Disclosure, someday soon, I will have some Apple stock...

Apple Investor's Ping!

If you want on or off the Mac Ping List, Freepmail me.

Posted on 04/11/2009 2:41:23 AM PDT by Swordmaker

This 33-year-old company dominates the consumer market spaces it competes in… has no debt… and is sitting on a cash pile of over $25 billion. In the face of the current recession it continues to do well - unlike many of its competitors.

Back in 1982, you could have purchased 100 shares of this company’s stock for $160. Those same 100 shares would be worth roughly $92,000 dollars at today’s split-adjusted share prices.

That’s a 5,460% return, something most people won’t ever see in a lifetime of investing.

Fortunately for us, this company’s prospects are only looking brighter. In fact, it has plenty of space to grow and do it all over again. And it won’t matter whether you’ve been there from the beginning or jumping into the bandwagon today - the ride looks to be profitable nonetheless.

Let me show you a few reasons why this stock belongs in everyone’s portfolio…

Ignoring Competitors and Analysts

Today, its bewildered competitors plod along, introducing ho-hum, cheap, “me-too” products in a vain attempt to undercut its expensive prices and its ever-increasing market share.

Most of these attempts are pitifully ineffective. Regardless, this company just ignores them. Always executing from a tower of strength, it defines and controls the markets it operates in, rewriting the rules for the other players.

In addition, it creates new markets where none existed before… paradigm-shifting consumers’ lives and thought processes.

The company’s uniquely distinctive advertising and its incredibly thoughtful, aesthetic product designs give it a unique position in the consumer electronics industry. One that it’s not likely to give up anytime soon, if ever.

Numerous analysts have predicted the company’s demise over the years, saying its products are too expensive and won’t sell well in recessionary environments, that it’s a “one man show.”

The company’s response? It ignores the analysts, too. Because they just don’t get it.

You see, it has something that most analysts don’t possess and never seem to be able to put a proper value on:

Apple: The Foremost Consumer Electronics Leader

If you haven’t already guessed, I’m talking about Apple, Inc. (Nasdaq: AAPL), the foremost consumer electronics company in the world. And its stock belongs in everyone’s portfolio.

Granted, I’m a little biased. I’ve owned its products since the 1980s and just can’t imagine living without them.

Its customer base is made up of students, educators, businesses, government agencies and consumers of every sort. The company’s business strategy centers on its ability to design and develop not only its products, but the software operating systems they run on.

Its Mac computers are first class, easy to use and run all the popular software found on Windows machines. And they run those programs better and without all the viruses, spyware, malware and hacker attacks that constantly plague Windows users.

I’ve converted several long-time Windows users to Macs, and once they saw how easy they were to use - and how few problems they had. Afterwards, they wondered why they hadn’t switched over long before.

The company single-handedly redefined the entire music business with its iPod and its iTunes music store. And it did it in a relatively short span of four to five years, generating billions in annual revenues in the process. Its share of the mp3-player market remains well above 75%.

Now it’s doing it again with the iPhone, the slickest smartphone on the market. Sales of the device grew 245% in 2008, according to a Gartner research report. That compares to 96% for Research in Motion and a paltry 0.8% for Nokia.

While the iPhone is number three in terms of overall marketshare (8.2%), it’s clearly growing the fastest, and could easily overtake Nokia and RIM in a couple of years.

In the simplest of terms, Apple has figured out how to create products that most people would design if they could give their two cents to the Apple product development teams. They’re simple and easy to use, just like everyone wants them to be.

Apple’s Cash Cow Just Keeps Getting Bigger…

Apple’s second-quarter financials will be released April 22, in what is always a highly anticipated conference call. The company constantly downplays future expectations when talking to analysts, and then routinely beats them by a wide margin.

This quarter’s results will be particularly interesting, as it will give investors a better idea as to the effect the recession is having on the company. Sso far, Apple has appeared to be somewhat resistant to its effects, helped in no small way by a constant stream of new product innovations and introductions.

However, one of the major sources of future revenue is constantly overlooked by analysts. Whenever the company sells an iPhone, it only books about 10% of the money it receives as revenue, and defers the rest.

It then books this annually over a period of 10 years. This is a constantly increasing future revenue stream that’s like cash in the bank. Great for when times get a little tough.

And then there’s the “Apple effect.” This is logic that goes along the lines of: “If Apple’s (iPhone or iPod) is this good, its computers must be great, too.”

That phenomenon has analysts betting the company will sell 2 to 2.2 million Mac computers for the January-March time period. The company has plenty of room to grow here, too, as it currently has under 10% of the overall PC market.

Given how well the company has been performing so far during this recession, it appears that shares are still cheap. Investors interested in owning a few shares might want to wait until after this quarter’s results are announced on April 22, as there is generally a pullback in the stock after earnings results.

Apple is certainly on top of its game, and I believe it will continue to stay there as long as it continues to make the rules that all its competitors have to follow.

Good investing,

David Fessler

Disclosure, someday soon, I will have some Apple stock...

If you want on or off the Mac Ping List, Freepmail me.

It’s just too bad I didn’t have it way back then.... :-)

Forest Gump and Bubba did real well with Apple, IIRC. :)

Let's see... AAPL currently has a market capitalization (combined value of all stock) of US$106.5 billion. If that were to again rise by 5,460%, it would then have a market capitalization of US$5.8149 TRILLION.

According to the CIA World Factbook, the U.S. had a G.D.P. (official exchange rate) of US$14.33 trillion in 2008. So the author of the article is predicting that Apple's stock will have a value of roughly HALF of our country's G.D.P.

You know, I find that prediction a little incredible.

Regards,

(more than a little)

Apple may or may not be a wise financial investment, but to listen to anyone who is emotionally involved in a company's products for purposes of investment advice, is a huge mistake.

Or to anyone who is sitting on a pile of it. (The stock.)

Yeah, the hype is way over the top. Perhaps Apple will go over $200 again by the end of this year and perhaps head to $300 next year. A great return for a stock, but if the economy recovers there will be lots of stocks doing that. Apple is a very solid company that has a bright future.

Curses on you! How darest thou invect reason into a specious argument?

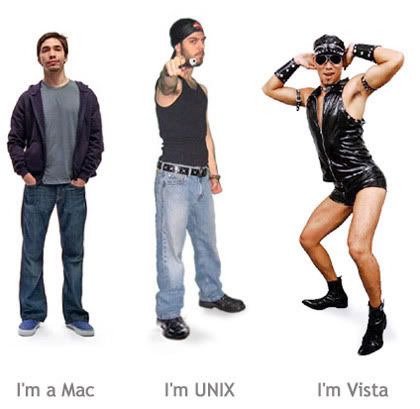

A Unix user would have a better shooting stance.

Other than that, I agree with the image and go Unix.

Thank you.

AAPL stock rocks as i type this from my shiny macbook......while i listen to my ipod.......they are truly on their game....just need rumors of an iBook reader for next hysteria.......

You know, I find that prediction a little incredible.

not if a loaf of bread cost $50 and a gallon of gas $70.... hyperinflation is kewl.

just look to the east and praise TOTUS.

All I had to do was look at the headline and I knew what company it was and who had posted it..

Look, Apple is a great innovator. However, Apple rarely stays at the top of its markets for long.

First, technology companies rarely stay on top of a market they invented.

Second, Apple is known for having too tight a grip on hardware, leading users to migrate to less restricted imitators.

It is that fact that is sending me into Apple's camp when I buy my next computer. I want computer whose hardware and software is all made by the same folks..

Isn’t Steve Jobs on his death bed? What will their stock do when he is six feet under?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.