Posted on 06/05/2022 1:34:21 PM PDT by blam

Has the ESG fraud bubble finally burst? More than two years ago, long before Elon Musk joined the growing anti-ESG bandwagon, we were the first to slam ESG as nothing but the latest Wall Street scam meant to fast-track gains for all those hypocrites who pretended to care about the environment but really had found a quick and efficient way of parting fools from their money (see from Feb 2020 “Behold The “Green” Scam” and from April 2020 “The Fraud That Is ESG Strikes Again: Six Of Top 10 ESG Funds Underperform The S&P500“).

Well, it appears that after years of forced capital allocations, the party is over and the bubble has burst. As Bloomberg writes, this year’s weak performance by US stocks has forced many investors to recalibrate their portfolios. And they’re fleeing “do-good” scams strategies.

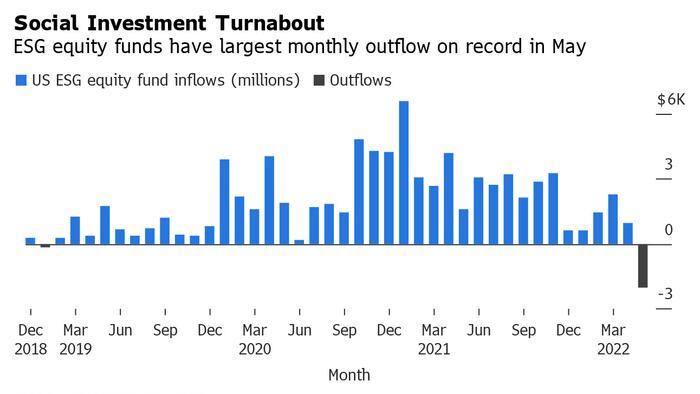

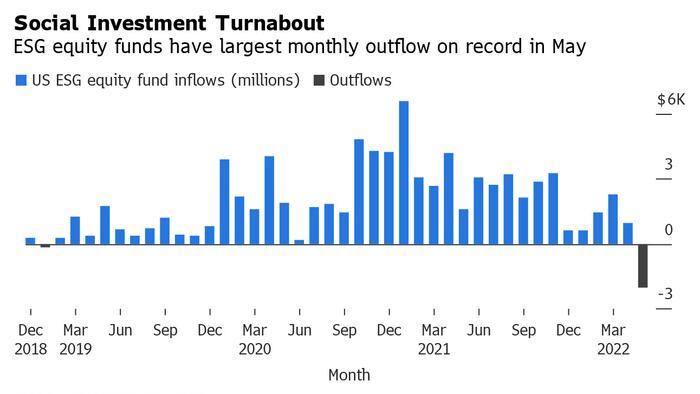

After more than three years of inflows, investors are now pulling cash out of US equity exchange-traded funds with higher environmental, social and governance standards. May saw $2 billion of outflows from ESG equity funds, according to data from Bloomberg Intelligence — the biggest monthly cash pullback ever.

“There’s no way to know for certain why the outflows were so extreme,” said Bloomberg Intelligence analyst James Seyffart, who noted that the funds had started from a high-asset base after years of inflows. “But also ESG ETFs may be finding that people care a lot more about them in bull markets.”

Do-good investing boomed during the pandemic, with more than $68 billion flowing into ESG equity funds in the past two years. Many believed that this momentum would continue into 2022. But the spike in oil prices since Russia invaded Ukraine has lifted fossil-fuel shares, driving the S&P 500 Energy Index to gain 59% this year even as the benchmark overall has dropped 14%.

This has made do-good investing more of a sacrifice. RBC Wealth Management recently surveyed over 900 of its US-based clients and 49% said that performance and returns were a higher priority than ESG impact, up from 42% last year.

“The story has been told that you don’t have to give up returns in order to do ESG, but everyone assumed that you would get the same exact return profile as a traditional benchmark, which is absolutely not true because traditional benchmarks are not looking at ESG factors,” said Kent McClanahan, vice president of responsible investing at RBC Wealth Management.

He added that social and environmental policy can take time to implement, so investors should focus more on longer-term payoffs. “You would think that now more than ever, people will be looking to ESG investing given what we are seeing in the energy markets and the need not to be so dependent on certain countries such as Russia and their energy and their oil and gas,” said Fiona Cincotta, senior market analyst at City Index.

That might be one reason that at least 20 ESG-focused funds have launched in the US this year, netting almost $3.2 billion of inflows in 2022, according to data compiled by Bloomberg.

Yet RBC clients also expressed skepticism about the ESG label. Though nearly two-thirds said that socially responsible investing is the way of the future, 74% of those surveyed said many companies provide misleading information about their ESG initiatives. This is an issue that could eventually be addressed through a Securities and Exchange Commission’s proposal for new restrictions to ensure ESG funds accurately describe their investments.

Ivy Jack, head of equities at Northstar Asset Management, said that this year’s performance has exposed the fact that some investors were caught up in ESG as a fad and misinformed.

“If you really want to understand if someone is serious about ESG, I would first ask them to look at their portfolio and ask them to explain why all the companies are in there and how those companies relate to their values,” Jack said. “To the extent that someone can’t do that for you, well that’s a red flag.”

Musk came out against them saying it’s ridiculous that an oil company like Exxon is rated high while the electric car company Tesla is rated low.

ESG?

Go woke, go broke.

Environmental Social Governance.

Essentially left wing wet dreams.

Given the near term threat of irreversible environmental catastrophe why wouldn't socially conscious corporations be hot performers now?

Just finished reading

https://www.amazon.com/dp/1546090789?psc=1&ref=ppx_yo2ov_dt_b_product_details

Excellent run down on shareholder vs the messed up stakeholder scam.

Anyone have any suggestions for anti-ESG funds?

Tesla has no dividend (unlike Exxon) and its price is 95 times earnings. I’ll stick with Exxon (I actually own Devon but don’t tell anybody).

Oil stocks are finally taking off…..go to barchart and click on oil stocks….up when market down 350 points…just click here

https://www.barchart.com/stocks/sectors/top-oil-stocks?orderBy=percentChange5d&orderDir=desc

Oil stocks are finally taking off…..go to barchart and click on oil stocks….up when market down 350 points…just click here

https://www.barchart.com/stocks/sectors/top-oil-stocks?orderBy=percentChange5d&orderDir=desc

The only “green” about ESG is the money they scam!

Yeah I’d be inclined to short Tesla stock myself, it’s way overpriced for many reasons imo.

Feel good fund for libtards too stupid to know how to invest 🤪

Yeah, energy stocks seem to be doing good. Price goes up and you get a dividend. That’s a win/win. natural gas also. Also keep an eye on the Qs (QQQ) of which tech makes the bulk of. And if you’re feeling risky (depending on the mood of the stock market), the leveraged plays are out there for a quick pop. But those aren’t suitable for long term holdings.

it is a corporate social credit score

the individual score is coming

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.