From Manhattan Institute’s Spending, Taxes & Deficits: A Book of Charts

Posted on 08/02/2025 8:49:33 PM PDT by SeekAndFind

When asked how far the US government has plunged into the red, many fiscally-conscious Americans will tell you the national debt has reached $37 trillion. As distressing as that official number is, America’s true fiscal situation is even worse — far worse. According to a barely-publicized Treasury report, the actual grand total of Uncle Sam’s obligations is more than $151 trillion.

That huge discrepancy springs from the fact that the federal government doesn’t hold itself to the same accounting standards it imposes on businesses. Rather than using accrual accounting — which recognizes expenses when they’re incurred — our Washington overlords self-servingly use simple cash accounting, only recognizing expenses when they’re paid. As a result, discourse on federal obligations solely focuses on the national debt, comprising Treasury bills, notes and bonds.

Once a year, however, an obscure report delivers a more accurate version of Uncle Sam’s balance sheet. While it receives almost no attention from journalists or public officials, the Treasury Department is required to submit an annual report to Congress detailing the government’s financial condition. Critically, the 1994 law compelling this report mandates that it reflect “unfunded liabilities” — that is, commitments made without any dedicated assets or income streams to ensure they’ll be kept.

One of the larger categories of those unfunded liabilities is future federal employee and veterans benefits. At the end of the 2024 fiscal year, this alone represented a $15 trillion obligation. However, by leaps and bounds, the largest unfunded liabilities spring from America’s social insurance obligations — primarily Social Security and Medicare. At fiscal-year end, these liabilities totaled a towering $105.8 trillion.

Stacking these and other unfunded liabilities on top of the publicly-held national debt and other obligations, you arrive at a grand total of $151.3 trillion at the end of the 2024 fiscal year. Offsetting that by an estimated $7.9 trillion in US government commercial assets — including property, plant, equipment and purported gold holdings — a Just Facts analysis puts Uncle Sam at an overall net-negative $143 trillion.

Writing at the Heartland Institute, Just Facts president James Agresti put that nearly-incomprehensible total in perspective: “$143 trillion amounts to 85% of the net wealth Americans have accumulated since the nation’s founding, estimated by the Federal Reserve to be $169 trillion. This includes all of their assets in savings, real estate, corporate stocks, private businesses, and even consumer durable goods like automobiles and furniture.”

Those numbers reflected the government’s position on Sept 30, 2024. They’ve not only grown significantly worse in the intervening months, they’re deteriorating at a blistering pace even as you read this: Not even counting the unfunded liabilities that represent the biggest part of the problem, the national debt alone is increasing at something like $156 million per hour.

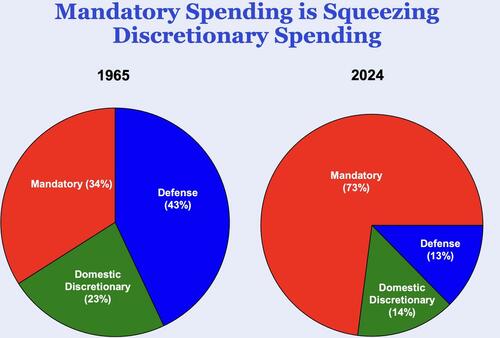

Wrangling over the budget isn’t going to save us. Congressional debates tend to center on discretionary spending — outlays that require a vote by Congress during the appropriations process. However, America’s steady march to insolvency is driven by so-called mandatory spending, which is hardwired by previously-enacted laws.

In what may be the most ominous indication that the government is on an autopilot-course for catastrophe, the proportion of total federal outlays driven by mandatory spending has more than doubled since 1965 — from 34% to 73% in 2024. It was at 71% just two years earlier, in 2022.

From Manhattan Institute’s Spending, Taxes & Deficits: A Book of Charts

The two largest examples of mandatory spending are Social Security and Medicare. Those old-age programs are now well within sight of a crisis that’s been warned about for a generation: According to the latest report from their program trustees, Social Security and Medicare trust funds are now just seven years from insolvency.

While the federal government requires private-sector pension plans to maintain assets equal to the present value of future obligations, the federal government exempts itself from providing the same security to the citizens that it forces into the Social Security program. Contrary to the mythology that payroll taxes are placed in individual “accounts” held for our future benefit, that money is immediately being dished out to other people who’ve already reached the benefit-receiving phase — which is why Social Security can be reasonably compared to a Ponzi scheme.

Because the ratio of taxpaying-workers to beneficiaries is in steady decline — from 5.1 in 1960 to 2.7 in 2023 — Social Security payouts have exceeded revenues for the last 15 years. As a result, the Social Security and Medicare trust funds are set to run out in 2033. Under the law governing Social Security, payouts that year will be limited to program incomes — which will translate to a sudden 23% cut in payouts.

While that represents a political time bomb, don’t expect any urgency in defusing it. The eight-year countdown is short, but it’s still outside the next-election framing that drives elected officials’ actions. Those politicians know that anyone proposing a long-overdue rethinking of Social Security and Medicare will be opportunistically accused of “attacking” the programs. However, when the crisis is finally in their laps, don’t be surprised if part of their solution is to borrow money to prop up the payouts.

There’s another key component of mandatory spending that isn’t counted in the national debt: interest payments on debt issued to cover past and current spending. “In total, social programs and interest on the national debt—which mainly stems from social programs—account for 75% of all federal spending,” notes Agresti.

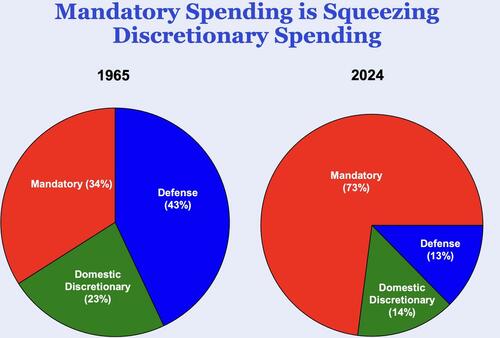

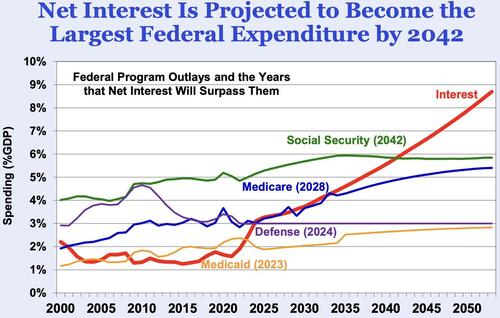

Interest payments also represent a steadily growing share of total outlays, and will total almost $1 trillion this year. Within 10 years, interest is projected to reach $2 trillion, roughly equal to the entire 2025 deficit. Last year saw a grim milestone, as interest expense surpassed spending on both defense and Medicare.

From Manhattan Institute’s Spending, Taxes & Deficits: A Book of Charts

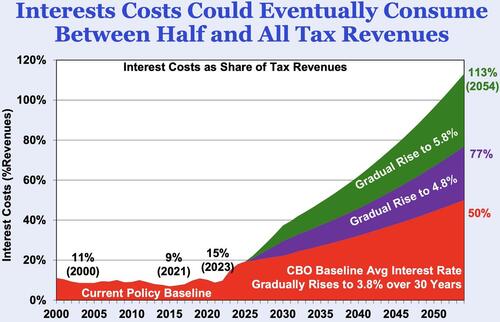

Current projections have interest surpassing Social Security to become the largest single expenditure by 2042, but don’t be surprised if that milestone doesn’t come sooner. The government is already descending into a vicious cycle in which mounting US debt has the buyers of that debt demanding higher interest rates in compensation for the growing risk of inflation and/or default — with those higher rates creating larger interest payouts and even more debt.

Beyond mandatory-vs-discretionary, and funded-vs-unfunded, there’s an even more important but far-less-discussed classification of spending that goes to the very heart of America’s march toward financial disaster: constitutional vs unconstitutional. As I noted in the most-read article at Stark Realities, “Americans Are Fighting For Control Of Federal Powers That Shouldn’t Exist”:

Today’s sprawling federal government, which involves itself in almost every aspect of daily American life, is almost entirely unconstitutional.

To rattle off just a random fistful of the federal government’s unauthorized undertakings and entities — brace yourself — there is zero constitutional authority for the Social Security, Medicare, federal drug prohibitions, the Small Business Administration, crop subsidies, the Department of Labor, automotive fuel efficiency standards, climate regulations, the Federal Reserve, union regulation, housing subsidies, the Department of Agriculture, workplace regulations, the Department of Education, federal student loans, the Food and Drug Administration, food stamps, unemployment insurance or light bulb regulations. Even that sampling doesn’t begin to fully account for the scope of the unsanctioned activity.

This Pandora’s box of unconstitutional endeavors was opened wide by unconscionably expansive Supreme Court interpretations of the Constitution in the 1930s. It’s no coincidence that federal spending represented a mere 3% of GDP in 1930 but soared to an economy-warping 23% by 2024.

Now we find the federal government in a $143 trillion hole, a burden that comes out to $1,085,022 per US household. History suggests this will end with a government default. In the United States, that will likely occur not via an explicit repudiation of the debt, but through rampant price inflation as the Treasury and the Federal Reserve conspire to create new money out of thin air to make debt payments.

From Manhattan Institute’s Spending, Taxes & Deficits: A Book of Charts

“They can’t pay the debt, so they have to liquidate the debt,” said Ron Paul in a June conversation with David Lin. “They [won’t] default — they’re always going to pay something for the Treasury bills. What they’re going to do is liquidate the debt by paying it off with counterfeit money.”

While the Fed-Treasury money creation scheme has been with us for a long time, the alarming trajectory of federal debt and spending point to future money-printing on a scale that will trigger hyperinflation and economic collapse. At that point, Americans will stand at a crossroads. Desperation and fear will make them susceptible to the siren song of even more authoritarianism and unconstitutional, centralized command of the economy and society than what put them in such dire straits to begin with.

“People will want to be taken care of,” Paul said. “I see it as an opportunity. If people are promoting the cause of liberty and there’s chaos in the streets, we better get out there and lead the charge and say you don’t need more of what caused this. You don’t need more authoritarianism. What you need is more liberty and more peace, and that means you ought to obey the Constitution.”

These are results for how much is spent on government social programs a year

Search instead for how much is sprnt on government social programs a year

AI Overview

In 2024, the US federal government spent approximately $1.5 trillion on Social Security alone. Total federal spending, including all programs, reached $6.8 trillion. A significant portion of this, around $1.1 trillion, is allocated to various welfare programs, according to EPIC for America.

Here’s a more detailed breakdown:

Social Security: This one program consumed $1.5 trillion in fiscal year 2024.

**Welfare Spending: Federal, state, and local governments combined spent roughly $5.543 trillion on social programs in 2023, according to Just Facts. This includes programs like SNAP, housing assistance, and Medicaid.

Total Federal Spending: The total federal budget for 2024 was $6.8 trillion.

Welfare as a Percentage of Spending: Welfare programs represent a substantial portion of the federal budget, with some estimates placing it at around 20%.

State and Local Contributions: State and local governments also contribute significantly to social welfare programs, with some estimates suggesting they add about $744 billion annually.

Historical Context: Over the past few decades, spending on welfare programs has significantly increased as a percentage of the federal budget.**

Libertarians are terrible economists.

No talk about revenue. Spending is half the problem.

Let me share a story. There was a man standing in Congress warning everyone about the bubble getting ready to pop soon in 2008. I listened to that man and sold out all my property investments for cash. I tripled on my investments. Two weeks after I collected my escrows the bubble popped and everyone lost their butts. That man was Ron Paul.

Libertarians are free traitors that I have no use for.

How so?

This came up during municipal failures to pay pensions or even to fund streetlight maintenance, vs make the interest payments on their municipal bond issuance.

It is a matter of priority in law, not in preference. People are always going to want to say those rich people holding $5 million in bonds should not be getting their interest payments before we pay for streetlights. But that is what the law says.

Understand what “default” means. If you fail to make an interest payment on even a small bond, the law says that is default and ALL debt instruments become due and payable immediately. You don’t get to pick and choose what debt you pay when in default. It is ALL due and payable.

So these unfunded liabilities are there and failure to pay them will go to court, but they are not, in law, an equivalent in priority liability to explicit bonds. Note btw that the foreign holdings of the $37T are 23% of the total at latest measure, which is not all that recent and countries have been divesting. The vast majority of US debt is held domestically.

To be fair, during the GM bailout process of 2009, GM’s unions went to court and got all the bondholders screwed so they could have higher pay. It’s been a while but my vague recall is the judge declared the bailout was going to avoid default and since there was no default, the bonds could be reduce in priority (by him). I know this was appealed but those were Obama years and the bondholders were declared evil by the media.

The article was about the size of US debt, not about the definition of default.

I must not have been clear.

If failure to pay a bill does not trigger default, then it is not debt.

So you’re saying that only if there is or can be failure to pay consequences is money owed, is that right?

The article was about U.S OBLIGATIONS.

So you’re saying that only if there is or can be failure to pay consequences is money owed, is that right?

The article was about U.S OBLIGATIONS.

Nope it used the word debt. Debt has a specific meaning.

Nope it used the word debt. Debt has a specific meaning. Can’t have the word debt anywhere in the article unless there is an equating, which there cannot be.

Nope.

Look at the title,

Look at the first paragraph..

It is about what the UnitedStates OWES.

Any further deflection reveals intellectual dishonesty.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.