Posted on 01/21/2023 10:57:10 AM PST by SoConPubbie

President Trump transmitted a message to congress, warning them not to cut Social Security and Medicare {Direct Rumble Link}. Many politicians and pundits will look at Trump’s position from the perspective of it being good to campaign for older voters, but that’s not the core of his reasoning.

In 2016 CTH was the first place to evaluate the totality of President Trump’s economic policies; specifically, as those policies related to the entitlement programs around Social Security and Medicare. We outlined the approach Trump was putting forth and the way he was approaching the issue. In the years that followed, he was right. He was creating a U.S. economy that could sustain all of the elements the traditional political class were calling “unsustainable.”

Before getting to the details, here’s his video message and policy as delivered yesterday. WATCH:

TRUMP: We must protect Social Security and Medicare

Fortunately, we do not have to guess if President Trump is correct. We have his actual economic policy results to look at and see how the expansion of the economy was creating the type of growth that would sustain Social Security and Medicare. This was/is MAGAnomics at work.

♦ On Social Security – Unlike many other 2016 Republican candidates, Donald Trump did NOT call for rapid or wholesale changes to the current Social Security program; and there’s a very good reason why he was the only candidate who did not propose wholesale changes.

With the single caveat of “high income retirees” (over $250k annually), which previously Trump said he was open to negotiating on, President Trump does not consider these programs as “entitlements”. The American people pay into them, and the federal government has an obligation to fulfill the promises made upon collection.

To fully understand how Donald Trump views the solvency of Social Security, you must again understand his economic model and how it outlines growth.

The issue with Social Security, as viewed by Trump, is more of an issue with receipts and expenditures. If the aggregate U.S. economy is growing by a factor larger than the distribution needed to fulfill its entitlement obligations, then no wholesale change on expenditure is needed. The focus needs to be on continued and successful economic growth.

What you will find in all of Donald Trump’s positions, is a paradigm shift he necessarily understood must take place in order to accomplish the long-term goals for the U.S. citizen as it relates to “entitlements” or “structural benefits”.

What you will find in all of Donald Trump’s positions, is a paradigm shift he necessarily understood must take place in order to accomplish the long-term goals for the U.S. citizen as it relates to “entitlements” or “structural benefits”.

All other candidates and politicians begin their policy proposals with a fundamentally divergent perception of the U.S. economy.

The customary political economy theory, carried by most politicians, positions them with an outlook of the U.S. economy based on “services”; a service-based economic model.

While this economic path has been created by decades old U.S. policy and is ultimately the only historical economic path now taught in school, President Trump initiated his economy policy with the intention to change the dynamic entirely, and that’s exactly what he did.

Because so many shifts -policy nudges- have taken place in the past several decades, few academics and even fewer MSM observers, were able to understand how to get off this path and chart a better course.

Donald Trump proposed less dependence on foreign companies for cheap goods, (the cornerstone of a service economy) and a return to a more balanced U.S. larger economic model where the manufacturing and production base can be re-established and competitive based on American entrepreneurship and innovation. This is the essence of MAGAnomics.

The key words in the prior statement are “dependence” and “balanced”. When a nation has an industrial manufacturing balance within the GDP there is far less dependence on the economic activity in global markets. In essence the U.S. can sustain itself, absorb global economic fluctuations and expand itself or contract itself depending on the free market.

When there is no balance, there is no longer a free market. The free market is sacrificed in favor of dependency, whether it’s foreign oil or foreign manufacturing, the dependency outcome is essentially the same. Without balance there is an inherent loss of economic independence, and a consequential increase in economic risk.

No other economy in the world innovates like the U.S.A. President Donald Trump saw/sees this as a key advantage across all industry – including manufacturing and technology.

The benefit of cheap overseas labor, which is considered a global market disadvantage for the U.S., is offset by utilizing innovation and energy independence. This was the core of the economic program that created so much immediate GDP growth in 2017, 2018 and 2019.

2017: […] “This policy will be successful in moving the U.S. economy away from low-growth secular stagnation towards significantly more buoyant performance. We would not be taken by surprise by a doubling of the growth rate of real GDP in the U.S. over the next two years, nor by a further significant move up of equity valuations and a material further appreciation of the dollar.” ~ David Folkerts-Landau, Chief Economist, Deutsche Bank

The third highest variable cost of goods beyond raw materials first, labor second, is energy. If the U.S. energy sector was unleashed -and fully developed- the manufacturing price of any given product would allow for global trade competition even with higher U.S. wage prices. This is why President Trump traveled to Saudi Arabia as his first foreign trip, followed closely by a trip to Asia. He was putting the basics of his U.S. economic policy into place.

Additionally, the U.S. has a key strategic advantage with raw manufacturing materials such as: iron ore, coal, steel, precious metals and vast mineral assets which are needed in most new modern era manufacturing. President Trump proposed we stopped selling these valuable national assets to countries we compete against – they belong to the American people; they should be used for the benefit of American citizens. Period. This was the central point of the Steel and Aluminum tariffs.

EXAMPLE: Prior to President Trump, China was buying and recycling our heavy (steel) and light (aluminum) metal products (for pennies on the original manufacturing dollar) and then using those metals to reproduce manufactured goods for sale back to the U.S.

As President, Donald Trump stopped that practice immediately, triggering a policy expectation that we do the manufacturing ourselves with the utilization of our own resources. Then he leveraged any sales of these raw materials in our international trade agreements.

When you combine FULL resource development (in a modern era) with the removal of over-burdensome regulatory and compliance systems, necessarily filled with enormous bureaucratic costs, Donald Trump began lowering the cost of production and the U.S. became globally competitive. In essence, Trump changed the economic paradigm, and we no longer were a dependent nation relying on a service driven economic model.

When you combine FULL resource development (in a modern era) with the removal of over-burdensome regulatory and compliance systems, necessarily filled with enormous bureaucratic costs, Donald Trump began lowering the cost of production and the U.S. became globally competitive. In essence, Trump changed the economic paradigm, and we no longer were a dependent nation relying on a service driven economic model.

The cornerstone to the success of this economic turnaround was the keen capability of the U.S. worker to innovate on their own platforms. Americans, more than any country in the world, just know how to get things accomplished. Independence and self-sufficiency are part of the DNA of the larger American workforce.

In addition, as we saw in 2018 and 2019, an unquantifiable benefit came from investment, where the smart money play -to get increased return on investment- became putting capital INTO the U.S. economy, instead of purchasing foreign stocks.

With all of the above opportunities in mind, this is how President Trump put us on a pathway to rebuilding our national infrastructure.

The demand for labor increased, and as a consequence so too did the U.S. wage rate which was stagnant (or non-existent) for the past three decades.

As the wage rate increased, and as the economy expanded, the governmental dependency model was reshaped and simultaneously receipts to the U.S. treasury improved.

More money into the U.S Treasury and less dependence on welfare/social service programs have a combined exponential impact. You gain a dollar and have no need to spend a dollar – the saved sum is doubled. That was how the SSI and safety net programs were positioned under President Trump. Again, this is MAGAnomics.

When you elevate your America First economic thinking you begin to see that all of the “entitlements” or expenditures become more affordable with an economy that is fully functional.

As the GDP of the U.S. expands, so does our ability to meet the growing need of the retiring U.S. worker. We stop thinking about how to best divide a limited economic pie and begin thinking about how many more economic pies we can create. Simply put, we begin to….

We know it works, because we have the results to cite.

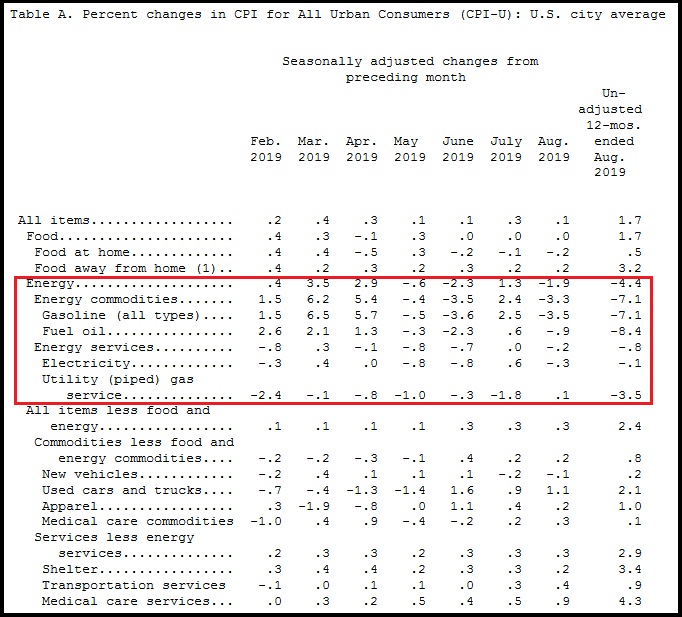

Right before the pandemic would hit a few months later…. Despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them saying Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation, it just wasn’t happening!

Overall year-over-year inflation was hovering around 1.7 percent [Table-A BLS]; yup, that was our inflation rate. The rate in the latter half of 2019 was firmed up with less month-over-month fluctuation, and the rate basically remained consistent. [See Below] The U.S. economy was on a smooth glide path, strong, stable and Main Street was growing with MAGAnomics at work.

A couple of important points. First, unleashing the energy sector to drive down overall costs to consumers and industry outputs was a key part of President Trump’s America-First MAGAnomic initiative. Lower energy prices help the worker economy, middle class and average American more than any other sector.

Which brings us to the second important point. Notice how food prices had very low year-over-year inflation, 0.5 percent. That is a combination of two key issues: low energy costs, and the fracturing of Big Ag hold on the farm production and the export dynamic:

(BLS) […] The index for food at home declined for the third month in a row, falling 0.2 percent. The index for meats, poultry, fish, and eggs decreased 0.7 percent in August as the index for eggs fell 2.6 percent. The index for fruits and vegetables, which rose in July, fell 0.5 percent in August; the index for fresh fruits declined 1.4 percent, but the index for fresh vegetables rose 0.4 percent. The index for cereals and bakery products fell 0.3 percent in August after rising 0.3 percent in July. (link)

For the previous twenty years food prices had been increasingly controlled by Big Ag, and not by normal supply and demand. The commodity market became a ‘controlled market’. U.S. food outputs (farm production) was controlled and exported to keep the U.S. consumer paying optimal prices.

President Trump’s trade reset was disrupting this process. As farm products were less exported the cost of the food in our supermarket became reconnected to a ‘more normal’ supply and demand cycle. Food prices dropped and our pantry costs were lowered.

The Commerce Dept. then announced that retail sales climbed by 0.4 percent in August 2019, twice as high as the 0.2 percent analysts had predicted. The result highlighted retail sales strength of more than 4 percent year-over-year. These excellent results came on the heels of blowout data in July, when households boosted purchases of cars and clothing.

The better-than-expected number stemmed largely from a 1.8 percent jump in spending vehicles. Online sales, meanwhile, also continued to climb, rising 1.6 percent. That’s similar to July 2019, when Amazon held its two-day, blowout Prime Day sale. (link)

Despite the efforts to remove and impeach President Trump, it did not look like middle-class America was overly concerned about the noise coming from the pundits. Likely that’s because blue-collar wages were higher, Main Street inflation was lower, and overall consumer confidence was strong. Yes, MAGAnomics was working.

Additionally, remember all those MSM hours and newspaper column inches where the professional financial pundits were claiming Trump’s tariffs were going to cause massive increases in prices of consumer goods?

Well, exactly the opposite happened [BLS report] Import prices were continuing to drop:

This was a really interesting dynamic that no-one in the professional punditry would dare explain.

Donald Trump’s tariffs were targeted to specific sectors of imported products. [Steel, Aluminum, and a host of smaller sectors etc.] However, when the EU and China respond by devaluing their currency, that approach hit all products imported, not just the tariff goods.

Because the EU and China were driving up the value of the dollar, everything we were importing became cheaper. Not just imports from Europe and China, but actually imports from everywhere. All imports were entering the U.S. at substantially lower prices.

This meant when we imported products, we were also importing deflation.

This price result is exactly the opposite of what the economic experts and Wall Street pundits predicted back in 2017 and 2018 when they were pushing the rapid price increase narrative.

Because all the export dependent economies were reacting with such urgency to retain their access to the U.S. market, aggregate import prices were actually lower than they were when the Trump tariffs began:

[…] Prices for imports from China edged down 0.1 percent in August following decreases of 0.2 percent in both July and June. Import prices from China have not advanced on a monthly basis since ticking up 0.1 percent in May 2018. The price index for imports from China fell 1.6 percent for the year ended in August.

[…] Import prices from the European Union fell 0.2 percent in August and 0.3 percent over the past 12 months.

So yes, we know President Trump can save Social Security and Medicare by expanding the economy with his America First economic policy. We do not need to guess if it is possible or listen to pundits theorize about his approach being some random ‘catch phrase’ disconnected from reality. Yes folks, we have the receipts.

This was MAGAnomics at work, and this is entirely what created the middle-class MAGA coalition. No other Republican candidate has this economic policy in their outlook because all other candidates are purchased by the Wall Street multinationals.

America First MAGAnomics is unique to President Trump because he is the only one independent enough to implement them.

That’s just the reality of the situation.

MAGA for life.

He will fix it.

When he’s back in office, I’ll be tired of winning again.

Social Security isn’t operating in the red right now. As Reagan said, those who blame Social Security for our federal deficits and debt (here’s looking at you, Mitch McConnell), are lying or ignorant. The Social Security tax, plus interest on Social Security bonds, currently covers the cost of Social Security payouts. Those who want to cut Social Security payouts seek to use the Social Security tax money to pay for their own pet programs, like foreign aid and social services for illegal aliens.

They’ve dipped their toes in so why not right? 😡

Years ago the Tenn legislature sued, on behalf of their constituents, the Soetero Administration over having to cover Medicare/Medicaid payments to the refugees that were settled in the state by Soetero. Suit was that since the refugees were being forced on them, the Tenn taxpayers shouldn’t also be forced to pay the bills. The Reds should.

The Tenn legislature had to hire outside counsel to represent it and that was used against them.

Eventually the case was tossed. The judge said that since neither the Governor, nor the Tenn AG, participated in the suit, the legislature had no STANDING. Hard to imagine that the elected representatives closest to the people had no standing.

Right now Florida is suing to force the Biden administration to enforce immigration law, as it’s required to do. I’m assuming it’s in response to the recent boat people showing up on Floridas shores.

How wonderful would it be if EVERY state signed onto the Rlorida suit and that same group also picked up the baton from the Tennessee lawsuit and refiled it?

All of that leads to me asking, how great it would be to get all these illegals off Medicaid/Medicare, SSI, and any other entitlement that is helping bleed these programs?

Old article but why were they getting them anyway?

https://www.cbpp.org/research/thousands-of-poor-refugees-face-loss-of-ssi-benefits

In short - Trump suggests that if we can considerably grow the economy the additional tax revenues from a higher growth economy can cover the IOUs owed to the social security fund.

I would vote for that solution if it was written into law that all federal income tax revenue exceeding budgeted/expected income tax revnue MUST be dedicated to paying off “federal debt” beginning with the IOUs held by social security to the extent covering those IOUs is needed for covering benefit paymemnts. Unless such an economic growth solution is made into law, it is no guarantee it is a long term, long running solution.

That's correct.

The childishly simplistic idea that mere "economic growth" will fix long-term Soc. Sec. liabilities completely ignores the past reality that all extra government revenue growth, and more, has always been immediately SPENT on everything from tranny-appreciation programs to green-energy scams to overseas wars.

So, Trump just wants us to allow all these programs to remain uncut, running up our deficit, just as he did while President, until, he hopes, he’s elected again. Then he finally promises to do something, if, he were to somehow win.

Forget it. Sounds like Cloward-Piven in action actually. A lot of these programs are likely ripe for some cuts, since they’ve already been hiding behind “social security” for decades.

Social Security Programs in the United States

https://www.ssa.gov/policy/docs/progdesc/sspus/index.html

Social Insurance Programs

Old-Age, Survivors, and Disability Insurance (OASDI)

Old-Age, Survivors, and Disability Insurance

Unemployment Insurance

Workers’ Compensation

Temporary Disability Insurance

Health Insurance and Health Services

Medicare

Medicaid

Programs for Specific Groups

Veterans’ Benefits

Government Employee Retirement Systems

Railroad Retirement

Assistance Programs

Supplemental Security Income

Temporary Assistance for Needy Families

Food and Nutrition Assistance

Housing Assistance

Low-Income Home Energy Assistance

General Assistance

“The childishly simplistic idea that mere “economic growth” will fix long-term Soc. Sec. liabilities completely ignores the past reality that all extra government revenue growth, and more, has always been immediately SPENT on everything from tranny-appreciation programs to green-energy scams to overseas wars.”

Yes. Even under Trump, on the excuse it was needed due to Covid, federal expenditures went up $1 trillion plus. And maybe if that had been the end of it, and no 2nd Covid “stimulus” and no additional Joe Biden trillions, tax revenues now COULD HAVE exceeded budgeted/expected tax revenue and even made a “surplus” which could have started to pay down federal debt and/or covered IOUs that Social Security had to cash in. But it would not have held up, to that purpose, or into the future (which is what is needed) unless a law tied Congress and the President’s hands to insure it would be done.

You prefer Biden. We get it.

That sounds like a mere fantasy nowadays.

“But do not cut the benefits our seniors worked for and paid for their entire lives. Save Social Security, don’t destroy it.”

Trump’s exact words...He was referring to the SS retirement and medicare pkgs for those over 66 years of age who worked and paid for it...

he did not refer to the other plans under the SS plan...He has, in other comments, said a lot of these have to be eliminated (the border protections he would impose)

Trump was an outstanding President and would be even more outstanding if he has some help instead of opposition for “professional politicians of BOTH parties)

Easiest fix in the world

Take all non-citizens off

IF one is accepted into the country and if mom and dad are accepted too they can get on ss.

Cut that out.

End SSDI

End all government retirement plans. Roll them into SSS.

Voila, all better.

“That sounds like a mere fantasy nowadays.”

Minus the excessive Covid “stimulus” bills, and minus Biden, it could have been possible - according to current revenue due to the Trump tax cuts.

No, I'm simply to the right of Trump. Where we don't like people telling us big government budgets are untouchable. Especially from those that already have a history of running up record deficits.

I think he has a rally tonight.

I’m watching Diamond’s funeral on RSBN now, and he’s supposed to speak.

Here’s a path to a solution. I think it has to look something like this, because simply cutting benefits in the short run is too draconian:

Pick the right actuarial age, maybe it’s 45, maybe it’s 50. That part I leave to the actuaries. Offer the individuals over that actuarially calculated age to continue benefits as before for those over that age.

For those younger (mandatory) than this, and for those older who opt for this, provide a one-time buyout into their private account. Again, the exact amount of the buyout I leave to the actuaries. The investment vehicles in the private accounts would be similar to the “Target 20xx” accounts that many investment houses offer today. But from that point on, individuals are on their own. The government does not get to, in any way, shape, or form, get to vote on any corporate issues. Hard wall between government and corporations.

This is all very high level, and some more extreme cases will fall through the cracks. Yes, there will be pain. Hopefully, families and charities can ease that pain. But properly done, it will avoid the coming certain disaster that will hit all of us.

Similar programs to be created for Medicare.

Every year that passes by the unfunded future liabilities will shrink as people die off. Eventually, 40 or 50 years later, the unfunded liabilities will be zero.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.