Posted on 02/01/2024 6:17:51 AM PST by Red Badger

Heads up folks…

I’ve been on my soapbox sounding the alarm about the banking system for the past several months.

We had 6 banks crash and collapse last year in 2023 and many thought the Banking Crash was over.

I kept telling you it wasn’t.

I kept telling you I feared that was just the prelude.

This is one of those times I wished I was wrong, but it’s not looking like I will be.

In fact, it’s looking like the Bank Crash 2.0 is right around the corner.

Here’s what’s happening right now as I type this:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~\\\ Disclose.tv @disclosetv · Follow JUST IN - New York Community Bancorp stock crashes, trading halted. 8:45 AM · Jan 31, 2024

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This is what the chart looks like:

This is the same bank that bought Signature Bank last year….gee, I guess the contagion spread?

Who would have thought?

James Lavish @jameslavish · Follow While everyone is focused on Mag7s, NYCB - New York Community Bancorp (yes, the bank that bought troubled Signature Bank last year) announced a $260M loss in Q4, and the stock opened down 40%.

What was in that loan portfolio?

Many are calling this the “death candle”:

I asked Grok if New York Community Bank is collapsing and here’s what it said:

Quote: “It is facing significant challenges….[but]…..it would be premature to conclude the bank is failing.

Anyone else get echoes of Jim Cramer in 2009 when you hear that?

“BEAR STERNS IS FINE!”

Remember this?

KRAMER VIDEO AT LINK...............

Look, I’m not a financial advisor….

I’m not an accountant….

I’m not a TV guru like Jim Cramer (thank God!).

I’m just a reporter and a dot-connector and I’m telling you I think a major crash is right around the corner.

I think it’s likely this bank fully goes under or gets bought out….

I think you see a much bigger name go down next, and if I had to pick one I’d say it’s Citibank….

And I'll leave you with this....

The time to get prepared is NOT after the crash starts.

The time to get prepared is now.

And while I'm not a financial advisor, I will tell you Gold and Silver have always been God's money and they historically are safe-havens in times of massive financial crashes.

That is, if you can find any.

Branch closures happen because there is almost no foot traffic at the physical locations. It is expensive to handle a face to face transaction these days.

15 years ago, I would make deposits at the local branch at least two times as week. I knew the manager well. I could name most of the tellers.

I went into the branch for the first time in months the other day. The place was a ghost town.

Everything is online now. Closing branches is financially a good decision. As long as your support systems online are adequate, there isn’t anything that cannot be done online or on the phone.

I have some thousands with Well Fargo and will be moving it *all* out in a few days. I had been planning to anyway. So this will leave me with Chase, TD Bank and Fidelity.

The 5 Safest Banks in the United States

https://nomadcapitalist.com/finance/safest-banks-in-the-us/

APMEX, JM Bullion, Gainesville Coins, for internet purchase. Best is local coin shows, cash.

Stay away from bullion, go with “ coins of the realm”, US Eagles, junk silver, Morgan’s Peace dollars if you can find them.

Warning: do NOT go into PM’s to make “ money “, it is financial insurance, like life insurance, car insurance, house insurance, health insurance…. If you don’t have “ Financial Insurance “, you are not to bright.

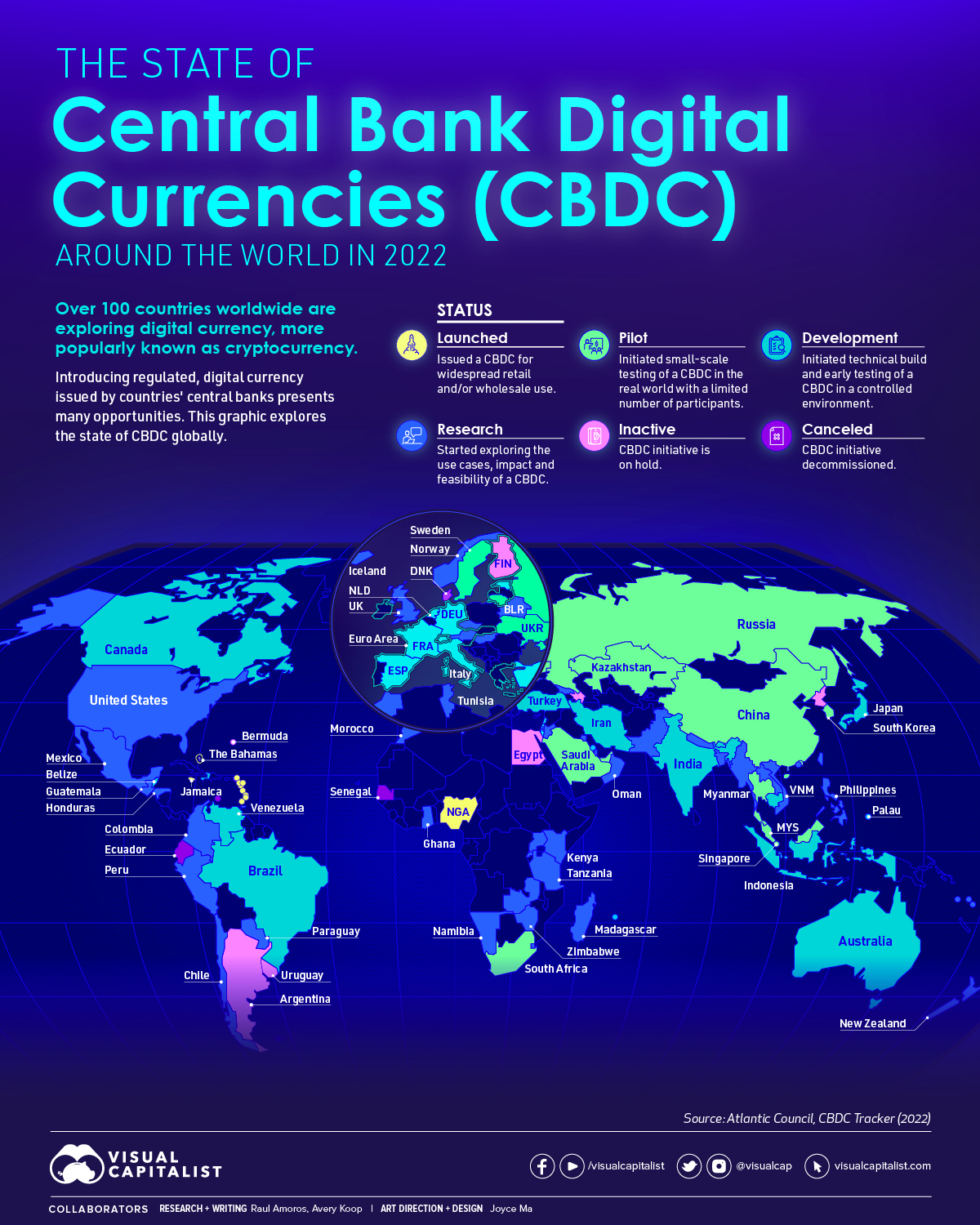

You know what’ll fix that problem? A big juicy CBDC. /s

Closing branches is financially a good decision.

——

For “ them”, no one will see the lines of people lining up to try and get their money out.

“Stay away from bullion, go with “ coins of the realm...” “

The article says the opposite. What was your rationale for avoiding bullion?

Thanks.

“...it is financial insurance...”

That’d be the only reason to do it.

I’m VERY WELL ‘invested’ in other PMs — lead, brass — but have avoided gold/silver due to its short-term volatility.

It’s funny you think that “the common folk” have money in the bank. (Joking)

Honestly, MOST people have less than $1,000 in their checking accounts. I know thats probably not the case for a lot of folks around here. But “we” would get our cash out long before they failed. And the FDIC would cover most people.

We won’t see bank runs like the Depression. It will be an “orderly” collapse...until it isn’t. Ha Ha.

Thanks; I would do that too.

Thanks.

Great movie!

Everyone should own some Bitcoin in my opinion , the hardest currency the world has ever known. If we get to the SHTF scenario it will be safe from confiscation, and it will be usable anywhere in the world with many purveyors of goods and services. Precious metals will need to be transported while Bitcoin is in the ether. Having a mix of assets is the best protection.

Be careful, there are Chinese fake gold coins showing up in supposedly reputable coin shops, some even have fake certifications.

https://www.youtube.com/watch?v=wXOHBK3XBYM

What to consider if your local bank branch closes

https://www.dailymail.co.uk/yourmoney/banks/article-13025343/bank-closue-Bank-Wells-Fargo-Bank-America-PNC-options.html

Since I work in banking, I can tell you none of the Big 4 are going to collapse - Citi, Wells, Chase, BofA.

The holders of commercial real estate debt are unfortunately, regional banks. Some of them are going to be in serious trouble when they have to admit those loans are toxic and take write downs.

Since I work in banking, I can tell you none of the Big 4 are going to collapse - Citi, Wells, Chase, BofA.

Of course not, the US Taxpayer has their backs.

That too. Ultimately the feds will not allow them to collapse. They also don’t hold a lot of the riskiest and most toxic assets this time around.

I work in risk management.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.