Posted on 03/16/2022 11:23:18 AM PDT by Browns Ultra Fan

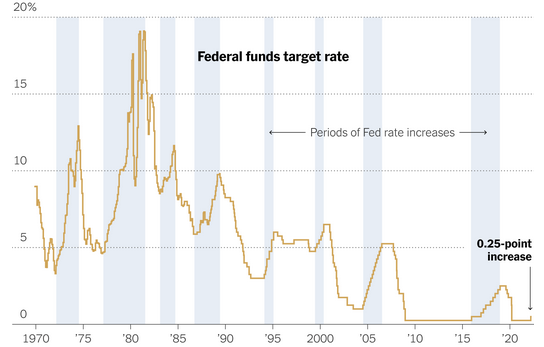

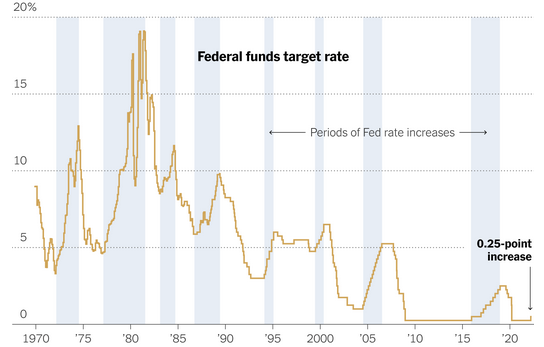

So, The Federal Reserve raised their target rate by … as expected … 25 basis points to 50 basis points.

The Taylor Rule suggests that the target rate should be 11.96%. So, Powell and The Gang are getting closer! /sarc

The short-term reaction to the measly rate increase? The Dow declined (but still in positive territory for the day) and the benchmark 10-year Treasury yield spiked to 2.23%.

Here is what The Fed had to say.

(Excerpt) Read more at confoundedinterest.net ...

And the fires of inflation will go on undiminished.

And the markets tanked all of the day’s gains on the FED news.

No, they said they’d raise rates by a quarter percentage-point.

Sorry, misread the headline- small text on my phone.

With the amount of intentional devaluation of our dollar over the last year, interest rates should be at least 10%

The Fed and Brandon are causing a catastrophe for the US. Inflation is out of control. The Fed is sitting on their hands because they, mistakenly, believe they can ignore inflation, keep interest rates low and avoid recession under a Rat-Commie administration. Meanwhile, Brandon and the crony Congress are continuing to ignore their contribution to economic problems and instead, are making things worse daily. The US dollar as the world’s reserve currency is now completely at risk. Dollar devaluation is not far off. Inflation will do nothing but get much worse. Oh, and a recession, it is coming anyway because of all this.

“you can’t taper a ponzi”

Haha so true as we will soon find out.

Weimar redux. Sad and frightening. Painful to remember a very short while ago the outlook for America’s businesses was optimistic for the first time in memory.

Yeah, I thought savings interest kind of tracked inflation.

<< interest rates should be at least 10% >>

Yep, like they were in the ‘80s when we could make good money on bank interest rather than being forced into investing in the stock market and worry about it crashing.

I was reading an “expert” at Marketwatch this morning who said the FED is crazy to raise, and would cause a stock and real estate crash plus a recession.

Just pointing out that opinions are all over the lot.

“Yeah, I thought savings interest kind of tracked inflation.”

It does, but it tracks it from well below of course. Banks are parking places for money, not investment houses.

Bank interest always runs well under the rate of inflation. If it didn’t economy activity would die off, few would take risks when money is beating inflation sitting in the bank at no risk.

“Yep, like they were in the ‘80s when we could make good money on bank interest rather than being forced into investing in the stock market and worry about it crashing.”

I was there doing that but we weren’t beating inflation, we were losing to it. Not losing as badly as now, but still losing. I would grab the paper and look for the ads for high interest Money Market Funds daily. S+Ls going broke would pay big interest to raise cash so the FEDs would let them stay open. They would go broke, close for a day and a new bank would take over. It felt good but we were still losing to inflation. The think that clobbered inflation was raw land, which was tripling every 3 years. Now THAT was fun.

So this has me bothered.

I work at a bank in credit administration. I am seeing loans going out the door with interest rates less than inflation. I am wondering how hard this is going to bite us near future.

“I am seeing loans going out the door with interest rates less than inflation.”

That’s normal at this stage of the cycle. It’s up the bank to make sure those loans aren’t too much of the total portfolio.

FHA/VA will take the biggest hits from this cycle as it unwinds.

Over-reactions by the federal reserve *triggered recessions in 1991, 2001 and 2007. (*Not the sole cause, just the catalyst.) The federal reserve is bizarrely late and STILL worsening the Quantitative Easing crisis. But boosting interest rates towards the Taylor Rule is a ridiculous proposition. It’s like finding out you’re flying too low for maximal fuel efficiency so pointing your 747’s nose straight up. Stupid idea. When the interest rates have deviated from the Taylor Rule this long and this severe, the actual prescribed value from the Taylor Rule is meaningless; all it really does is point “up.”

25 basis points. Are they calling it “Shock and Awe”?

Thanks. That just seems so strange.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.