Posted on 03/29/2009 5:38:34 PM PDT by oldtimer2

Exclusive:

AIG Was Responsible For The Banks' January & February Profitability

Posted by Tyler Durden at 6:35 PM

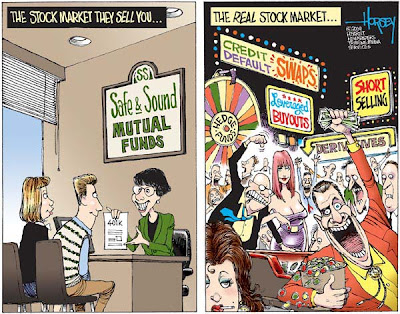

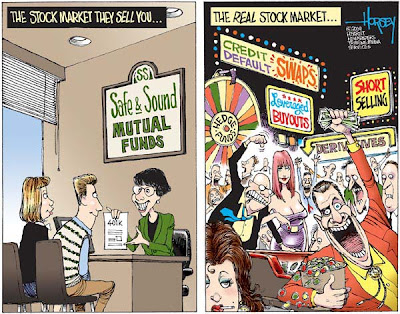

Zero Hedge is rarely speechless, but after receiving this email from a correlation desk trader, we simply had to hold a moment of silence for the phenomenal scam that continues unabated in the financial markets, and now has the full oversight and blessing of the U.S. government, which in turns keeps on duping U.S. taxpayers into believing everything is good.

I present the insider perspective of trader Lou (who wishes to remain anonymous) in its entirety:

"AIG-FP accumulated thousands of trades over the years, all essentially consisted of selling default protection. This was done via a number of structures with really only one criteria - rated at least AA- (if it fit these criteria all OK - as far as I could tell credit assessment was completely outsourced to the rating agencies).

Main products they took on were always levered credit risk, credit-linked notes (collateral and CDS both had to be at least AA-, no joint probability stuff) and AAA or super senior portfolio swaps. Portfolio swaps were either corporate synthetic CDO or asset backed, effectively sub-prime wraps (as per news stories regarding GS and DB).

Credit linked notes are done through single-name CDS desks and a cash desk (for the note collateral) and the portfolio swaps are done through the correlation desk. These trades were done is almost every jurisdiction - wherever AIG had an office they had IB salespeople covering them.

Correlation desks just back their risk out via the single names desks - the correlation desk manages the delta/gamma according to their correlation model. So correlation desks carry model risk but very little market risk.

I was mostly involved in the corporate synthetic CDO side.

During Jan/Feb AIG would call up and just ask for complete unwind prices from the credit desk in the relevant jurisdiction. These were not single deal unwinds as are typically more price transparent - these were whole portfolio unwinds. The size of these unwinds were enormous, the quotes I have heard were "we have never done as big or as profitable trades - ever".

As these trades are unwound, the correlation desk needs to unwind the single name risk through the single name desks - effectively the AIG-FP unwinds caused massive single name protection buying. This caused single name credit to massively underperform equities - run a chart from say last September to current of say S&P 500 and Itraxx - credit has underperformed massively. This is largely due to AIG-FP unwinds.

I can only guess/extrapolate what sort of PnL this put into the major global banks (both correlation and single names desks) during this period. Allowing for significant reserve release and trade PnL, I think for the big correlation players this could have easily been US$1-2bn per bank in this period."

For those to whom this is merely a lot of mumbo-jumbo, let me explain in layman's terms: AIG, knowing it would need to ask for much more capital from the Treasury imminently, decided to throw in the towel, and gifted major bank counter-parties with trades which were egregiously profitable to the banks, and even more egregiously money losing to the U.S. taxpayers, who had to dump more and more cash into AIG, without having the U.S. Treasury Secretary Tim Geithner disclose the real extent of this, for lack of a better word, fraudulent scam.

In simple terms think of it as an auto dealer, which knows that U.S. taxpayers will provide for an infinite amount of money to fund its ongoing sales of horrendous vehicles (think Pontiac Azteks): the company decides to sell all the cars currently in contract, to lessors at far below the amortized market value, thereby generating huge profits for these lessors, as these turn around and sell the cars at a major profit, funded exclusively by U.S. taxpayers (readers should feel free to provide more gripping allegories).

What this all means is that the statements by major banks, i.e. JPM, Citi, and BofA, regarding abnormal profitability in January and February were true, however these profits were a) one-time in nature due to wholesale unwinds of AIG portfolios, b) entirely at the expense of AIG, and thus taxpayers, c) executed with Tim Geithner's (and thus the administration's) full knowledge and intent, d) were basically a transfer of money from taxpayers to banks (in yet another form) using AIG as an intermediary.

For banks to proclaim their profitability in January and February is about as close to criminal hypocrisy as is possible. And again, the taxpayers fund this "one time profit", which causes a market rally, thus allowing the banks to promptly turn around and start selling more expensive equity (soon coming to a prospectus near you), also funded by taxpayers' money flows into the market. If the administration is truly aware of all these events (and if Zero Hedge knows about it, it is safe to say Tim Geithner also got the memo), then the potential fallout would be staggering once this information makes the light of day.

And the conspiracy thickens.

Thanks to an intrepid reader who pointed this out, a month ago ISDA published an amended close out protocol. This protocol would allow non-market close outs, i.e. CDS trade crosses that were not alligned with market bid/offers.

The purpose of the Protocol is to permit parties to agree upfront that in the event of a counterparty default, they will use Close-Out Amount valuation methodology to value trades. Close-Out Amount valuation, which was introduced in the 2002 ISDA Master Agreement, differs from the Market Quotation approach in that it allows participants more flexibility in valuation where market quotations may be difficult to obtain. Of course ISDA made it seems that it was doing a favor to industry participants, very likely dictating under the gun:

Industry participants observed the significant benefits of the Close-Out Amount approach following the default of Lehman Brothers. In launching the Close-Out Amount Protocol, ISDA is facilitating amendment of existing 1992 ISDA Master Agreements by replacing Market Quotation and, if elected, Loss with the Close-Out Amount approach.

"This is yet another example of ISDA helping the industry to coalesce around more efficient and effective practices, while maintaining flexibility," said Robert Pickel, Executive Director and Chief Executive Officer, ISDA. "The Protocol permits parties to value trades in the way that is most appropriate, which greatly enhances smooth functioning of the market in testing circumstances."

And, lo and behold, on the list of adhering parties, AIG takes front and center stage (together with several other parties that probably deserve the microscope treatment).

This wholesale manipulation of markets, investors and taxpayers has gone on long enough

bump for ;ater

All is fair in love and war, and I guess now in banking when it comes to socialism.

I just forwarded this to some people who “should know”! They will not be at all happy!

This whole mess is becoming more clear and more depressing daily. If you think CDO’s and how they were rated and sold is scandalous check out the synthetic CDO’s, check out how these banks manipulated oil prices. Consider how the gubment allowed this ,cheering them on. Check out who were the big contributors for reelections. Check out how all the big news organizations rooted for the banks. Who was watching our backs. Where was the investigative reporting? Where were you Cavuto? Where were you Kudlow? We’re getting close to the time for all good men to come to the aid of their nation.

Be careful how you express that sentiment. The govt could interpet such a remark as calling for an insurection if it is not phrased right.

Maybe I am being paranoid.

Good men are good people and can only do good things for their country.

Yea and I wonder if they are going to contribute to any political campaigns this year? Or maybe their counter parties will for them. Does anyone know if TARP recipients can donate to campaigns?

If this is true, it is scary that they think we are that stupid, and it is scary that the markets went up in response to claims of profits.

I've been wondering whether or not is was really necessary to pay these guys (the guys who caused AIG's September liquidity crisis) this much money to unwind the book and I wondered how good a job they were doing; and the answer seems to be, not a very good job.

In the AIG bonus scandal threads most posters here seemed think that these guys were being unfairly picked upon, that they were Ayn Rand heroes, (Ayn Rand heroes who made 66% of their political contributions to Democrats in the last election cycle) that they had already "saved" the taxpayer some $1.1 trillion, that no one else could do the job that these "talented" employees were doing. If you are willing to give away the store, anyone can unwind the book.

I don’t know enough about these financial affairs but I know that if you only read the msm, everything looks not too bad. If however you follow the obscure journals and blogs, it looks very bad. I am becoming very frightened for our country.

You need to check out the time frame.

The execs were paid for work performed in 2008.

This article is about selling the farm in January and Februaray of 2009.

Ping!

Karl Denninger/Market Ticker comments on this:

http://market-ticker.org/archives/912-Was-This-An-Outright-Scam-AIG-Again.html

They used to hang people for robbing banks. These thieves are stealing the entire banking system and our money with it!

See 18.

Off topic:

After John D. Macdonald had stopped writing, I heard a rumor that he had a final book written and in his files.

Supposedly it would have tied up all strings about Trav McGee and would include black in the title.

Had you heard this and was it true?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.