Posted on 03/06/2023 4:58:58 PM PST by SeekAndFind

The U.S. Supreme Court has heard different arguments from supporters and opponents of President Joe Biden’s student debt forgiveness program. It is probable that the justices will rule before June. However, it is important to remember a few challenges.

Student loans are an essential tool to help maximize the number of citizens that have access to the best and most exclusive tuition. American universities are among the top in the world and high-quality tuition comes with an elevated cost. To help the disadvantaged access top universities it is important to have a thriving and affordable loan system, a solid grant program and an open market that supports the majority, including those who are not in university yet.

We must aim to make the current system better, not maintain it disguising the problem with a deficit-financed subsidy.

A student loan debt relief program does nothing to solve the cost of tuition. It justifies it and will likely make fees rise again as universities see that the government subsidizes those that may take a difficult-to-pay loan. Furthermore, by providing a subsidy to the already indebted, banks may have an incentive to give loans to students with less probability to repay them. It is likely to create a wave of non-performing loans predicated on the view that this scheme will be prolonged and even increased. The reader may say that I am exaggerating, which I find interesting when we are living every day the result of debt accumulation excess.

A student loan debt relief program is a subsidy to take risky debt. It penalizes those that paid their loans and those that access new tuition, and it incentivizes others who did not take student loans and worked their way through college to take a risky loan. It may sound like a clever idea on paper, but it helps an exceedingly small proportion of citizens while hurting everyone else. Why? Because the loan relief program is paid with higher deficit, which means higher taxes and more inflation now and in the future. There is no revenue measure that finances this scheme because the government already runs a massive deficit. One cannot think of this measure without considering that the Federal budget runs an unsustainable deficit and that there has been no discussion of any budget cuts to finance this program, let alone the structural deficit.

Providing a subsidy to students that cannot pay their loans does not help them consume more. First, even if that were the case, the impact on total consumption of those that receive the relief compared to the negative effect for those that suffer higher taxes and persistent inflation does not even move the needle. However, I believe that the impact on consumption even for those benefitted by the program will be limited. It is unlikely that a partial bailout of the debt of a citizen is going to make a complete reversal of that person’s credit score. A partial debt release will make a small impact on one family or citizen, but extraordinarily little to consider this a stimulus for the economy.

If the debt relief of students is considered a stimulus for the economy that will boost consumption, why do the same proponents ask for constant increases in taxes for those that can consume and invest?

Would it not be easier to provide a tax deduction scheme that allows all those who take student loans to benefit from lower personal income burdens? Furthermore, would it not be better to agree with the financial system on support to help re-finance and re-structure non-performing loans in order to provide a market-oriented relief instead of a subsidy to excess debt?

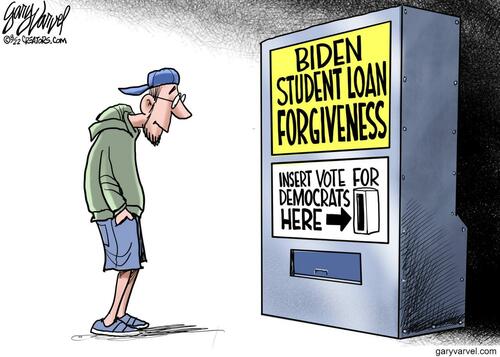

The problem of the debt relief program is that it needs to be a subsidy so that the ones that receive it think that it was the government who helped them, not the taxpayers and consumers, who are the ones that pay for it in higher inflation and taxes. Any other, and more reasonable, alternatives do not create votes. If we looked for better alternatives, we would be thinking of providing support through a market-based re-structuring of debt and avoid the negative consequences of perpetuating and increasing tuition fees and elevated inflation as well as penalizing those that paid their debt. This student loan relief helps a few thousand to hurt millions.

There are numerous ways to facilitate a re-structuring of high debt burdens and the financial system can help to make it quickly and efficiently.

Of course, there must be ways of support to those students that took loans they cannot repay today. It must be a tailored, ad-hoc re-structuring that does not create negative perverse incentives for everyone else to take credit they cannot afford. It can include tax deductions for talented students.

The same students that think it is a promising idea to receive this relief will also pay for it in high inflation and higher taxes for longer.

He keeps saying “cannot repay”.

A lot of it is will not , don’t want to and why should I have to.

It was a bad idea when zerohisseff made it a federal deal...with an eye towards this eventuality, I feel sure. And it’s a horrible idea to shift the cost of a black trans basket weavers in sub-sahara Africa degree on to Bob the cabinet maker.

Get to the Root of the Problem….the institutions themselves.

#1. Academia needs skin i the game. They need to hold the bag on the loans they push students/parents into.

I always go back to this simple concept:

“Who hired the money?”

If we re-set the student loan problem about half of the colleges in the country would go out of business tomorrow.

That’s not a bad thing.

The smart colleges have been building up their endowments; they know the end is nigh.

The GI Bill has been around for a long, long time. It is a way to get the federal government to pay for a college education (or a trade school education).

I would not object to someone who finds themself in way over their head in student debt either getting some of that debt paid off via new legislation that says if they go in the military or the Peace Corp or some other public service position for say ten to fifteen years.

Another thought is that some college courses or even trade school courses are not worth taking. I also believe that for some people the most seemingly bizarre course can be very valuable. One of the courses that Steve Jobs took that had a profound impact on Apple Computer was a course on calligraphy.

Still some courses in women's studies, or 12th Century Comparative Art History may not be worth the tuition dollars and debt. Going to college to stay out drinking until 2 AM in the morning while sleeping through classes is not a good expenditure of tuition.

I think that universities need to exhibit a bit more “tough love” toward the students to borrow huge amounts of money. Some counseling on not only what electives to take, but can they pay off the loans they are incurring is warranted. I understand that if you walk into a car dealership they will try to sell you the most expensive model they can, but college/universities should be a little more about “educating” the person so they become a “success.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.