Posted on 05/23/2022 10:07:07 PM PDT by SeekAndFind

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

The above quote comes straight from Warren Buffett’s 1986 annual letter to Berkshire Hathaway shareholders. It’s one of his most timeless quotes… and one of the most important for investors in the current market.

Everyone is worried about inflation, rising interest rates, and a likely recession… The data shows the crowd is already panicking—and selling stocks in a big way.

You might be scared and tempted to sell, too.

But if Warren Buffett is right… that means now is actually a great time to buy stocks. In fact, the latest filings show he’s using the recent declines as a buying opportunity.

And as I’ll explain, the latest data agrees a big opportunity is here… and that the market is likely to zoom a lot higher over the next 12–24 months.

Exchange-traded funds (ETFs) are a great way to get exposure to a specific sector or the entire market.

As you probably know, an ETF is a basket of securities (similar to a mutual fund). When you buy an ETF, it’s like buying dozens—or even hundreds—of stocks instantly.

According to independent research firm ETFGI, there are more than 8,800 ETFs in the market today. Altogether, they hold almost $10 trillion in assets. As you can see in the chart below, ETFs have become a huge part of the market over the past decade:

And they can give us a valuable look at what investors are doing…

In today’s shaky environment, plenty of folks are selling their stocks and heading to the sidelines. In other words, they’re scared… and we can see that fear in the latest ETF action.

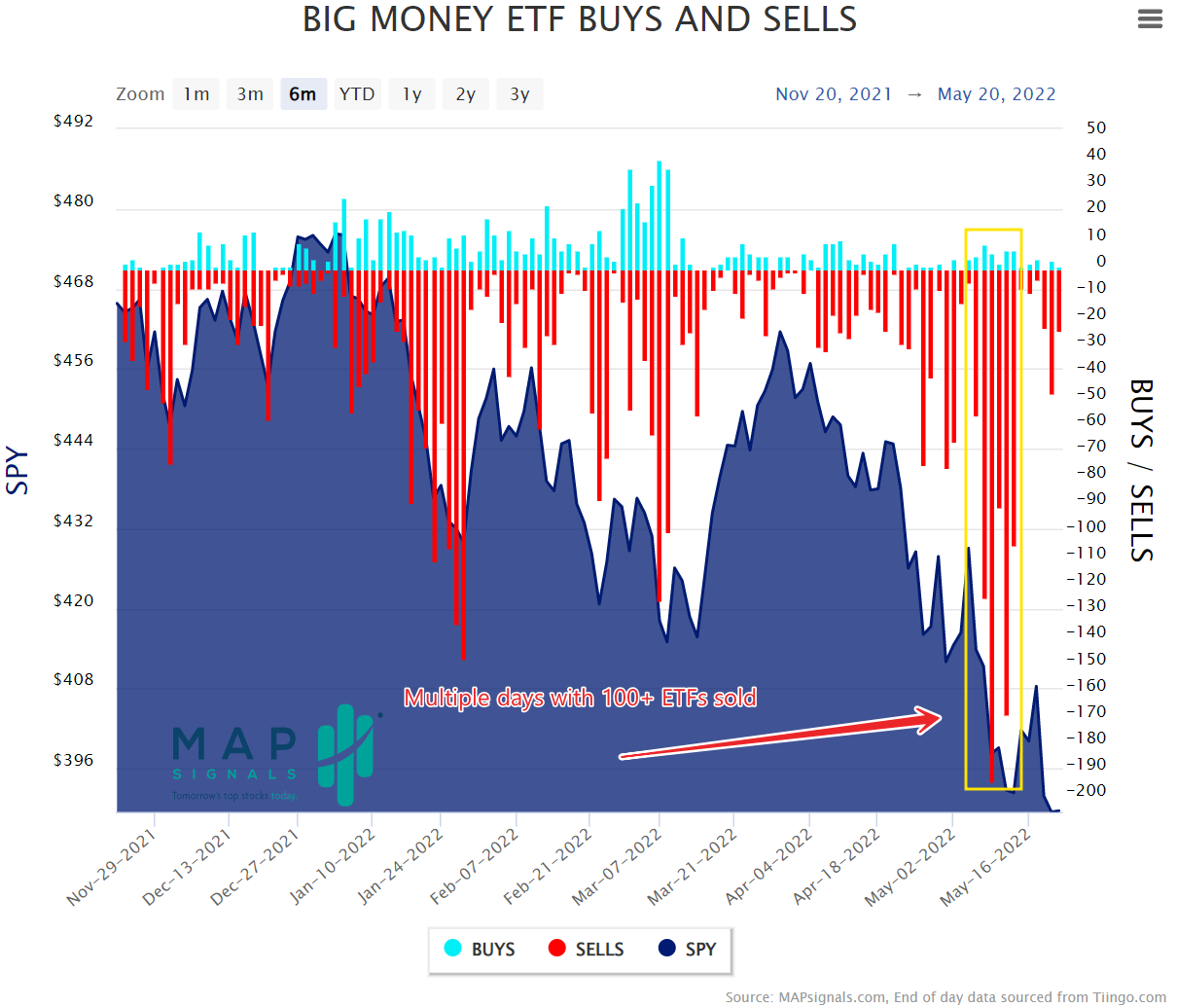

Below, I’ve included a chart of the daily buying and selling in ETFs over the past six months. Blue bars indicate the number of ETFs ramping higher on increasing volume (a sign of big buying). And the red bars tell us how many ETFs are being sold each day:

Click to enlarge

As you can see on the right side of the chart, there’s been huge selling in ETFs this month. Notice all the steep red bars (boxed off in yellow). Over the past couple of weeks, we’ve seen multiple occasions where 150 ETFs were sold in one day. That’s more selling than at any point over the past two years.

Put simply, the data shows folks are fearful. They’re scared of rising interest rates, 40-year high inflation, and a possible recession.

But if you’re a long-term investor, a bear market is typically a huge opportunity to generate above-average gains…

Extreme selling in ETFs doesn’t come around often. According to MAPsignals data, the amount of ETF selling in May is approaching pandemic levels.

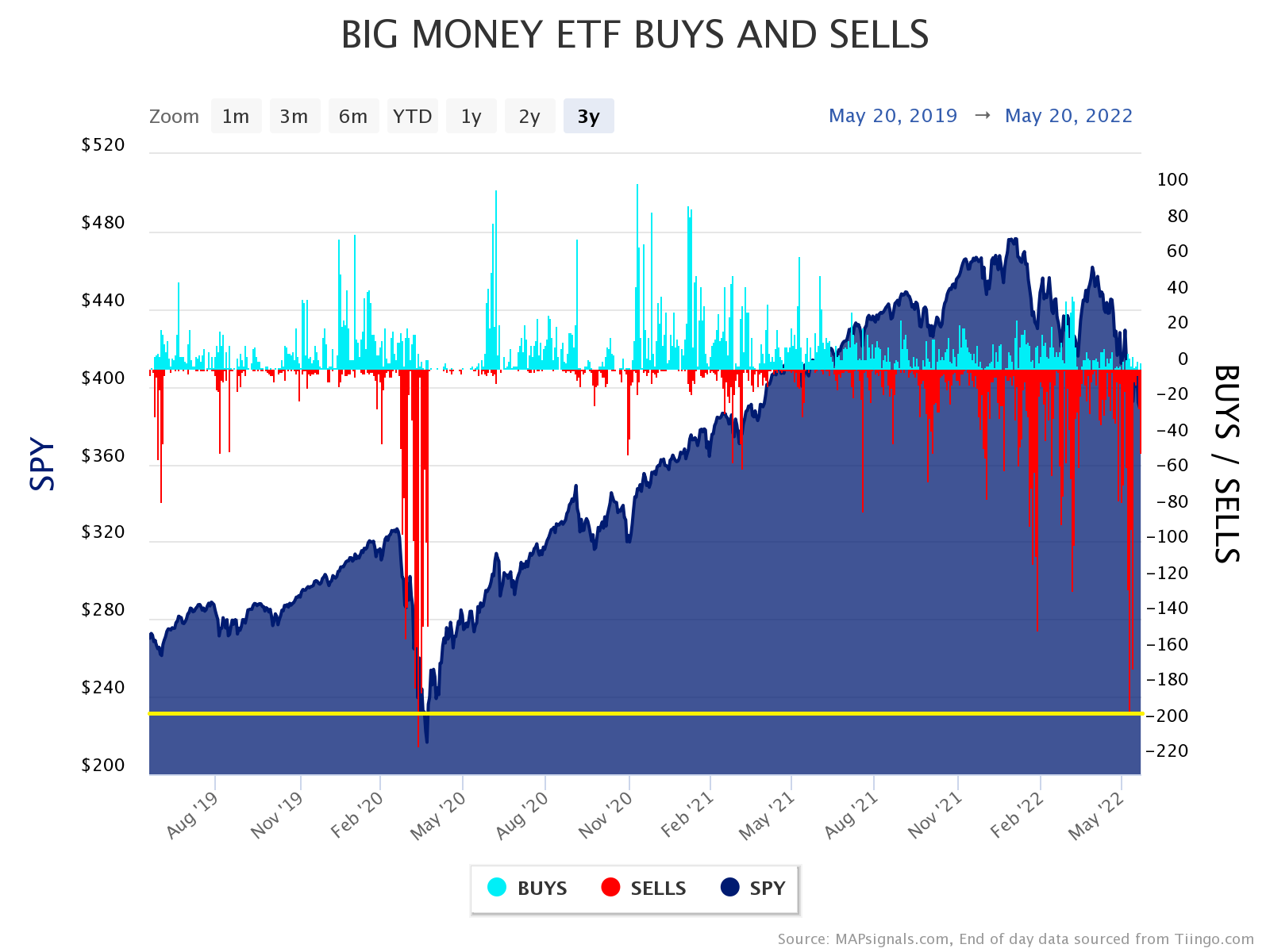

To put the recent selling into perspective, I’ve included another chart below. It’s similar to the previous one, but stretches back further so we can see the massive selling that happened when COVID hit in early 2020. On the right axis, you can see that nearly 200 ETFs generated sell signals last week:

Click to enlarge

Notice the yellow line that stretches across the bottom of the chart. It shows how ETF selling has almost hit the same levels we saw at the pandemic low in March 2020.

In the short term, the data is scary. It’s tough to hold steady as others are running away from stocks.

But the truth is: This kind of panic selling usually leads to double-digit gains over the next year.

That might sound crazy… but experienced investors are familiar with this phenomenon. It’s the key concept behind Warren Buffett’s quote above.

You see, once investors fully appreciate the negatives (like inflation and a likely recession)… it means those factors are already “priced in.” In other words, investors won’t be surprised if future numbers—like economic data, interest rate hikes, or inflation—are ugly.

Don’t take my word for it… Look at the data below.

I’ve put together a table showing the seven times in ETF history that selling topped the 150 mark. (We hit 193 last week). This data goes back to 1993, but keep in mind that there’s been an explosion in the number of ETF listings over the last few years. So the 150 threshold has only been able to be triggered in recent years. Nonetheless, it’s a powerful bullish signal.

To show how the stock market performs after this extreme selling, I’ve included the one- and two-year performance for the S&P 500, represented by the SPDR S&P 500 ETF Trust (SPY):

Source: MAPsignals, FactSet

As you can see, if you’d bought SPY every time the ETF data showed 150-plus sell signals, your average gain would have been over 45% in just 12 months. And if you’d held SPY for the next two years, your average gain would have been over 64%.

These results show why the current bear market is a major opportunity for long-term investors. When other investors are throwing in the towel, it’s likely the market is putting in a bottom… and sowing the seeds of the next bull market.

That means it’s time to be greedy, not fearful.

In normal times, in a traditional American economy, I would agree. But this market is going lower because the fundamentals all suck as a result of the government attacking in every imaginable way.

Also the sheer volume of helicopter money being created by the government has been plowed by companies back into their own stocks.

I think stocks are heading much lower, the dollar is at serious risk of being dethroned, and the fundamentals are weak.

If you are Warren Buffett, you might as well buy. But mere mortals will be getting killed for way too long to come.

Bad advise.

Yup. Pump-n-Dump practitioner. At this point there is no safe harbor. Make sure your debts are paid off, your home repairs are all done, your water supply is secure, and your olde ammo locquer is topped up.

Couldn't agree more. People should go back and look at the chart for the 2008 flash crash it took about a year for the market to lose 1/2 (half) its value. There were bear market rallies all the way down.

Interest rates are going up until inflation starts going down. The market has always been interest rate sensitive. The mid-terms may be a turning point in getting the Biden administration to be more pro growth. But I doubt it. We will likely have to wait until 2024 and elect a new president. Which means things start looking up in 2025.

This is not investment advice just my own personal opinion. Remember when the Dot Com bubble burst the QQQ, it took 10+ years to get back to new all time highs.

Market is going much lower before it recovers in 2025 when Trump is President.

High Risk investing for uninitiated... or the initiated risk takers.

My neighbor is a high risk investor, he’s done really well, but he is also making arrangements to mitigate here shortly.

Rockefeller said you buy when the blood is flowing, including your own.

Normally, the market tends to return to the new normals when the fundamentals are right which was the case since WWII.

One problem is that the world is crashing and burning right now, but I don’t see the market at rock bottom.

There wasn’t helicopter money in the times of Rockefeller.

Buffet vs mortals.

Seems like an eternity, doesn’t it.

Nothing but cherries.

Buffett said the way to great wealth is to buy Coca Cola stock and wait fifty years. If you have fifty years ahead of you, go ahead and follow Buffett.

Not yet. About a month before midterms.

Some prediction or outlook will be correct. This is no V bottom event as in ‘20. Considerable damage has been done by this administration. They have battered the fundamentals for growth in their all out push for green and with their boneheaded other programs and spending. Energy prices are what make for growth or none. They effect everything we do and you can’t shift energy policy this quickly without battering the economy.

We are not even to the bottom yet and it will be flat. Too much damage has been done. Remember the obama / biden era and the “green shoots” of 2011 that never were. We were in stifled recovery mode for much of the 8 years of obama with hope only arriving in the ‘16 election. We then enjoyed an unleashing of growth and optimism. There was no FED help in that rally. I thought Trump would surely get 8 years and we’d be off to a new and better time that might last a couple of decades.

We older people resist change and we are becoming less significant as consumers. The trend is electric and everything associated with it... right or wrong and I believe it to be wrong, prohibitively expensive and wasteful but it will persist none-the-less. The youngsters believe in it.

New ideas and applications are popping out of the woodwork just like they did in the energy crisis of the 70s / 80s. Some of those will stick. Really only a few did back then to the point it is hard to name them. This time it is much more fundamental, then we still had in mind ICE and fossil fuel for our future. All day the last few days I have been doing chores moving from one piece of equipment to another, they all burn diesel. I imagined what it would take to convert them all to electric. Massive spending and very complex. Worse is to imagine doing what I did without benefit of the equipment.

I don’t know where this ends but I see major change to how we fuel our daily lives. The change has been put in motion and right or wrong it will happen. Norway, a fossil fueled economy, has nearly eliminated ICE with most cars now EV. Making that change is the growth I see coming. Young people are all over it like white on rice. The choke hold on fossil fuel has been made even though nobody in their right mind can see how we can possibly make a total switch so fast. We are driving through a tunnel that has no light at the end, no map and no headlight but we are going very fast.

Where will all this new electricity come from? Some forms of nuclear will have to make a comeback. I expect it to be some form of modular, small and distributed, factory manufactured plants. Eventually the folly of wind, solar and battery storage will be seen. Blackouts and cold or steamy houses have a way of eventually forcing reality. What will be interesting is when they try to figure out emergency generators. Perhaps it will be a pile of batteries?

Going green is misguided but it has been made the dot.com of the times. The washout of unsuccessful efforts will be another 2000 crash eventually. From that will emerge the next apples of the electric age.

When I see a stock trailer pulled by a whirring truck or a tractor soundlessly cutting hay out in the field the change will be complete. I should live so long. It is amazing though what soaring OPEX can do for change though.

Agree with the war on oil it has placed everything on the unstable list until then.

Yes, perhaps money can be made buying and selling into the bear market rallies? Oil stocks especially are over bought right now. There is very little that is a good value. Was looking at a conglomerate that holds a regional airline, but are airlines stocks going to get hit as well?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.