Skip to comments.

More Goldman Sachs Secrets that Tim Geithner Might

Not Share with You!

Safehaven ^

| 04/22/09

| Reggie Middleton

Posted on 04/23/2009 5:39:21 AM PDT by TigerLikesRooster

April 22, 2009

More Goldman Sachs Secrets that Tim Geithner Might Not Share with You!

by Reggie Middleton

Okay, this is going to be a quick and dirty review of Goldman's derivative real estate and off balance sheet real estate exposure as is probably reflected through their credit exposure as well.

| OTC Derivative Credit Exposure ($ mn) |

| |

Feb-09 |

% of total |

Nov-09 |

% of total |

Credit Quality Deterioration? |

Comments |

| AAA/Aaa |

$15,387 |

15.6% |

$14,596 |

20.7% |

(5.10%) |

<--Very significant decrease in AAA exposure |

| AA/Aa2 |

$33,820 |

34.2% |

$24,419 |

34.7% |

(0.50%) |

<-- Decrease in AA exposure |

| A/A2 |

$25,291 |

25.6% |

$16,189 |

23.0% |

2.6% |

<-- Significant increase in A exposure |

| BBB/Baa2 |

$9,724 |

9.8% |

$6,558 |

9.3% |

0.5% |

<-- Increase in BBB exposure |

| BB/Ba2 or lower |

$13,354 |

13.5% |

$7,478 |

10.6% |

2.9% |

<-- Very significant increase in non-investment grade (junk) exposure |

| Unrated |

$1,236 |

1.3% |

$1,169 |

1.7% |

(0.40%) |

<-- Marginal decrease in small unrated exposure |

| Total |

$98,812 |

100.0% |

$70,409 |

100.0% |

|

|

(Excerpt) Read more at safehaven.com ...

TOPICS: Business/Economy

KEYWORDS: goldmansachs; greedybastards

Exposure by

asset category |

($ bn) (a) |

(a)

% of Equity |

Incl in L3

(b) ($ bn) |

(b)

% of (a) |

(b)

% of Equity |

| Prime |

$12 |

29% |

$1.7 |

14% |

3.9% |

| Alt-A |

$5 |

12% |

$2.0 |

41% |

4.7% |

| Subprime |

$2 |

4% |

$0.9 |

49% |

2.1% |

| Total |

$19.1 |

45% |

$4.6 |

24% |

10.8% |

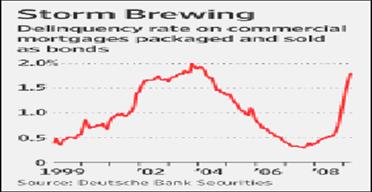

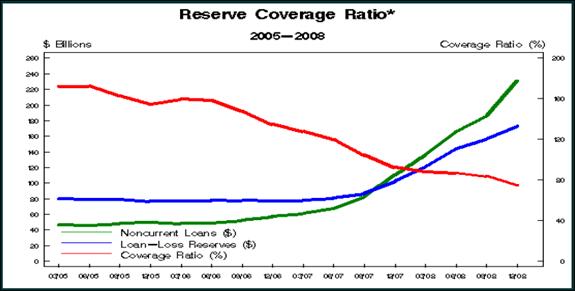

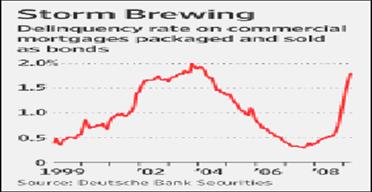

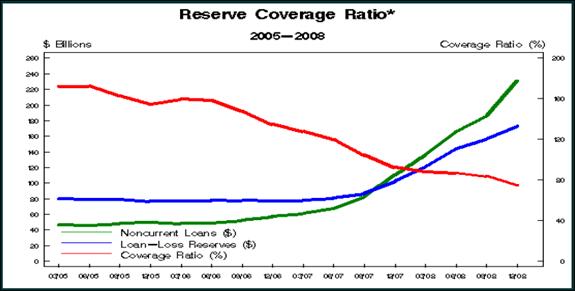

Hmmm! 16% of Goldman's equity is in Alt-A and subprime assets. Alt-a doesn't look to good. Read this article thoroughly (The banking backdrop for 2009 ), then let's move on - or we can just glance at this chart.

To: TigerLikesRooster; PAR35; AndyJackson; Thane_Banquo; nicksaunt; MadLibDisease; happygrl; ...

To: TigerLikesRooster

"The logic of the conspiracy theorists in this regard is, of course, impeccable: Goldman alumnus Josh Bolten runs the White House, while his former boss, Hank Paulson, runs the Treasury. They both speak regularly to former Treasury Secretary Bob Rubin, now over at Citigroup, who ran Goldman before Paulson and who keeps Paulson and Bolton dangling like puppets on a string. They all supposedly touch base with the heads of the Italian and Canadian central banks—both Goldman alumni—and with Robert Zoellick, head of the World Bank, ex Goldman. What's more Paulson is now getting his advice on how to handle the crisis from Ken Wilson, the recently retired Goldman partner and financial-institutions M&A banker, who Paulson just recruited to Washington to help him out. Already at Treasury were Goldman alumni Dan Jester, Anthony Ryan, David Nason and Bob Hoyt, the department's general counsel. And—the conspiracy crowd can't help but point out—Neel Kashkari, 35, a former vice-president at Goldman who Paulson recruited as assistant secretary of international affairs in 2006, has just been appointed—by Paulson—to run, on an interim basis, the new $700 billion bailout fund."~~William Cohan, "Does Goldman Sachs Really Rule the World?" October 2008

3

posted on

04/23/2009 5:52:45 AM PDT

by

Travis McGee

("Foreign Enemies And Traitors" will be ready the first week of May.)

To: TigerLikesRooster

That Nov 09 heading must be a projection or it should be Nov 08, which I think is the case based on text describing GS increasing its real estate holdings.

4

posted on

04/23/2009 5:59:57 AM PDT

by

kabar

To: TigerLikesRooster; M. Espinola; Travis McGee; GOPJ; Calpernia; All

This graph pretty much explains what is happening. It has been posted on my freeper page for over two years. Things will get far worse before they will get better. Obama and his Wall Street handlers are lying. Everybody in government has been lying to us for over six years.

Subprime and Alt-A Mortgages Will Reset Until 2012

Study the graph. We have another four years to go. Most of my friends with real wealth are planning in advance. They want to live in safe havens away from political turmoil. Check my freeper page. Check my recent posts. Do some deep thinking. Wake up, people!

5

posted on

04/23/2009 6:05:16 AM PDT

by

ex-Texan

(Ecclesiastes 5:10 - 20)

To: TigerLikesRooster; ex-Texan

Eye opening data and charts. The market manipulating Big Banking insiders & their strategically placed cohorts in the White House and the Treasury Department are making more $$$ now since they are controlling the financial future, while the general public continues declining in their standard of living.

Additional market problems ahead:

"Michael Mayo of Calyon Securities gave warning of broadening bank losses, which actually roiled the stock market when released. He said, “Mortgage related losses are about halfway to their peak, while credit card and consumer loan losses are only a third of the way to their expected highest levels. The nation’s largest banks may be transitioning from a financial crisis marked by write-downs of capital, to an economic crisis featuring large loan losses.” And then the headline catching report from Calyon Securities suggesting that total bank loan losses could reach 5.5% by the end of year 2010.

Source: http://www.marketoracle.co.uk/Article10074.html

6

posted on

04/23/2009 10:32:41 AM PDT

by

M. Espinola

(Freedom is not 'free'.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson