundamentals. Many silver price predictions are quite aggressive as insiders forecast silver prices to range from US$30 to US$50 / ounce in 2011. The facts and fundamentals which drove silver prices from US$4 / ounce to the current price of US$27 / ounce remain in place. The question is, will silver rival or surpass that of the 1970s inflation adjusted price?

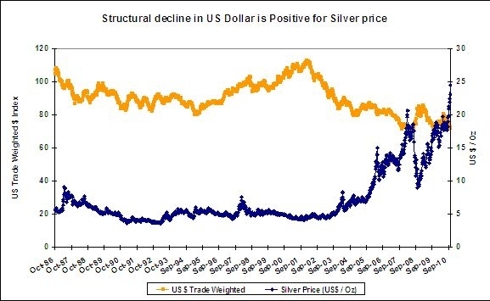

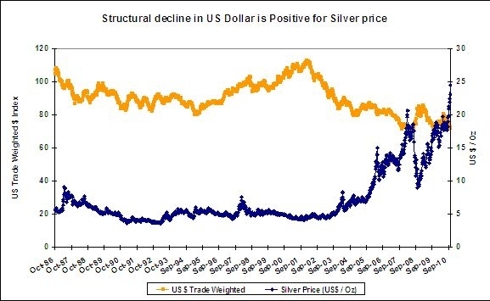

Silver is a commodity which lies between gold and oil in term of industrial / consumer demand and investment demand. This very fact makes silver fundamentally most attractive in a slow recovery amidst lingering risks. Silver is still sitting in the early stage of a bull market that will benefit from any further stimulus driven economic improvement. Silver may have a higher price upside (compared to gold) due to: continuing and increasing global macroeconomic, currency and geopolitical risks; silver's historic role as money and a store of value; the declining and very small supply of silver; significant industrial demand and perhaps most importantly, significant and increasing investment demand.

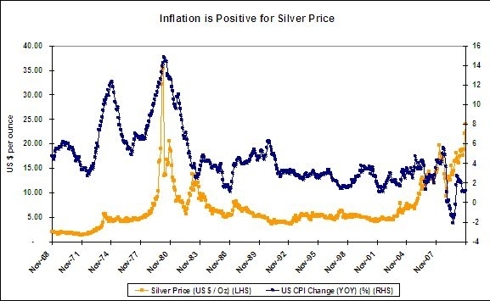

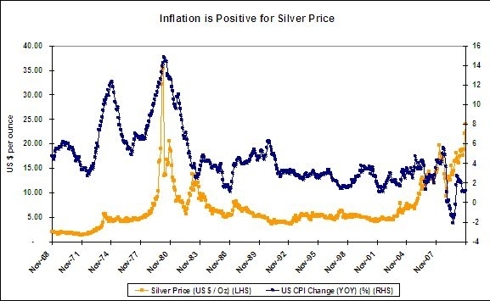

Favorable supply and demand balance, continuing global macroeconomic and geopolitical risk and concerns over the emergence of inflation and stagflation as the massive global monetary and fiscal expansion all point to higher silver prices in the long term. In the 1970s, silver rose from under $1.50/oz in 1970 to nearly $50/oz in 1980. In order to replicate its performance in the 1970s, it would have to rise by more than 25 times, resulting in the price possibly rising to over $110/oz. Silver is a hedge against macroeconomic, systemic and inflationary risk with the attractive added potential for significant capital gains. Real asset allocation and diversification would be an important reason to have an allocation of silver. It is worth remembering that silver's record high in 1980 adjusted for inflation (according to US government inflation figures) was some $130/oz (although the final phase of the bubble was due to the Hunt brothers trying to corner the market).

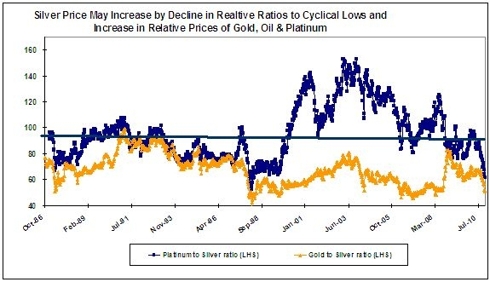

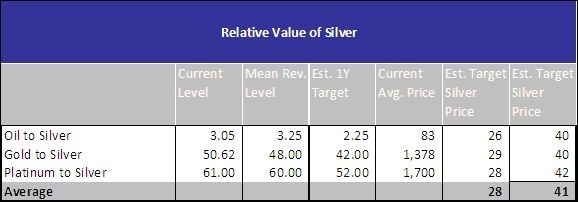

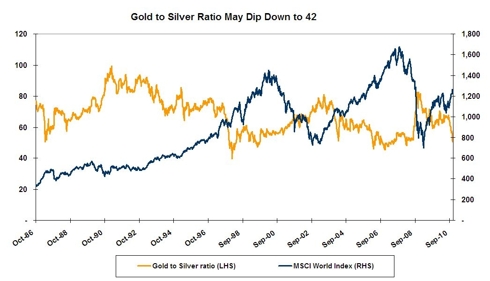

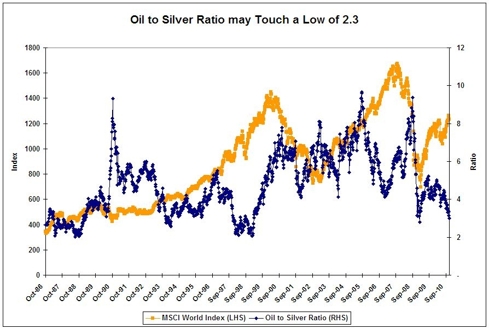

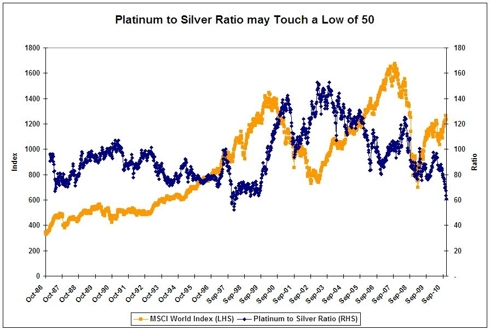

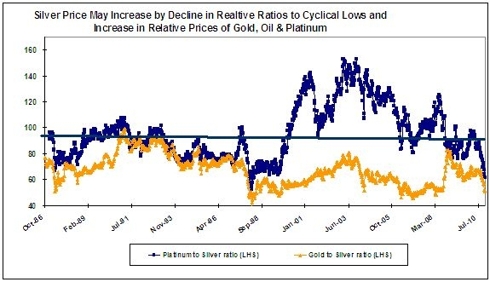

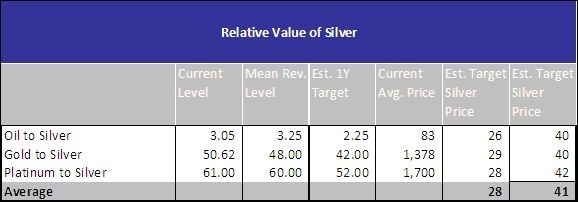

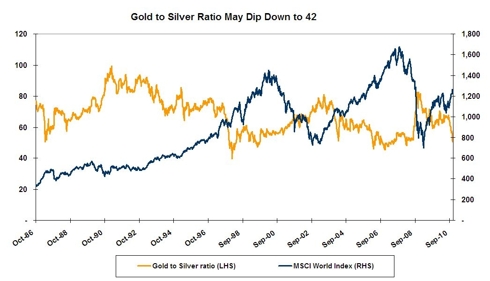

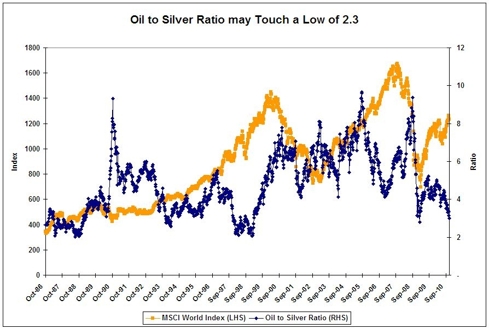

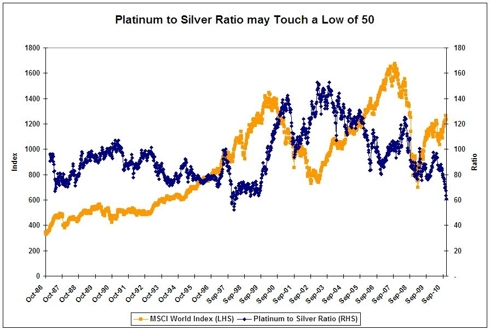

Small allocations by institutional and individual players will see sharp price reactions as the silver market is too small to absorb these effects. Not the least of which is the relative value measured as that of gold to silver, platinum to silver and the oil to silver ratio. These ratios can dip as low as around 42, 2.2 and 52 from current levels of 50, 3 & 61 by the end of early expansion in the business cycle. This implies a 1Y silver price of US$41 / ounce.

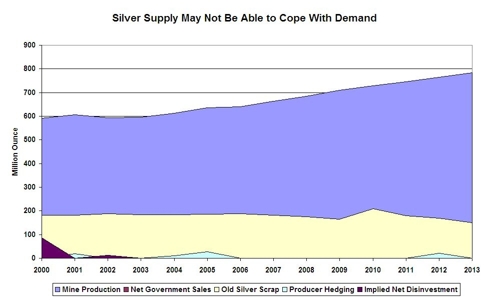

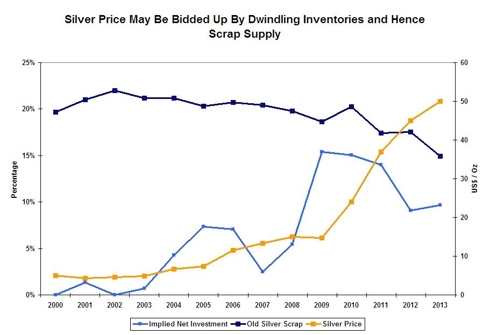

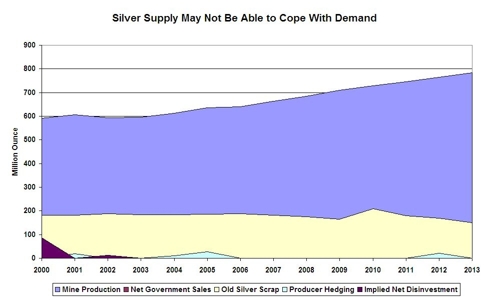

Supply is Low and Declining: The current estimated supply of refined silver has come down to less than 200 million ounces from 2.2 billion ounces in 1990 and 1.5 billion ounces in 2001. In 1900, there were 12 billion ounces of silver in the world. It is estimated that 90+% of the refined silver has been eaten away by a chronic deficit in mined silver and industrial usage in global photography, technology, medical, defense and the electronics industries. Since 1990, industrial demand has averaged 1.56 times of the yearly mine production. For every ounce of silver the mines produced, industry consumed one and a half ounces of silver and there is no reason why it will change now. Silver production has been flat in recent years while demand has been increasing. However, today, the U.S. government's stockpile is all but gone, and sales from other official sources are declining, too. Inventories of most of the central banks are down to an unprecedented level. On current supply/demand trends, the amount of above ground refined silver is projected to disappear completely in 2011. Any increase in recycling may only come from private holders of silver, which until this point was non-existent.

Another important aspect of silver supply is its price inelasticity. From a historical perspective, supply didn't increase significantly in the 1970s when silver rose more than 25 times (from $1.40/oz in 1971 to nearly $50/oz in 1980). The reason for supply inflexibility is that around 80% of mined silver is a side product of base metals. Higher prices for silver do not cause copper, nickel, zinc, lead or other base metal miners to increase their production. In the event of a global stagflation or deflation, demand for base metals should fall, thus further decreasing the supply of mined silver.

There are very few pure silver mines (in the U.S., China, Russia and India) and all of them have depleting reserves. This inflexible supply means that the market cannot expect an increase in mine supply to depress the price after an increase in the silver price. In the event of a global stagflation or deflation slowdown, these base metal miners will not increase production for the sake of silver as demand for the core product would likely fall, thus further decreasing the supply of mined silver.

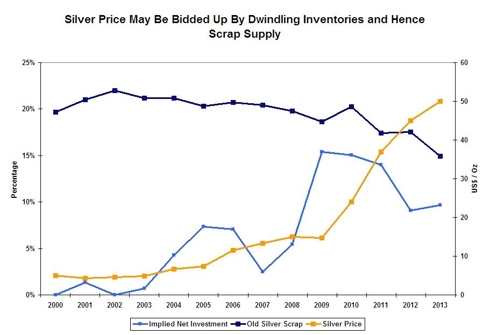

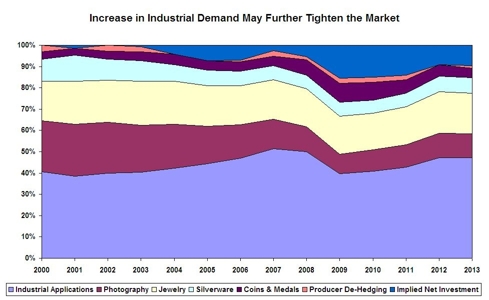

Industrial Demand of Silver is Still Below 2006 Level: Silver remains at a critical fundamental juncture as the silver supply cannot keep up with silver demand and the demand gap will have to be filled by scrap supply, as well as central banks. If this supply comes in, it may have a price impact as holders may ask for better bids than the market to part with their silver.

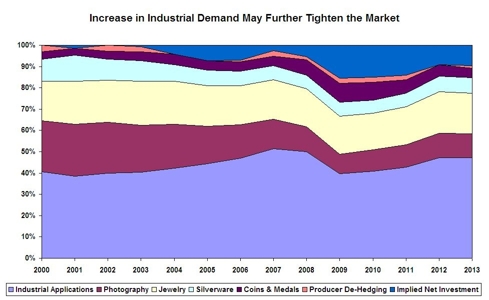

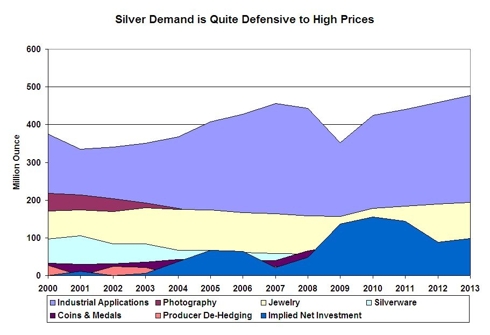

To give a flavor of the demand and supply situation, silver industrial demand in 2010 is estimated at 424 tons, which is below industrial applications demand in 2006. Silver today is mainly used in traditional applications such as mirrors, batteries, medical devices and electrical appliances as well as more recent ones like cell phones, flat-screen televisions, laptops and other modern high tech devices. Increasing industrial demand and application for silver forecast higher prices due to economic growth in the BRIC and frontier markets.

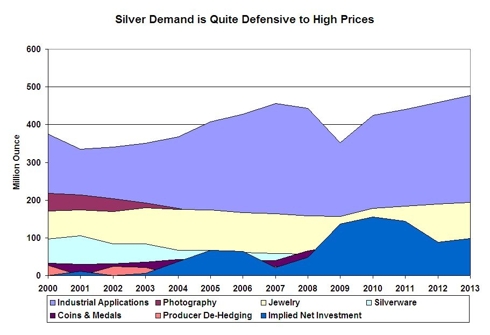

An important difference from gold is that silver is not recycled because of its much lower value. So silver is in a way like oil – as it is consumed and disappears. The increased demand has been met by silver ounces from inventories and official government stockpiles, which today are close to depletion. 80% of silver has been mined as a byproduct of other base metals such as copper, nickel, zinc and lead. In the case of a stagflation / deflation investment demand, an increase may fill in any decline in industrial demand. A further aspect is that silver is used in such small quantities in most industrial applications, that it forms a negligible part of total cost. Increase in silver price has a negligible impact on the total cost of most of the industrial products for which it is used. So demand for silver does not decline because of the effect of high prices. This price defensiveness demand makes silver’s industrial demand distinct compared to other usable commodities like oil. Silver’s unique chemical nature also makes demand defensive as there is a reliable substitute for silver. For instance, for electric conduction the only near substitute in printed circuit boards is gold, which is even more expensive. In photography, there is no substitute at all, because of the unique reaction of silver salts to light.

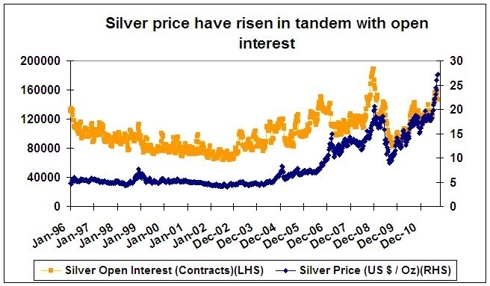

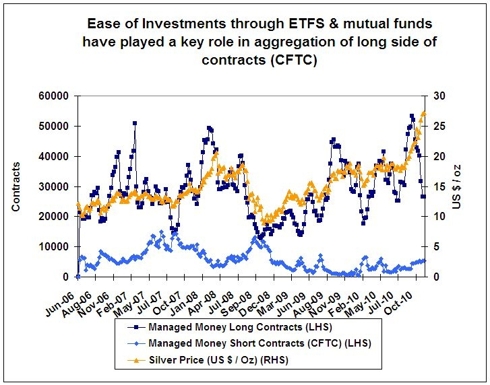

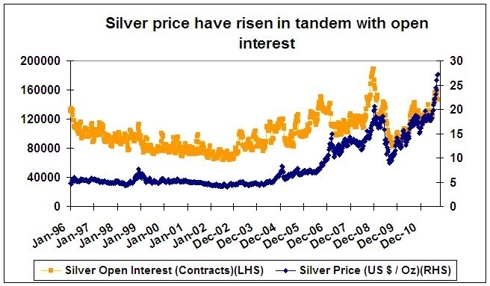

Investment demand: Although silver provides a safe asset to store value in line with gold, it always had the problem of carrying and storage. This has been solved by the ETFs, which hold physical assets. It has opened the investment avenue available to lots of retail investors. There has been a marked increase in investment demand for silver in recent years as witnessed by the investment portion of silver demand and the rise in silver open interest.

Precious metals outperformed most asset classes over a 3, 5 and 10 year period. Silver was a little late to the party. Silver is a business cycle sensitive investment against gold, which is a fear / value / wealth trade. Silver fell to its lowest level relative to gold in early 2009 as the silver price went as low as $8.92, which was 84th of an ounce of gold. However, as the business cycle turned, it became one of the best performing assets in 2010. This outperformance looks set to continue in 2011 due to the very bullish fundamentals. Many silver price predictions are quite aggressive as insiders forecast silver prices to range from US$30 to US$50 / ounce in 2011. The facts and fundamentals which drove silver prices from US$4 / ounce to the current price of US$27 / ounce remain in place. The question is, will silver rival or surpass that of the 1970s inflation adjusted price?

Silver is a commodity which lies between gold and oil in term of industrial / consumer demand and investment demand. This very fact makes silver fundamentally most attractive in a slow recovery amidst lingering risks. Silver is still sitting in the early stage of a bull market that will benefit from any further stimulus driven economic improvement. Silver may have a higher price upside (compared to gold) due to: continuing and increasing global macroeconomic, currency and geopolitical risks; silver's historic role as money and a store of value; the declining and very small supply of silver; significant industrial demand and perhaps most importantly, significant and increasing investment demand.

click to enlarge

Favorable supply and demand balance, continuing global macroeconomic and geopolitical risk and concerns over the emergence of inflation and stagflation as the massive global monetary and fiscal expansion all point to higher silver prices in the long term. In the 1970s, silver rose from under $1.50/oz in 1970 to nearly $50/oz in 1980. In order to replicate its performance in the 1970s, it would have to rise by more than 25 times, resulting in the price possibly rising to over $110/oz. Silver is a hedge against macroeconomic, systemic and inflationary risk with the attractive added potential for significant capital gains. Real asset allocation and diversification would be an important reason to have an allocation of silver. It is worth remembering that silver's record high in 1980 adjusted for inflation (according to US government inflation figures) was some $130/oz (although the final phase of the bubble was due to the Hunt brothers trying to corner the market).

Small allocations by institutional and individual players will see sharp price reactions as the silver market is too small to absorb these effects. Not the least of which is the relative value measured as that of gold to silver, platinum to silver and the oil to silver ratio. These ratios can dip as low as around 42, 2.2 and 52 from current levels of 50, 3 & 61 by the end of early expansion in the business cycle. This implies a 1Y silver price of US$41 / ounce.

Supply is Low and Declining: The current estimated supply of refined silver has come down to less than 200 million ounces from 2.2 billion ounces in 1990 and 1.5 billion ounces in 2001. In 1900, there were 12 billion ounces of silver in the world. It is estimated that 90+% of the refined silver has been eaten away by a chronic deficit in mined silver and industrial usage in global photography, technology, medical, defense and the electronics industries. Since 1990, industrial demand has averaged 1.56 times of the yearly mine production. For every ounce of silver the mines produced, industry consumed one and a half ounces of silver and there is no reason why it will change now. Silver production has been flat in recent years while demand has been increasing. However, today, the U.S. government's stockpile is all but gone, and sales from other official sources are declining, too. Inventories of most of the central banks are down to an unprecedented level. On current supply/demand trends, the amount of above ground refined silver is projected to disappear completely in 2011. Any increase in recycling may only come from private holders of silver, which until this point was non-existent.

Another important aspect of silver supply is its price inelasticity. From a historical perspective, supply didn't increase significantly in the 1970s when silver rose more than 25 times (from $1.40/oz in 1971 to nearly $50/oz in 1980). The reason for supply inflexibility is that around 80% of mined silver is a side product of base metals. Higher prices for silver do not cause copper, nickel, zinc, lead or other base metal miners to increase their production. In the event of a global stagflation or deflation, demand for base metals should fall, thus further decreasing the supply of mined silver.

There are very few pure silver mines (in the U.S., China, Russia and India) and all of them have depleting reserves. This inflexible supply means that the market cannot expect an increase in mine supply to depress the price after an increase in the silver price. In the event of a global stagflation or deflation slowdown, these base metal miners will not increase production for the sake of silver as demand for the core product would likely fall, thus further decreasing the supply of mined silver.

Industrial Demand of Silver is Still Below 2006 Level: Silver remains at a critical fundamental juncture as the silver supply cannot keep up with silver demand and the demand gap will have to be filled by scrap supply, as well as central banks. If this supply comes in, it may have a price impact as holders may ask for better bids than the market to part with their silver.

To give a flavor of the demand and supply situation, silver industrial demand in 2010 is estimated at 424 tons, which is below industrial applications demand in 2006. Silver today is mainly used in traditional applications such as mirrors, batteries, medical devices and electrical appliances as well as more recent ones like cell phones, flat-screen televisions, laptops and other modern high tech devices. Increasing industrial demand and application for silver forecast higher prices due to economic growth in the BRIC and frontier markets.

An important difference from gold is that silver is not recycled because of its much lower value. So silver is in a way like oil – as it is consumed and disappears. The increased demand has been met by silver ounces from inventories and official government stockpiles, which today are close to depletion. 80% of silver has been mined as a byproduct of other base metals such as copper, nickel, zinc and lead. In the case of a stagflation / deflation investment demand, an increase may fill in any decline in industrial demand. A further aspect is that silver is used in such small quantities in most industrial applications, that it forms a negligible part of total cost. Increase in silver price has a negligible impact on the total cost of most of the industrial products for which it is used. So demand for silver does not decline because of the effect of high prices. This price defensiveness demand makes silver’s industrial demand distinct compared to other usable commodities like oil. Silver’s unique chemical nature also makes demand defensive as there is a reliable substitute for silver. For instance, for electric conduction the only near substitute in printed circuit boards is gold, which is even more expensive. In photography, there is no substitute at all, because of the unique reaction of silver salts to light.

Investment demand: Although silver provides a safe asset to store value in line with gold, it always had the problem of carrying and storage. This has been solved by the ETFs, which hold physical assets. It has opened the investment avenue available to lots of retail investors. There has been a marked increase in investment demand for silver in recent years as witnessed by the investment portion of silver demand and the rise in silver open interest.

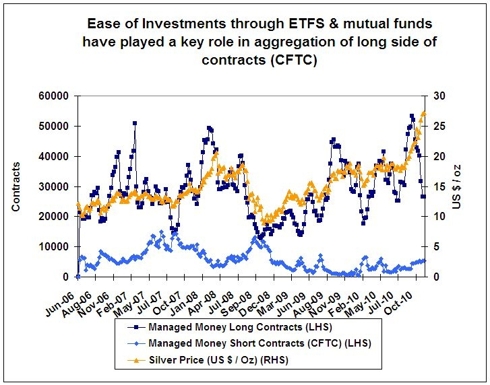

Further, more managed money is allocating an increasing portion of AUMs into the silver market. This can be seen in the rise of CFTC managed money long contracts. Silver faced a recent long liquidation in managed money contracts as its price corrected to US$23 / ounce. Sentiment has reversed, but long contracts are still far below August / September 2010 levels. As long aggregation increases, this may provide short term upside to the silver price.

Investment Strategist Irfan Chaudhry has more than 14 years of investing experience in global equity markets, commodities. real estate and alternative strategies. He has an undegraduate degree in electrical engineering, MBA and is a memeber of CFA Institute. Being passionately curious about the market’s behavior he uses his statistical and financial background to question the common views and profit on the misconceptions. His time is divided mainly to analyzing various markets, energy markets, precious and industrial metals and alternative asset classes.

TOPICS: Business/Economy; Society

KEYWORDS: commodity; investment; silver; stimulus

To: SeekAndFind

Buying Silver a good investment? I guess it is better than driving an electric car but the feed bills are murder.

2

posted on

11/29/2010 8:15:12 AM PST

by

Lazlo in PA

(Now living in a newly minted Red State.)

To: Lazlo in PA

I remember how silver skyrocketed in late 79, and in the course of a few weeks corrected itself. They called the plummet a “healthy correction”.

3

posted on

11/29/2010 8:23:39 AM PST

by

hannibaal

To: hannibaal

Silver is great as long as you don’t have deflation. If that occurs, you get slaughtered.

4

posted on

11/29/2010 8:29:26 AM PST

by

SC_Pete

(pRO)

To: SeekAndFind

5

posted on

11/29/2010 8:41:29 AM PST

by

CPT Clay

(Pick up your weapon and follow me.)

To: SeekAndFind

An important difference from gold is that silver is not recycled because of its much lower value.In photography, there is no substitute at all, because of the unique reaction of silver salts to light.

Interestingly, silver recovery from photographic processes used to be a fairly big business. But consumer film consumption has of course cratered, and this may make silver recovery no longer profitable here.

I am surprised that the segment of his industrial-use chart devoted to photography hasn't shrunk more. Maybe it's the motion picture industry holding it up. And of course even there, film will be going away sooner or later.

6

posted on

11/29/2010 12:34:24 PM PST

by

Erasmus

(Personal goal: Have a bigger carbon footprint than Tony Robbins.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson