Posted on 06/14/2022 6:51:00 AM PDT by blam

Until recently, many strategists had assumed central banks would prefer to live with rising inflation rather than put economic growth at risk. Events in the last few days are causing them to rethink that.

“More hawkish central banks last week reminded us that inflation is their prime concern, while activity/growth and markets are lesser considerations,” say Barclays strategists including Matthew Joyce.

It’s such concerns that are behind the latest selloff in equities, both in Europe and beyond. Joyce and his colleagues say plunging consumer confidence may indicate a direct impact on growth from the inflation situation, and recommend keeping an overweight on defensive stocks, as well as on value shares.

These worries have been lingering for some time. During an informal Bloomberg survey in December, investors named a hasty policy shift by central banks to tame rising prices as the biggest potential downside risk for global stocks. Back then, most investors saw US inflation of 4% to 6% as high enough to derail markets, and it’s now topped 8% for three consecutive months.

No wonder then that investor sentiment has been crushed, while volatility has awakened to a risk that’s been embedded in credit spreads for several weeks.

The biggest issue for stocks might be that fast-paced rate hikes pose multiple challenges at once: higher borrowing costs for companies, a weaker consumer, lower growth and uncertain outlooks. Now with bond yields rising across the curves, some might wonder if the next sovereign-debt crisis is creeping in.

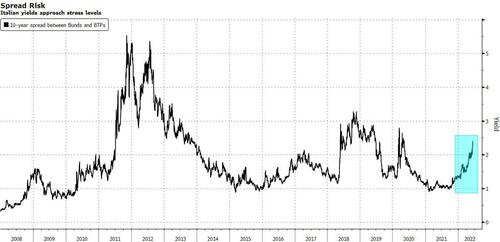

“Dormant sovereign risk is starting to wake up,” say Goldman Sachs strategists led by Peter Oppenheimer. The spread between Italian and German debt isn’t yet at levels seen at the height of the last crisis, but the higher the rates, the tougher it is for a government to sustainably pay its debts, according to Goldman economists. At current rates, Italy is already in the “danger zone,” they say.

With the chances rising of bigger and faster rate increases, equities may need to start paying less attention to central-bank guidance, which in the past had helped gauge their intentions.

“The problem as we enter the next couple of Fed and ECB meetings is that the central banks haven’t quite been able to let go of forward guidance and are a little trapped,” says Deutsche Bank macro strategist Jim Reid. “Providing clarity is admirable, but in the wake of another shocking US CPI print on Friday, should a 75bps hike not be a serious consideration?” And some strategists are now floating the possibility of a 100 basis point hike on Wednesday.

And it’s not just that unsettling equities. According to Patrick Linden, managing director at Clartan Associes in Germany, inflationary pressures are being amplified as the side effects of the Ukraine invasion and Chinese Covid-19 restrictions make it harder to revive post-pandemic logistics chains.

“All together this fuels the vulnerability of the markets,” Linden says.

Not going to be good for the ‘grasshoppers’ of the world - just sayin …

Economic growth assumes more goods and services being produced and tendered. I see a heavy demand for goods but an inability for supply chains to deliver. I think we are simply selling scraps from warehouses. Very little is being produced.

Too little! Too late!

Raising rates isn’t going to work. Inflation is primarily being driven by the rising cost of energy. Energy cost are rising because of Biden and his merry band of idiots. Raising interest rates will cause some demand destruction, but it will not attack the primary cause of our current bout of inflation.

Imagine if you have a house. Part of the attic has inadequate insulation so you are losing heat. Raising interstate rates is like adding insulation to the part of the attic that is well insulated. It will help a little but it doesn’t fix the real problem fix energy policy and you fix inflation.

They'll have you begging for an electric vehicle just to reduce your energy costs in the near future.

A problem there is that (last I read) 40% of the electric that we're presently using is generated from EVIL natural gas.

You'll have outrageous energy bill the rest of your lives....there's no way back. Even Trump won't be able to fix...to much damage has already been done by Democrats.

Gee, hope it doesn’t peak around, oh, September / October and interfere with the midterms. /shiny side out

The Virginia State Bar has disbarred Virginia attorneys for deliberately misleading opposing counsel or the court. If they are consistent, they will do the same to the Commonwealth’s Attorney here.

Sorry, wrong thread.

Too much fear. I predict big rally after FOMC on Wednesday.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.