Posted on 06/05/2024 10:08:24 PM PDT by SeekAndFind

It turns out renters and homeowners are living in two entirely different economies, at least according to a new study by the Federal Reserve—which, ironically enough, made it happen.

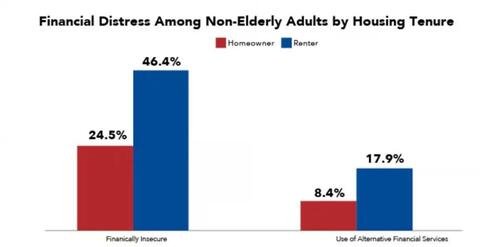

In short, renters are in dire straits financially, while homeowners are “continuing to reap the rewards” of cheap pandemic money that left renters with nothing but inflation.

This is “complicating” the Fed’s crystal ball as homeowners continue to splurge on everything from travel to eating out, “propping up prices with their discretionary spending power.”

Of course, the Fed’s money printers are what are propping up prices. But the robust homeowner spending means they’re not seeing the distress.

That process goes on turbo when they crank up the money printers, which they did during the pandemic to the tune of $7 trillion fresh dollars—one in three.

Hence the media’s favorite economic theme these days: why Americans can’t see the glory of Bidenomics. After all, if you’re a journalist at The New York Times, or an economics professor at Harvard, everybody at your dinner parties owns a home. They own stocks. They’re doing great, regaling one another with explanations of their investing acumen.

Alas, the 90 percent aren’t at those dinner parties to regale. They can only speak in ballot boxes.

Renters are more likely to not be able to pay the electric, water, or gas bill in the past month, and they report much higher rates of financial anxiety.

This all might rankle when CNN lectures them about how amazing the economy is.

It’s a whole other world for homeowners, who overwhelmingly refinanced during the pandemic at average rates around 3 percent, taking hundreds of thousands out of their Fed-pumped homes.

They plowed a good chunk of that money into stocks, which also soared thanks to the Fed’s near-zero interest rates—the so-called everything bubble. Courtesy of the Fed.

That means homeowners actually saved money compared with pre-pandemic. They had a larger mortgage, sure, but at 3 percent, the Fed actually lowered their monthly nut.

When the smoke cleared, the money-printing orgy was a bonanza for the wealthy. And it was a cruel joke on everybody else, above all on the young stuck watching that ship sail further and further away, giving up on starting a family, instead returning to Mom’s basement to complain about capitalism.

This means that government policies are bedazzled in sweet nothings about the less fortunate or, these days, the under-represented. But when the music stops, somehow the poor don’t get a thing; it is the wealthy who got the goodies.

The solution’s easy: Get the government out of the economy. End the Fed, drain the swamp.

Of course, they’ll fight that with everything they’ve got.

Sounds like they are trying to stir up class envy now.

rent or mortgage. You still have living expenses to pay and while where the money goes is different, the rest of the expenses, medical, fuel, car, food, etc, are the same.

Here in L.A. on the left coast a small single apartment in a decent neighborhood can demand $1,800 a month, while a two-bedroom can easily top $3,500. Utilities not included, and good luck trying to get garage parking.

The cheap money era led to high valuations in the two markets that always “get fat” when cheap money rules.

“Real estate & equities.”

As long as there are buyers with access to debt/credit this position will hold. The “fun starts” when financing bloated assets gets harder & harder, as the bankers get tighter & tighter.

> the rest of the expenses, medical, fuel, car, food, etc, are the same.

Don’t know if you’ve been to the grocery store lately, or have to buy car or homeowners insurance. Those things have gone up incredibly in the last couple of years. Me, I’m going to vamoose to a different country for a couple or ten years.

>> In short, renters are in dire straits financially

“You will own nothing, and be miserable.” :-)

Oops, The Great Reset is The Great Epic FAIL. Bye bye Klaus! Have a nice afterlife...

As was the O-BodyMortgage complete exploitation.

RICO

Actually, out right fascist exploitation, right out of the banking Bushes Playbook. Con-gress, and the Executive Imposter, own their homes-estates outright, zero mortgages.

Ever see Pence’s “home”...or any of them?

No, there are 2 separate classes.

* 1. Those that actually possess zero Mortgages.

And

* 2. Those that are both property, AND body mortgage.

Look up the derivation of “mortgage”. It means “Death-Grip”.

Here in a surrounding Boston city a one bed can run 2800 and a 2 bed 3200. For the cheaper one bed 2100 and 2500 for a 2 bed...but good luck finding a 2 bed at 2500.

In 1984, I paid $1,000/month for a 2 bedroom apartment in LA.

Doesn’t seem to me rent has gone up as much as other things. My new Toyota SR5 pickup cost me $13,000 in ‘84. A new Tacoma is $40-$50K now.

Yup, turning one Citizen against another

All the while not seeing the folks causing all the pain.

You still need a job to either pay rent or a mortgage.

Them jobs are disappearing. Folks need three side gigs to make ends meet

Where do you charge your battery car?

finally someone is putting all the pieces together.

If you OWN a home or property, inflation helps you, if you don’t... you are screwed.

“Housing: Renters and Owners Live in Separate Economies”

Always have, and always will. This is not “news”, this is, as someone stated, stirring up class envy.

Not necessarily.

Granted you may get more for your house if you sell it, BUT, you will also be paying a lot more to buy a new one.

Owners?

SNORT.

In states with property taxes, like NYS, you don’t own your home.

You rent it from Deep State.

And some people we know who’ve been trying to sell are finding out the hard way that while people are willing to pay through the nose to buy the house, they don’t want the confiscatory property tax bills that come with it.

We own a very, very small, very, very inexpensive home.

New apartments have more square footage.

Our friends and family used to think we were nuts.

Not anymore.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.