Posted on 01/03/2023 10:04:06 AM PST by SeekAndFind

A Prudential Pulse survey finds large percentages of millennials, gen Z and women struggle with finances. The result is more gig work...

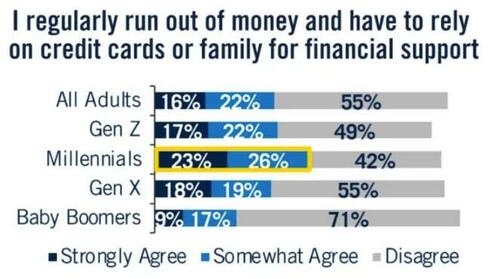

Nearly half of millennials agree or somewhat agree with the statement "I regularly run out of money and have to rely on credit cards or family for financial support."

Please consider Generational Gap Grows: Work & Money Outlook Divided

Job Hopping to Increase Pay or Better Work Balance

Younger generations continue to drive the Great Resignation: One-third of millennials and 46% of Gen Z have switched employers since the start of the pandemic — a stark contrast compared to 29% of all workers.

Job-hopping for paycheck-bumping: Younger generations are more likely to say that the best way to increase their earning potential is to change employers every few years, with 41% of millennial workers and 44% of Gen Z workers expressing this belief, compared to 36% of all workers.

Younger generations look to employers for help: Almost 6 in 10 Gen Z (58%) and millennial (57%) workers believe their employer has a responsibility to help them feel more financially empowered.

Flexibility strong against the dollar: Conversely, over the past year, 29% of millennials who switched jobs took a pay cut, with more than 1 in 4 millennials who took a pay cut explaining they did so in order to achieve a better work/life balance.

Salary not sufficing: 49% of millennials and 48% of Gen Z don’t believe that a salary is going to be enough to achieve their financial goals.

Growth in gig work: 70% of all workers have pursued or considered pursuing gig work to supplement their income over the past year. This is even higher among Gen Z (81%) and millennials (77%) — roughly a quarter of whom hope that their gig work will one day be their full-time job.

Gig work seen as a temporary option: Most workers who are considering or are pursuing gig work (34%) say they are only doing it until their main source of income can fully sustain their financial needs.

Looking to others for financial help: Half of millennials say they regularly run out of money and have to rely on credit cards or family for financial support, and 65% of millennials and Gen Z have received financial support in the past two years from either parents, significant others, relatives or grandparents.

Emergency savings funds in crisis: 50% of all respondents have less than $500 or no emergency savings fund. Nearly 4 in 10 (39%) of both millennials and Gen Z report having no emergency savings at all.

Debt taking a toll: 55% of millennials say that debt is preventing them from accomplishing personal goals, such as owning a home and having kids; 33% of millennials and 32% of Gen Z say student loan debt is a barrier to accomplishing those personal goals.

Social obligations turn financial burden: 46% of millennials and 48% of Gen Z say they’d be able to spend more on personal goals if they did not have to spend on friends’ and family members’ life milestones like wedding gifts, baby gifts, or milestone birthday celebrations and gifts.

Not keeping a budget or prioritizing investing: Nearly 70% of millennials and Gen Z do not keep a formal budget; 44% of Gen Z and 38% of millennials do not invest.

A shaky situation: 4 in 10 women (41%) strongly agree that the economic environment has made them more concerned about their financial security (compared to 34% of men). Alarmingly, only 56% of all women have an emergency savings account (compared to 73% of men).

Income is stretched: More than half of women (53%) say they cannot afford their current lifestyle or are barely getting by — just 40% of men say the same.

Feeling the stress: More than one-third of women (36%) report experiencing health or mental health issues as a result of financial stress (versus 28% of men). More than 4 in 10 women (45%) say they have trouble sleeping for the same reason (versus 36% of men).

The stunner to me was the growth in gig work. Many want to work less but are working more because they have to.

81% of zoomers and 77% of millennials have pursued or considered pursuing gig work to supplement their income over the past year.

Undoubtedly, it's not just gig work but rather any part-time work, especially the leisure and hospitality sector.

Yesterday I noted Act Your Wage is the New Meme as Career Ambitions Plunge

There's no time to do extra unpaid work when you need a second part-time job just to pay the bills.

This also explains Quiet Quitting, Are You Doing Only What's Necessary at Work and No More?

Sentiment is pessimistic and many zoomers are flat out giving up on the American dream of owning a home.

I am going to gather some data from the BLS this week to tie some of these ideas together.

* * *

Reality is sinking in for the younger crowd. Need money? Don’t have enough to get by? Either upgrade your skills, or work more.

The long-term political effect will be interesting. Usually those who have to work and pay taxes moderate their leftist views.

I’m thinking, much of this is not new. When I was younger, I was more carefree about spending. I didn’t worry too much about going into debt. I just figured playing dodgeball with debt collector (in those days) phone calls and letters was just the way things would be for a while.

Later on, I started getting better jobs and was able to save.

Once I saved enough, I was ready to look for a nicer place to live and a nicer car to drive. At that point, I began to face my debt situation. After many years of paying things off, I had better credit again.

I am presuming this happens to a lot of people once they leave the family home and need to pay their own bills.

At least people can get jobs, unlike Obama’s first term.

Behavior can help — get an education, work hard, spend less than you make, save money, etc.

But, really, there is a limit to what behavior can do. The demographics indicate that as Baby Boomers retire (something well underway) there will simply not be sufficient numbers of people working, producing, consuming, and paying taxes. Our economic system (and this is true around the world) has been built on the idea of lots and lots of productive people pushing economies into overdrive. That’s over. There aren’t enough young people. It’s not a fixable problem in any real sense.

The good times are over.

My daughter has one main job that pays just OK. I think she has 3-4 other gigs plus the occasional wedding planner gig. She’s an artist mentality with some of the artist skills. One of her gigs is face painting at parties. She recently got a $500 gig for a couple hours.

If there are fewer workers, you would expect wages to be relatively higher, and the returns on the investment that retirees are holding to be relatively lower. But the demographics aren’t that bad - there are more millennials than Baby Boomers.

Why would anyone worry about financials when we are all going to die from global warming, racism, offensive statements, etc?

Boy. That’s a LOT of low-hanging fruit for Dave Ramsey to pick off!

Love the guy. Between his system/advice and my naturally frugal bent I retired, debt free, at 56.

Works every time it’s tried. :)

It’s not. 30 years ago I had to go to my parents to get money to get my wisdom teeth removed. They needed to go and I couldn’t afford it even with a full time job and a couple of really good babysitting gigs and a Saturday receptionist job.

I had a job switch and to maintain health insurance for a month it went to a credit card and I took 6 months to pay it.

Since then, I got better jobs and gig money went to vacations. I did gig work less and less. Picking in it up again as supplemental retirement income.

https://www.merriam-webster.com/dictionary/gig%20worker

: a person who works temporary jobs typically in the service sector as an independent contractor or freelancer : a worker in the gig economy

Gig workers have freedoms that most full-timers only dream of: setting their own hours, working from home, being their own bosses. No wonder the gig economy comprised 16 percent of all workers by 2015, according to research by economists Lawrence Katz and Alan Krueger.

—Andy Sullivan

In addition to having more stable space, the affluent often have greater latitude to remain inside it. They can work on Zoom, shop on Amazon and have gig workers deliver meals.

HENCE the democrats demand that any payment over $600 requires a 1099.

WHAT’S THAT ONY FANS MODEL??? You thought those 85,000 IRS agents were for millionaires and billionaires.

It’s nice to have the choice to work vs only the pressing need. I’m semi-retired now, but work a few days a week.

Just enough for social interaction and a small amount of fresh disposable cash.

exactly. My experience was similar to yours.

I got married when I was twenty one and in less than a year I enlisted in the USAF. The Air Force taught me to be a telecommunications troubleshooter, and I was hired in the wide open field in the civilian world.

When I was laid-off at the age of 61, Verizon stamped me retired and I rolled over my one lump sum grandfathered pension into my 401k account and then transferred it to private management. I had two years notice unofficially of my eventual layoff, so when it happened, my wife had the house note paid, the car loans were paid and every credit card was a zero balance. My wife still cried about the layoff even though she knew we were OK.

I didn't want to take my SS benefit and get harshly penalized for applying early. So we lived a few years on my healthy severance package that was in the bank.

In forty years I never asked for a raise but almost always got them. The two times I felt I was not treated well I was employed with the competition within a week and under better circumstances.

Looking back, it seems like I just drifted through it but I was a company man all the way. Twice I was the last man employed in large offices, up to one hundred people, Supervisors, Managers and Senior Managers were let go, where I shut off the lights and was the last man out the door, to report for work at another location.

You handle your money with great prudence and long term planning.

A lot could learn from controlling the impulse to spend sort of like that mountain climber: “Because it is there!”

This is why credit card debt has soared while consumer spending has held steady. Younger people are charging basic expenses rather than cutting back on spending.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.